Do job displacements compound private costs (i.e. earnings losses) with productivity-enhancing reallocation? The former aspect has been documented in a vast literature. Since Jacobson et al. (1993) and Farber (1993), research has consistently shown that displaced workers suffer long-run earnings losses (see Bertheau et al. 2022 for recent cross-country evidence). The latter aspect is however called into question by recent advances in the job displacement literature.

On the one hand, it is an old idea that low productivity firms (must) shrink while high productivity firms (can) grow (Schumpeter 1942, Foster et al., 2001). In that view, declining industries and struggling businesses are the inevitable consequences of a changing economy, and displacements are just a specific type of reallocation of factors. Because reallocation appears as a process at the core of productivity growth (Hsieh and Klenow 2009, Foster et al. 2016), displacement can thus be viewed as socially productive.

On the other hand, the most recent advances in the job displacement literature document that workers are reallocated toward lower-wage firms. Recent papers indeed highlight the role of differences between origin (i.e. firing) and destination (i.e. hiring) firms to explain the long-run decline in wage rate that is commonly observed upon displacement (Gulyas and Pytka 2019, Lachowska et al. 2020, Moore and Scott-Clayton 2019, Schmieder et al. 2020, Fackler et al. 2021, Bertheau et al. 2022). In particular, these studies show that displaced workers reallocate to firms with lower wage premium – where premia are measured à la Abowd et al. (1999).

This is surprising because an ever-growing literature documents that productivity and wages are correlated in the cross section of firms (Berlingieri et al. 2018, Card et al. 2016). If displaced workers go down the wage ladder, does this imply that they also reallocate toward lower productivity firms? Or does this imply that losses in firm premium are driven by reemployment at high-productivity yet low-labour-share firms (Autor et al. 2020, Aghion et al. 2022)? Whether earnings losses reflect a reallocation to firms generating less surplus per worker or a decline in workers’ negotiation power is an important question. Not only does it matter for our understanding of labour reallocation in the wake of downsizing events, but it is also telling about the role of firms in the labour market and can therefore help derive more effective policies.

In a recent paper (Brandily et al. 2022), we shed new light on these questions by studying the process of reallocation that follows job displacement. Relying on rich administrative data from France, we study jointly the wage policy and productive performance of the firms in which displaced workers are re-employed.

The role of firms in shaping the cost of job displacement in France

We rely on an administrative definition of economic layoffs whereby firms must justify facing economic difficulties. This enables us to minimise the risk of studying individuals who voluntarily left their firm and whose employment trajectory is highly endogenous, while relying on a larger set of involuntary labour market separations than in the literature relying on mass layoffs (defined as episodes of large employment contraction – typically in excess of 30% of the initial workforce).

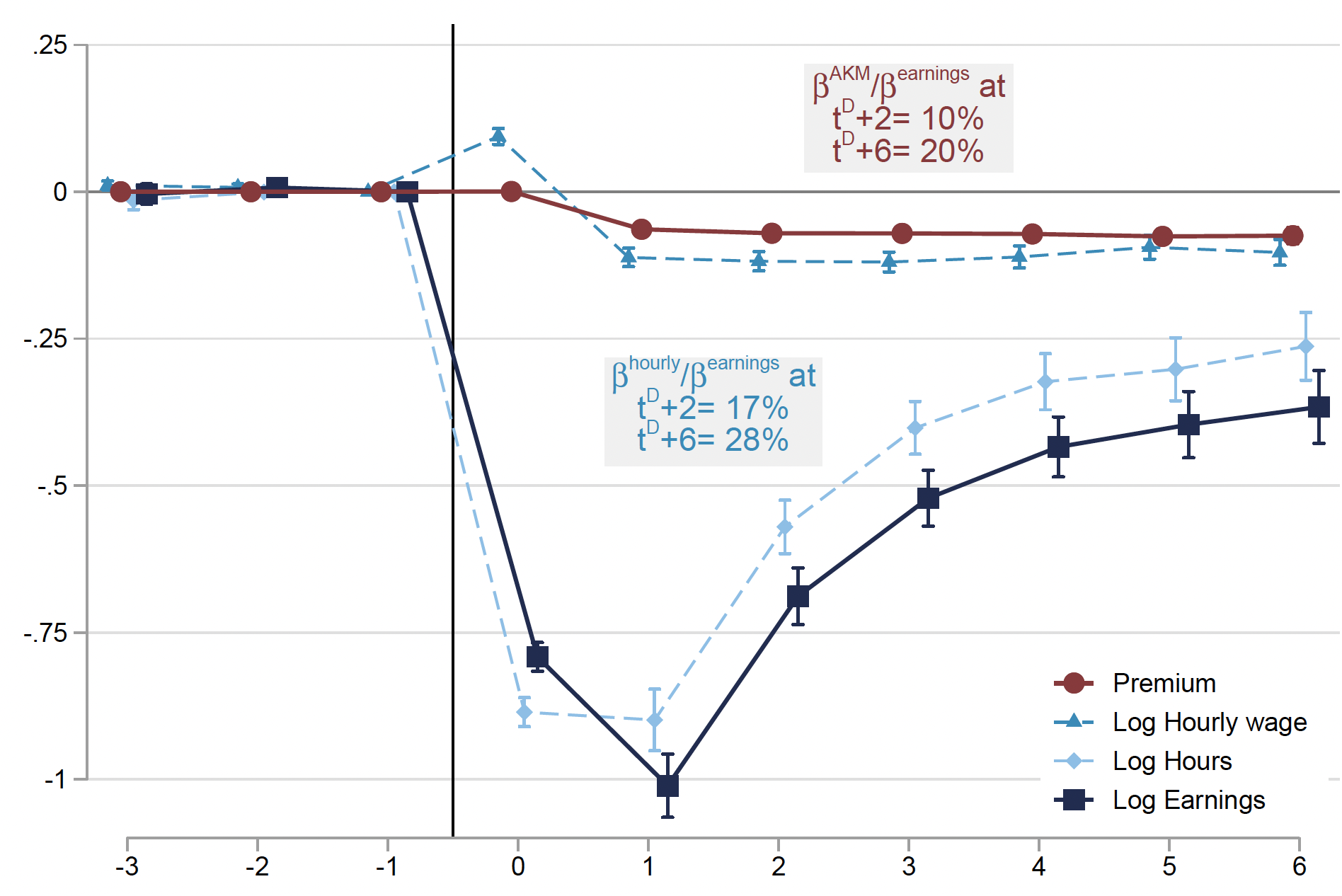

Using this sample of workers laid-off for economic reasons, we first find evidence of large and persistent earnings losses, that amount to about a third of pre-displacement earnings six years post-displacement. Figure 1 traces out the average difference (between displaced and control workers) before and after the job displacement event. It further decomposes this difference in terms of hours, hourly wage and firm premium. In the long run, losses in hourly wage rate show no sign of recovery. These persistent losses in hourly wage are explained to a very large extent (80.5%) by loss in firm wage premium. This finding adds to an active literature assessing the importance of lost wage premium in shaping the cost of displacement in other countries. Lachowska et al. (2020) and Schmieder et al. (2020) came to different conclusions on this matter, thereby prompting further research (Gulyas and Pytka 2019, Moore and Scott-Clayton 2019, Fackler et al. 2021, Bertheau et al. 2022).

Figure 1 Decomposition of the cost of job displacement

Overall, this first analysis shows that in our setting losses in firm premium are a major driver of decline in hourly wage in the wake of job displacement, and that reallocation to low-wage firms appears quantitatively more important than alternative explanations (such as employer-employee match effects or human capital depreciation as emphasised by Lachowska et al. 2020).

Productivity and wage premium

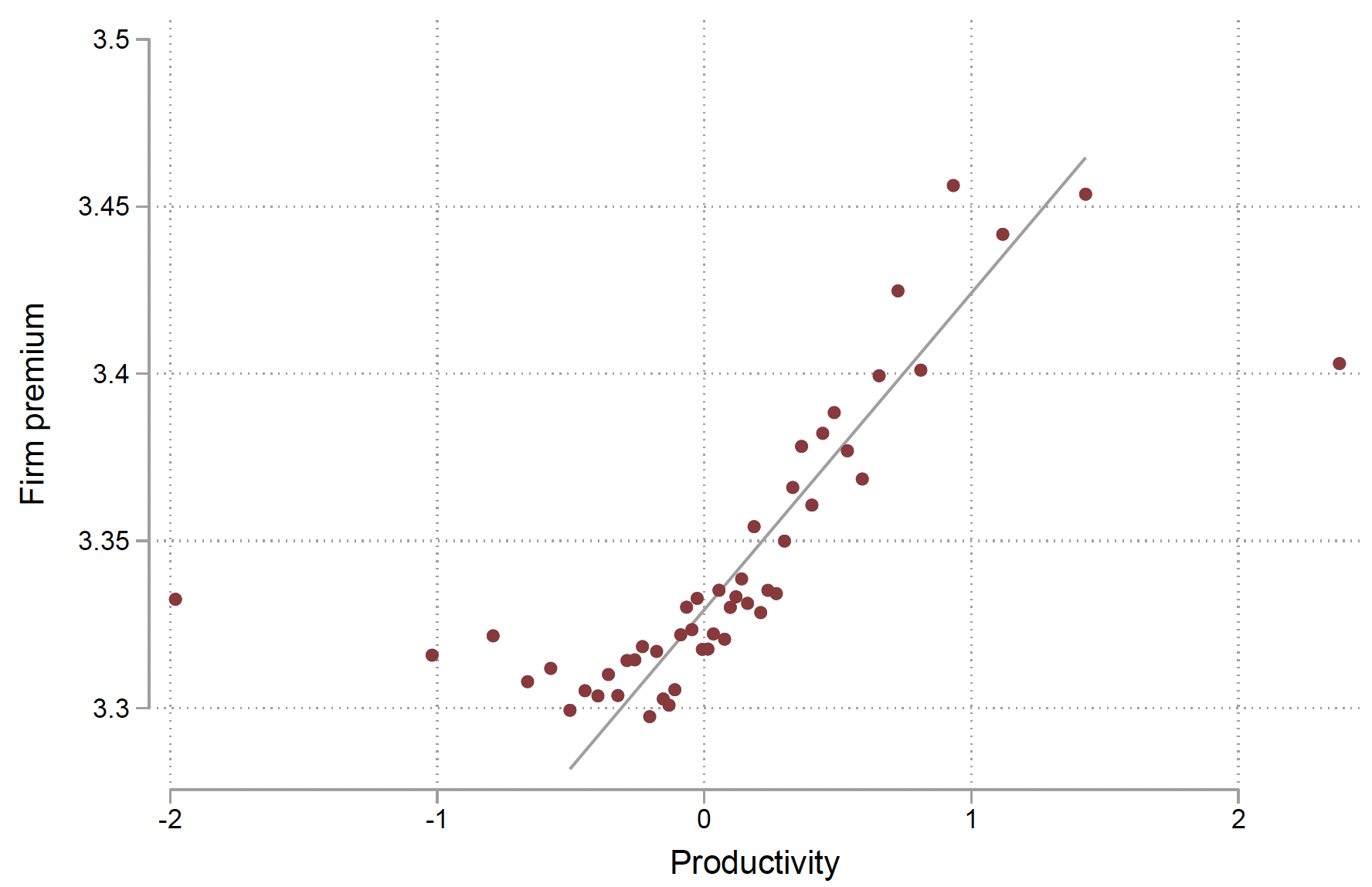

As explained before, these findings could be consistent with two views. In the first view, displaced workers are reallocated toward lower productivity firms. Indeed, we know from the literature that wage premium and productivity are positively related across firms (Card et al. 2013), a feature we also observe in our estimation sample (Figure 2). The other possibility is that losses in firm premium are instead driven by reemployment at high-productivity yet low-labour-share firms.

Figure 2 Firm-specific wage premium and productivity

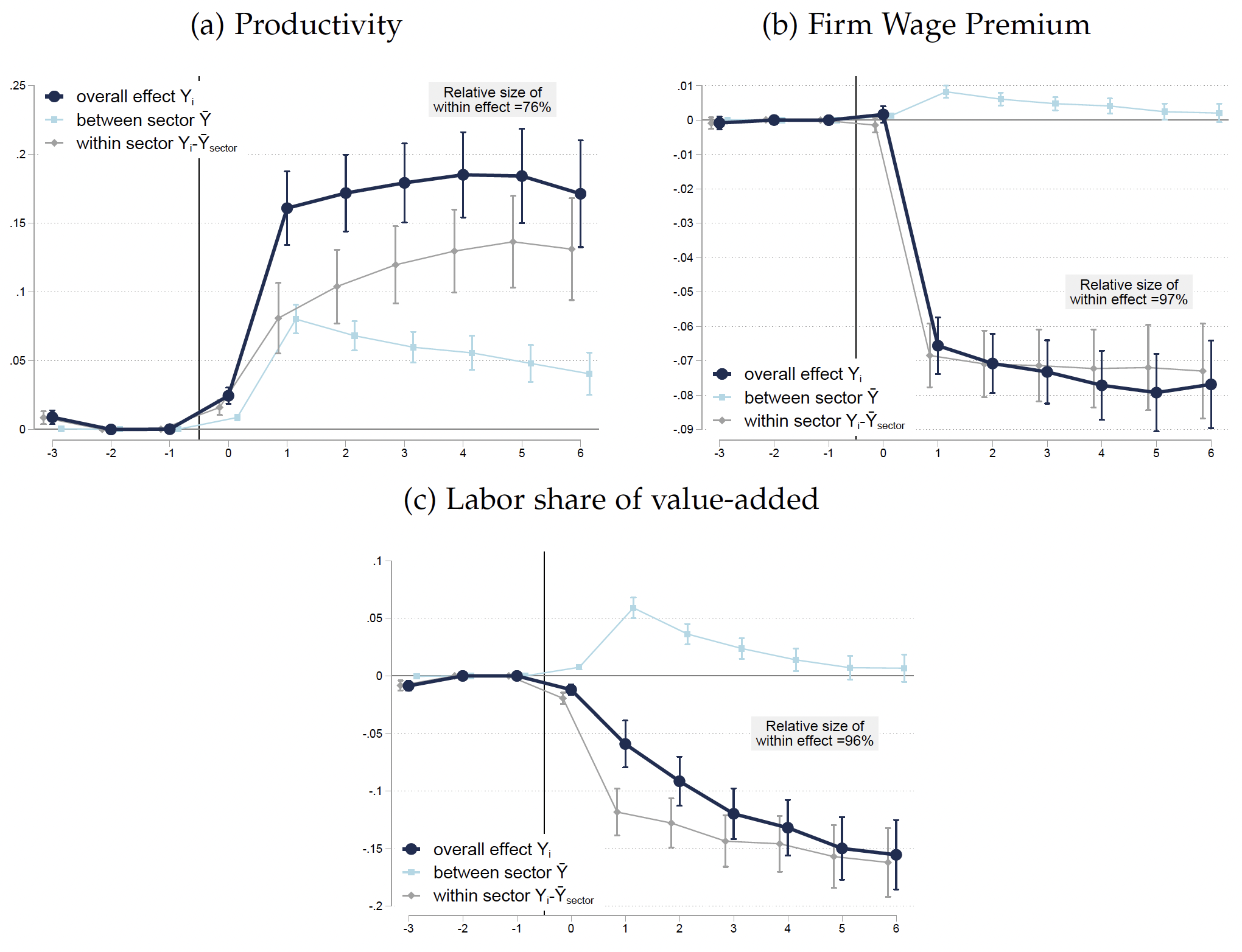

Leveraging detailed administrative firm data, we show that the reallocation of workers to lower wage premium firms does not reflect a reallocation towards low productivity firms. Instead, destination firms tend to be more productive but pay lower premium (Figure 3). More precisely, we find that displaced workers reallocate on average toward firms that are 15% more productive than the counterfactual workers' (Figure 3a),1 and that they face a reduction in the firm wage-premium (Figure 3b). Consequently, displaced workers are reallocated to firms that also feature a lower labour share of value-added than the counterfactual (-15.5% five years after displacement; see Figure 3c).

Figure 3 Productivity and labour share of current employers

Collective bargaining in destination firms

We view the pattern documented above as suggestive of a decline in bargaining power as opposed to difficulties to access jobs in productive firms. That is, losses in premium seem to reflect a decline in workers' negotiation power; where we define loss in negotiation power as being re-employed by firms with unfavourable wage policy given (as opposed to because of) their productivity.

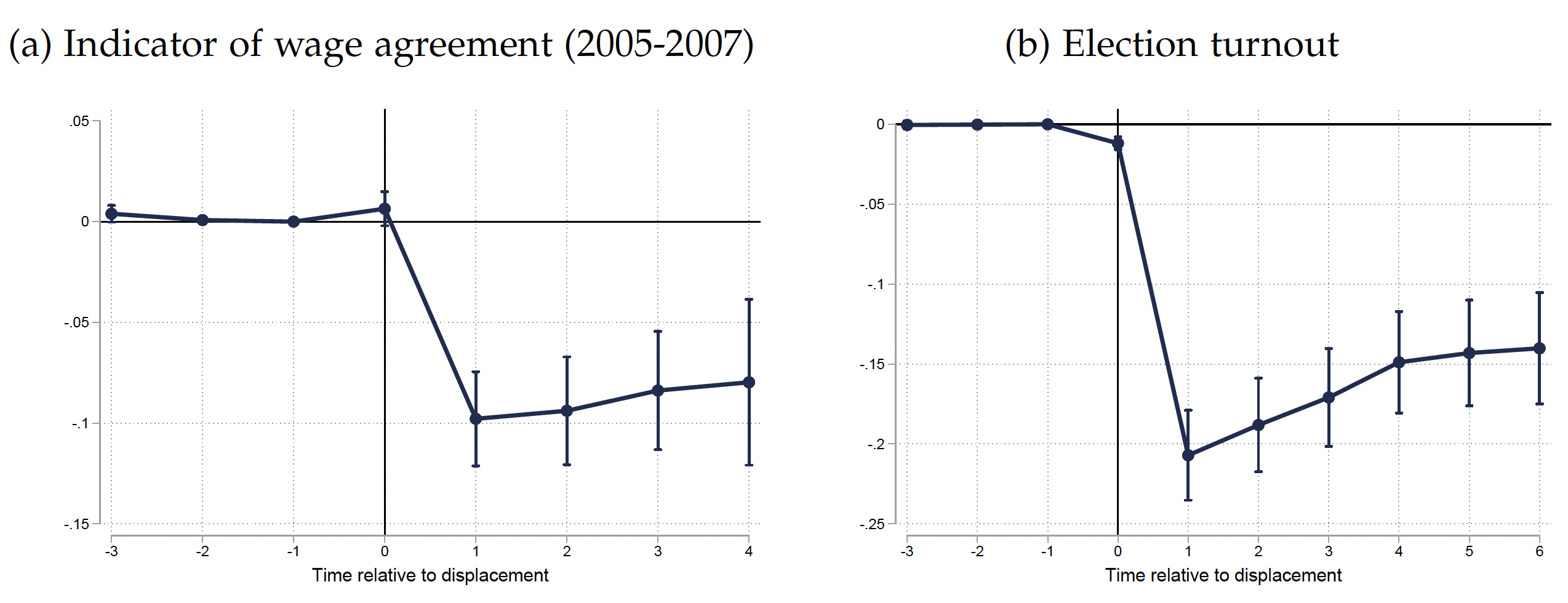

To support this idea, we build original firm-level indicators capturing the state of labour relations in each employer. The use of firm-level data (as opposed to sector-level proxies for collective bargaining) is crucial because we show that the effects are driven by within-sector dynamics rather than reallocation across sectors with systematic differences. In Figure 4, we provide evidence that displaced workers are reallocated to employers that are less likely to successfully conclude firm-level collective wage agreements (prior to workers' displacement event) and where workers have a lower participation rate during professional elections – arguably reflecting a lower degree of organization of the workforce.

Figure 4 Quality of labour relations: Firm-level measures

Conclusion

Our findings have several implications. In terms of modelling of the labour market, they highlight that wage and productivity ladders (Moscarini and Postel-Vinay 2018) are not always collinear – workers can fall from one while climbing the other. In terms of policy, confirming that job displacements are productivity-enhancing reallocations suggests that, rather than slowing down the process of reallocation, it would be useful to explore ways of mitigating the private cost they impose on workers, for instance through wage insurance. Alternatively, policy could instead focus on enhancing workers bargaining power in destination firms.

Those destination firms are able to constrain labour compensation despite the fact that they generate large surplus-per-worker. Understanding whether this ability derives from market power (on the labour or the product market) and in turn what the determinants of this market power are remain important questions which we leave for future research.

References

Abowd, J M, F Kramarz, and D N Margolis (1999), “High wage workers and high wage firms”, Econometrica 67(2): 251–333.

Aghion, P, A Bergeaud, T Boppart, P J Klenow, and H Li (2022), “A theory of falling growth and rising rents”, National Bureau of Economic Research and Stanford mimeo.

Autor, D, D Dorn, L F Katz, C Patterson, and J Van Reenen (2020), “The fall of the labor share and the rise of superstar firms,” The Quarterly Journal of Economics 135 (2): 645–709.

Berlingieri, G, S Calligaris, and C Criscuolo (2018), “The productivity wage premium: It’s productivity, not size, that matters in a service economy”, VoxEU.org, 19 September.

Bertheau, A, E M Acabbi, C Barcelo, A Gulyas, S Lombardi, and R Saggio (2022), “The unequal cost of job loss across countries”, VoxEU.org, 11 March.

Brandily, P, C Hémet, and C Malgouyres (2022), “Understanding the reallocation of displaced workers to firms”, CEPR Discussion Paper 17071.

Card, D, A R Cardoso, and P Kline (2016), “Bargaining, sorting, and the gender wage gap: Quantifying the impact of firms on the relative pay of women”, The Quarterly Journal of Economics 131(2): 633–686.

Fackler, D, S Mueller, and J Stegmaier (2021), “Explaining wage losses after job displacement: Employer size and lost firm wage premiums”, Journal of the European Economic Association 19 (5): 2695–2736.

Farber, H S (1993), “The incidence and costs of job loss: 1982-91”, Brookings Papers on Economic Activity 24 (1 Microeconomics): 73–132.

Foster, L, C Grim, and J Haltiwanger (2016), “Reallocation in the great recession: Cleansing or not?,” Journal of Labor Economics 34(S1): S293–S331.

Gulyas, A and K Pytka (2019), “Understanding the sources of earnings losses after job displacement: A machine-learning approach”, CRC-TR-224 Discussion Paper Series, University of Bonn and University of Mannheim, Germany.

Hsieh, C-T and P J Klenow (2009), “Misallocation and manufacturing TFP in China and India”, The Quarterly Journal of Economics 124(4): 1403–1448.

Jacobson, L S, R J LaLonde, and D G Sullivan (1993), “Earnings losses of displaced workers”, The American Economic Review 83(4): 685–709.

Lachowska, M, A Mas, and S A Woodbury (2020), “Sources of displaced workers’ long-term earnings losses”, The American Economic Review, October, 110(10): 3231–66.

Moore, Brendan and Judith Scott-Clayton(2019), “The firm’s role in displaced workers’ earnings losses”, Technical Report, National Bureau of Economic Research.

Moscarini, G and F Postel-Vinay (2018), “The cyclical job ladder”, Annual Review of Economics 10: 165–188.

Schmieder, J, T von Wachter, and J Heining, “The costs of job displacement over the business cycle and its sources: Evidence from Germany”, Working Papers February 2020.

Schumpeter, J A (1942), Capitalism, socialism, and democracy, New York: Harper.

Endnotes

1 Note that firm-level productivity is measured over the 2001-2004 (pre-displacement) period and is held fixed, so that the coefficients solely reflect the displacement-induced reallocation of workers toward firms with different initial productivity.