The global engagement of a firm could range from none at all, to exporting and importing only, to exporting, importing and engaging in foreign direct investment. Research has shown that, for firms located in the US, the most globally engaged firms dominate both trade and investment. Bernard et al. (2009) find that multinational enterprises (MNEs) accounted for roughly 90% of US exports and imports of goods in 1993 and 2000. Bruner and Grimm (2019) find that MNEs accounted for roughly 90% of US exports and imports of selected services in 2011–2017. The dominance of MNEs in both trade and investment suggests that most international trade is associated with their global value chains (GVCs) and that the traditional notion of exports and imports representing transactions between producers and final consumers is in need of an update.

Statistical efforts are underway worldwide to provide insight into GVCs by developing estimates of Trade in Value Added (TiVA). Bilateral trade balances measured using TiVA statistics can be very different from those based on gross trade flows, which is not surprising since a sizeable share of trade is composed of intermediate goods that have crossed borders multiple times (Johnson and Noguera 2012). Also, while gross trade flows are appropriate for identifying the types of firms engaged in trade transactions, TiVA measures that account for firm type will more accurately represent the contributions of content to trade flows and final demand by different types of firms. Finding direct measurement of TiVA to be impractical, national statistical offices have focused their efforts on indirectly measuring TiVA by refining national-level supply-use tables (SUTs) that can be combined into a global SUT. While these SUTs account for heterogeneity in production across industries, extended SUTs that are disaggregated by both industry and firm type are needed to account for heterogeneity across different types of firms within an industry. Comparing the extended SUTs to standard SUTs allows us to better understand how firms within industries engage in GVCs and to see how the incorporation of firm heterogeneity provides a more accurate measure of TiVA.

Accounting for firm heterogeneity with extended SUTs

Much research has found evidence of heterogeneity in value added, trade, and imported intermediate inputs between different types of firms across a broad group of countries including the US, Japan, China, and many European countries (Zeile 1998, Ahmad et al. 2013, Fetzer and Strassner 2015, Piacentini and Fortanier 2015, and Ma et al. 2015). Other research, such as Ito et al. (2017), Michel et al. (2018), and Saborío and Torres-Mora (2018), has produced TiVA estimates from extended SUTs broken out by the export activities of firms or firms that are export oriented. Heterogeneity across types of firms is consistent with the productivity sorting hypothesis of Melitz (2003) and Helpman et al. (2004), which explains how a firm’s level of global engagement tends to result from its level of productivity.

To account for heterogeneity within industries, the US Bureau of Economic Analysis (BEA) has built experimental, extended SUTs for the US by ownership status of firms for 2005 and 2012 (Fetzer et al. 2018a). These tables are a more refined set of estimates that build off the 2011 table constructed by Fetzer et al. (2018b). In both rounds, firm heterogeneity was introduced into BEA’s published SUTs through the incorporation of BEA Activities of Multinational Enterprise (AMNE) statistics. These statistics cover the financial and operating characteristics of US parent companies (domestic-owned MNEs) and US affiliates that are majority-owned by foreign MNEs (foreign-owned MNEs). Estimates of activity by industry for domestic-owned and foreign-owned MNEs are derived directly from BEA AMNE datasets, and non-MNE activity is derived residually as total activity less the MNE data. These tables are a precursor to more precise estimates of extended SUTs that will eventually result from ongoing collaboration between BEA and the US Census Bureau to identify firm characteristics in the microdata used to produce SUTs.

The imported content of exports of MNEs is typically higher than that of non-MNEs

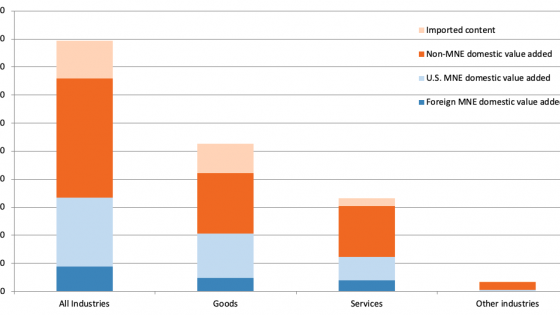

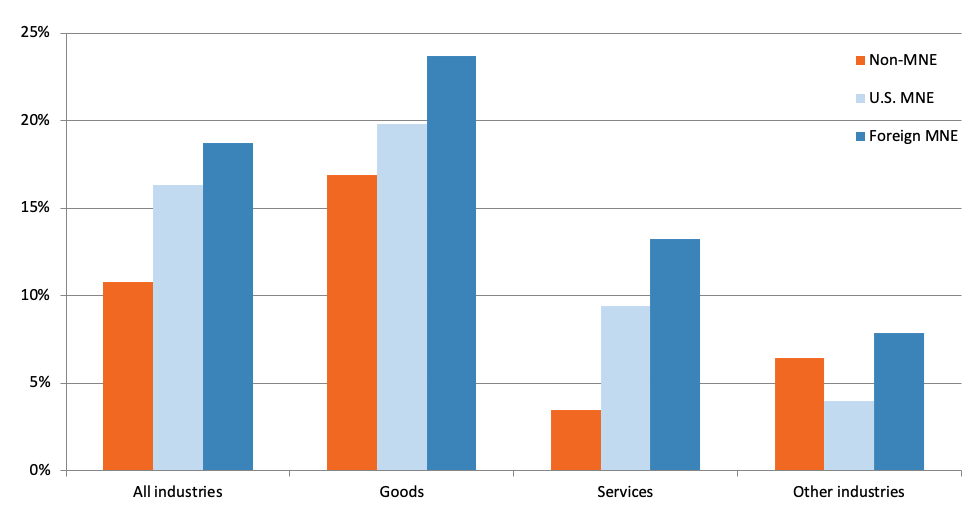

According to extended SUT estimates for 2012, our most recent year of data, the imported content of exports was 19% for exports by US units of foreign MNEs, followed by 16% for exports by US MNEs, and 11% for exports by non-MNEs (Figure 1). The import share of content was particularly high in motor vehicle manufacturing for US units of foreign MNEs, in management, scientific, and technical services for US MNEs, and in petroleum manufacturing for all three firm types. The higher import content for US establishments owned by MNEs partly reflects the presence of global chains in their production strategies.

Figure 1 Imported content of exports as a share of gross exports, by industry type and firm type, 2012

Source: Fetzer et al. (2018a)’s calculations based on BEA SUTs and BEA AMNE and trade in services microdata.

Both MNEs and non-MNEs make a significant contribution to the content of US exports

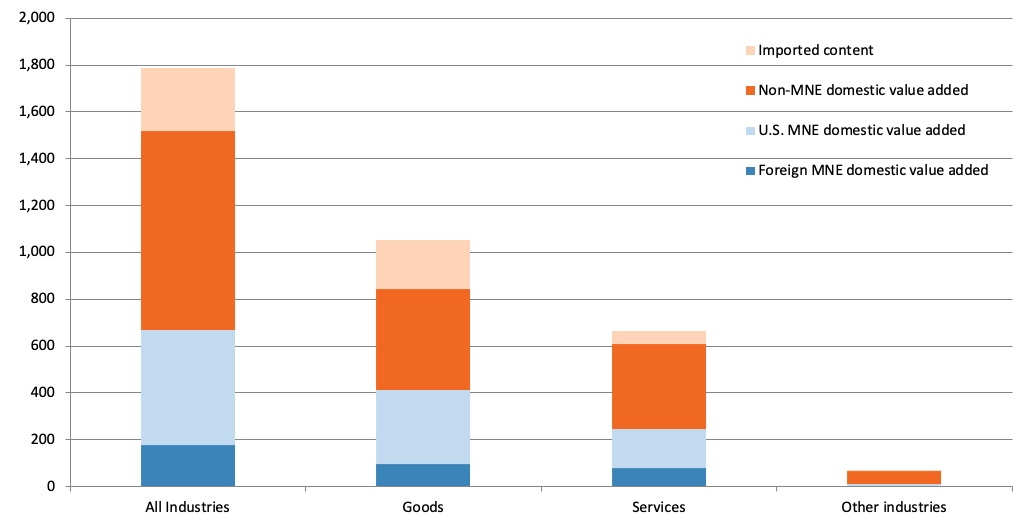

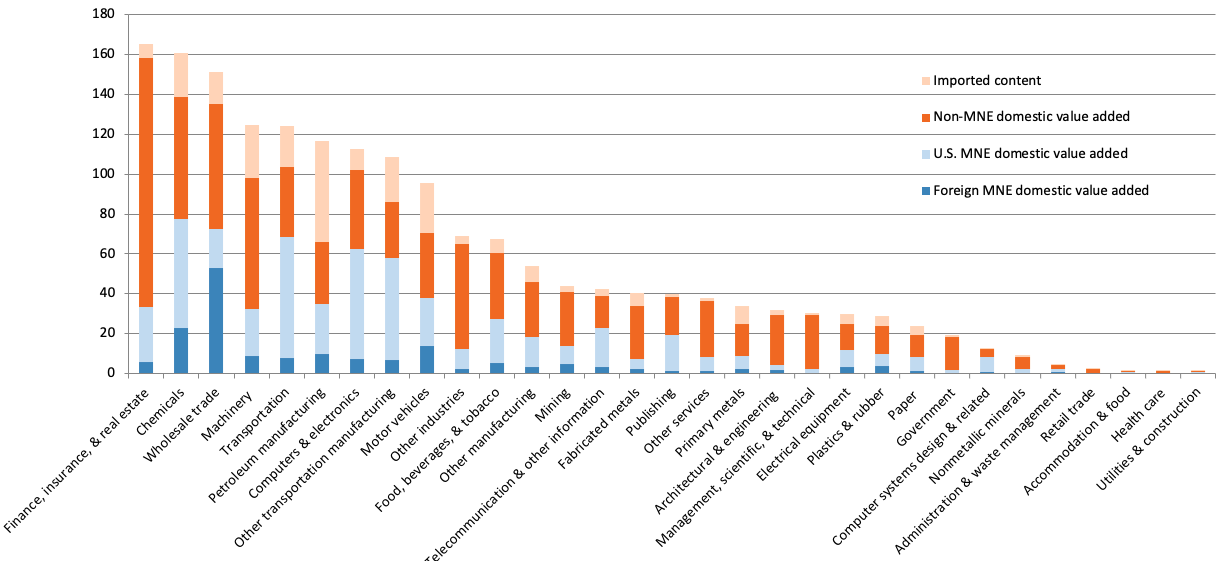

Despite the dominance that MNEs have over trade transactions, both MNEs and non-MNEs make significant contributions to the content of US exports. According to TiVA estimates for the US in 2012 based on these extended SUTs,1 non-MNEs contribute close to one-half of the content of exports (Figure 2). US and foreign MNEs contribute close to 40% of the content of exports and the remaining contribution is from imported content. Non-MNEs contribute slightly more than one-half of the content of exports from services industries, and slightly more content as a share of exports from goods industries than MNEs. However, MNEs contributed more value-added content than non-MNEs to exports of seven of the nine largest industries in terms of exports (Figure 3).

Figure 2 Source of content in exports by goods-producing and service industries, 2012 (billions of $)

Source: Fetzer et al. (2018a)’s calculations based on BEA SUTs and BEA AMNE and trade in services microdata.

Figure 3 Source of content in exports by industry, sorted by value of exports, 2012 (billions of $)

Source: Fetzer et al. (2018a)’s calculations based on BEA SUTs and BEA AMNE and trade in services microdata.

Turning from exports to domestically consumed goods and services, non-MNEs contribute a much larger share of value added to the production of final domestic demand than MNEs since they tend to contribute more value added to industries accounting for the largest share of final domestic demand. Value added by non-MNEs made up almost three-fourths of final domestic demand for service industries in 2012, while it contributed about one-half of the content of final domestic demand in goods-producing industries. Government services, finance, insurance, and real estate (FIRE), and healthcare are the largest components of final domestic demand and their value added primarily comes from non-MNEs. Foreign-owned-MNE value added made up only about 4% of final domestic demand in 2012, compared with 10% of exports.

Labour productivity – measured by gross output per employee – for both US-owned MNEs and foreign-owned MNEs is almost twice as large as that for non-MNEs in both 2005 and 2012. These patterns are consistent with the productivity sorting hypothesis of Melitz (2003) and Helpman et al. (2004) mentioned earlier. Consistent with the framework developed by Bernard et al. (2018) on productivity of global firms, we expect that one source of the high productivity of MNEs is that they are more likely to lower their costs by importing inputs from multiple countries and also expand the scale of their operations by exporting a larger number of products to many countries.

Firm size class and exporters also identify heterogeneity in the semiconductor industry

The conclusions thus far have been based on an approximation of establishment-level data based on enterprise-level data and other information, but we do look at actual establishment-level data for one industry – namely, semiconductor manufacturing. We find that the ownership criterion identifies more heterogeneity in value added and its components than the firm size class and export intensity criteria in this industry. However, firm size class identifies more heterogeneity in exports as a share of gross output than the ownership criterion. While these results are experimental and only for one industry, they suggest that the three firm types (by ownership, by size, and by export intensity) identify visible heterogeneity in production patterns and that different criterion better identify heterogeneity for different measures of economic activity.

Conclusion and next steps

Our results provide further evidence that accounting for firm heterogeneity matters in measuring production, and that adjusting for firm heterogeneity gives us a better picture of the role of GVCs in the US economy. Using these data, we can illustrate how US production relies on inputs from both domestic and global supply chains. Looking ahead, BEA continues to work towards producing complete extended SUTs using data at the establishment level, as well as producing more accurate single country TiVA statistics for the US. BEA is also participating in international statistical initiatives with the OECD to produce international TiVA estimates and is collaborating with the US International Trade Commission, Statistics Canada, and Mexico’s Instituto Nacional de Estadística y Geografía to develop North American regional SUTs and TiVA statistics. In addition, BEA continues to collaborate with the Asia-Pacific Economic Cooperation (APEC) to support work by APEC member countries to produce SUTs.

Authors’ note: The statistical analysis of firm-level data on US multinational companies was conducted at the Bureau of Economic Analysis, US Department of Commerce, and the Federal Statistical Research Data Center Network under arrangements that maintain legal confidentiality requirements. The views expressed in this column are those of the authors and do not necessarily represent the Bureau of Economic Analysis, the US Census Bureau, or the U.S. Department of Commerce. The Census Bureau's Disclosure Review Board and Disclosure Avoidance Officers have reviewed this information product for unauthorised disclosure of confidential information and have approved the disclosure avoidance practices applied to this release. (CMS/Delegated Authority Number 6308).

References

Ahmad, N, S Araujo, A Lo Turco, and D Maggioni (2013), “Using trade microdata to improve trade in value added measures: proof of concept using Turkish data”, in A Mattoo, Z Wang, and S Wei (eds), Trade in Value Added: Developing New Measures of Cross-Border Trade, The World Bank, pp. 187–219.

Bernard, A B, J B Jensen, S J Redding, and P K Schott (2018), “Global Firms”, Journal of Economic Literature 56(2): 565–619.

Bernard, A B, J B Jensen, and P K Schott (2009), “Importers, exporters and multinationals: a portrait of firms in the US that trade goods”, in T Dunne, J B Jensen, and M J Roberts (eds), Producer dynamics: New evidence from micro data, University of Chicago Press, pp. 513-552.

Bruner, J and A Grimm (2019), “A Profile of U.S. Exporters and Importers of Services, 2017”, Survey of Current Business 99(12).

Fetzer, J J, T Highfill, K W Hossiso, T F Howells III, E H Strassner, and J A Young, (2018a), “Accounting for Firm Heterogeneity within U.S. Industries: Extended Supply-Use Tables and Trade in Value Added using Enterprise and Establishment Level Data”, prepared for the NBER CRIW conference on “The Challenges of Globalization in the Measurement of National Accounts”, March (revised March 2021).

Fetzer, J J, T F Howells III, L Jones, E H Strassner, and Z Wang (2018b), “Estimating Extended Supply-Use Tables in Basic Prices with Firm Heterogeneity for the United States: A Proof of Concept”, BEA Working paper WP2018-12.

Fetzer, J J and E H Strassner (2015), “Identifying Heterogeneity in the Production Components of Globally Engaged Business Enterprises in the United States”, BEA Working Paper WP2015-13.

Helpman, E, M J Melitz, and S R Yeaple (2004), “Export versus FDI with heterogeneous firms”, American Economic Review 94(1): 300–316.

Ito, K, I Deseatnicov, and K Fukao (2017), “Japanese Plants’ Heterogeneity in Sales, Factor Inputs, and Participation in Global Value Chains”, Research Institute of Economy, Trade, and Industry Discussion Paper Series 17-E-117.

Johnson, R C and G Noguera, (2012), “Accounting for intermediates: production sharing and trade in value added”, Journal of International Economics 86(2): 224–236.

Melitz, M J (2003), “The impact of trade on intra‐industry reallocations and aggregate industry productivity”, Econometrica 71(6): 1695–1725.

Michel, B, C Hambÿe, and B Hertveldt (2018), “The Role of Exporters and Domestic Producers in GVCs: Evidence for Belgium Based on Extended National Supply-and-Use Tables Integrated into a Global Multiregional Input-Output Table”, prepared for the NBER CRIW conference on “The Challenges of Globalization in the Measurement of National Accounts”, March.

Piacentini, M and F Fortanier (2015), “Firm heterogeneity and trade in value added”, OECD Working Paper STD/CSSP/WPTGS(2015)23.

Saborío, G and R Torres-Mora (2018), “Costa Rica: Integrating Foreign Direct Investment Data and Extended Supply and Use Tables into National Accounts”, prepared for the NBER CRIW conference on “The Challenges of Globalization in the Measurement of National Accounts”, March.

Zeile, W (1998), “Imported Inputs and the Domestic Content of Production by Foreign-Owned Manufacturing Affiliates in the United States”, in R E Baldwin, R E Lipsey, and J D Richardson (eds), Geography and Ownership as Bases for Economic Accounting, University of Chicago Press, pp. 205–232.

Endnotes

1 It is important to note that these results are based on a single-country TiVA model, which assumes that imported products do not contain embedded domestic value added. In this case, estimates of domestic content in production can be viewed as lower bounds, rather than point estimates.