Central bank communication, like monetary policy itself, has evolved significantly since the global financial crisis. In a 2016 survey of central bank governors, more than 80% of respondents indicated that their communications had intensified since the crisis, and a clear majority expected that these changes are here to stay (Blinder et al. 2017). This is not surprising – central banks need to explain increasingly complex monetary policies, often in the context of broader mandates. This has repercussions on communication. For instance, central bank speeches have spanned a wider range of topics since the financial crisis (Siklos et al. 2018).

Central banks have also become the subject of intense and often controversial public discussions, at times accompanied by a loss of trust (van der Cruijsen and Samarina 2021). Increasing trust and ensuring accountability requires more communication with the wider public, which imposes very different challenges than communicating with the traditional counterparts of central banks, namely financial markets and other expert audiences (Coibion et al. 2019).

In addition, central banks are confronted with changing media landscapes within which their communication is transmitted. New technologies, such as social media, also offer possibilities to engage with a wider audience (Ehrmann and Wabitsch 2021).

In light of all these developments, it is important to assess current communication practices and to identify room for improvement. Who would be better placed to do so than former policymakers, given their intimate knowledge of the subject matter and ability to pass judgement from a relatively neutral perspective as they are no longer in office?

In a new paper (Ehrmann et al. 2021), we do precisely this – we report the results of a survey of former members of the ECB’s Governing Council, which sought their views on euro area monetary policy communication, the related challenges, and the road ahead. The survey was conducted in November and December 2020. By the closing date, we had received 27 responses, making for a gratifying response rate of 59%, which, despite the overall small population, enables proper statistical analysis.

A first notable finding is that although the survey allows differentiating across several respondent groups, pronounced differences are rare, suggesting that even though the survey covers a broad range of issues and is conducted for a monetary union with 19 separate countries, overall there is a broad consensus of opinion.

Why and with whom to communicate

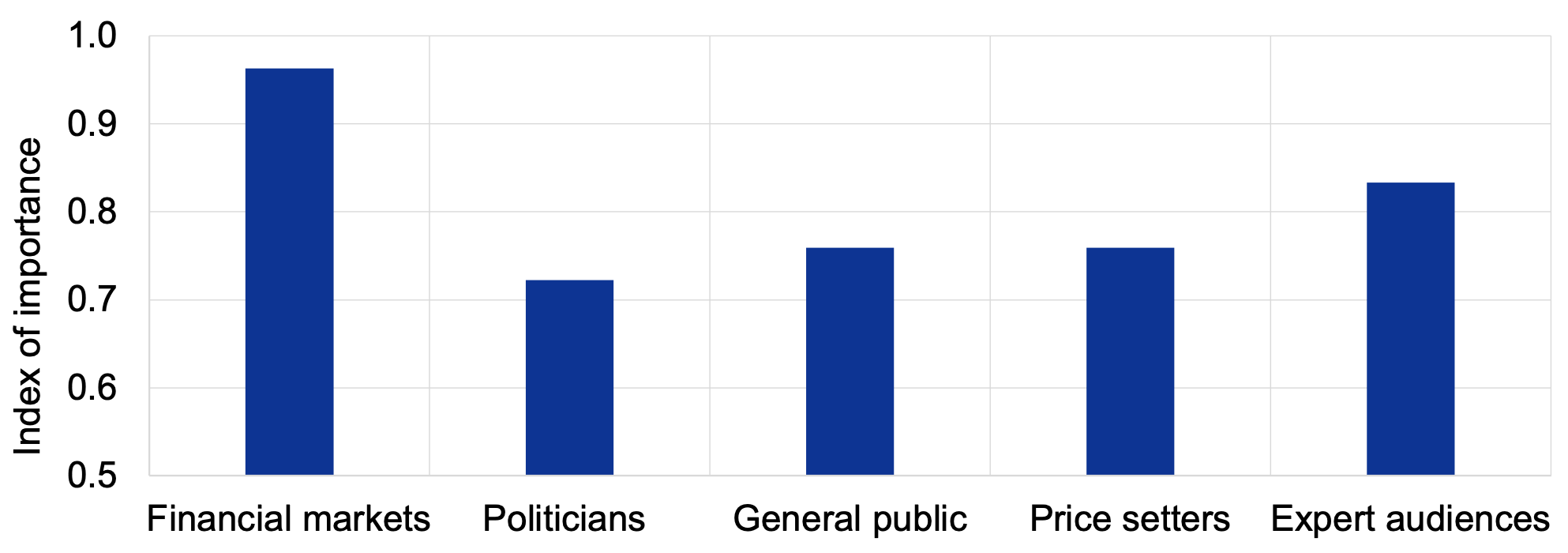

Enhancing credibility and trust is seen as the most important objective of central bank communication by our respondents, closely followed by managing expectations and enhancing transparency. When asked which target audiences were most relevant for the effectiveness of monetary policy, emphasis was given to the more traditional target groups of financial markets and other expert audiences (Figure 1). Nevertheless, some respondents commented on the risk that communication with financial markets can go too far, in particular if market expectations dominate policy. The importance of avoiding privileged communication with financial markets was also stressed in the comments to this question.

Figure 1 The importance of different audiences for the effectiveness of monetary policy

Notes: The figure shows the responses to the question “With regard to the effectiveness of monetary policy, how important is it to communicate with different audience groups?” The “Index of importance” is the percentage of respondents reporting on the importance of objectives weighted by the level of importance attached to each. If all respondents answered, ‘extremely important’, the index would be 1; ‘very important’, the index would be 0.75; ‘important’, the index would be 0.5; ‘somewhat important’, the index would be 0.25; and if all respondents reported ‘not important at all’ the index would be 0.

As to the assessment of ECB practices, communication with the more traditional target groups is considered adequate by an overwhelming majority (74%) of respondents. In contrast, respondents see substantial room for improvement in communication with the general public: only 22% think that communication with this audience is adequate, while 33% see a lot of room for improvement.

What to communicate

The next part of the survey asked about the topics of communication. Communication about the central bank objective is seen as the most important topic, which 100% of former Governing Council members saw as either “very” or “extremely” important. In that regard, several respondents perceived a need for clarification of the ECB’s inflation aim, citing the ambiguity of the “below, but close to, 2%” formulation that had been in place at the time of the survey. Considerable importance was also given to communication on the rationale for monetary policy decisions and on the economic outlook, whereas communication on uncertainty, the reaction function and the future path of policy were perceived as relatively less important.

Figure 2 What type of forward guidance?

Notes: The figure shows the responses to the question, “For several years, the ECB has provided forward guidance, in different forms. Forward guidance is often classified as being either calendar based (or ‘time contingent’), data based (or ‘state contingent’), or purely qualitative (that is, providing neither a time frame nor economic conditions). Which type(s) of forward guidance do you believe should be part of the ECB toolkit?” and the proportion of respondents selecting each response option.

The survey also asked for respondents’ views regarding the various types of forward guidance. The ECB, like many other central banks, has employed different forms of forward guidance. It has used purely qualitative statements, calendar-based forward guidance (i.e. statements about the policy path with an explicit reference to a calendar date), as well as state-contingent forward guidance (i.e. where the policy path is conditional on economic outcomes). Most respondents (67%) suggest that state-contingent forward guidance should remain in the ECB’s toolbox, just over half think that purely qualitative guidance should remain in use, and less than a third are supportive of calendar-based guidance (Figure 2). In fact, a very slight majority of respondents believe that calendar-based guidance should not be in the toolkit any longer.

How to communicate

After having asked about the ‘why’ and the ‘what’, the survey turned to questions about the ‘how’, covering many different aspects of communication. Communication innovations in recent years, such as the publication of monetary policy accounts and the use of social media, got the endorsement of the majority of respondents, who felt these innovations should remain in place. Regarding the accounts, a large majority of 67% is in favour of continuing to publish unattributed accounts, but 26% support the publication of attributed accounts. On the use of social media, views are balanced, with 48% of respondents favouring the status quo, 22% suggesting that social media should be used more, and 26% saying they should be used less.

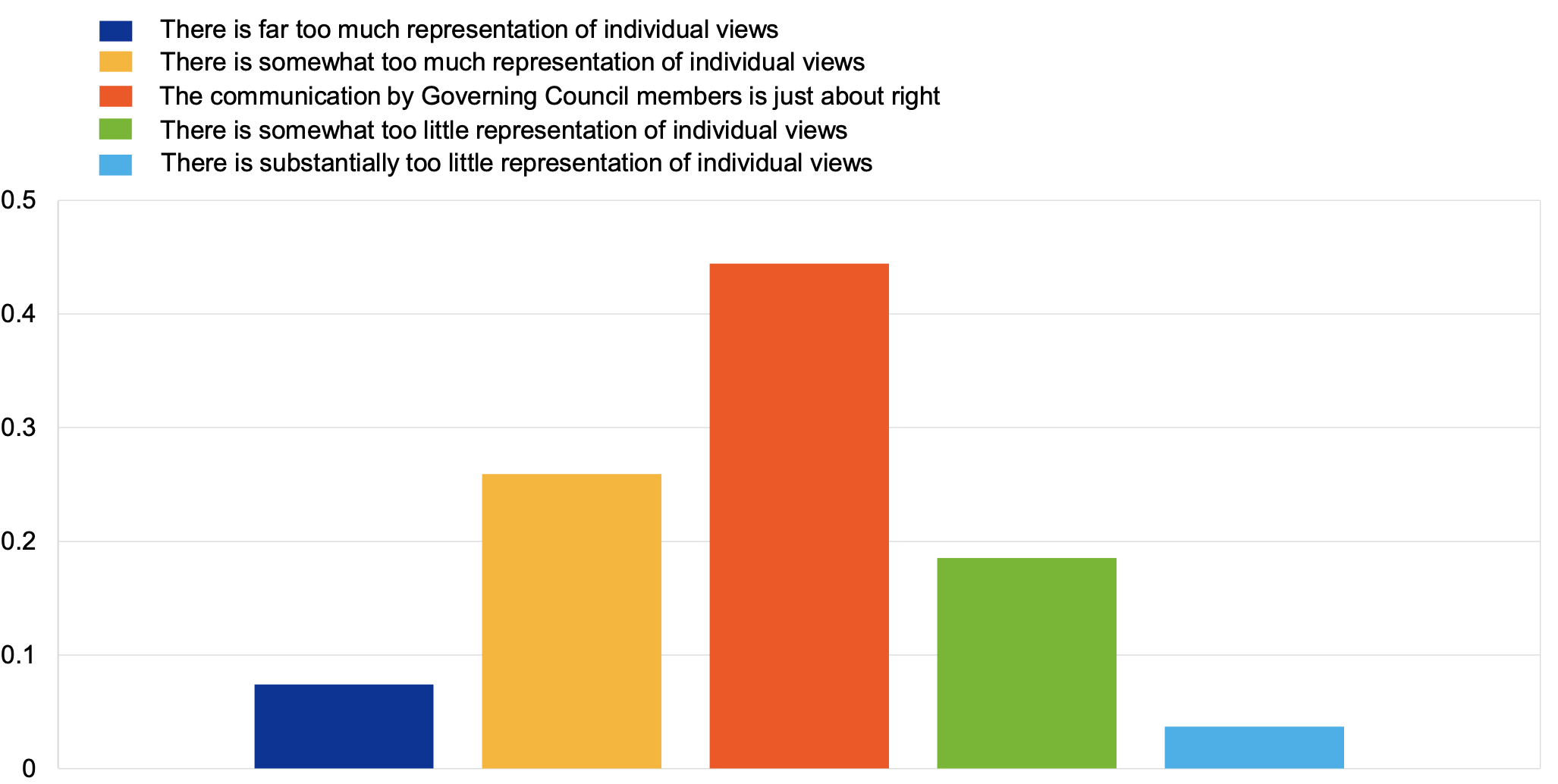

Another question deals with the communication of individual views. Here, most respondents think that the ECB’s monetary policy communication is about right (Figure 3). However, a higher share of respondents believes that there is too much representation of individual views (33%) compared to those who believe that there is too little (22%). Relatedly, the survey also asked to what extent communication should be done by the ECB or by the national central banks (NCBs) – after all, the particular communication challenges posed by a multi-cultural and multi-lingual monetary union could imply an important role for NCBs. A majority of respondents believe that the balance of communication between the ECB and NCBs is currently about right. At the same time, there is a higher share of respondents who believe the balance should shift more to the ECB (27%) compared to those who believe it should shift more to the NCBs (15%).

Figure 3 Diversity of views on the Governing Council

Notes: The figure shows the responses to the question “In most central banks, monetary policy is set by a committee. Whereas some central banks encourage that the diversity of views on the committee is represented in the external communication, others have adopted a one-voice policy. Where, in your view, is the monetary policy communication by Governing Council members located along this spectrum?”.

The survey also asked for views about whether the language used in the ECB’s communication is too complex. The ECB’s introductory statement at the press conference used to be a case in point – to understand it required around 13-15 years of formal education (Coenen et al. 2017), which is why the ECB decided in its recent strategy review to reduce the length and the complexity of its statements. But simplification also carries a risk, in particular if it gives the public a false sense of certainty about future developments that might subsequently not materialise (Assenmacher et al. 2021). When asked about their assessment of the ECB in terms of balancing this trade-off, a majority of respondents think that its communication at the time of the survey was just about right. A substantial share believe that it was too complex (33%), while almost no one thinks that it was running the risk of being overly simplistic. Also, a number of respondents who selected that communication is “about right” noted in their comments on the question that the answer depends on the audience and that probably for the general public, communication remains too complex.

The future evolution of monetary policy communication

Overall, it seems that the respondents assessed the ECB’s monetary policy communication as broadly adequate. But challenges remain. When asked how monetary policy should evolve over the next five to ten years, simplification and clarity, greater involvement between NCBs and the ECB, and the need to avoid a cacophony of voices were the most-frequently noted factors. Less complex communication is seen as a means to reach a wider audience. In this context, the importance of clear and targeted communication was cited. Respondents also suggested greater involvement of NCBs together with the ECB in communication in order to engage with the public across the euro area. In addition, some respondents indicated a need to avoid contradictory communication, favouring a more coordinated, ‘one voice’ approach. These results make it apparent that what constitutes effective communication varies across audiences and is likely to evolve over time. Central banks will therefore need to continue to assess and adjust their communication practices.

Authors’ note: The views expressed in this column present the authors’ personal opinions and do not necessarily reflect the views of the ECB, the Central Bank of Ireland or the Eurosystem.

References

Assenmacher, K, G Glöckler, S Holton, P Trautmann, D Ioannou and S Mee (2021), “Clear, consistent and engaging: ECB monetary policy communication in a changing world”, European Central Bank Occasional Paper No. 274.

Blinder, A S, M Ehrmann, J de Haan, and D-J Jansen (2017), “Necessity as the mother of invention: Monetary policy after the crisis”, Economic Policy 32(92): 707-755.

Coenen, G, M Ehrmann, G Gaballo, P Hoffmann, A Nakov, S Nardelli, E Persson, and G Strasser (2017), “Communication of monetary policy in unconventional times”, European Central Bank Working Paper No. 2080.

Coibion, O, Y Gorodnichenko, and M Weber (2019), “Monetary policy communications and their effects on household inflation expectations”, VoxEU.org, 22 February.

Ehrmann, M and A Wabitsch (2021), "Central banks on social media: The reception of ECB communication among experts and non-experts on Twitter”, VoxEU.org, 29 November.

Ehrmann, M, S Holton, D Kedan, and G Phelan (2021), “Monetary policy communication: perspectives from former policy makers at the ECB”, CEPR Discussion Paper No. 16816.

Siklos, P, S St. Amand, and J Wajda (2018), “The evolving scope and content of central bank speeches”, VoxEU.org, 16 December.

van der Cruijsen, C and A Samarina (2021), “Trust in the ECB during the pandemic”, VoxEU.org, 03 October.