The Centre for Macroeconomics (CFM) – a partnership between the University of Cambridge, the London School of Economics (LSE), University College London (UCL), the Bank of England and the National Institute of Economic and Social Research (NIESR) – is today publishing the results of a new monthly survey to inform the public about the views held by leading UK based macroeconomists on important questions about macroeconomics and public policy.1 The survey will shed light on the extent to which there is agreement or disagreement on these questions among our panel of experts.

An important motivation for the survey is to allow for a more comprehensive coverage of the views of economists, and in particular, to include the views of those experts whose opinions are not frequently heard in public debates. Our panel of economists are encouraged to add comments with their answers which we hope will contribute to the wider public discourse. Although the survey will primarily focus on questions of macroeconomics and public policy for the UK economy, it will also consider issues related to other countries and regions, as well as questions of broad relevance to all national economies.

Prospects for economic growth in the UK

The first survey focuses on the growth potential of the UK economy.

The global financial crisis has both exposed and contributed to the vulnerability of many financial institutions and markets, as well as that of private and public balance sheets. The UK economy seems to be finally gaining some momentum after years of negative or low growth. Real GDP grew by 1.8% in 2013. The Office of Budget Responsibility (OBR) forecasts growth of 2.7% in 2014, followed by 2.3% in 2015, and settling down to 2.6% over the subsequent two years.

There are many factors that have to be considered when assessing the state of the economy. This survey deals with two such factors:

- The first is the size of the current output gap; and

- The second is the long-term potential growth rate of the economy.

Output gap

The output gap measures the extent to which the level of output is below the potential level of output of the economy. According to the Office of Budget Responsibility, the output gap in the last quarter of 2013 was 1.7% (OBR 2014); and the Bank of England’s measure of spare capacity is currently estimated to be around 1-1.5% of GDP (Bank of England 2014). These estimates imply that the drop in GDP, relative to its pre-crisis trend, which may be as much as 10% on some estimates of trend, is for the most part permanent.

Question 1: The long period of slow or negative growth might imply that there is a substantial output gap in the UK economy. Do you agree that there is currently a larger output gap than the Office of Budget Responsibility estimate to the extent that the shortfall in output relative to capacity is 3% or greater?

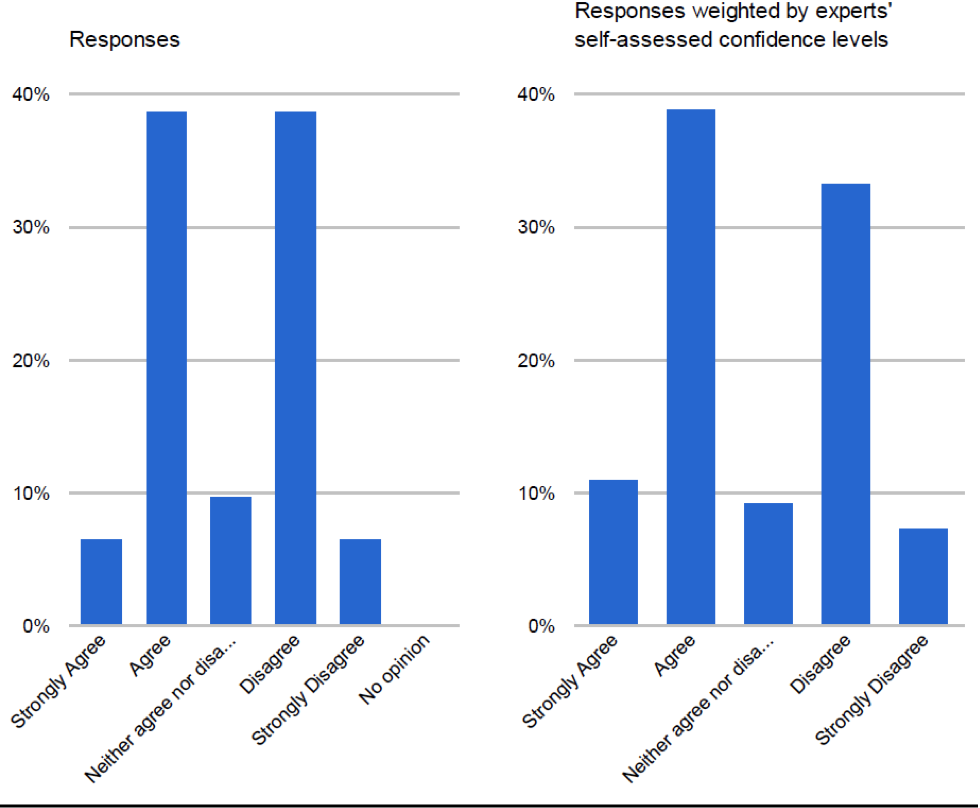

Figure 1. Question 1

Survey results on the output gap

The Centre for Macroeconomics’ survey indicates a broadly positive view of the UK’s immediate capacity for higher growth. UK macroeconomists either support the view of the Office of Budget Responsibility, or support the view that there is more spare capacity, indicating that part of the loss experienced during and after the financial crisis and recession could be recovered.

It is important to note that the assertion in the question is that the shortfall in output relative to capacity is noticeably larger than the Office’s estimate of 1.7%, namely 3% or more. Nevertheless, 46% of the respondents either agree or strongly agree. An equal number disagrees or strongly disagrees, but in this latter group, there is extensive support for the Office of Budget Responsibility’s estimate as indicated in their comments.

Among those who agree with the assertion, the following arguments are given. Jonathan Portes (NIESR) points out that unemployment remains high and that there is little or no sign of unsustainable wage inflation. Regarding the possibility of the economy recouping losses experienced during the financial crisis and the recession, Morten Ravn (UCL) may be the most positive: “I find it hard to identify key reasons for why there should have [been a] permanent decline in the level of output”. A similar view is expressed by Andrew Mountford (Royal Holloway): “the hypothesis that the UK economy returns to trend after recessions looks reasonable”.

Costas Milas (University of Liverpool), who disagrees with the assertion that there is a large output gap, points out that quite a few different analytical techniques lead to low output gap measures. Similarly, George Buckley (Deutsche Bank) points out that the Office of Budget Responsibility’s estimate is consistent with estimates made by others, and consistent with surveys of spare capacity indicating that firms are operating around normal levels.

Long-term potential growth and financial crisis

Even though the UK economy is gaining momentum, it is possible that these vulnerabilities will have long-term consequences for the economy, for example, because of increased awareness of financial market risk and/or the response of policymakers. It is also possible that the economy will be influenced indirectly, for example by long-lasting consequences of the financial crisis on the Eurozone.

Although it seems likely that these developments will have a persistent effect on the level of GDP, it is less clear that they will have a long-lasting effect on the growth rate. In the following question, long-term growth refers to growth over a decade. Note that agreeing with the assertion allows you to think that the financial crisis will have a negative effect on future growth rates as long as it is not substantial.

Question 2: Do you agree that, in the wake of the financial crisis, any downward adjustment to the expected average annual long-term growth rate of the UK economy is likely to be by less than 0.25 percentage points?

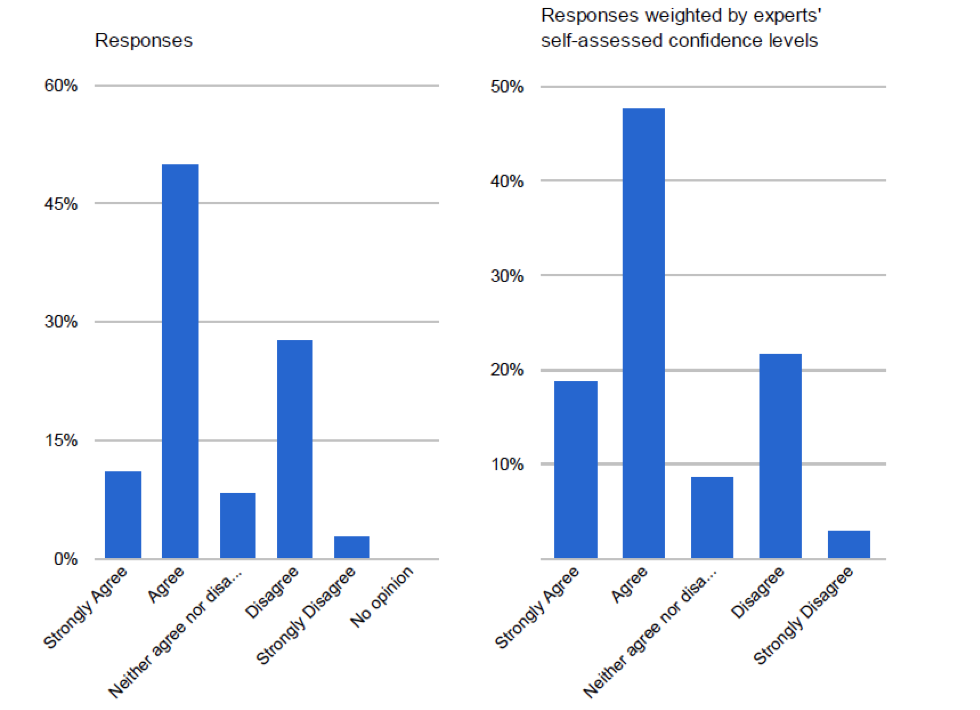

Figure 2. Question 2

Survey results on the impact of the financial crisis on growth

The Centre for Macroeconomics’ survey suggests that fears that the financial crisis will have a significant negative impact on long-term UK economic growth are largely unfounded. Among the respondents, 61% think that the financial crisis will either have no effect on long-term UK growth rates, or a small negative effect that pushes GDP down by less than 2.5% in total over a ten-year horizon. In comparison, 31% disagree or strongly disagree. When we weight the responses by confidence levels, then the support for the assertion intensifies (67% agreeing and 25% disagreeing).

Martin Ellison (University of Oxford) and David Cobham (Heriot Watt University), who agree with the assertion, point out that past UK recessions did not seem to have had a long-term impact on growth.

Although respondents that disagree with the assertion are a minority, several reasons are given why the impact of the financial sector may be more severe. Tony Yates (University of Bristol) does not think that the financial crisis has an impact on long-term growth rates, but points out that this is conditional on intermediary balance sheets being repaired. George Buckley (Deutsche Bank) and John Driffill (Birkbeck College, London) say that growth before the financial crisis was unsustainable: the financial crisis can have then an impact on growth rates by bursting this bubble.

Luis Garicano (LSE) and Marco Bassetto (UCL) note that financial services have played an important part in past GDP growth in the UK. Marco Bassetto writes: “if the crisis leads to a prolonged decline of the industry, it could have an impact on growth for several years to come”. Finally, Marco Bassetto (UCL) and Wouter Den Haan (LSE) highlight possible negative consequences related to the uncertainty of policy reform in the financial sector.

Footnotes

1. Results are available at http://www.cfmsurvey.org.

References

Bank of England (2014), "Inflation Report", February.

Office of Budget Responsibility (2014), “Economic and fiscal outlook”.