Empirically, there is a hump-shaped curve relating export diversification and economic development (Cadot et al. 2011). Many countries on the rising part of the curve seek to diversify their exports (in terms of shipped products and destinations) as a way of boosting income or reducing risk.

In such policy efforts, only long-lasting export relationships are often considered successful for firms and countries, while exports running for a year or two represent failed strategies. Empirical evidence from a number of countries at different levels of development, however, shows that export spells are quite short. In this piece, based on an analysis of patterns in a disaggregated trade dataset, we argue that such short spells may not necessarily reflect failures. It can be a perfectly rational strategy for some firms to quickly enter and exit export markets, or export for a few years only.

Short trade spells have indeed been observed in many countries. Besedes and Prusa (2006), for example, showed that the median duration of importing a product is between two and four years in the US. Similarly, Nitsch (2009) presented evidence that the same phenomenon can be observed in Germany – the majority of trade relationships exist for only one to three years. At the firm level, considering all export transactions in 2000 in Hungary, we found that 16.1% of exporters exited within four years after they started exporting (Békés and Muraközy 2012). At the even more disaggregated level of firm-destination trade relationships, 31.8% of transactions lasted for less than four years, and this rises to 56.5% at firm-destination-product level; short-term flows, however, reflected only a small percentage of total export volume. We call such short trade spells temporary trade, and offer an explanation for their existence.

The high prevalence of temporary trade is quite surprising, as trade theories usually predict a large degree of stability in trade relationships. Comparative advantage or love of variety, for example, is unlikely to change to a large degree in one or two years. The situation is similar in the heterogeneous-firm trade theories based on Mélitz (2003), which assume that firms have to pay sunk costs when entering export markets and use this fact to explain that relatively few firms export (Bernard et al. 2007). The sunk costs of entering export markets seem to be substantial. Das et al. (2007), for example, estimated that on average this cost is in the magnitude of $400,000 for Colombian firms.

Temporary trade as endogenous choice by some firms

While at first sight one can interpret the high frequency of temporary trade as a result of suboptimal decisions, a number of authors argued that temporary trade may be a result of optimal choices when the trade relationship is modelled in more detail.

One explanation focuses on asymmetric information and incomplete contracts. If the attributes of a trading partner cannot be observed by an exporter when they first meet, it can be optimal to ‘test’ potential foreign partners by starting small. In the learning model of Rauch and Watson (2003), new entrants should only continue the relationship if the potential partner successfully stood this test. In this spirit, Besedes (2006) shows that initial size, risk and search costs play an important role in determining the duration of a trade relationship. Higher reliability and lower search costs lead to larger initial transactions and longer duration.

In Békés and Muraközy (2012) we propose a further explanation in which temporary trade does not necessarily represent a failed relationship. In particular, we argue that short spells and unstable trade relationships may be an endogenous choice of some firms when they can choose between different ‘trade technologies’. We start from an extension of the Mélitz (2003) model, assuming that sunk costs differ across firms; in particular firms may choose different trade technologies according to their needs (a similar idea was proposed in Arkolakis 2010). While one firm that is able to sell large quantities abroad for a long period would opt to build a large distribution network of its own in the foreign country, others may sell when an opportunity emerges or even contract a trade intermediary to export a smaller shipment. Obviously, the first choice will include a larger amount of sunk cost, while the intermediary may charge a higher, variable fee.

This idea is then applied to a dynamic setting. In this approach, firms can choose one of the above two technologies when they enter the export market. We show that firms sort themselves according to their productivity. The most productive firms export with the trade technology requiring higher sunk costs, the next most productive firms export using the technology requiring smaller sunk cost, while the least productive firms do not export. In such a setting, lower productivity firms will choose the lower sunk cost trade technology and hence, they will be more likely to enter and exit exporting frequently. In other words, allowing firms to adjust their trade technology to market conditions may explain the high prevalence of temporary trade.

Which firms trade temporarily?

While technology choice itself is not easily observable, the sorting model provides a number of predictions that can be tested empirically. We use a cross sectional dataset of Hungarian manufacturing firms and aggregate their export to the firm-destination level. In particular, we classify each firm–destination trade flow as either permanent or temporary by introducing a simple trade relationship stability filter applied for the year 2000. Permanent trade is an uninterrupted export spell that is at least four years long, while temporary trade can be either a short spell or a non-continuous export relationship.

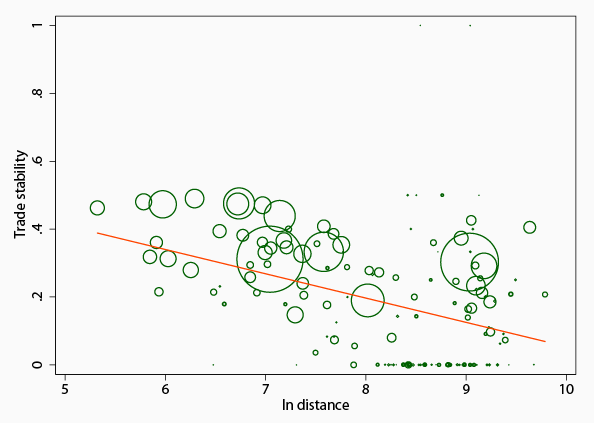

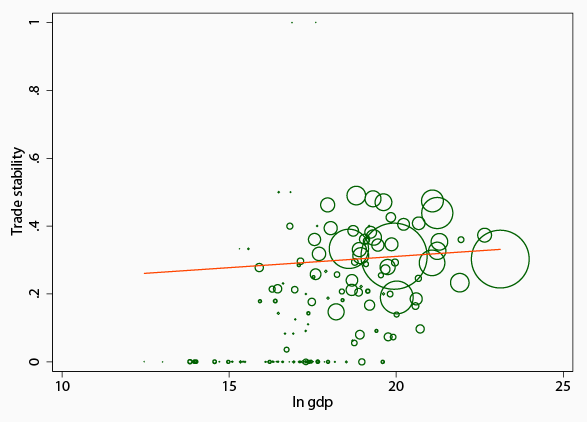

The first hypothesis we test is that more productive and larger firms are more likely to invest into their own distribution network; hence one may expect that they are more likely to export permanently. This prediction is strongly supported by the data. Doubling total-factor productivity is associated with a 5% increase in the probability of the trade flow being long-term. Second, the data shows that firms are less likely to trade temporarily in closer and larger markets (illustrated in Figure 1), which is in line with the hypothesis that investing into the high-sunk-cost technology is more profitable in larger markets or destinations where transport is cheaper.

Figure 1. The share of permanent trade by country

Note: The circles represent countries, and their size is proportional to their share of Hungarian exports. The share of permanent trade is the share of product destination combinations which are permanent for all products exported to the country.

Third, it appears that more financially constrained firms are more likely to trade temporarily, as they are less able to invest up front into building distribution networks.

We also consider the differences across products, by repeating the analysis at the firm-destination-product level. We confirm that temporary trade is not solely a result of exporting a few large items, like ships. It is quite frequent also when low-value items are considered. In fact, temporary trade is important in each industry and each product category. In line with our extended model, we found that products for which trade is expected to be more costly or contract-intensive, are likely to be exported in a more permanent fashion.

Another important characteristic of temporary trade came from outside our model. Firms are found to be selling their assets and inventories quite irregularly. For example, we found out that a large manufacturing firm once sold all the equipment from a plant, which showed up in the trade statistics as a very large number of one-off exports to a set of countries. Another concern was that temporary trade is a result of firm death, but this factor also proved to be of small importance. In our estimations, we controlled for such items.

Implications

The study of trade dynamics in general and short-term trade relationships in particular is useful because it points to the importance of analysing the structure of trade relationships in more detail. Learning, contractual frictions and a choice among trade technologies all emphasise the variety of factors which determine the dynamics of individual trade flows.

All these approaches point to inherent differences between short- and long-term trade relationships. Such heterogeneity may imply that, in some instances, the two kinds of trade flows should be studied separately. Trade liberalisation, for example, may change the composition of firms in terms of their trade technology choice, because it leads to the entry of a large number of small temporary exporters. Such composition effects may affect significantly the decomposition of trade growth into extensive and intensive margins. Distinguishing between short- and long-term traders with filters like proposed in our empirical analysis may help in gaining a deeper understanding of the effects of such a liberalisation exercise.

Finally, from a policy point of view, the main message is that short-term export flows – sometimes called ‘hit and run’ strategies – do not necessarily reflect a failure. On the contrary, they may reflect that some smaller firms are able to enter export markets at a relatively small cost, without building up a full-fledged network at the destination country. Trade policy may take into account the heterogeneity of trade technology. Different tools may help small firms export for shorter terms and larger firms establish more permanent export links.

References

Arkolakis, C (2010), "Market Penetration Costs and the New Consumers Margin in International Trade", Journal of Political Economy, University of Chicago Press 118 (6), 1151–1199.

Békés, G and B Muraközy (2012), "Temporary trade and heterogeneous firms", Journal of International Economics 87, 232-246.

Bernard, A B, J B Jensen, S J Redding and P K Schott, 2007, "Firms in International Trade", Journal of Economic Perspectives 21 (3), 105–130.

Besedes, T (2006), A search cost perspective on duration of trade, Review of International Economics 5, 835–849.

Besedes, T, and T J Prusa, (2006) "Ins, outs, and the duration of trade", Canadian Journal of Economics 1, 266–295.

Cadot, Olivier, C Carrère and V Strauss-Kahn (2011), “Export Diversification: What's behind the Hump?”, Review of Economics and Statistics, May, Vol. 93, 2, 590-605.

Das, S, M J Roberts, J R Tybout, (2007), Market entry costs, producer heterogeneity, and export dynamics, Econometrica 3 837–873, May.

Mélitz, M J (2003), "The impact of trade in intra-industry reallocations and aggregate industry productivity", Econometrica 6, 1695–1725.

Nitsch, V (2009), "Die another day: duration in German import trade", Review of World Economics 1, 133–154.

Rauch, J E, J Watson (2003), Starting small in an unfamiliar environment. International Journal of Industrial Organization 7, 1021–1042.