The rapid transmission of the US subprime mortgage crisis to other financial markets in the US and abroad during the second half of 2007 raises some important questions:

- Through which mechanisms were the liquidity shocks transmitted across US financial markets during this period?

- What was the relative strength of these potential linkages?

- Did the episode of funding illiquidity in structured investment vehicles (SIVs) and conduits turn into an issue of bank insolvency?

Conceptually, a number of transmission mechanisms are likely to have been established during the recent period of turbulence, either through increased market liquidity, funding liquidity, or even default risks. In addition, re-enforcing liquidity spirals may be observed.

Market liquidity is an asset-specific characteristic measuring the ease with which positions may be traded without significantly affecting their corresponding asset price. In contrast, funding liquidity refers to the availability of funds such that a solvent agent is able to borrow in the market in order to service his obligations.

In general, the mechanisms through which liquidity shocks influence the market-clearing process may operate through different channels during normal times than in the midst of an episode of financial stress. During tranquil periods, market illiquidity shocks are typically short-lived, as they create opportunities for traders to profit and, in doing so, provide liquidity and contribute to the price-discovery process. However, during periods of crisis, several mechanisms may amplify and propagate liquidity shocks across financial markets, creating systemic risks. These mechanisms can operate through direct linkages between the balance sheets of financial institutions but also indirectly through asset prices. Specifically, these price movements are set in motion when financial institutions face marked-to-market losses. As a consequence, positions are deleveraged, and if the value of the corresponding assets is significantly affected, the creditworthiness of the respective institutions will deteriorate due to rising risk of default. Here, leverage is procyclical and can amplify the financial cycle.

Transmission channels in the subprime crisis

The recent crisis’ initial shock, the deteriorating quality of US subprime mortgages, was a credit event rather than a liquidity issue. Increased delinquencies on subprime mortgages resulted in uncertainty surrounding the value of a number of structured credit products that had these assets in their underlying portfolios. As a result, rating agencies downgraded many of the related securities and announced changes in their methodologies for rating such products, first in mid-July but then again in August and October. Meanwhile, asset-backed securities indices saw rapid declines, and the liquidity for initially tradable securities in their respective secondary markets evaporated. The losses, downgrades, and changes in methodologies shattered investors’ confidence in the rating agencies’ abilities to evaluate risks of complex securities, a result of which, investors pulled back from structured products in general.

The main channels of transmission were:

- Asset-backed commercial paper funding liquidity: Investors became unwilling to roll over the asset-backed commercial paper (ABCP) by which SIVs and conduits funded themselves. This idiosyncratic funding liquidity shock reflected increasing uncertainty with regard to the value of underlying securities.

- Bank funding liquidity: The SIVs began calling on the contingent credit lines from the sponsoring banks, and the balance sheets of those financial institutions were strained by the reabsorption of the SIVs, which was amplified due to declining asset values. As a result, the level of interbanking lending declined both for reasons of liquidity and credit risk, leading to higher LIBOR spreads.

- Market liquidity and volatility: As turbulence related to the US subprime mortgages heightened, financial markets more generally showed signs of stress, as investor preference moved away from complex structured products in a flight to transparency. Subsequently, positions were shifted in order to invest in only the safest and most liquid of all assets, such as US Treasury bonds. Furthermore, hedge funds that held asset-backed securities and other structured products were burdened by increased margin requirements, driven in turn by greater market volatility.

- Bank solvency: The crisis also brought to the forefront concerns about the soundness of some of the largest banks, as witnessed by the collapse of Bear Stearns. Financial institutions saw a decline in the values of the securitised mortgages and structured securities on their balance sheets, resulting in extensive write-downs. Also, funding liquidity pressures forced rapid deleveraging during this period at depressed asset prices. Finally, refinancing costs increased due to rising money market spreads, amplified by banks’ increasing reliance on wholesale funding.

Mapping the transmission channels

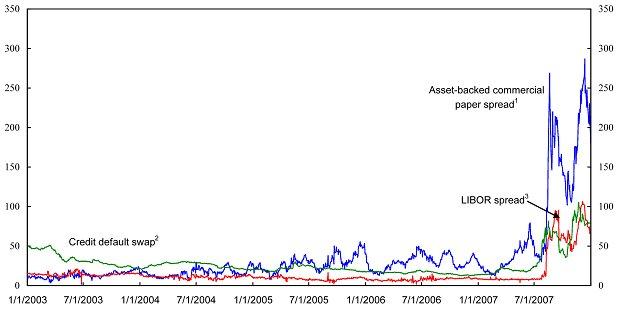

In a recent paper (Frank, González-Hermosillo, and Hesse 2008), we use a model of five variables which act as proxies for overall market liquidity, funding liquidity, default risk and volatility to examine the linkages across the different channels. For example, as Figure 1 shows, the ABCP spread, proxying for ABCP funding liquidity, the Libor spread, capturing bank funding liquidity and the CDS spread as a measure of bank default risk, all sharply increased at the onset of the subprime crisis.

Figure 1. Aggregate bank credit default swap rate and selected spreads

Sources: Bloomberg LP and IMF staff estimates

Notes: Spreads are expressed in basis points. Asset-backed commercial paper spread is the spread between yields on 90-day US ABCP and three-month US Treasury bills. Credit default swap is the unweighted daily average of the five-year credit default swaps for the following institutions: Morgan Stanley, Merrill Lynch, Goldman Sachs, Lehman Brothers, JPMorgan, Deutsche Bank, Bank of America, Citigroup, Barclays, Credit Suisse, UBS, and Bear Sterns. LIBOR spread is the spread between yields on three-month US LIBOR and three-month US overnight index swap.

We adopt a multivariate generalised autoregressive conditional heteroscedasticity (GARCH) framework that accounts for structural breaks to analyse the co-movement of markets by inferring the correlations of the changes in the spreads discussed above, which in turn is essential in understanding whether the recent episode of financial distress has become systemic.

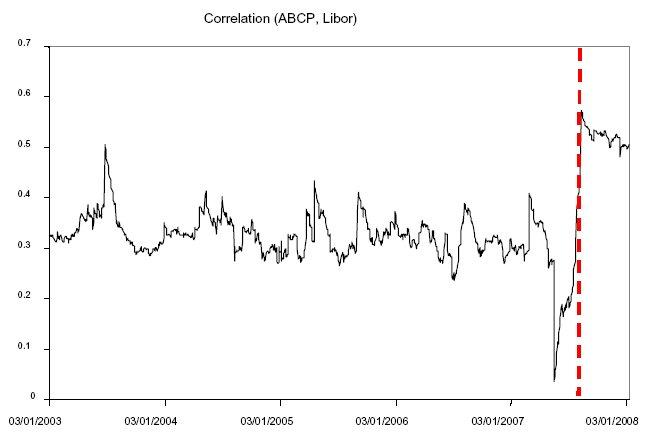

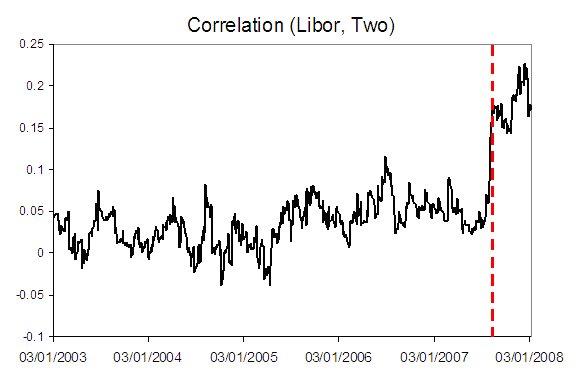

Figure 2 presents some results of the GARCH specification. There is strong evidence of increased interaction between the proxies for market and funding liquidity. The implied correlations between the ABCP and Libor spreads rise from a pre-crisis average of approximately 0.3 to above 0.5, a level at which they remain. Furthermore, the linkages between these two funding liquidity measures and the 2-year on-the-run/off-the-run spread, proxying for market liquidity, jump from around zero to 0.2.

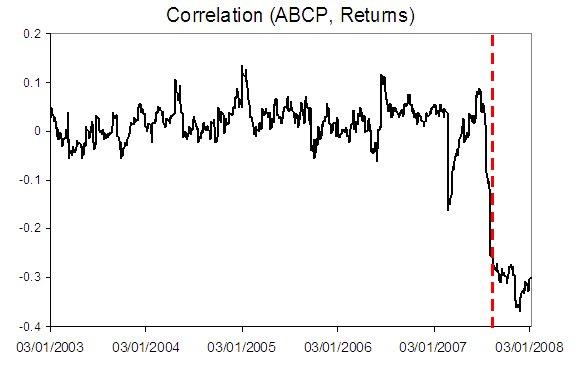

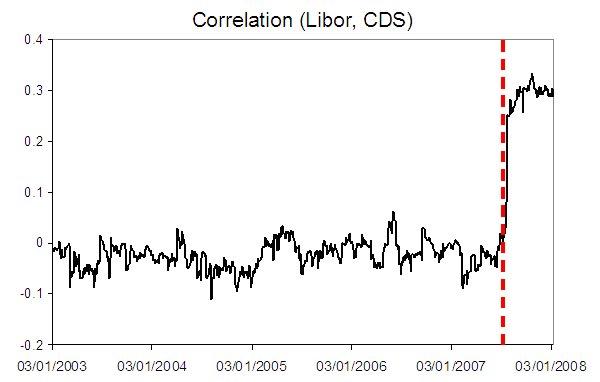

Furthermore, stronger interactions across the bond and the stock markets are evident, with S&P 500 returns and the ABCP spread becoming more highly correlated amongst each other, as well as with all other variables. Finally, the co-movement between liquidity and solvency is sharply increased. Before the hypothesised break date at the end of July 2007, changes in the credit default swap spreads remain approximately uncorrelated with all other measures, whereby the magnitude of these correlations increase to between 0.25 and 0.5 in absolute value. Whilst implied correlations had been fairly small in the pre-crisis period, the results presented here suggest that new channels of transmission of liquidity shocks were established during the second half of 2007.

Figure 2. Crisis correlations

The results of a very pronounced interaction between market and funding liquidity are consistent with the emergence of re-enforcing liquidity spirals during the crisis period. On the one side of this liquidity spiral, financial institutions were exposed to refinancing needs in the form of issuing ABCP, a situation where market illiquidity in complex structured products led to funding illiquidity. In this regard, the results also show that increased correlations between the ABCP and Libor spreads reduced the possibilities of funding from the interbank money market, thus highlighting systemic risks. On the other side of this spiral, many European banks that had large exposures to US asset-backed securities had difficulties accessing wholesale funding, inducing subsequent market illiquidity in different market segments. Due to the major importance of the interbank money market, central banks in turn intervened by reducing interest rates and providing additional liquidity to the markets in order to reduce pressures.

In addition to the described period of illiquidity, the US subprime crisis increasingly became one of insolvency, as banks such as Northern Rock, IKB, and Bear Stearns had to be rescued. This is captured by the implied correlations between the CDS and other variables in the GARCH model, which show clear signs of a structural break during the crisis period. Furthermore, these correlations have remained at elevated levels since then, suggesting that solvency concerns remain an issue.

Finally, it is also shown that seemingly unrelated stock and bond markets were affected during these times of severe stress. These transmission mechanisms were not restricted to the US financial markets but were also observed across other advanced and key emerging market economies. In particular, many of these markets abroad were also subject to heightened implied correlations between funding and market liquidity, and their respective domestic stock and bond markets.

Conclusion

The financial turbulence that originated in US financial markets has so far been very protracted. What started out as a liquidity crisis turned into a solvency issue. Indeed, a number of major central banks have intervened heavily in order to maintain the stability of the global financial system. Many of the largest complex financial institutions had to replenish their balance sheet positions through capital injections from Sovereign Wealth Funds and by other investors. The analysis presented here suggests that innovation, such as structured credit products and banks’ increased ability to move risk off their balance sheets as well as augmented interconnectedness of large complex banks, made market and funding liquidity pressures readily turn into issues of insolvency.

The views expressed here are those of the author(s) and do not necessarily represent those of the IMF or IMF policy.

References

Nathaniel Frank, Brenda González-Hermosillo and Heiko Hesse, 2008. “Transmission of Liquidity Shocks: Evidence from the 2007 Subprime Crisis.” IMF Working Paper No. 08/200