The world of trade is changing. After a period of ‘murky protectionism’ (Baldwin and Evenett 2011) in the wake of the financial and economic crisis, current political dynamics appear to favour a strategic repositioning of trade alliances. The US is questioning the benefits of existing trade arrangements. The UK may exit the European Single Market, even as it signals that it would like to strengthen its commercial ties with the rest of the world. Meanwhile, China is seeking to foster trade and economic integration with its partners in the Belt and Road Initiative.

The issues trading partners discuss are also changing. Canada and the EU have strengthened their collaboration on standards-setting through the EU-Canada Comprehensive Economic and Trade Agreement (CETA), even as the Brexit vote has put into question the UK’s future role in European standards-setting bodies. Japan and the EU have agreed to move closer in the area of data protection regulation (Jansen et al. 2019). When it comes to investment, the negotiations on a Transatlantic Trade and Investment Partnership are stalled, while negotiations on EU-China Comprehensive Agreement on Investment continue.

How will business react to these changes? In this column, we argue that a renewed focus on regional value chain set-ups is a likely outcome (Delgado et al, 2014, Ghemawat 2018). Well integrated regions, in particular those already benefiting from deep trade agreements,1 are best positioned to take advantage of this ‘flight to certainty’. Regions that take serious steps to embark on deeper integration may also be able to benefit.

The regional nature of ‘global’ value chains

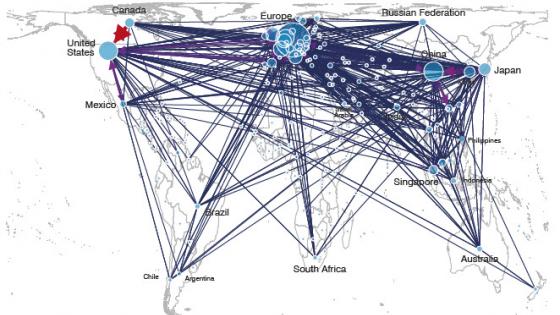

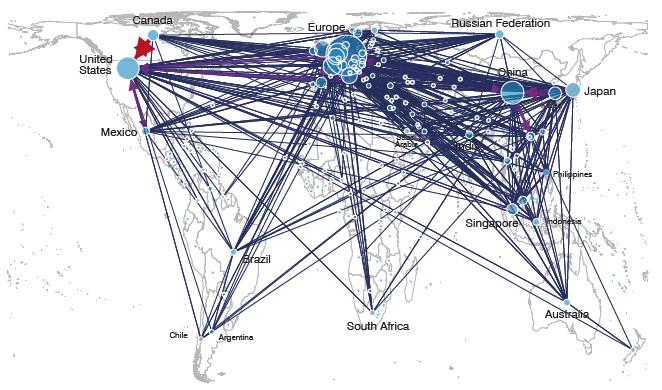

Despite the commonly used term global value chains (GVCs), value chain activity has always had strong regional characteristics, with a high share of value chain activity evolving around North American, European and Asian hubs (Baldwin and Lopez-Gonzalez, 2015). See Figure 1.

Figure 1 The regional nature of value chain trade

Note: The size of the arrows is proportional to the amount of vertical trade, defined as the sum of domestic value-added re-exported and foreign content of exports, based on EORA multi-regional input-output tables. For readability, we plot flows that are at least 1% as large as the largest flow.

The deeper regional integration, the more and the ‘better’ trade

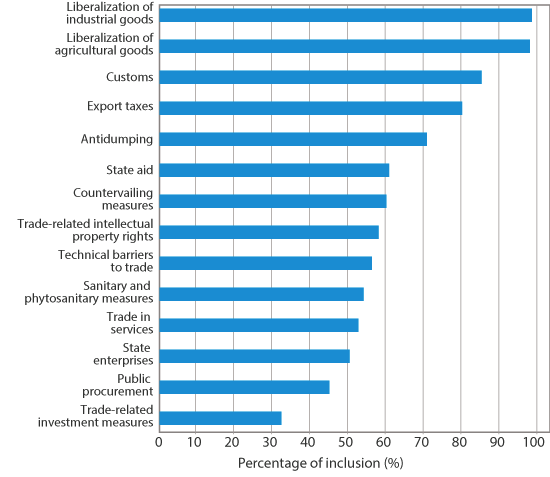

In a new paper (Boffa et al. forthcoming), we assess whether the existence and nature of regional trade agreements has played a role in this. The scope of regional trade agreements typically goes beyond provisions traditionally regulated by the WTO (Figure 2). A growing share of new agreements deals with investment, government procurement and competition policy, areas of direct relevance to prospective investors in cross-border value chains (Baldwin 2011, ITC 2017).

Figure 2 Content of regional trade agreements

a) Deeper than WTO (WTO-plus)

b) Beyond WTO (WTO-extra)

Note: Only legally enforceable provisions are plotted, covering 261 agreements in force in 2015. Based on data from World Bank’s Content of Deep Trade Agreements (Hoffman, Osnago and Ruta 2017).

The results of our research suggest that deeper trade agreements are associated with more value chain trade (see Table 1). An interesting result arises when we define trade in GVCs along two dimensions, using the standard GVC decomposition of value added in gross exports (Johnson and Noguera 2012, Koopman et al. 2014, Wang et al. 2017).

In the empirical analyses we focus on the bilateral level and make the distinction between GVC integration as a buyer and as a seller of value-added. When comparing an RTA of an average depth with the deepest agreements, we find that backward linkages, in the sense of foreign inputs in exports, are more than tripled. For these same agreements, forward linkages, in terms of domestic value-added content in exports, more than quadruple. Increasing domestic value added in trade is typically an established objective of policymakers and our findings suggest that deepening trade agreements contributes to meeting this objective.

Table 1 Impact of depth of trade agreements, investment provisions on value chain trade

Note: Estimates from gravity model. IVC indicators using Wang, Wei, Yu and Zhu (2017) decomposition implemented by Quast and Kummritz (2015). Only legally enforceable provisions are included. Data are sourced from the World Bank database Content of Deep Trade Agreements (Hoffman, Osnago and Ruta, 2017) and UNCTAD database on BITs (UNCTAD, 2009).

Trade and investment under one legal umbrella good for domestic value addition to trade

The role of investment provisions within regional trade agreements is particularly interesting, as investment is often dealt with in separate legal treaties. The latter typically take the form of bilateral investment treaties (BITs).

Bringing trade and investment under a single legal umbrella brings international economic law, at least in principle, closer to business reality where investment and trade decisions are interlinked. In our work we assess whether this matters for economic outcomes.

We do this by using the augmented gravity framework to estimate the impact of different trade and investment agreements on trade (as in Mulabdic et al. 2017). We consider three different policy actions:

- First, the signature of an RTA agreement (a dummy variable).

- Second, a variable that denotes the depth of the RTAs (measured by the count of RTA provisions).

- Third, a dummy taking the value of unity if there is a BIT in place between the two countries.

We find that deep RTAs – i.e. those with provisions covering both trade and investment – have a greater effect on value chain activity than a combination of a standalone shallow RTA and a BIT.

The role of legally binding investment provisions within trade agreements appears to be particularly important. Both BITs and deep RTAs are associated with an increase in value chain trade. However, BITs act only on backward linkages, and hence on the use of foreign inputs.

Deep trade agreements, in contrast, act along the two dimensions of GVC integration, fostering both backward and forward linkages (Table 1). Hence, concluding a bilateral investment treaty where a trade agreement is in place is associated with an increased use of foreign inputs. Deepening trade agreements by including enforceable investment provisions, however, increases forward linkages as well, boosting the share of domestic inputs into exports. This finding is particularly interesting for developing and emerging economies that wish to increase domestic value addition to trade.

What this means for trade negotiators

Supply chain managers have always had a tendency to assess trade and investment regimes together when deciding where, how and with whom to set up operations. The more coherent trade and investment policies are, the more attractive a country would be from the point of view of a lead firm in a value chain. This supposition is confirmed by the findings in this column, which show that addressing trade and investment under a single legal umbrella is conducive to value chain trade.

In light of these findings, the recent move by several WTO members to discuss investment facilitation under the WTO umbrella makes sense. Comprehensive bilateral or regional agreements like CETA would also be conducive to value chain activity. Our findings imply that the standstill in the EU-US trade and investment negotiations is regrettable, and that EU and Swiss negotiators may want to consider looking at both sides of the coin in their dealings with China rather than focusing only on one: investment in the case of EU-China, and trade in the case of Switzerland-China.2

References

Baldwin, R E (2011), “21st Century Regionalism: Filling the gap between 21st century trade and 20th century trade rules”, WTO Staff Working Paper, No. ERSD-2011-08.

Baldwin R and S Evenett (eds) (2011), The Collapse of Global Trade, Murky Protectionism, and the Crisis: Recommendations for the G20, VoxEU.Org Book

Baldwin, R and J Lopez-Gonzalez (2015), “Supply-chain Trade: A Portrait of Global Patterns and Several Testable Hypotheses”, The World Economy 38(11): 1682–1721.

Boffa, M, M Jansen and O Solleder (forthcoming), “Do we need deeper trade agreements for GVCs or just a BIT?”, The World Economy.

Delgado M, M E Porter and S Stern (2014), “Clusters, convergence, and economic performance”, Research Policy 43(10): 1785-1799.

Ghemawat, P (2018), The New Global Road Map: Enduring Strategies for Turbulent Times, Harvard Business Review Press.

Hofmann, C, A Osnago and M Ruta (2017), “Horizontal depth: a new database on the content of preferential trade agreements”, World Bank Policy Research Working Paper 7981.

International Trade Centre (ITC) (2017) SME Competitiveness Outlook 2017. The Region: A Door to Global Trade.

Jansen, M, S Klotz and J Virdee (forthcoming), “Regional integration: the next wave”, in A Klasen (ed), Handbook of Global Trade Policy, Wiley.

Johnson, R C and G Noguera (2012), “Accounting for intermediates: Production sharing and trade in value added”, Journal of International Economics 86(2): 224–236.

Koopman, R, Z Wang and S-J Wei (2014), “Tracing value-added and double counting in gross exports”, The American Economic Review, 104(2): 459–494.

UNCTAD (2009), "The role of international investment agreements in attracting foreign direct investment to developing countries".

Wang, Z, S-J Wei, X Yu and K Zhu (2017), “Measures of Participation in Global Value Chains and Global Business Cycles”, NBER Working Paper 23222.

Endnotes

[1] Deep regional trade agreements differ from typical regional trade agreements (RTAs), as they cover a wider range of issues including those not covered by the traditional WTO mandate, such as investment, labor and competition. Formally, we define the “depth of an RTA” as the sum of the policy areas that contain legally enforceable provisions, and “deep RTAs” as those agreements that contain more policy areas than a RTA of an average depth.

[2] The free trade agreement between Switzerland and the People’s Republic of China entered into force in 2014. It contains investment provisions but they are not legally binding.