The Fed has unintentionally picked a fight with top US bankers, but it can stop. Its ongoing balance-sheet expansion has stuffed banks with $3.9 trillion in Fed deposits. The Fed sees the deposits as the means for it, all by itself, to buy Treasury bonds to compress their yields. Bankers lost a round on 19 March as the Fed sided with Senator Warren and let expire a year-long regulatory relief. Bankers warn that, starting on 1 April 2021, capital rules could crimp their market-making in bonds in a market that is already stressed by rising yields in a recovering economy.

In particular, on Friday 19 March 2021, the Federal Reserve Board announced that an important regulatory relief granted amid bond market turmoil on 1 April 2020 would expire as originally scheduled on 31 March 2021 (Board of Governors 2021). Treasury securities and banks’ Fed deposits would no longer be excluded from banks’ assets in testing whether their shareholders’ equity (technically, Tier 1 capital) sufficed to support their assets. These capital rules require $1 of shareholders’ equity for every $20 of assets of any stripe. This decision came none too early1 and despite a blitz of lobbying by banks for an extension.2 The Fed announced that it would conduct a review of the so-called enhanced Supplementary Leverage Ratio (eSLR), so the issue remains very much alive.

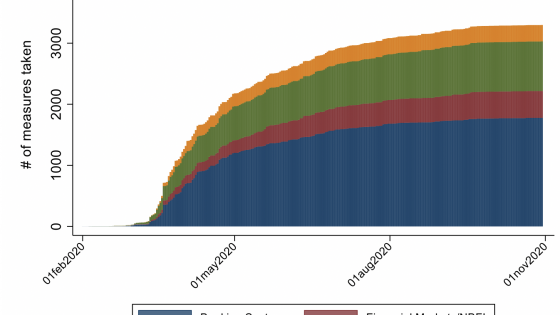

The easing of the SLR, which occurred in multiple jurisdictions (Bank of England 2016a, 2016b, Basel Committee on Banking Supervision 2020, Financial Stability Board 2020, Choulet 2020),3 was only one of a host of financial policy responses to the pandemic. Feyen et al. (2020) review the broad range of measures, while Altavilla et al. (2020) focus on bank lending. Two messages of this column may apply more broadly. First, vested interests who got what they long wanted during the pandemic will fight to keep it. Second, “build back better” is the name of contested terrain.

Simple as one, two, three

To set the stage, recall the powerful winds buffeting US bank balance sheets in March 2020. In a ‘dash for cash’, nonfinancial firms drew down bank credit lines to replace revenues and as a precaution against the closure of the commercial paper or bond market or a bank credit crunch (Acharya and Steffen 2020, Li et al. 2020, Li et al. 2020). Strains in the bond market led the Fed to promise to buy corporate bonds, but it actually bought Treasury and agency bonds at a furious rate (Caballero and Simsek 2020, McCauley 2020). Banks’ deposits at the Fed propagated virally, rising from $1.68 trillion on 26 February to reach $2.68 trillion on 1 April 2020.4

That day, the Fed recognised the strain on bank balance sheets by loosening the braces of the SLR, while not loosening the belt of risk-weighted asset capital rules (Board 2020). The Fed sought to release capital and thereby to open balance sheet space to permit banks to support the pandemic-ridden economy with loans to businesses and with unfettered market-making in the Treasury bond market.

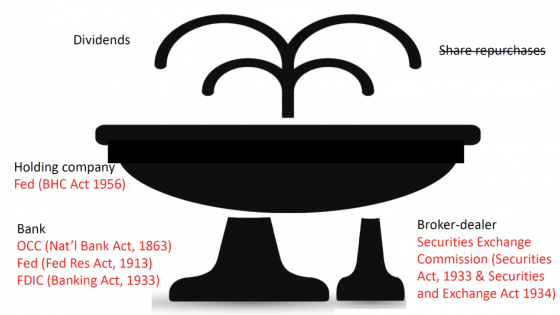

Understanding the policy move is as easy as 1, 2, 3. There was 1 policy, but 2 versions of it, because there are 3 bank supervisory agencies in the United States. To understand that 1, 2, 3, you need to understand another 1, 2, 3. A big US bank is an organisation of mind-numbing complexity, but abstracting from much detail, it is 1) a bank that is regulated by the Office of the Comptroller of the Currency (OCC), the Fed or the Federal Deposit Insurance Corporation (FDIC), 2) a publicly-held bank holding company (BHC) regulated by the Fed, and 3) a broker-dealer regulated by the Securities and Exchange Commission (SEC). Visualise it as a double-based profit fountain, spouting cash in dividend payments and share repurchases (Figure 1).

Figure 1 Bank holding company structure: The double-based profit fountain

Note: Supervisor in red (original law in parentheses)

The two versions of the policy were announced and launched in the Federal Register a month and a half apart. The Federal Reserve (2020) took a fortnight to go the Federal Register with its holding company policy on 14 April, pleading emergency to exempt the measure from the normal administrative procedures. The OCC, the Board and FDIC (2020) took the version for banks per se to the Federal Register only on 1 June.

The policies differed markedly in conditionality. To exclude its Fed deposits and Treasury securities from its assets, a bank had to give its regulator a say over dividend:

“a depository institution that opts into this treatment ... would be required to obtain prior approval of distributions from its primary Federal banking regulator... The prior approval requirement applies to distributions to be paid beginning in the third quarter of 2020” [emphasis added]

Now, at the outbreak of pandemic, the big banks had all suspended the major flow of profits to shareholders, namely their share repurchases. But to run the risk of being told to cut the flow of dividends, as had been done in Europe (Muñoz 2020), that was something from which bank CEOs recoiled. Among the big US banks, only Goldman Sachs signed up its bank (Choulet 2020, Pozsar 2021).5

How the policy worked in practice

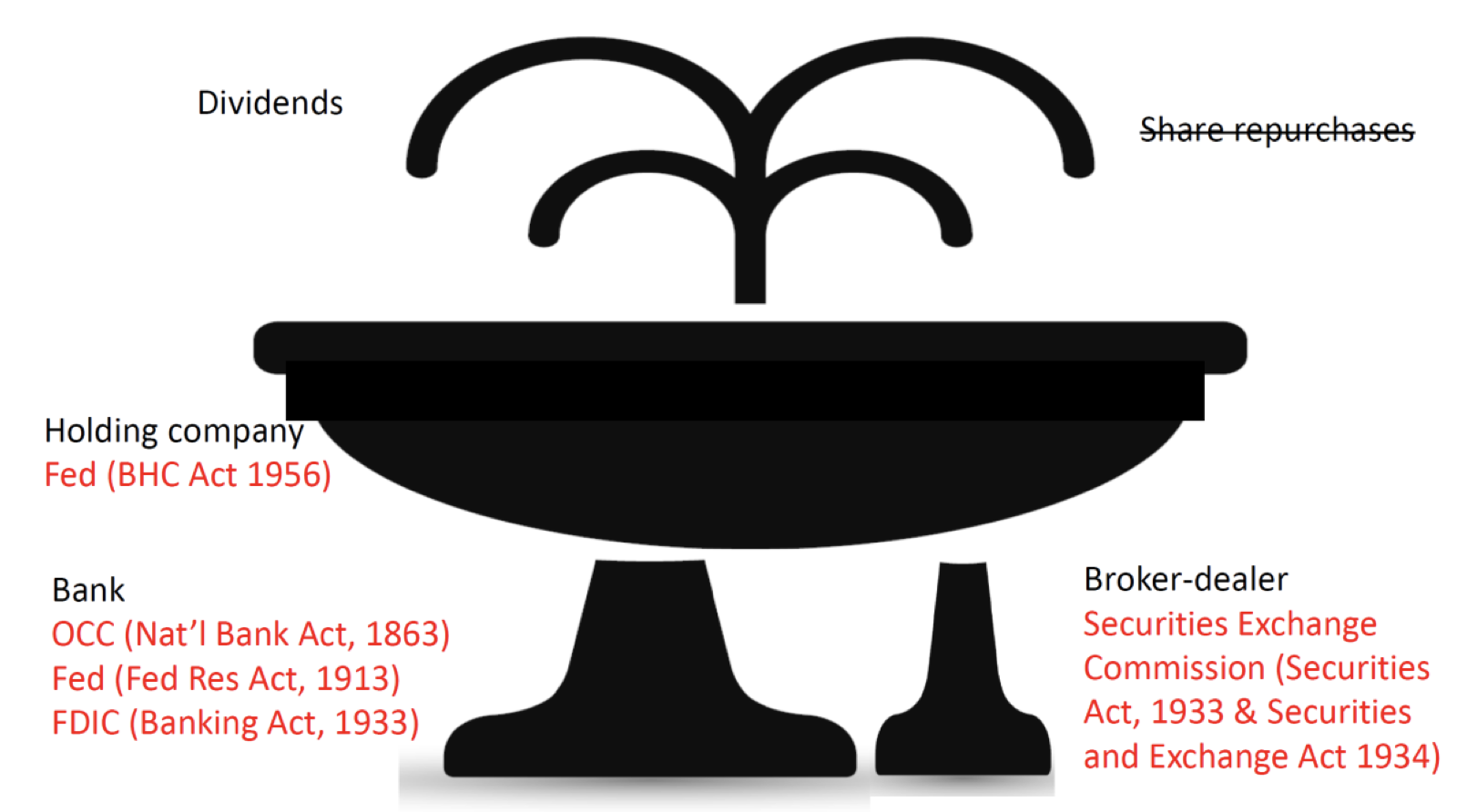

The banks’ response to the conditions that the bank regulators attached to their offer limited the regulatory relief enjoyed by the banks. As shown qualitatively in Figure 1, banks are just much larger than broker-dealers in banks, and so are their holdings of Fed deposits and US Treasury securities. Take a consolidated view of the largest BHC, JP Morgan Chase & Co. (Table 1). The potential relief on offer was $649 billion times the 5% minimum equity ration, or $32 billion. The bank’s management opted into a mere $5 billion.

Table 1 Consolidated balance sheet of JP Morgan Chase & Co., end-2020 (in billions of dollars)

Source: Pozsar (2021).

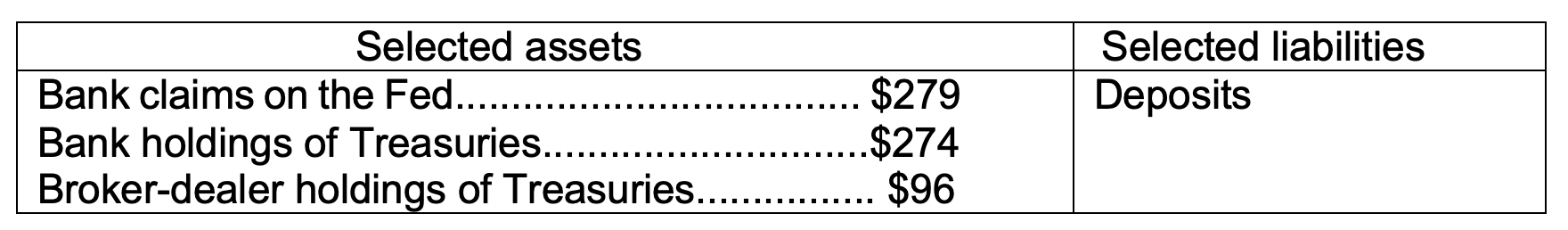

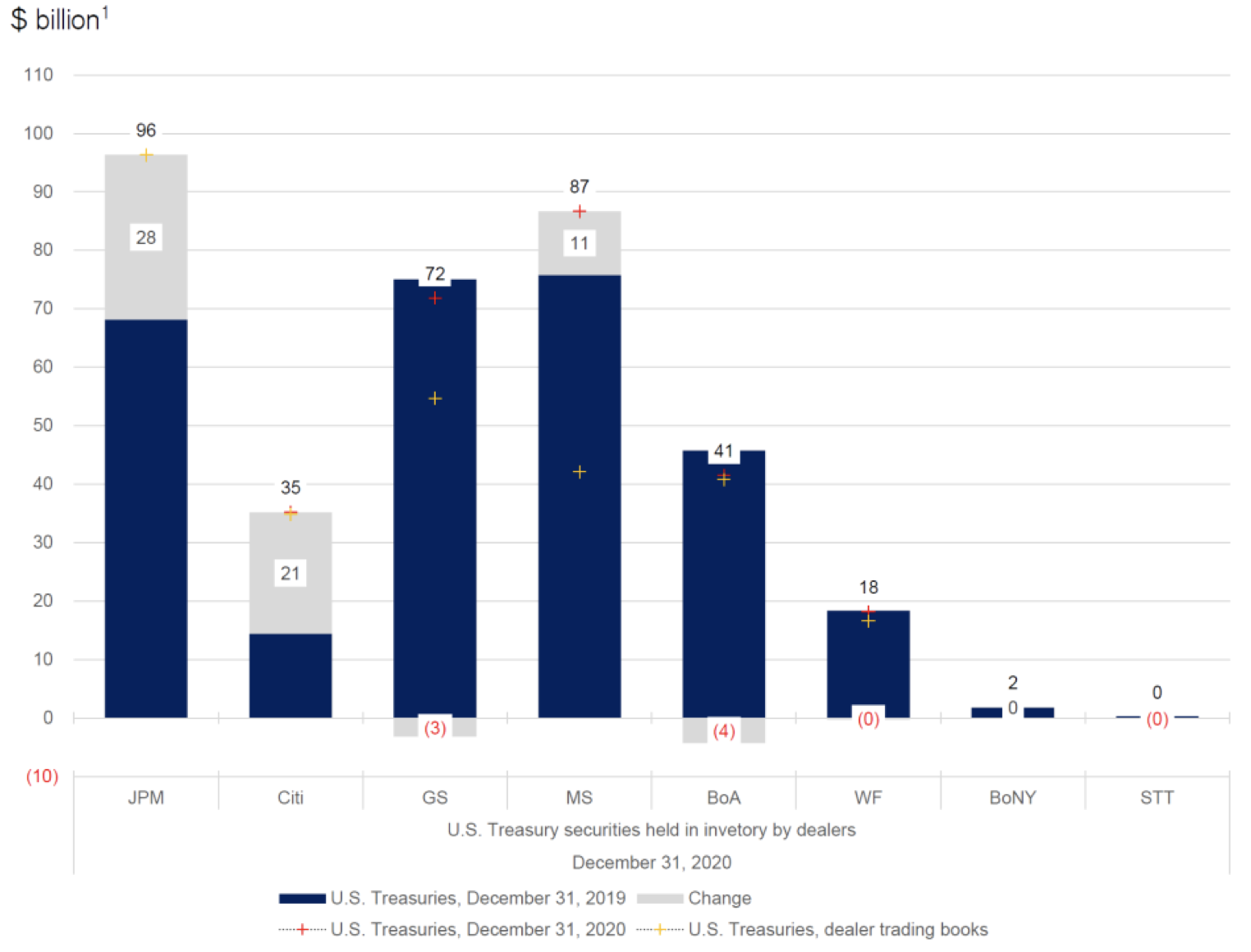

Similarly, for the other seven banks in the Financial Services Forum,6 the Fed deposits and Treasury securities in the bank operating subsidiaries well exceeded Treasury securities at the broker-dealers. Big banks’ deposits at the Fed reached $1.089 trillion at the end of 2020 (Figure 2a), and their holdings of Treasury securities, $0.834 trillion (Figure 2b). Compare the total of $1.923 with the big banks’ broker-dealers holdings of Treasury securities of $0.351 trillion (Figure 3).

Figure 2 Banks refused relief on holdings of Fed depos and Treasuries...

a) Reserves held by bank operating subsidiaries

b) US Treasuries held by bank operating subsidiaries

Source: Zoltan Pozcar, “Global money dispatch”, Credit Suisse Economics, 16 March 2021 https://plus.credit-suisse.com/rpc4/ravDocView?docid=V7qjPE2AN-VHSK, citing FFIEC 031.

Note: JPM = JP Morgan; Citi = Citigroup; GS = Goldman Sachs; MS = Morgan Stanley; BoA = Bank of America; WF = Wells Fargo; BoNY = Bank of New York; STT = State Street Trust.

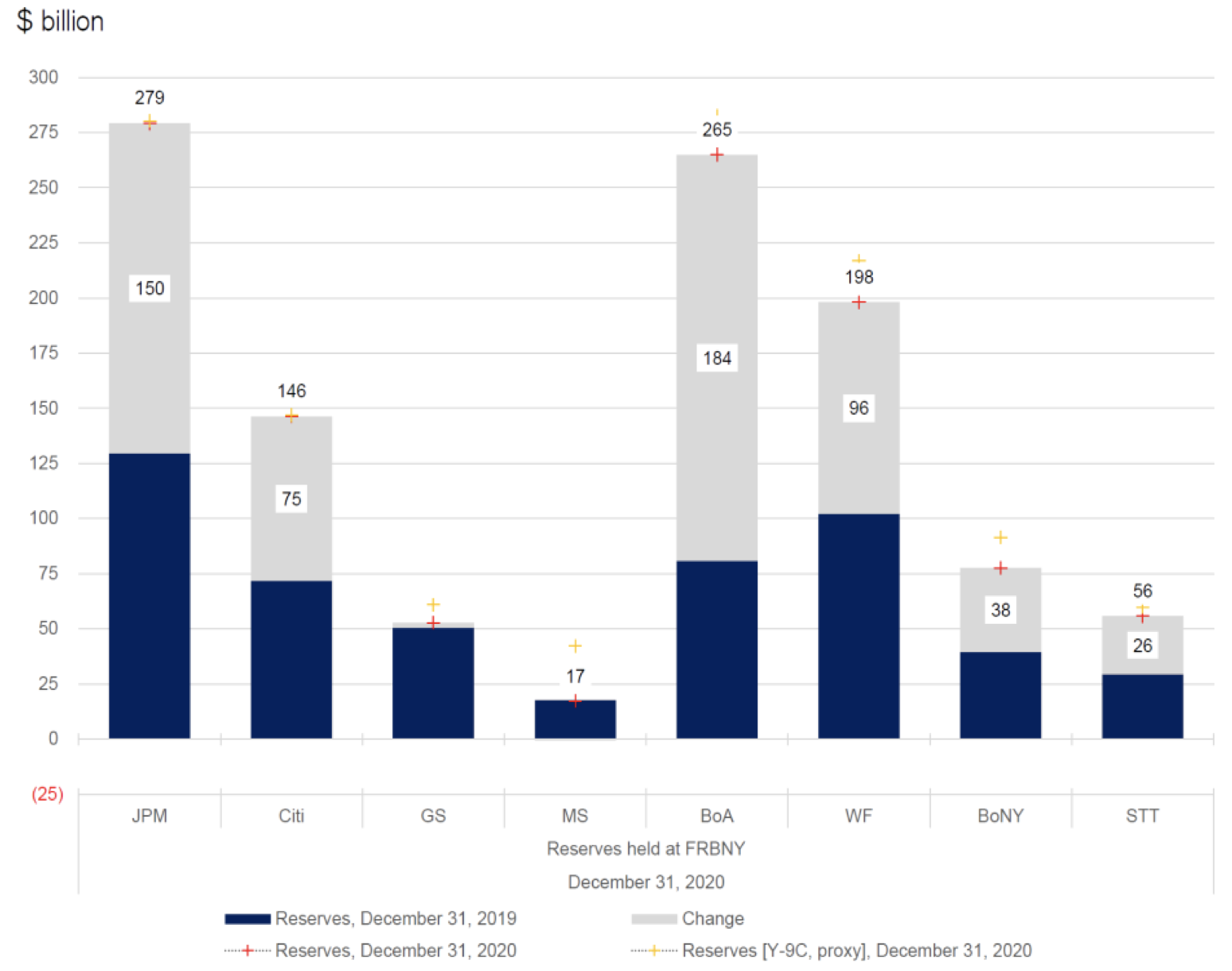

Figure 3 ... but accepted relief on their broker-dealers’ Treasury holdings

US Treasuries held by the broker-dealer subsidiary, end-2020

Source: Zoltan Pozcar, “Global money dispatch”, Credit Suisse Economics, 16 March 2021 https://plus.credit-suisse.com/rpc4/ravDocView?docid=V7qjPE2AN-VHSK, citing FFIEC 031.

Note: JPM = JP Morgan; Citi = Citigroup; GS = Goldman Sachs; MS = Morgan Stanley; BoA = Bank of America; WF = Wells Fargo; BoNY = Bank of New York; STT = State Street Trust.

It follows that these banks obtained by the end of 2020 only a fraction of what was on offer. They obtained $24 billion in relief,7 whereas they could have opted into $114 billion.8

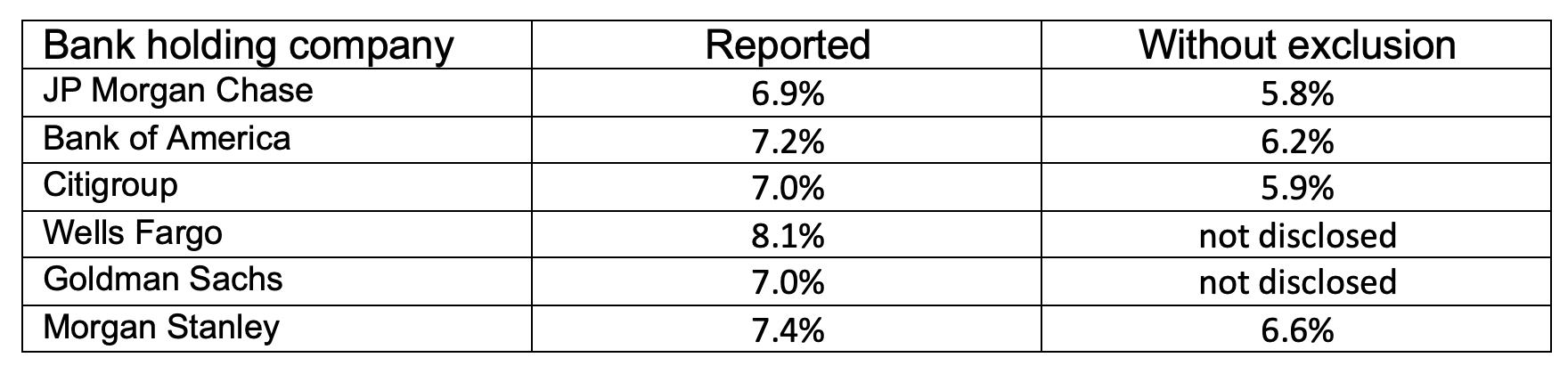

In short, the big US banks opted out of regulatory relief to keep control over their dividends. But the Fed’s decision is still consequential. Smith and Noonan (2021), Pozsar (2021) and Wolfe et al. (2021) report that it will bring BHCs about 1 percentage point closer to their 5% leverage constraint (Table 2 and Figure 4).

Table 2 Bank holding company supplementary leverage ratios (SLRs)

Source: Smith and Noonan (2021), citing company reports and earnings calls disclosures.

Figure 4 Without relief, leverage ratios to fall 1% on 1 April 2021

SLRs at the holding company level with and without relief

Source: Zoltan Pozcar, “Global money dispatch”, Credit Suisse Economics, 16 March 2021 https://plus.credit-suisse.com/rpc4/ravDocView?docid=V7qjPE2AN-VHSK,citing Y9C.

Note: JPM = JP Morgan; Citi = Citigroup; GS = Goldman Sachs; MS = Morgan Stanley; BoA = Bank of America; WF = Wells Fargo; BoNY = Bank of New York; STT = State Street Trust.

Notwithstanding big banks’ not opting into much relief, 2020 credit developments did not frustrate Fed intentions.9 Corporate bank loans rose by $93 billion (9%); outstanding corporate bonds by $742 billion (12.8%).10 Consumer credit did not grow, as stimulus checks paid off credit card debt. Mortgage debt rose by $454 billion (4.3%).11 The big broker-dealers increased their Treasury holdings by $53 billion (17%). Despite the pandemic, credit flowed to businesses and households and dealing capacity rose.

Bond market fragility?

On 1 April 2021, time is up on the big broker-dealers’ ability to hold Treasuries without 5% equity. Limits excite (Aliber and Kindleberger 2015).

The US bond market is already showing strains as the economy recovers. Further large fiscal deficits are taking place with the Fed committed to allowing inflation to rise above its 2% target.12 A former Treasury Secretary brands policy “the least responsible in forty years” (DeLong 2021, Wallace-Wells 2021). Note to Larry Summers: Jay Powell stood up to Donald Trump and to Jamie Dimon: are you feeling lucky, prof?

A capital squeeze at big broker-dealers thus arrives at an awkward time. US corporate bonds outstanding are huge and US Treasuries outstanding are growing rapidly. Liang and Parkinson (2020) and Duffie (2020) agree that the market needs a fix. The industry just warned the Treasury on 2 February that “Treasury funding costs would likely move higher and that market functioning could become more fragile if this [SLR] exemption was not extended or made permanent”.13

None of the eight broker-dealers will be forced to sell Treasuries (Pozsar 2021), but the changes are chunky. JP Morgan Securities, which stocked up on Treasuries in 2020, may already be shedding them given its prospectively higher SLR.

The risks multiply each other. Yields driven fundamentally higher raise market volatility (Borio and McCauley 1996a, 1996b), and can lead fair-weather liquidity providers to step back or literally to unplug themselves. Already, the bond market flies into air-pockets.

Will BHCs allocate enough capital to their broker-dealers to keep the bond market going? One could answer this question more confidently were the big banks’ holding of Fed deposits to fall from end-2020’s $1.089 trillion level. But that is impossible if overall Fed deposits are $3.873 trillion14 and rising as of St Patrick’s Day 2021.

“Condensing the Fed’s balance sheet is as simple as this” (Stella 2017)15

Emerging market policymakers finance large central bank foreign exchange reserves, without Treasury debt alongside that of the central bank (Stella 2020). Stella’s Mexican example points to a reverse Kemmerer mission (Nodari 2019): Secretary Yellen and Chair Powell spend spring break in Mexico City learning how it is done. Other major central banks might well join them as well (Figure 5).

Figure 5 Central bank liabilities: We’re not in Kansas anymore

To make peace between the Fed and the big banks, to preserve crisis-tested regulatory standards,16 and to save the taxpayer money to boot, the Treasury could “overfund17 and repurchase” its bonds held by the Fed (McCauley 2003, 2006, 2008, McCauley and Ueda 2009, Greenwood et al. 2014, Ma and McCauley 2015). The Treasury could announce that over time it would auction, $3 trillion more in its bills than its deficit requires.18 It could then exchange these dollars with the Fed for Treasuries at market prices. Of course, the Treasury would have to communicate carefully the intended average maturity of its debt post-consolidation.

Banks could buy the bills in the market to replace exactly their deposits at the Fed: this corner solution is unlikely. More likely, money market funds and foreign official accounts, investors now allowed to place funds with the Fed at administered rates, could buy the Treasury bills. (Recall that only banks hold remunerated Fed deposits.) Banks could reallocate their assets more productively, making more loans, or shrink their assets.

As Fed deposits fell, BHCs could reallocate capital from subsidiary banks less burdened with Fed deposits to their broker-dealers, whose holdings of Treasury securities will, starting 1 April, attract required capital. Households and firms might draw down some of the $3 trillion that piled up at the largest US banks (Wolfe et al. 2021) in the past year in favour of government money market funds.

This substitution of Treasury bills for deposits in the Fed might reduce the total cost of the aggregate Federal funding. Treasury bills, despite their longer maturity, often yield less than the Fed’s administered rate on excess reserves (Figure 6). Currently, one-month bills yield about 2 basis points, whereas the Fed is paying 10 basis points. Multiply $3 trillion by 8 basis points and the result is $2.4 billion per year, all for the privilege of the Fed’s not having to cooperate with the US Treasury. The savings could be a multiple of that sum.

Figure 6 Fed pays more overnight than Treasury pays for a month

One objection is that, if the Treasury buys its bonds from the Fed at prices above par, then it would crystallise losses (measuring its debt at par, rather than at market value).19 But surely any right-thinking Congressperson could see that freeing the banks from their Fed deposits is the right thing to do for the economy, even if it means raising the debt limit.

What is more, the Treasury need not actually purchase the Fed’s Treasury bonds. Instead, the Treasury’s could deposit the proceeds of its overfunding in the Fed, in the manner of its 2008 so-called Supplementary Financing Program (US Treasury 2008, Stella 2009, Baba et al 2009, Stella 2017). The Treasury then financed the Fed’s extension of credit to foreign central banks and to the corporate sector (Figure 7). The goal was precisely to keep these credit extensions from increasing bank deposits in the Fed, given that the Fed was still aiming for a positive fed funds rate.20 In this case, the Treasury’s holdings of deposits at the Fed would have to be excluded from the debt ceiling. Consolidating over the Treasury and Fed for the purpose of the debt limit makes more sense than consolidating private banks and the Fed for the purpose of bank supervision.

Figure 7 Fed and Treasury cooperate after Lehman Brothers failure in 2008

Source: Naohiko Baba, Robert N McCauley and Srichander Ramaswamy, “US dollar money market funds and non-US banks”, BIS Quarterly Review, March 2009, pp 65-81 http://www.bis.org/publ/qtrpdf/r_qt0903g.pdf, citing the Federal Reserve and Datastream.

Conclusion

In short, reshaping our simple bank capital rule, which served US banks well in 2007-08, around giant, permanent bank holdings of Fed deposits is a bad policy accommodating a policy that has passed its sell-by date. Unstuffing banks with Fed deposits avoids needless conflict between the Fed and the banks, maintains sound bank regulation and just might save taxpayers money.

Author’s note: I thank Iñaki Aldasoro, Claudio Borio, Neil Esho, Claire Jones, Charles Lane, Clark McCauley, Patrick McGuire, Zoltan Pozsar, Catherine Schenk, Hyun Song Shin and Peter Stella for discussion, without implicating anyone in this column’s advocacy.

References

Acharya, V and S Steffen (2020), “Covid-19: the risk of being a fallen angel and the corporate dash for cash”, Covid Economics 10, 27 April, pp 49-68.

Aliber, R and C Kindleberger (2015), Manias, panics and crashes, 7th edition, Houndmills, Basingstoke, Hampshire: Palgrave Macmillan..

Altavilla, C, F Barbiero, M Boucinha and L Burlon (2020), “The COVID-19 policy response and bank lending”, VoxEU.org, 3 October.

Baba, N, R McCauley and S Ramaswamy (2009), “US dollar money market funds and non-US banks”, BIS Quarterly Review, March, pp 65-81.

Baer, G and B Nelson (2021), “If the Treasury issues debt and the Fed buys it, should bank capital requirements go up?” Bank Policy Institute, 8 March.

Bank of England (2016a), Record of the Financial Policy Committee meeting held on 25 July 2016, 4 August.

_____, Prudential Regulatory Authority (2016b), “PRA statement on the leverage ratio”, 16 August .

Basel Committee on Banking Supervision (2020), Implementation of Basel standards: a report to G20 Leaders on implementation of the Basel III regulatory reforms, November.

Board of Governors of the Federal Reserve System (2020), “Federal Reserve Board announces temporary change to its supplementary leverage ratio rule to ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses”, press release, 1 April.

_____ (2021), “Federal Reserve Board announces that the temporary change to its supplementary leverage ratio (SLR) for bank holding companies will expire as scheduled on March 31”, press release, 19 March.

Borio, C and R McCauley (1996a), "The economics of recent bond yield volatility", BIS Economic Papers, no 45.

_____ (1996b), “The anatomy of the bond market turbulence of 1994”, in F Bruni, D Fair and R O'Brien, (eds), Risk management in volatile financial markets, Dordrecht, Kluwer Academic Press for the Société Universitaire Européenne de Recherches Financières, pp 61-84 .

Caballero, R and A Simsek (2020), “A risk-centric perspective on the central banks’ Covid-19 policy response”, VoxEU.org, 30 April.

Campbell, S (2021), “Leverage requirements and financial stability: getting the transition right”, Financial Services Forum, 10 February.

Center for Financial Stability (2021), “Advances in monetary and financial measurement (AMFM)”.

Chen, J, H Liu, D Rubio, A Sarkar, and Z Song (2021), “Did dealers fail to make markets during the Pandemic?” Liberty Street Economics, 24 March.

Choulet, C (2020), “A temporary relaxation of leverage standards”, BNP Paribas Ecoflash no 20-20, 19 October.

Condon, C, S Mohsin and J Hamilton (2021), “Biden Treasury pick quietly starts work to rein in Wall Street”, Bloomberg, 11 March.

Delong, B (2021), “What are the new inflation hawks thinking?” Project Syndicate, 4 March

Dudley, B (2016), “Market and funding liquidity: an overview”, remarks at the Federal Reserve Bank of Atlanta 2016 Financial Markets Conference, Fernandina Beach, Florida, 1 May.

Duffie, Darrell (2020), “Still the world’s safe haven? Redesigning the U.S. Treasury market after the COVID19 Crisis,” Brookings Institution, Hutchins Center Working Paper #62, 3 June.

Federal Reserve System (2020), “12 CFR Part 217 [Regulations Q; Docket No. R–1707], RIN 7100–AF81, temporary exclusion of U.S. Treasury securities and deposits at Federal Reserve Banks from the supplementary leverage ratio”, Federal Register, 14 April, pp 20578-86.

Feyen, E, T Gispert, T Kliatskova, and D. Mare (2020), “Taking stock of the financial sector policy response to COVID-19 around the world”, VoxEU.org, 17 December.

Financial Stability Board (2020), COVID-19 pandemic: financial stability implications and policy measures taken, report submitted to the G20 Finance Ministers and Governors, 15 July.

Gambacorta, L, T Oliviero and H-S Shin (2020), “Low price-to-book ratios and bank dividend payout policies”, BIS Working Papers, no 907, 9 December.

Goodhart, C (2012), “Monetary policy and public debt”, in Public debt, monetary policy and financial stability, Banque de France Financial Stability Review, no 16, April, pp 123-147.

Greenwood, R, S Hanson, J Rudolph, and L Summers (2014), “Government debt management at the zero lower bound”, Hutchins Center on Fiscal and Monetary Policy at Brookings Working Papers no 5, 30 September.

Hamilton, J and A Harris (2021), “Banks press Fed to preserve $600 billion in balance-sheet leeway”, Bloomberg, 9 March.

Hardy, B (2021), “Covid-19 bank dividend payout restrictions: effects and trade-offs”, BIS Bulletin no 38, 10 March.

Kreicher, L, R McCauley and P McGuire (2013), “The 2011 FDIC assessment on banks managed liabilities: interest rate and balance-sheet responses”, BIS Working Papers, no 413, 22 May; also in R de Mooij and G Nicodeme (eds), Taxation of the financial sector, Cambridge: MIT Press, 2014.

Li, L, Yi Li, M Macchiavelli, X (Alex) Zhou (2020), “Prime money funds during COVID-19”, VoxEU.org, 14 July 2020.

Li, L, P Strahan and S Zhang (2020), “Banks as lenders of first resort: Evidence from the Covid-19 crisis”, Covid Economics 21, 22 May, pp 134-167.

Liang, N and P Parkinson (2020), “Enhancing liquidity of the U.S. Treasury market under stress”, Hutchins Center on Fiscal and Monetary Policy at Brookings Working Papers no 72, 16 December.

Logan, L (2020), “A return to operating with abundant reserves”, remarks before the Money Marketeers of New York University, 1 December.

Ma, G and R McCauley (2015), “Transforming central bank liabilities into government debt: the case of China”, China & World Economy 23(4): pp 1–18.

Martin, A, J McAndrews and D Skeie (2011), “Bank lending in times of large bank reserves”, Federal Reserve Bank of New York Staff Reports no 497, May & June 2013.

McCauley, R (2003), “Unifying the government bond markets of East Asia”, BIS Quarterly Review, December, pp 89-98.

_____ (2006), ”Consolidating the public bond markets of Asia”, in Asian bond markets: issues and prospects, BIS Papers no 30, October, pp 82-98.

_____ (2008), “Developing financial markets and operating monetary policy in East Asia”, in Financial market developments and their implications for monetary policy, BIS Papers no 39, April, pp 126-41 .

_____ (2020), “The Federal Reserve needs the power to buy corporate bonds”, VoxEU.org, 26 August.

McCauley, R and P McGuire (2014), “Non-US banks’ claims on the Federal Reserve”, BIS Quarterly Review, March, pp 89-97.

McCauley, R and K Ueda (2009), “Government debt management at low interest rates”, BIS Quarterly Review, June, pp 35-51, also published in J S Alworth and G Arachi (eds), Taxation and the financial crisis, Oxford: Oxford University Press (2012), pp 214-230.

Muñoz, M (2020), “Macroprudential policy and COVID-19: Restrict dividend distributions to significantly improve the effectiveness of the countercyclical capital buffer release”, VoxEU.org, 3 July.

Nodari, G (2019), “‘Putting Mexico on its feet again’: the Kemmerer mission in Mexico, 1917–1931”, Financial History Review 26(2): 223–246.

Office of the Comptroller of the Currency (OCC), Board of Governors of the Federal Reserve System (Board), and Federal Deposit Insurance Corporation (FDIC) (2020), “Regulatory capital rule: temporary exclusion of U.S. Treasury securities and deposits at Federal Reserve Banks from the supplementary leverage ratio for depository institutions”, Federal Register 85(1): 32980-32990.

Pozsar, Z (2021), “Global money dispatch”, Credit Suisse Economics, 16 March.

Securities Industry and Financial Markets Association (SIFMA), Treasury Borrowing Advisory Committee (2021), Report to the Secretary of the Treasury, 3 February.

_____, American Bankers Association and Financial Stability Forum (2021), Letter to Randall Quarles, Lael Brainard and Michelle Bowman, 23 February

Smialek, J (2021), “Fed lets break for banks expire but opens door to future changes”, New York Times, 19 March.

Stella, P (2009), “The Federal Reserve System balance sheet: what happened and why it matters", IMF Working Paper 09/120, International Monetary Fund.

_____ (2017), “Condensing the Fed’s balance sheet is as simple as this”, unpublished manuscript.

_____ (2020), “How countries manage large central bank balance sheets”, in J Bjorheim, ed, Asset management at central banks and monetary authorities, Cham, Switzerland: Springer, pp 55-78 .

US Treasury (2008), “Treasury announces Supplementary Financing Program”, press release, 17 September.

Wallace-Wells (2021), “Larry Summers versus the stimulus”, The New Yorker, 18 March .

Warren, E and S Brown (2021), Letter to J Powell, R Quarles, B Paulson and J McWilliams, 26 February .

Waters, M (2021), Letter to J Powell, R Quarles, B Paulson and J McWilliams, 9 March.

Weatherhead, T (2020), “Supplementary leverage ratio exemptions still only temporary, Fed's Quarles says”, S&P Global Market Intelligence, 14 October .

Wolfe, C, J Solar, B Rumohr and L Kaster (2021), “US banks sufficiently capitalized to withstand SLR expiration”, FitchRatings Fitch Wire, 22 March.

Endnotes

1 That said, Federal Reserve Board Vice Chair Randal Quarles said before the election in October: "It is not currently in discussion for making it other than temporary" (Weatherhead 2020).

2 See Campbell (2021), SIFMA et al (2021), Baer and Nelson (2021), Hamilton and Harris (2021), Smialek (2021),

3 When the Bank of England excluded UK banks’ holdings of central bank deposits matched with local liabilities globally, it bumped up the UK banks’ SLRs to offset the impact. But as big UK banks’ portfolios have since grown, taking advantage of the exclusion, the exclusion has become ever more flattering to their leverage ratio. Going forward, a lower cost of Fed holding deposits for non-US banks may again drive up their share of Fed deposits: see Kreicher et al (2013), McCauley and McGuire (2014) and Logan (2020).

4 https://www.federalreserve.gov/releases/h41/20200402/; https://www.federalreserve.gov/releases/h41/20200227/

5 See Gambacorta et al. (2020) and Hardy (2021) on policies on bank dividends during the pandemic. On the continued importance of the Glass Steagall Act for the ability of banks to fund their broker-dealers, and therefore on the ability of the Fed to backstop broker-dealers’ funding, see Dudley (2016).

6 https://www.fsforum.com/about/members/

7 $24 billion = .05 X (Goldman Sachs’ Fed deposits of $20 billion + its Treasury holdings of $70 billion + 8 broker-dealers’ holdings of Treasuries of $351 billion).

8 $114 billion = .05 X ($1,923 billion + $351 billion).

9 See Chen et al (2021) for the finding that broker-dealers that were not bound by the SLR, if anything, pulled back more from market-making in bonds in March 2020 more than the major dealers that were so bound.

10 https://www.federalreserve.gov/releases/z1/20210311/html/l103.htm. Martin et al (2011) argue that holdings of Fed deposits compete with bank loans and could even crowd them out under some circumstances.

11 https://www.federalreserve.gov/releases/z1/20210311/html/l101.htm.

12 The Center for Financial Stability (2021) plots money growth.

13 Treasury Borrowing Advisory Committee (SIFMA 2021) also warned that that “continued growth in [Fed] reserves was negatively impacting certain bank capital ratios (including Tier 1 leverage, SLR, GSIB) and could constrain bank balance sheet capacity for repo and Treasury purchases”

14 https://www.federalreserve.gov/releases/h41/current/.

15 Peter Stella spent half a lifetime at the IMF rummaging through central bank balance sheets as Chief of the Central Banking Division. He has forgotten more about central banking than most of us know.

16 Senators Warren and Brown (2021) threw a hard ball: “To the extent there are concerns about banks’ ability to accept customer deposits and absorb reserves due to leverage requirements, regulators should suspend bank capital distributions”. The Chair of the House Banking Committee, Maxine Waters (2021) followed up on 9 March with the suggestion that the bank regulators should consult with Treasury Secretary Yellen about any extension of the exclusion in her capacity as head of the Financial Stability Oversight Council. Last year, Federal Reserve Vice Chair Randal Quarles was quoted as saying, "If you're going to have a leverage ratio, once you start excepting out of the denominator everything that you think is safe ... then you've just got another risk-based ratio” (Weatherhead 2020). See the Brookings paper of Undersecretary-designate Nellie Liang and co-author Pat Parkinson (2020), which proposes excluding Fed deposits from the SLR as part of a package that includes requiring more central clearing of Treasury securities. See Condon et al (2021).

17 Goodhart (2012) uses the term as it was used 30 years ago to describe the Bank of England policy of selling more long-term gilt-edged securities (ie UK government bonds) than needed to meet the public sector borrowing requirement and to roll over maturing gilts. He dubs this “reverse QE”, since it adds (rather than subtracts as with Quantitative Easing) duration to the bond portfolio of the non-government sectors. Here the term is used more generally to refer to the Treasury selling more of its securities, including bills, than needed to meet the public sector borrowing requirement and to roll over maturing Treasury securities. The proposed overfunding would be neither reverse QE nor QE, but would rather by construction remain neutral with respect to the duration of the portfolio of the non-government sectors, since very short duration bills would replace zero-duration deposits at the Fed. See McCauley and Ueda (2009).

18 Any concern for rollover risk would point to sales of Treasury floating-rate notes—possibly with longer maturities than the current two years—instead of Treasury bills.

19 According to the Fed, its unrealised profits on the System Open Market Account at the end of 2020 were $354 billion, although this measures the gap between its historical cost and its calculation of fair value at year-end. In any case, the rise in interest rates thus far in 2021 means that the gap between fair value and par or historical value has probably narrowed.

20 Fed economists have a bad memory of this program because the Treasury ran up against the debt limit and had to unwind the deposits. But in the mooted revival of this programme, the Treasury would be funding Fed holdings of claims on itself, rather than claims on central banks and the US corporate sector.