One of the fundamental questions in political economy is why governments often fail to adopt reforms that are believed to be needed and welfare-improving. The common explanation was well encapsulated by Jean-Claude Juncker, Prime Minister of Luxembourg and President of the Eurogroup: "We all know what to do, but we don't know how to get re-elected once we have done it".

In research since Peltzman (1992), including a recent contribution by Alesina et al. (2010), however, economists and political scientists alike have not found evidence that reforms affect adversely the chances of re-election. But if governments are not punished at the ballot box, why is reform so politically difficult?

The political cost of reforms

In Bonfiglioli and Gancia (2011), we propose a model that reconciles these seemingly contradictory observations and sheds new light on the political determinants of reforms. Our theory builds on three premises.

- First, reforms have current costs and future returns.

- Second, the level of effort and resources invested in reforms are not easily verifiable by voters before the payoffs materialise.

- Third, ability of politicians is heterogeneous and not directly observable, so that it must be inferred on the basis of performance.

In this model, elections serve the purpose of replacing bad performing politicians, but this ex-post selection introduces an ex-ante “political cost” of adopting reforms. Governments are tempted to invest less in reforms so as to improve current performance and hence increase their chances to stay in power. Yet, rational voters cannot be fooled because they correctly foresee the government’s equilibrium strategy. As a result, the election outcome remains independent of reforms. Nonetheless, the choice of underinvestment is sustained by the fact that politicians can deviate from their equilibrium strategy in ways unobserved by voters.

An interesting and novel implication of our theory is that more uncertainty on the realisation of performance lowers the political cost of reforms. The reason is simple. If uncertainty is high, for example because the economy is going through a period of high turbulence, the politician will know that his re-election will depend more on luck rather than on his actions. For this reason, he will be less tempted to boost current performance in an attempt to secure his seat and will be free to take the right policy measures. Therefore, perhaps surprisingly, we find that higher uncertainty and greater macroeconomic volatility make reforms more politically viable.

Empirical evidence

Our theory is consistent with a number of empirical observations.

- First, Alesina, et al. (2006) and Conconi et al. (2011) have found that electoral proximity reduces the likelihood of fiscal adjustments and trade liberalisation, respectively.

This suggests that governments are indeed afraid of the electoral consequences of reforms.

- Second, regarding the impact of economic variables, several existing works have found that crises promote the adoption of fiscal and structural reforms.

Although crises are often coupled with high economic volatility, direct evidence on the effect of the latter on reforms is missing.

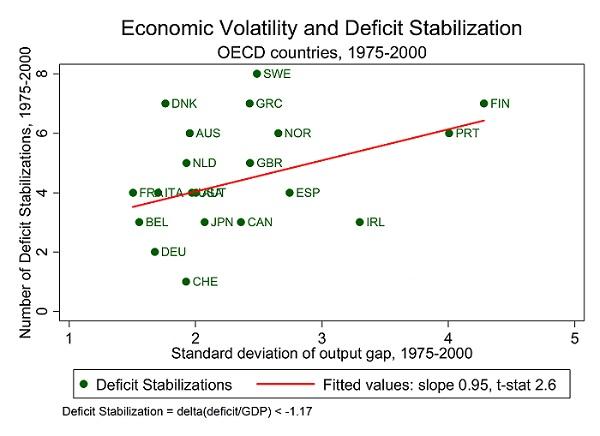

To fill this gap, in Bonfiglioli and Gancia (2011) we take a fist look at the correlation between episodes of fiscal adjustments, defined as a fall in the deficit/GDP ratio by at least 1.17 percentage points, and measures of economic volatility for a panel of 20 OECD countries observed between 1975 and 2000. As Figure 1 shows and consistently with our theory, fiscal reforms have occurred more often in more volatile economies. In our paper we complement this evidence by showing that a larger economic volatility in the preceding 5 years is associated with a higher likelihood of implementing fiscal adjustments. The result holds when controlling for country fixed effects, economic and fiscal crises, and political variables and is not sensitive to the definition of a fiscal cut. We also find the effects to be quantitatively significant. In sum, while more work on the subject would be desirable, the data seem compatible with the prediction that economic uncertainty promotes reforms.

Figure 1. Economic volatility and fiscal reforms

Conclusions

In modern democracies, elections are the fundamental instrument of political accountability. In some circumstances, however, this instrument may induce myopic behaviour and hence a tendency for policymakers to avoid costly adjustments. Does this mean that electoral incentives necessarily undermine the credibility of governments to implement the structural and fiscal reforms needed to fight the current crisis? We believe the answer is no, for at least two reasons.

- First, external pressure from markets and the EU may actually help governments to publicly commit to the adoption of anti-crisis measures and swing away part of the political responsibility of unpopular policies.

- Second, and perhaps more importantly, since times of market turmoil are characterised by a high degree of uncertainty, our theory suggests that they may provide a unique opportunity to implement reforms that would otherwise not pass.

References

Alesina, A, S Ardagna and F Trebbi (2006), "Who Adjusts and When? On the Political Economy of Reforms", IMF Staff Papers 53, Mundell-Fleming Lecture, 1-29.

Alesina, A, D Carloni and G Lecce (2010), “The electoral consequences of large fiscal adjustments”, VoxEU.org, 29 May.

Bonfiglioli, A and G Gancia (2011), "The Political Cost of Reforms", CEPR Discussion Paper 8421.

Conconi, P, G Facchini, and M Zanardi (2011). “Policymakers' Horizon and Trade Reforms”, ECARES mimeo.

Peltzman, S (1992), “Voters as Fiscal Conservatives”, Quarterly Journal of Economics, 107(2):327-361.