Editors' note: This column is part of the Vox debate on the economic consequences of war.

How would the German economy cope with a sudden stop of energy imports from Russia, either triggered by a further tightening of the sanction regime or following a stop of energy deliveries by Russia? Germany imports about 60% of its energy (World Bank 2022), with import quotas of between 94% and 100% for oil, gas, and hard coal (Umweltbundesamt 2022). In 2021, the value of energy imports amounted to about €80 billion, or around 2% of GDP (Statistisches Bundesamt 2022b). About half of German imports of gas and hard coal, and about one-third of its oil imports, originate from Russia. Germany depends on Russia for about one-third of its total energy consumption (see Table 1).

In the German economy, gas is predominantly used by industry (36%), households (31%), and trade and commerce (13%) – in the case of the last two, predominantly for heating purposes (BDEW 2019, 2021). The usage of gas for electricity production is comparatively small. In manufacturing, about three-quarters of the gas is used for heating and cooling, as well as for material use. About one-third of industrial use comes from the chemical industry (Zukunft Gas 2022). About 75% of oil is used as gasoline and diesel fuel (Wissenschaftliche Dienste des Deutschen Bundestages 2019).

In a new paper (Bachmann et al. 2022), we combine the latest theoretical advances in multi-sectoral open-economy macroeconomics with an in-depth look at German energy usage and empirical estimates for elasticities of substitution to estimate the short-run costs. To estimate the macroeconomic effect, we build on a state-of-the-art multi-sector macro model with production networks based on work by Baqaae and Farhi (2021).

Table 1 German primary energy usage 2021

Notes: 1 in 2020 (already lower in 2021 and 2022).

Source: Agora Energiewende (2022); Eckert and Abnett (2022).

Ending German dependency on Russian energy

If Germany is cut off from Russian energy imports, it will need to compensate either through alternative supply sources, fuel shifting and economic reallocation, or demand reduction. The different channels are likely to be of different importance over the short and long term. In the short run, a stop of imports from Russia has to be compensated through alternative energy sources from other countries and domestic sources to meet electricity, transport, heating, and industrial demand, or through substituting energy-intense production of certain products by direct imports. In the medium and long term, increased use of renewable energy and energy efficiency improvements can contribute significantly to lowering fossil energy demand.

To start with, substituting Russian imports of oil and coal will likely not pose a major problem. Sufficient world market capacity exists from other oil- and coal-exporting countries to make up the shortfall. The greater challenge is to find short-run substitutes for Russian gas, which accounts for about 15% of Germany’s total energy consumption. Owing to the existing pipeline network and limited terminal capacities, a short-term substitution via LNG is challenging, while raising pipeline imports from other countries is also subject to limitations.

Germany’s imports of Russian gas already decreased substantially in the second half of 2021 and especially in the first months of 2022. In the EU, the share of Russian imports of gas fell from about 40% to 20–30% (McWilliams et al. 2021). LNG imports in Europe surpassed imports from Russia, although capacity for further increases of LNG imports is limited (Rashad and Binnie 2022). Taken together, the current available evidence suggests that other gas producers will only be partially able to make up the shortfall from Russia. Substitution and reallocation will thus be crucial.

To construct a plausible size for the shock to the German economy, we make the assumption that the result of a Russian energy embargo will be a reduction of gas deliveries of 30%, or about 8% of total German energy consumption. This will have to be borne by domestic industry, households, and services. While some part of this gap can potentially be closed by filling reserves over the summer when heating demand from households is low without hurting industrial usage, our baseline assumption is that in the short run the Germany economy would be forced to adjust to such a shock. What would be the economic effects?

Macroeconomic effects

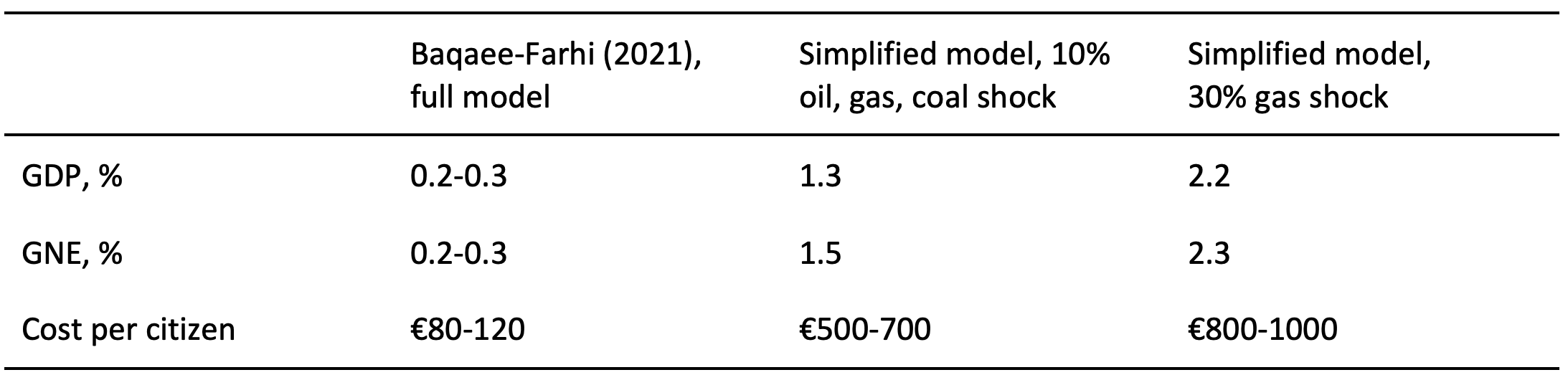

As our workhouse model, we rely on a state-of-the-art multi-sector macro model with production networks based on Baqaae and Farhi (2021) to estimate the economic costs for the German economy of stopping Russian energy imports. The size of economic losses depends crucially on the time frame over which adjustments take place. It is implausible to assume that even in the short run the elasticity of substitution is zero. Producers and households will always be able to switch to other inputs to some extent, change their consumption baskets, or import energy, especially gas, or products with high energy content that can be transported in bulk. In the estimated model, for low elasticities of substitution, the Baqaee-Farhi multi-sector model predicts modest losses equivalent to 0.2–0.3% of German GDP (see Table 2).

Table 2

The macroeconomic effects of cutting Germany off from Russian energy depend highly on the extent to which the production structure can adjust to the reduction of fossil energy and on how substitutable imports from Russia are by imports from other suppliers. In the very short run, this substitutability is of course limited. Electricity production can adjust quickly and at relatively low cost, while replacing the material use of gas, for instance, will be more difficult or even impossible.

We acknowledge that the uncertainty surrounding elasticities of substitution could be large. To derive a plausible upper bound of the costs, we complement our calculations from the rich multi-sector model with an analysis of a simpler model. We discipline these estimates with empirical elasticities found in the literature for industrial energy usage on 4-digit Standard Industrial Classification (SIC) level (Steinbuks 2012). Similar estimates are found for short-run residential demand for natural gas (Auffhammer and Rubin 2018) and they also lie in the middle of the estimates for short-run demand elasticities across a large set of studies (Labandeira et al. 2017).

In the first exercise, we calculate the effects of an 8% aggregate reduction in overall German energy use. In the second scenario, we model a 30% reduction in gas inputs as a shock to that specific energy source. Assuming very low short-run substitution elasticities, an 8% energy adjustment to oil, gas, and coal consumption leads to a 1.4% GDP loss, or costs of €500–700 per year per German citizen. In a last scenario where we model a more extreme 30% adjustment in gas usage, the economic losses rise to 2.2% of GDP (2.3% of GNE), equivalent to up to €1,000 per year per citizen – an order of magnitude higher than the 0.2–0.3% (or €80–120 per citizen) implied by the Baqaee-Farhi model.

It is important to stress that the model we use is a real model with no further business cycle amplification. Such amplifications are possible if monetary and fiscal policy do not counter the effects of nominal rigidities on the economy. On the monetary side, a firm commitment to stable prices can soften the potential trade-off between stabilising output and inflation. At the same time, fiscal policy needs to – and can, through insurance mechanisms like short-term work – take care of second-round demand effects. To account for potential amplification, as a pessimistic scenario we approximate a number of a 3% output shock, hence a rate of contraction that is 30% greater than in the estimated model.

The reason why the overall effects across different scenarios are substantial but remain in a manageable range and lower than the output drop during the Covid-19 pandemic (-4.5%) is that, even with low elasticities, the effects are buffered by some substitution. Put differently, only in a scenario where no substitution is possible at all will the output cost rise above the range described in our study. The empirical evidence on fuel switching in industry and household adjustment to higher fuel prices strongly argues against such a view of a Leontieff production function, as shown in Figure 1.

Figure 1 Output losses following a fall in energy supply for different elasticities of substitution

Policy implications

The overall economic costs can be affected by targeted policy measures and their timing. Such policy measures should include:

Incentives to substitute: Policy measures should aim at strategically increasing incentives to substitute and save fossil energies as soon as possible even if an embargo is not imminent. Taking action immediately would avoid even harsher adjustments later this year or in 2023 should push come to shove.

Insurance schemes delay adjustments: Existing insurance schemes (e.g. emergency rationing plans for gas to favour households, expected bail outs for affected industries) tend to lull decision makers in industry and households into not fully internalising the potential costs of delaying their adjustments. They might be induced to gamble on a no-embargo scenario with a normalisation of energy prices. This, in turn, might severely limit political options to strengthen the sanctions regime down the road.

Early adjustments: If an embargo of Russian energy turns into a political necessity in the short run, such action has the lowest economic costs if it is taken as early as possible. The main reason is the seasonality of gas demand. A cut-off from Russian gas over the summer months could be substituted from Norwegian and other sources, keeping industrial supply going. An early move would immediately trigger the substitution and reallocation dynamics that are central to reducing economic costs.

Commitment to extended periods of higher fossil prices: Governments should commit to elevated fossil energy prices for an extended period even if no embargo is realised. This could include, for example, some sort of ‘energy security levy’ on natural gas. It also means that there should be a firm commitment to climate policy-driven increases in energy prices.

Better energy infrastructure: Given the higher costs of adjustment in the short run compared to the long run, it makes a difference if an LNG terminal is ready by autumn 2023 or 2026. Government subsidies and contracts should therefore create clear incentives here as well, providing substantially higher payments for early completion. This includes encouraging private investors to privately assume risks, such as when Tesla builds a factory without all constructions being finally approved by the public authorities.

Buffering consequences for poor households: A persistent increase in energy prices would have implications for households as well as industry. While power shortages or cold homes are highly unlikely, rising energy prices will be felt acutely. One concrete remedy would be to (artificially) rebate increased gas, oil, and electricity prices through lump-sum payments that could ease the adjustment burden for low-income households.

Conclusion

Contrary to fears frequently voiced in the German public debate, substitution and reallocation would likely keep the economic costs of a Russian energy embargo below 3% of GDP – probably closer to the 2% mark. There is no doubt that these are substantial economic costs, but at the same time, they are clearly manageable in the sense that the German economy has weathered deeper slumps in recent years and recovered quickly. Both after 2009 and 2020, the economy and the polity overcame larger GDP declines. Public fear-mongering about the catastrophic consequences of an energy embargo from lobby groups and affiliated think tanks does not hold up to academic standards.

References

Agora Energiewende (2022), “Die Energiewende in Deutschland: Stand Der Dinge 2021. Rückblick Auf Die Wesentlichen Entwicklungen sowie Ausblick auf 2022”.

Bachmann, R, D Baqaee, C Bayer, M Kuhn, B Moll, A Peichl, K Pittel and M Schularick (2022), “What if? The Economic Effects for Germany of a Stop of Energy Imports from Russia”, ECONtribute Policy Brief 28/2022.

Baqaee, D and E Farhi (2021) “Networks, Barriers, and Trade”, Working Paper.

BDEW (2019), “Energy Market Germany 2019”, BDEW Bundesverband der Energie- und Wasserwirtschaft e.V.

BDEW (2021), “Die Energieversorgung 2021 – Jahresbericht”, BDEW Bundesverband der Energie- und Wasserwirtschaft e.V.

Eckert, V and K Abnett (2022), “Factbox: How Dependent Is Germany on Russian Gas?”, Reuters.

IEA (2022), “A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas”.

McWilliams, B, G Sgaravatti, S Tagliapietra and G Zachmann (2022a), “Can Europe Survive Painlessly without Russian Gas?”, Bruegel, 27 January.

McWilliams, B, G Sgaravatti, S Tagliapietra and G Zachmann (2022b), “Preparing for the First Winter without Russian Gas,” Bruegel, 28 February.

McWilliams, B, G Sgaravatti and G Zachmann (2021), “European Natural Gas Imports”, Bruegel Datasets (accessed 3 March 2022).

Neidell, M, S Uchida and M Veronesi (2019), “Be Cautious with the Precautionary Principle: Evidence from Fukushima Daiichi Nuclear Accident”, IZA Discussion Paper 12687.

Nesheiwat, J and J S Cross (2013), “Japan’s Post-Fukushima Reconstruction: A Case Study for Implementation of Sustainable Energy Technologies”, Energy Policy 60:509–19.

Rashad, M and I Binnie (2022), “Brimming European LNG Terminals Lack Room for More Gas”, Reuters.

Sandau, F, S Timme, C Baumgarten, R Beckers, W Bretschneider, S Briem, J Frauenstein, et al. (2021), “Daten Und Fakten Zu Braun- Und Steinkohlen”, 28/2021, Texte, Umweltbundesamt.

Statistisches Bundesamt (2022a), “Facts on Trade with Russia”, Press release.

Statisitsches Bundesamt (2022b), “Exporte Und Importe (Spezialhandel) Nach Güterabteilungen Des Güterverzeichnisses Für Produktionsstatistiken”, Wiesbaden: Statistisches Bundesamt,

Umweltbundesamt (2022), “Primärenergiegewinnung Und -Importe”.

Wissenschaftliche Dienste des Deutschen Bundestages (2019), “Erdölverbrauch in Deutschland”, Dokumentation, WD 5 - 3000 - 033/19.

World Bank (2022), “Gross national expenditure (current LCU) – Germany”.

Zukunft Gas (2022), “Erdgas in Deutschland: Zahlen Und Fakten Für Das Jahr 2021”.