Germany is under attack, once again, for running a trade surplus that seems to keep getting bigger. US President Donald Trump expressed the criticism with characteristic bluntness at the G7 meeting in Sicily last month, reportedly decrying the “very bad” Germans and complaining about the “millions of cars they sell in the US”. On this issue, he is not alone: the IMF (2017) has talked about Germany’s “excessive imbalances”, and the European Commission has also joined the criticism; EU rules call for current account imbalances to be corrected when they exceed 6% of GDP (Kollman et al. 2014).

To German eyes, this seems like déjà vu. Three decades ago, another US president – Ronald Reagan – also used the occasion of a G7 summit, in Tokyo, to criticise German surpluses. The German government has delivered, as it did then, a robust defence of why these surpluses are not as bad as everyone else seems to make out (Federal Ministry of Finance 2017). Global imbalances and their broader economic effect have been the focus of considerable academic attention (e.g. Caballero et al. 2015).

We believe that Germany actually could and should take some important steps that would not only reduce the imbalances, but also make the German economy stronger and more competitive in the future (Labaye et al. 2015). The solution is to reframe the trade debate away from the focus on German exports, which are a sign of German success, and towards productive German domestic spending on areas that currently are weak – most notably, digital infrastructure.

First, let’s look at the numbers, which do indeed tell a dramatic tale. In 2016, Germany ran a current account surplus of more than €260 billion, or 8.6% of GDP. In dollar terms, that is the largest in the world, bigger than China’s – and well above the EU’s 6% ceiling. In GDP terms, it is also more than double the size of the current account surplus in 1986, when President Reagan made his criticism. Germany’s bilateral trade surplus with the US alone reached €56 billion last year.

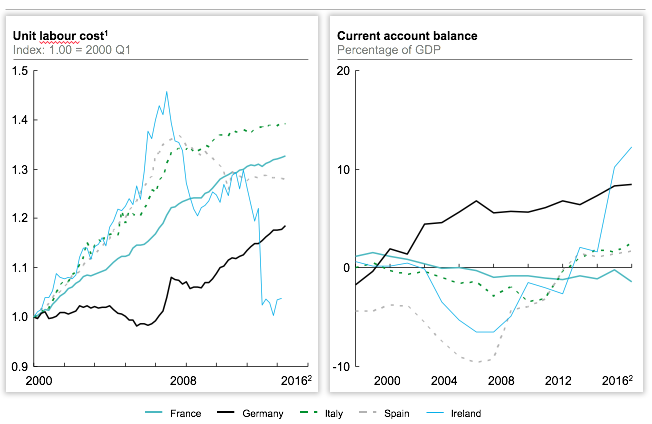

The trade and current account surplus took off in the 1980s, only to drop sharply after unification in 1990. Since the early 2000s, the trend has been a steep and steady rise (Figure 1). Since 2010, the current account increase has been accompanied by fiscal surpluses, with the German government budget swinging from a deficit in 2010 to a surplus of 1.2% of GDP in the first half of 2016.

Figure 1 Germany’s current account surplus ramped up again after the early 2000s in line with an improvement in competitiveness, a situation that stabilised post-crisis

Notes: 1 Data for Ireland until Q2 2016. 2 Data up to Q3 2016.

Source: Eurostat; OECD; McKinsey Global Institute analysis.

This trend towards ever-increasing surpluses is often attributed to relative declines in unit labour costs since the euro’s introduction, a result of wage moderation (at the firm level). This was tantamount to increased price competitiveness. But there is also a non-price or qualitative dimension: surpluses reflect a strong demand for German goods, most notably of knowledge-intensive manufacturing such as automobiles and machinery, but also knowledge-intensive business services like technical services that often go along with this (Roxburgh et al. 2012). As a result, exports as a percentage of GDP have increased from 31% in 2000 to 46% in 2016, according to OECD statistics. By contrast, German imports amount to less than 40% of GDP.

Governments cannot simply dial exports up or down; they are the sum total of individual purchasing decisions taken by consumers and businesses around the world – and it just so happens that German companies make a lot of products those customers really want to buy. Moreover, it makes little sense to view a German export as 100% German, given the growth of global supply chains. The import-intensity of German goods is about 35%.

Nor is it useful to fixate on the macroeconomic perspective and currency issues. Since adopting the euro in 1999, Germany does not control its own currency. While it has drawn some short-term comparative advantage from the relative weakness of the euro exchange rate against the dollar and other currencies in the past couple of years, and from its favourable unit labour cost development in comparison with its Eurozone peers, the post-war history of Germany’s economy actually suggests that a strong currency is a strong incentive for companies, forcing them to become even more competitive. Germany maintained large export surpluses long before the euro was conceived. The strong Deutschmark was always seen as what a leading German economist has called a “productivity whip” (Giersch 1993). Switzerland is another case in point: even an increase in the Swiss franc exchange rate from about CHF 1.65 to the euro pre-crisis to CHF 1.09 today has not balanced the current account or the trade balance, as customers continued to buy Swiss watches, pharma products, and financial services. This is again a case of ‘hors prix’ competitiveness.

The critical issue from our perspective is that the imbalances reflect a retrenchment of capital expenditures within German borders. It is very much in Germany’s own interest to make investment attractive again. Even as exports have risen, savings have grown while investment slowed. Figure 2 shows how corporations vastly increased retained earnings and ramped up their cash buffers while also cutting back on their capital expenditures. Corporate investment in Germany declined from a peak of 14.3% of GDP in 2000 to a low of 11.9% of GDP in 2004 following the dot-com bust and has yet to fully recover even today, despite a strengthening economy and what many companies see as ample opportunities to invest. German companies increased gross savings by 1.8 percentage points of GDP (2010-15 average versus 2000-2005 average). Household savings kept broadly steady while residential housing investment declined since the mid-1990s, and public budgets turned to surplus as public investment declined.

Figure 2 Companies are amassing cash to hedge risk and enable future investment

Source: AMECO; McKinsey Global Institute analysis.

Rather than arguing about how unhealthy this situation is, we see solutions in the form of Germany increasing its productive domestic investment and spending. There is not just room but a need to raise investment on several fronts, as some have pointed out (Enderlein et al. 2017):

- Germany is not a digital leader, even though it aspires to. According to a survey by Bughin et al. (2017), 55% of German firms feel “moderately or very positive” about the impact of increased digitisation and automation on their business. Yet Bughin et al. (2016) estimate that the country has realised only 10% of its digital potential, far behind the US at 18%, the UK at 17%, and Sweden and the Netherlands at 16%. As a starting point, Germany could do a lot more to build out the very high speed and broad digital infrastructure that its industry will need to harness the full potential of the Internet of Things.

- Germany is especially behind on digital government; its public services are still overwhelming ‘analogue’. For example, just 17% of individuals used the internet to submit a form to a public authority in 2015. An EU eGovernment effort ranked Germany as ‘insufficient’ or ‘moderate’ on nearly half of its indicators in 2014. One area where digitisation could make a substantial difference is in expediting the processing of asylum seekers, for example, to improve information collection, decision-making, and communication through all stages of the asylum process.

- Physical infrastructure, including roads, bridges, and railways, could also use an injection of investment. In Germany’s most populous state of North Rhine Westphalia, travellers and commuters suffer from more than 300,000 km of traffic jams caused by infrastructure gaps every year (Wolf 2016). Overall, Woetzel et al. (2016) estimate a gap of 0.4% of GDP between what Germany has been spending on infrastructure and what its needs will be to the year 2030.

Public investment has been rising to finance the integration of the more than one million refugees and asylum seekers who have arrived in Germany since 2015. While this is important and necessary, it is no substitute for a more comprehensive programme of ‘smart’ investment that will bolster Germany’s competitiveness for the longer term. According to our survey (Bughin et al. 2017), 77% of executives would support a programme of higher public investment in areas like energy and green as well as ICT; 32% even if it meant higher taxes.

If the controversy over Germany’s ‘bad’ surpluses that has raged on and off for more than three decades means that the country will end up investing more to become even more productive in the future, some good will have come out of it after all.

References

Bughin J, E Labaye, F Mattern, S Smit, E Windhagen, J Mischke and K Bragg (2017), “European Business: Overcoming uncertainty, strengthening recovery”, McKinsey Global Institute, May.

Bughin J, E Hazan, E Labaye, J Manyika, P Dahlstroem, S Ramaswamy and C Cochin de Billy (2016), “Digital Europe: Pushing the frontier, capturing the benefits”, McKinsey Global Institute, June.

Caballero R J, E Farhi and P-O Gourinchas (2015), “Global imbalances and currency wars at the ZLB”, NBER Working Paper No. 21670.

Enderlein H, P-J Dittrich and D Rinaldi (2017), “#DigitalAmitié, A Franco-German axis to drive digital growth and integration”, Notre Europe Jacques Delors Institute.

Federal Ministry of Finance (2017), “Don’t slam Germany’s trade surplus”, Letter from the Chief Economist, 24 February.

Giersch, H (1993), Openness for prosperity: Essays in world economics, MIT Press.

IMF (2017), Transcript of an interview with IMF Managing Director Christine Lagarde, April 12.

Kollmann R, M Ratto, W Roeger, J in’t Veld and L Vogel (2014), “What drives the German current account? And how does it affect other EU member states”, European Commission Economic Papers No. 516, April.

Labaye E, S Smit, E Windhagen, R Dobbs, J Mischke and M Stone (2015), “A window of opportunity for Europe”, McKinsey Global Institute, June.

Roxburgh C, J Manyika, R Dobbs and J Mischke (2012), “Trading myths: Addressing misconceptions about trade, jobs, and competitiveness”, McKinsey Global Institute, May.

Woetzel J, N Garemo, J Mischke, M Hjerpe and R Palter (2016), “Bridging global infrastructure gaps”, McKinsey Global Institute, June.

Wolf, C (2016), “Wie NRW für weniger Staus sorgen will”, WDR, 26 June.