Trust in central banks is relevant. Especially in turbulent times like the current Covid-19 crisis, it is important yet challenging to maintain trust (Gros and Roth 2009). However, little is known about trust in the ECB during the pandemic. We use a new rich monthly dataset to fill this gap.

Central bankers recognise the importance of trust in their institutions. In the speech on the importance of trust for the ECB’s monetary policy, Isabel Schnabel said that “[t]he trust of citizens in the ECB and public support for the euro are essential for the effectiveness of our monetary policy and the independence of the central bank” (Schnabel 2020). Trust in the ECB is essential for maintaining price stability. High trust comes with better-anchored consumer inflation expectations around the ECB’s price stability objective. When inflation expectations are well-anchored, deviations of realised inflation from the target do not significantly affect the wage and price decisions of households and firms. This makes it easier to reach the inflation target, which may help build trust (a self-reinforcing process).

It is therefore important to monitor consumers’ trust in the ECB and to identify its drivers and effects. Our recent study (van der Cruijsen and Samarina 2021) uses the ECB’s Consumer Expectations Survey (CES) pilot microdata for 2020-2021 to examine trust in the ECB during the Covid-19 pandemic. This is a new rich panel dataset, covering the six largest euro area economies: Belgium, France, Germany, Italy, Spain, and the Netherlands (Christelis et al. 2021). From April 2020 onwards the survey includes additional questions about the impact of Covid-19 on households’ financial situation, working hours, and overall spending, as well as questions on trust in the ECB and other European institutions. These data provide a unique opportunity to research the effects of the pandemic on trust in the ECB as well as to analyse how trust matters for anchoring of inflation expectations in the euro area.

Trust in the ECB: Stylised facts

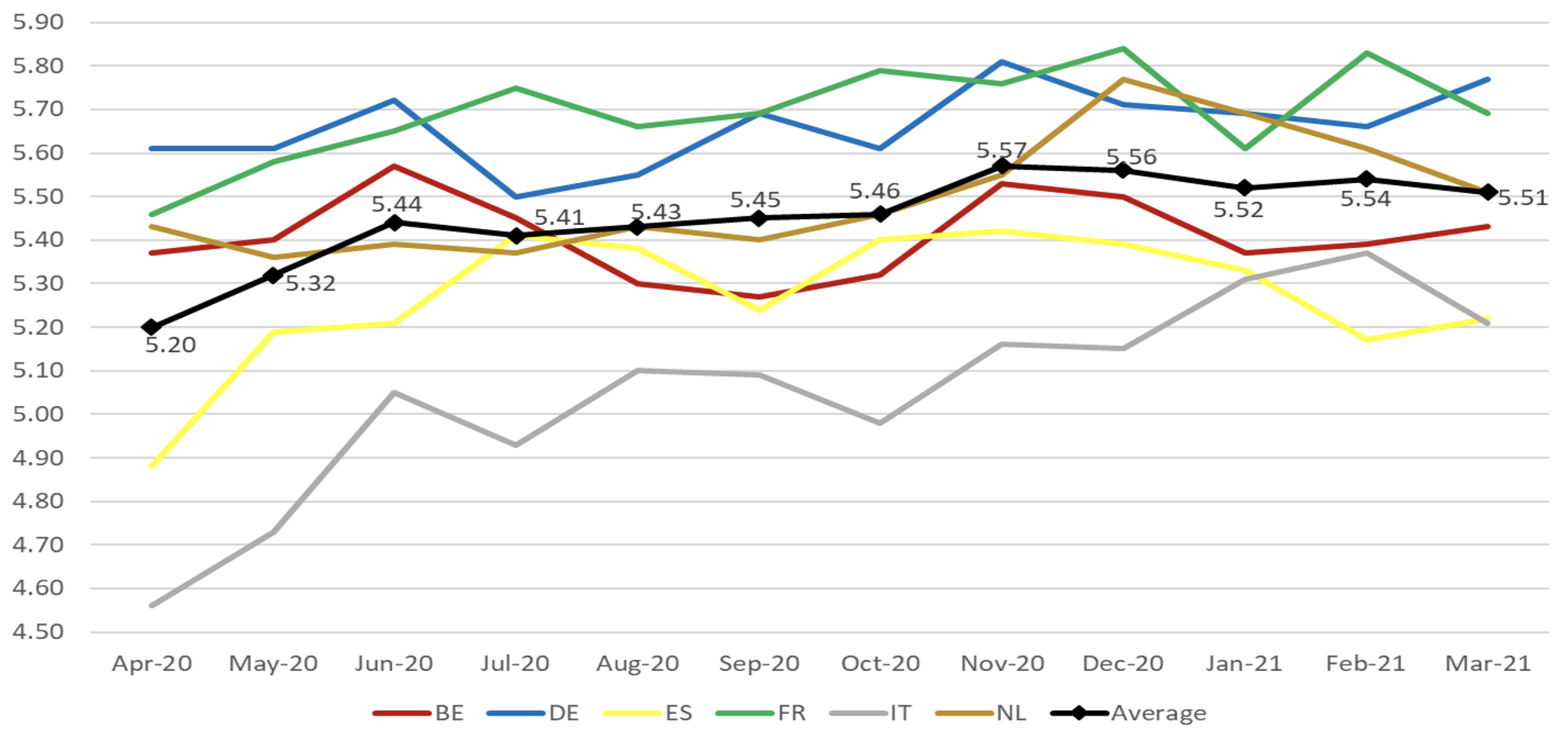

Consumers’ trust in the ECB is moderate. In the CES, trust is measured on an 11-point scale from 0 (no trust at all) to 10 (complete trust). On average, trust in the ECB was lowest (5.2) in April 2020, increased to 5.6 in November 2020, and was at 5.5 in March 2021 (see Figure 1). Germans and the French have the highest level of trust, followed by the Dutch and Belgians, while Italians and Spaniards trust the ECB the least. Similar patterns are observed for trust in the European Commission and the European Parliament.

Figure 1 Trust in the ECB, April 2020 – March 2021

Note: From 0 (no trust at all) to 10 (complete trust). Weighted results.

Source: ECB CES pilot survey.

Trust in the ECB depends on Covid-19 experiences and financial knowledge

Personal Covid-19 experiences and domestic policies that help alleviate the negative impact of the pandemic have affected trust in the ECB. Personal adverse Covid-19 experiences are detrimental for trust: respondents who reduced their number of hours worked due to the pandemic have lower trust in the ECB than those whose working hours did not change. Domestic government policies aimed at minimising the impact of the Covid-19 crisis on consumers’ economic situation, as well as better country-specific macroeconomic conditions, contribute indirectly to trust in the ECB. In addition, the worsening of the pandemic situation – captured by more stringent restrictions – is correlated with lower trust.

Trust in the ECB increases with financial knowledge. Self-assessed financial knowledge is measured on a scale from 1 (not knowledgeable) to 4 (very knowledgeable). Compared to respondents who think they are not knowledgeable, those who view themselves as very knowledgeable report 0.2 point higher trust in the ECB. The result is similar when we include actual financial knowledge, based on answers to four questions. People that get all four questions correct have 0.1 point higher trust in the ECB than people who answered all these questions incorrectly, did not know the answer, or skipped the questions.

There is heterogeneity in consumers’ trust in the ECB, related to their personal characteristics. Trust is highest among men and people with a better financial situation. It with education, income, and wealth. In addition, people who trust other EU institutions more and have higher generalised trust (trust in other people) also have higher trust in the ECB.

Trust in the ECB facilitates better anchoring of inflation expectations

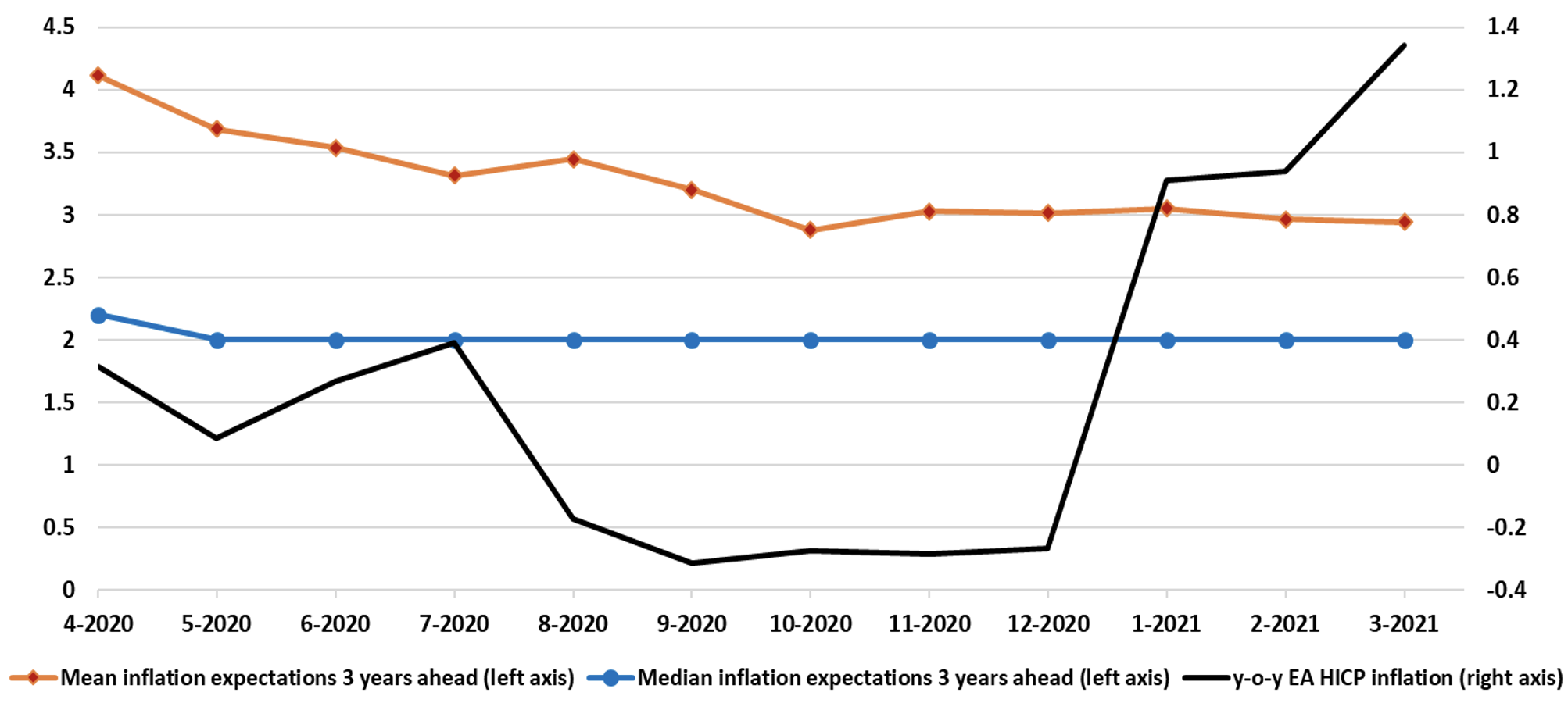

We examine how trust in the ECB influences consumers’ inflation expectations three years ahead, to get as close as possible to evaluating the anchoring of expectations around the ECB’s inflation aim, defined over a (flexible) medium-term horizon. On average across all the analysed countries and waves, the mean expected inflation three years ahead was 3.3% and the median was 2%. Thus, median expected inflation by consumers was in line with the ECB’s formulation of the price stability objective. Mean expected inflation three years ahead fell from 4.1% in April 2020 to 2.9% in March 2021 (see Figure 2). The downward dynamics in inflation expectations are consistent with a decline in HICP inflation in the euro area, related to depressed aggregated demand and spending due to the Covid-19 crisis. Notably, consumers’ inflation expectations are well above realised inflation in the euro area. This observation is in line with the evidence showing that euro area consumers believe inflation to be significantly higher than it actually is (Coibion et al. 2020).

Figure 2 Inflation expectations and HICP inflation, April 2020 – March 2021

Note: Weighted data for mean, unweighted for median. Inflation expectations are winsorised at 5%.

Source: ECB CES pilot survey; Eurostat.

We find that trust in the ECB and financial knowledge facilitate better anchoring of consumers’ inflation expectations three years ahead around the ECB’s inflation aim. According to its monetary policy strategy applicable during our sample period (April 2020 – March 2021), the ECB’s aim was to keep inflation “below, but close to 2%” (until the adoption of the new strategy on 8 July 2021).1 For example, a person with complete trust in the ECB is 1.5 percentage points more likely to have inflation expectations between 1.5% and 2% than a person with absolutely no trust in the ECB. Compared to trust in the ECB, financial knowledge has a much stronger positive effect on the likelihood that inflation expectations are well-anchored. For example, the likelihood that someone expects inflation three years ahead to range between 1.5% and 2% is 6 percentage points higher for someone who thinks he/she is very knowledgeable with respect to financial matters than for someone who is not. The effect of actual financial knowledge is even larger. People who answered all four knowledge questions correct are 17 percentage points more likely to have well-anchored inflation expectations than people who answered all of the ‘knowledge’ questions incorrectly and/or left them unanswered.

Various routes to improve trust in the ECB

Our research suggests several routes to improve the public’s trust in the ECB, which could contribute to better anchoring of consumers’ inflation expectations. One route is to enhance financial knowledge, as it comes with higher trust in the ECB. The ECB and national central banks in the euro area can underscore the importance of financial education and contribute to financial knowledge by providing educational programs and explaining monetary policy to a wider public. The public’s knowledge of monetary policy is far from perfect (van der Cruijsen et al. 2015). Good examples of activities that contribute to financial knowledge include the ‘ECB Listens’ event, held in October 2020 with intention to hear the European public’s views on the impact of the ECB’s monetary policy, communication, and global challenges ahead. Similar events were also hosted by national central banks. The ECB’s strategy review has benefited from the input received from these events. The Governing Council intends to improve its communication on monetary policy decisions by enhancing the information provided and its accessibility for various audiences (ECB 2021b).

In addition, trust in the ECB can be improved by tailoring central bank communication in terms of content and targeting it at individuals with low levels of trust.

Finally, government policies that help alleviate the negative effect of Covid-19 on consumers’ financial situation and other policies that improve general macroeconomic conditions may also indirectly support trust in the ECB.

Authors’ note: The views expressed here are those of the authors and do not necessarily represent the views of De Nederlandsche Bank, the European Central Bank, or the Eurosystem.

References

Christelis, D, D Georgarakos, T Jappelli, and G Kenny (2021), “Heterogenous effects of Covid-19 on households' financial situation and consumption”, VoxEU.org, 8 June.

Coibion, O, Y Gorodnichenko, S Kumar, and M Pedemonte (2020), “Inflation expectations as a policy tool?”, Journal of International Economics 124(C): 103297.

ECB (2021a), The ECB’s monetary policy strategy statement, 8 July.

ECB (2021b), “Clear, consistent and engaging: ECB monetary policy communication in a changing world”, ECB Occasional Paper No. 274.

Gros, D and F Roth (2009), “The crisis and citizens’ trust in central banks”, VoxEU.org, 10 September.

Schnabel, I (2020), “The importance of trust for the ECB’s monetary policy”, speech as part of the seminar series “Havarie Europa. Zur Pathogenese Europäischer Gegenwarten” at the Hamburg Institute for Social Research, 16 December.

Van der Cruijsen, C, D-J Jansen and J de Haan (2015), “What the general public knows about monetary policy”, VoxEU.org, 23 August.

Van der Cruijsen, C and A Samarina (2021), “Trust in the ECB in turbulent times”, De Nederlandsche Bank Working Paper No. 722.

Endnotes

1 See ECB (2021a) for details on the new monetary policy strategy.