In 2020, the creation of US startups shot up by 24% relative to the previous year. This is the largest annual increase since business statistics started being collected in the US. Some of this boom in entrepreneurial activity is accounted for by the migration of businesses to online activity.

This business dynamism is unexpected. Vox columns written in early 2020 (e.g. Baker et al. 2020, Coibion et al. 2020, Sedláček and Sterk 2020, Calvino et al. 2020) recorded steep falls in entrepreneurial activity across G7 economies. In a recent paper (Djankov and Zhang 2021), we show that such falls were indeed the norm across advanced economies at the end of 2020. The US is an exception, fuelled by the government assistance provided to small businesses.

The focus on new entry is warranted, as research in the US shows that young firms tend to grow faster than incumbents (Haltiwanger et al. 2013). Haltiwanger et al. (2017) document that startups account for about 40% of aggregate growth in total factor productivity, 50% of aggregate output growth, and 60% of aggregate employment growth. Another important benefit of entrepreneurship is the ability of new firms to increase competition, thus reducing mark-ups (Djankov et al. 2002).

Still, the positive impact of these entrants on long-term economic growth should be taken with a grain of salt, as research shows that firms born during recessions not only start smaller but also tend to stay smaller in future years, even when the economy recovers (Sedláček and Sterk 2017). Also, the crisis has reshaped the outlook for many sectors, more so than previous crises have. Firms and workers have invested in years’ worth of digital transformation in just a few months (Baldwin 2020). This transformation is likely to result in significant further churning among businesses in the months and years to come.

Business formation rises

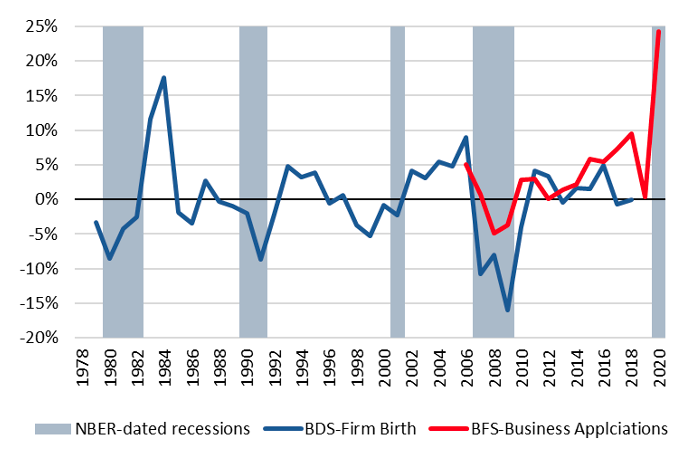

Data on new company applications in the US since 2004, when these data first became available, show a blip in startups in 2010, following the euro area crisis, and a large spike in 2020. To study the patterns of new entry, we employ data on firm births, which record the month businesses start paying payroll taxes since 1978 (Figure 1). We show that firm birth generally accelerates in the aftermath of economic crises. This pattern is particularly pronounced in 2020 and after the second oil shock (1984).

Figure 1 Annual growth rate of entrepreneurship, 1979–2020

Note: Business application data are gathered by the US Census Bureau’s Business Formation Statistics. The measure documents new business formations as indicated by applications for an Employer Identification Number (EIN). Firm birth data are gathered by US Census Bureau’s Business Dynamic Statistics. The measure documents firm birth as indicated by the report of first positive employment based on payroll tax records. A firm’s birth year is the year an establishment belonging to the firm first reports positive employment in the week including March 12. In other words, “birth” is defined as going from zero March 12 employment in year t-1 to positive March 12 employment in year t. It is a lagging indicator as a firm that starts operations on, say, March 20 will appear as born only the following year. We take the data and calculated the year-on-year growth of business applications at US state level. The business formation and dynamics data follow similar growth patterns in the years they overlap (red line and blue line, respectively). The business dynamics data on firm birth lag behind the business application data. This is a meaningful difference: it takes time between applying to register the business and the actual start of operations (renting office space, hiring workers, complying with sector-specific requirements). As such, business applications are a leading indicator for subsequent business entry.

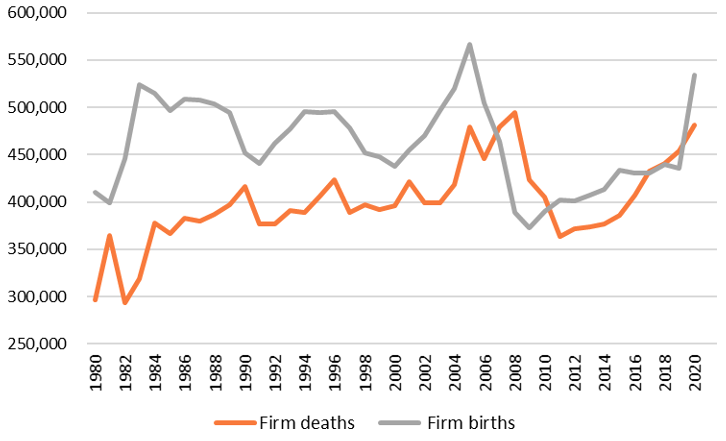

We next use a more comprehensive measure of business dynamism: net business entry, which is the number of firm births minus firm deaths. Firm deaths are difficult to measure contemporaneously and official statistics are released with significant lags. For example, the US Census’s Business Dynamic Statistics (BDS) data on firm deaths in 2020 will be public only in 2023. We hence approximate firm deaths from 2018 April to 2021 March (matching the BDS time series) using the historical correlation between firm exit rates (using BDS firm deaths as a share of total firms) and the annual changes in the unemployment rate (March-over-March).1 Crane et al. (2020) pioneered this estimation approach to examine the patterns of business closure; similarly, Greenwood et al. (2020) forecast business bankruptcy filings based on unemployment rates. We also estimate firm births beyond March 2018 using the annual growth of high-propensity business applications, matched to correspond with the BDS annual time series (April to March).

Net business entry is rising too (Figure 2). US firm births are estimated to surpass firm deaths in 2020, unlike in the aftermath of the previous financial crisis.

Figure 2 Firm dynamism, 1980–2020

Note: Pre-2018 data are retrieved from BDS. 2018-2020 data are based on the authors’ estimates. Firm deaths and births correspond to the period between April of the year shown on X-axis to March of the following year. This exercise is done to match the BDS data timing. For example, 2018 data corresponds to firm births and deaths estimated for April 2018 to March 2019. Data for 2020 (April 2020 –March 2021) are annualized with April – December 2020 data.

Composition of startup activity

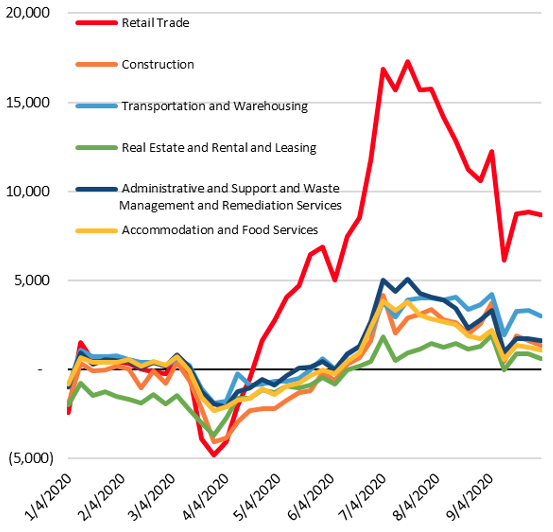

In 2020, business applications in the construction, real estate, and accommodation and food service sectors were hit the most during the stay-at-home period in the US, and they did not recover to their pre-crisis flow until June (Figure 3, top panel). Business applications in retail were also hampered by the pandemic at first, but started to pick up as early as mid-April. In fact, retail startups saw the largest rebound among all sectors, and they continued to drive the expansion of US entrepreneurship in the second half of 2020. In this sector, the rebound is due to online (non-store) retail startups (Figure 3, bottom panel).

Figure 3 Change in weekly business applications in 2020, by sector

Note: The top panel only presents sectors most effected by Covid in terms of their year-on-year changes in business applications. In the bottom panel, Nonstore retailers include mail-order houses, vending machine operators, home delivery sales, door-to-door sales, party plan sales, electronic shopping, and sales through portable stalls (e.g., street vendors, except food).

Source: Weekly business application data from US BFS.

Explaining US business dynamism

The focus of economic recovery efforts in G7 economies so far has been mostly on assisting businesses to weather the crisis and on saving jobs. Governments have offered less to help new companies emerge. Still, several governments have established programmes to aid new business formation during the pandemic. The scale of the programme in the US is much larger than in other advanced economies. The US Small Business Administration provides Paycheck Protection Program (PPP) loans to small businesses, including eligible startups. The loans can be forgiven when certain conditions are met. By August 2020, 3.3 million PPP loans under $50,000 had been approved.

Other G7 economies have developed more tailored programmes. The UK, for example, created a Coronavirus Future Fund for startups, which gives out loans ranging from £125,000 to £5 million, subject to equal match funding from private investors. Between its launch in May and October 2020, the programme approved a total of £800 million convertible loans to 745 companies. Germany has announced the creation of the €10 billion Future Fund programme for startups. KfW, Germany’s state development bank, will invest in German venture capital funds, a model arrangement designed to encourage private institutions like pension funds to invest more in startups as well. France has similarly pledged to raise €5 billion for startups by getting institutional investors to co-invest.

Implications for the recovery

Tough times for doing business during a likely protracted recovery will dampen survival rates among the 2020 cohort of startups. However, some of these workers may be absorbed by the gig economy (working for Lyft, DoorDash, and others). And the changing nature of some sectors suggests that new firms may become market leaders quickly, accelerating their growth.

References

Baker, S, N Bloom, S Davis and S Terry (2020), “COVID-induced economic uncertainty and its consequences”, VoxEU.org, 13 April.

Baldwin, S (2020), “Covid, hysteresis, and the future of work”, VoxEU.org, 29 May.

Calvino, F, C Criscuolo and R Verlhac (2020), “Start-ups in the time of COVID-19: Facing the challenges, seizing the opportunities”, VoxEU.org, 23 June.

Coibion O, Y Gorodnichenko and M Weber (2020), “Labour markets during the COVID-19 crisis: A preliminary view”, VoxEU.org, 14 April.

Crane, L D, R A Decker, A Flaaen, A Hamins-Puertolas, and C Kurz (2020), “Business Exit During the COVID-19 Pandemic: NonTraditional Measures in Historical Context”, Finance and Economics Discussion Series 2020-089, Board of Governors of the Federal Reserve System.

Djankov, S, R LaPorta, F Lopez-de-Silanes, and A Shleifer (2002), “The Regulation of Entry”, Quarterly Journal of Economics 117(1): 1-37.

Djankov, S and E Zhang (2021), “Startups boom in the United States during COVID-19”, Real Time Issues Watch, 17 February.

Greenwood, R, B Iverson and D Thesmar (2020), “Sizing up corporate restructuring in the covid crisis”, NBER Working Paper 28104.

Haltiwanger, J, R Jarmin, R Kulick and J Miranda (2017), “High growth firms: Contribution to job, output and productivity growth”, in J Haltiwanger, E Hurst, J Miranda and A Schoar (eds), Measuring Entrepreneurial Businesses: Current Knowledge and Challenges, University of Chicago Press, pp. 11–62.

Haltiwanger, J, R Jarmin and J Miranda (2013), “Who creates jobs? Small versus large versus young”, The Review of Economics and Statistics 95(2): 347–61.

Sedláček, P and V Sterk (2017), “The growth potential of startups over the business cycle”, American Economics Review 107(10): 3182–210.

Sedláček, P and V Sterk (2020), “Startups and employment following the COVID-19 pandemic: A calculator”, VoxEU.org, 25 April.

Endnotes

1 The simple OLS regression of exit rates on the change in the unemployment rate in the period 1979 to 2018 yields a coefficient of 0.315, statistically significant at the 1% level.1