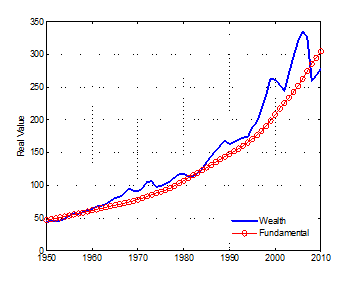

Wealth has fluctuated substantially in recent US macroeconomic history. Figure 1 below documents this by plotting the evolution of real net worth of US households and non-profit organisations between 1950 and 2010. Up until the early 1990s the evolution of wealth seems relatively stable, displaying only mild and short-lived fluctuations around its trend. Since then, however, this behaviour has changed dramatically. From 1995 to 1999, and again from 2002 to 2006, wealth grew at a staggering 9% per year only to contract violently in subsequent years. Most of these fluctuations have been driven by changes in stock and housing prices.

Figure 1. Real value of US wealth and its fundamental, 1960-2010

The magnitude of these episodes is unprecedented in US post-war history. To grasp their significance it is useful to scale wealth by GDP. From 1950 to 1995, the wealth-to-GDP ratio had been stable around a value of 3.4. In the mid-1990s, wealth took off, peaking at 4.6 and 5 times GDP in 1999 and 2006 respectively. Both peaks were followed by destruction of wealth on a massive scale, bringing the wealth-to-GDP ratio close to its historical average by the end of the sample.

The theory of rational bubbles shows that these movements in asset prices can be interpreted as the change in two separate components: the fundamental and the bubble. Consider, for instance, the value of all productive assets located in the US, which mostly consist of its capital stock and land. In any given period, the fundamental component of this value is the present discounted value of all the cash flows that these assets might generate in the future. The bubble component is instead the value of all pyramid schemes attached to US productive assets.

At first sight, the notion that part of wealth is a bubble or a pyramid scheme might seem quite abstract or exotic. But it is easy to find real-world situations that correspond fairly well to this concept. Consider, for instance, the stock of a firm that is traded at a price that exceeds its fundamental, i.e. the net present value of the dividends that this stock will generate. This ‘overvalued’ price might be part of an equilibrium if buyers rationally expect to sell these stocks in the future at a price that also exceeds the fundamental. Consider, alternatively, credit given to a firm in excess of the net present value of the cash flows that this firm will generate. This ‘excessive’ credit might be part of an equilibrium if creditors rationally expect that the firm will be able to raise enough credit in the future to repay them.

Overvalued stock prices and excessive credit can be therefore be interpreted as bubbles or pyramid schemes, that is, as voluntary contributions to the firm's financing that give the right to the next voluntary contribution. Once we think in these terms, the concept of a bubble ceases to be abstract or exotic and it becomes quite mundane. Indeed, it seems to capture the type of real-world behaviour that our macroeconomic models should be generating as an equilibrium phenomenon.

Still, standard macroeconomic models largely ignore the possibility of bubbles and try to explain all fluctuations in wealth as a result of fluctuations in the fundamental. We show the limitations of this approach by performing a simple calculation of this fundamental. To do this, we measure the cash flows that US productive assets generate as capital income, net of taxes and investment. We then compute the expected present discounted value of these cash-flows by following Robert J Shiller (2005) in making two assumptions: (i) the expected rate of return is constant for all time horizon, and it is well approximated by the average real return on wealth over the 1950-2010 period; and (ii) out-of-sample cash-flows grow at a constant rate - given by the historical average of their real growth rate - and we resort to perfect foresight for within-sample cash-flows. This procedure generates an estimate of the fundamental that is plotted as the circled line in Figure 1.

Two facts are immediately apparent from Figure 1. First, up until the early 1990s - and despite the crudeness of the method described above - wealth has remained remarkably close to its fundamental. While we do observe deviations from the fundamental during this period, these are typically mild and short-lived. Second, the two boom-and-bust episodes of the last two decades constitute unprecedented deviations from the fundamental. This is consistent with the popular view that the evolution of wealth since the late 1990s has been in part driven by the appearance and subsequent bursting of bubbles in markets for key assets such as equity and real estate.

This poses a challenge. To understand recent developments in the US and other industrial countries, we need to introduce bubbly episodes into the general equilibrium models that are routinely used in modern macroeconomics. Only then could we use these models to study the sort o wealth fluctuations that we have documented above. When can we have a bubbly episode? What are its main macroeconomic effects? How should policymakers react to the onset of a bubbly episode and/or its collapse? As the recent crisis has painfully exposed, these are critical questions for macroeconomics.

In previous work, Martin and Ventura (2011a, 2011b) and Carvalho et al. (2012a, 2012b) we started developing one possible answer to these questions. In particular, we explore the implications of a simple macroeconomic model in which investment financing is constrained because entrepreneurs do not have enough collateral. This model illustrates how, in such a situation, the appearance of a stock or credit bubble relaxes these constraints and raises investment and output. The mechanism is simple: savers are willing to purchase overvalued stock and/or give easy credit to entrepreneurs today if they expect that stock prices will be overvalued and/or entrepreneurs will find easy credit tomorrow. That is, a bubble is possible today just because it is expected to continue tomorrow. The financial market is therefore not using future production as collateral, but instead it is using the bubble itself. Through this mechanism, the bubble raises investment and fosters growth. This allows the economy to sustain a higher level of consumption and welfare.

Conclusions

The development of models that combine rational bubbles and financial frictions has profound implications for the way we think about economic fluctuations. First, it lays the foundations for the introduction of investor sentiment shocks into standard macroeconomic models. This seems crucial to explain the recent macroeconomic history of the US and other industrial countries. Second, it has important implications for the way we think about policy responses to downturns. If a downturn originates in a negative productivity shock that tightens credit constraints, the government might have little to do unless it has an advantage in lending vis-à-vis the private sector. But if a downturn originates in a negative investor sentiment shock that bursts a bubble, the government might have an important role to play in coordinating expectations and taking the economy back to the bubbly equilibrium.

References

Abel, A, G Mankiw, L Summers, and R Zeckhauser (1989), “Assessing Dynamic Efficiency: Theory and Evidence”, Review of Economic Studies, 56:1-19.

Carvalho, VM, A Martin, and J Ventura (2012), “Bubbly Business Cycles”, CREi working paper.

Martin, A and J Ventura (2011), “Economic Growth with Bubbles”, forthcoming, American Economic Review.

Samuelson, P (1958), “An Exact Consumption-loan Model of Interest with or without the Social Contrivance of Money”, Journal of Political Economy, 66:467-482.

Shiller, R (2005), Irrational Exuberance, Princeton University Press.

Tirole, J (1985), “Asset Bubbles and Overlapping Generations”, Econometrica, 53(6):1499-1528.