The Economic and Monetary Union is still not out of harm’s way. The recent meeting of the European Council did not deliver a further deepening of the union, and on top of that, the spreads on Italian government bonds have increased since the start of the new government. To make EMU future proof, it is important to complete a banking union (European Commission 2017b). The transition to a banking union is, however, not straightforward. The discussion is over whether to put risk sharing or risk reduction first. A group of eight, mostly Nordic, countries are in favour of the banking union ultimately being completed, but believe that the first priority should be risk reduction. In this column, we describe three possible transition scenarios to a banking union and analyse the consequences for the banks during the transition phase based on data from the June 2017 transparency exercise by the European Banking Authority.

Risks to the euro remain

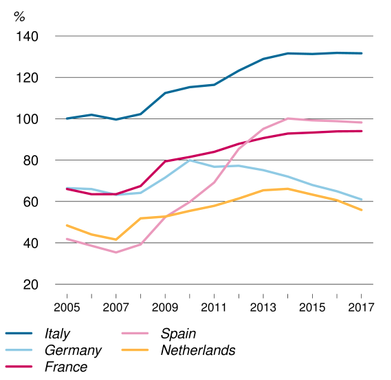

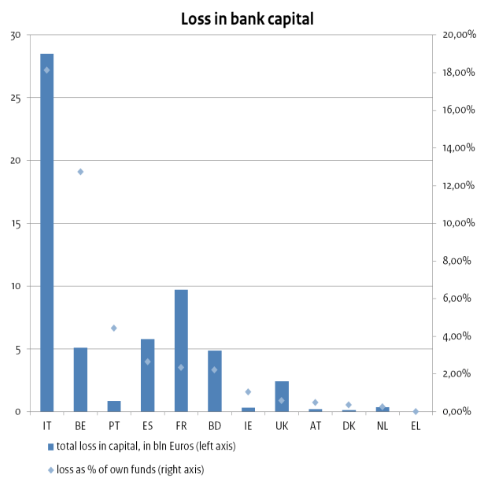

The interdependence between banks and their governments has increased since the crisis. From the start of the crisis, the government debts have increased as a share of GDP (Figure 1, top panel).In addition, banks hold substantial amounts of this debt on their balance sheet, giving rise to the bank-sovereign nexus. For example, in Italy, 17% of the total bank balance consists of Italian government debt, and the figure for Spain is 10% (Figure 1, bottom panel). In the case of a restructuring of Italian government debt, Italian banks would face serious difficulties, as their equity makes up only 5% of their balance sheets (Figure 2, bottom panel). Once Italian banks find themselves in trouble, this will in turn negatively impact the Italian government, and vice versa. Other countries also have a strong interdependence between banks and the government (Soederhuizen and Teulings 2018).

Figure 1 Government debt has increased, a larger share of which is held by banks

Source: ECB.

Notes: Exposure as a % of the balance sheet.

Source: ECB.

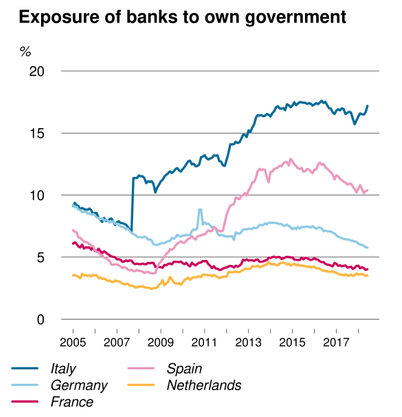

Figure 2 Italian banks have many non-performing loans and little equity

Notes: Loans in arrears of over 90 days, as a percentage of the total loans portfolio.

Source: IMF FSI.

Notes: Equity, here, consists of Tier1 capital.

Source: ECB.

Next to government debt, banks in multiple member states carry substantial non-performing loans on their books. In Italy, 14% of loans have been in arrears for more than 90 days (Figure 2, bottom panel) and although this percentage has been decreasing since 2015, it still remains high. Meanwhile, the percentage of non-performing loans in Spain has been halved.

The banking union can reduce the bank-sovereign nexus

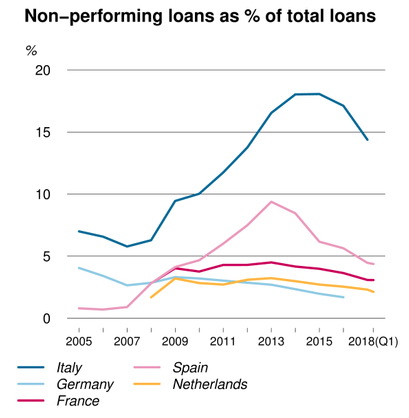

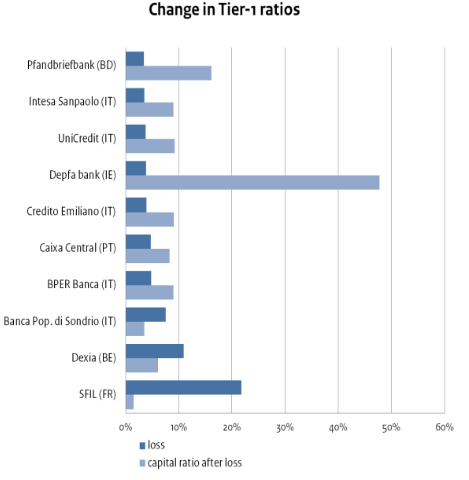

EMU is still vulnerable due to the strong interdependence between banks and governments (bank–sovereign nexus). It is possible that the market may start to doubt the sustainability of Italian government debt. This would then make the need to write off part of the Italian debt more likely. Figure 3 shows the impact on capital positions and Tier-1 ratios of banks in case of a presumed 20% write-off of Italian government debt. Italian banks are most vulnerable to a restructuring of the Italian government debt, resulting in a substantial loss of capital and a fall in the Tier-1 ratios of individual Italian banks. Banks outside Italy are hit less severely. A banking union can reduce the interdependence between governments and banks. Important elements are the reduction of sovereign exposure of banks, a European Deposit Insurance Scheme, and a credible backstop for the Single Resolution Fund.

Adjusting the regulation for banks would prevent them from purchasing too many of their own government’s bonds again. If banks hold fewer of their own government’s bonds, they are less vulnerable to a sovereign debt crisis by their own government. A European deposit insurance scheme would reduce the likelihood of insolvent banks inducing a crisis in either government bonds or other banks. It would ensure an external mechanism to absorb losses and protect deposits, without compromising the solvency of the national government. The Single Resolution Fund for banks needs a credible backstop. In the event that the Single Resolution Fund should prove insufficient to finance the resolution of a bank, it should be clear how the remaining costs are financed. For a more extensive discussion on these two topics see, for example, Gros and Schoenmaker (2014) or Bénassy-Quéré et al. (2018).

Figure 3 Impact of a 20% write-off of Italian government debt

Source: June 2017 transparency exercise of the European Banking Authority, CPB calculations.

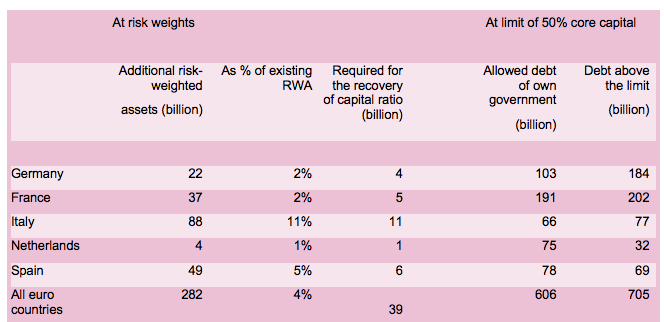

The introduction of risk weights for government bonds would result in a limited increase in bank buffers. Setting the risk weights equal to those of corporate bonds would eliminate the preferential treatment of government bonds.This would, in itself, represent a positive development, but the requirement of additional buffers would not contribute appreciably toward making EMU more stable. Italian banks, for example, would only need to attract €11 billion in additional capital in order to reach their old capital ratio (Table 1). For other countries, this amount would be even lower. This is in line with the estimates of Meyland and Schäfer (2017). Note that banks may already have reserved capital in preparation for new measures.

Limiting the level of government debt on bank balance sheets, as proposed by Véron (2017), would be an effective measure to reduce the interdependence between banks and governments. The amount of debt a bank would be allowed to hold from its national government could be limited to 50% of a its core capital. This puts a cap on the exposure of banks to their own government. Assuming a limit of 50% of core capital, various banks would need to dispose of a large share of their government debt (Table 1). Italian banks, for example, would, for example, need to sell €77 billion in Italian government debt. Banks would presumably exchange a share of their national government’s debt for debt of other countries with a comparable interest rate. This would result in more diversified bank portfolios that are less dependent on their own government.

Table 1 Effects of risk weights or debt limits, with respect to government debt on banks’ balance sheets

Notes: Risk weights are set equal to those for commercial obligations; e.g. 0% for AAA, 50% for BBB (Italy). For current sovereign ratings, see Fitch. Source: EBA 2017, adaptation by CPB.

Three scenarios for the completion of a banking union

There is little agreement about the order and pace at which the elements of a banking union should be introduced. This is understandable, considering the current state of banks and governments finances within EMU. We outline three possible scenarios for the transition process. More scenarios are possible, but these three demonstrate the trade-offs between risk sharing and risk reduction (Bénassy-Quéré et al. 2018).

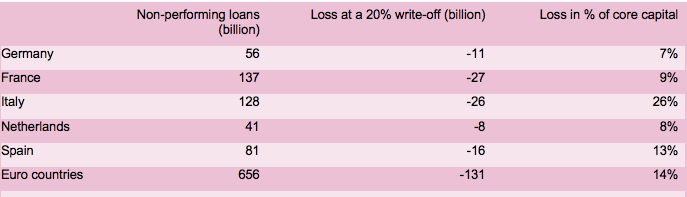

Table 2 Effects of writing off 20% of non-performing loans on the capital position of banks

Source: EBA 2017, calculations by CPB.

All scenarios require a reduction in the number of non-performing loans within the EMU. Although banks do hold reserves for the expected losses due to non-performing loans, it is unclear whether they would prove to be sufficient. Table 2 shows what the losses would be if banks were required to write off 20% of their non-performing loans. This 20% write-off is based on the net write-offs of UniCredit (after new capital has been attracted) in the sale of a large share of their non-performing loans of a value of around €16 billion (Bloomberg 2017). The first column shows that Italian banks have €128 billion in non-performing loans on their balance sheets. A write-off of 20% represents a loss of €26 billion, equalling over a quarter of their current core capital.

Under the first scenario, risk-reduction and risk-sharing measures are implemented simultaneously (Goyal et al. 2013). This may mean that countries and banks that are in relatively good shape will be unintentionally or willingly (moral hazard) burdened with the risks of others from the past. For this reason, opposition to this scenario exists particularly in the northern EMU countries.

Under the second scenario, the problems at weaker banks must be solved first, before the banking union could be completed. Under this scenario, the emphasis is on risk reduction and only at a later stage on risk sharing. Addressing the problem of non-performing loans would take time and/or additional capital. Italian banks would need a total of €37 billion in additional capital in order to be able to write off 20% of non-performing loans and implement risk weighting (Soederhuizen and Teulings 2018).

EMU remains vulnerable during this period of transition. In the short run, the bank–sovereign nexus would not be severed and there would still be conflicts of interest on both national and European levels. This would partly be due to the fact that a European Deposit Insurance Scheme would not yet be implemented, and, therefore, any bank insolvency could still have a national impact.

Adopting a middle course would make further risk sharing conditional on achieving risk reduction. In this scenario, the pace of implementing risk sharing depends on the progress made in risk reduction. Such progress could be assessed on an annual basis, and any subsequent steps would only be taken after a certain amount of progress had been established. Each year, the European Deposit Insurance Scheme could, for instance, cover a larger share of deposits, which could be made contingent on sufficient numbers of non-performing loans being resolved (Gros and Schoenmaker 2014). This would provide the incentive to reduce the existing risks as well as allowing for more risk sharing. A complicating factor here would be the annual assessments and/or negotiations about the progress made on risk reduction.

None of the scenarios is optimal for all countries. Under the first scenario, in which both risk reduction and risk sharing are implemented relatively rapidly, there is the chance of the northern countries being presented with part of the bill. Under the scenario in which first all problems must be addressed and solved, EMU would remain vulnerable to shocks for a longer period of time. The scenario in which risk sharing is made contingent on risk reduction would require making complex, annual political choices. Waiting too long to implement measures may lead to a situation in which solutions need to be found under the pressure of a new crisis. Although the pressure of a crisis might conceivably force decisive action, it most likely would not result in the most efficient outcome. Any repercussions would then also be felt all over Europe.

Authors’ note: This column is a summarised version of a CPB Communication (Smid et al. 2018).

References

Bénassy-Quéré,A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N Veron, B Weder di Mauro and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No 91.

Bloomberg (2017), “UniCredit $21 Billion Bad-Loan Sale Draws ECB Scrutiny”, 29 October.

European Commission (2017a), Further Steps Towards Completing Europe’s Economic And Monetary Union: A Roadmap, COM(2017) 821 final.

European Commission (2017b), On completing the Banking Union, COM(2017) 592 final.

Goyal, R et al. (2013), “A banking union for the euro area,” IMF, Staff Discussion Notes, 12 February.

Gros, D and D Schoenmaker (2014), “European deposit insurance and resolution in the banking union,” Journal of Common Market Studies52(3): 529–546.

Meyland, D and D Schäfer (2017), “Risk weighting for government bonds: Challenge for Italian banks,” DIW, Economic Bulletin 28/29.

Smid, B, B Soederhuizen, R Teulings and K Ji (2018), “Towards an EMU banking union: Three scenarios,” CPB, Communication.

Soederhuizen, B and R Teulings (2018), “Capital position of banks in the EMU: An analysis of Banking Union scenarios,” CPB, background document.

Véron, N (2017), “Sovereign concentration charges”, report for the European Parliament.