A key advantage claimed for the outward-oriented development strategy is that it allows poor, labour-abundant countries to specialise in labour-intensive products and, thus make efficient use of limited capital stocks. To quote Anne O. Kruger (1985), “An export-oriented strategy permits countries to use the international market to exchange their own, relatively labour-intensive commodities for capital-intensive goods. They are thus able to take advantage of the division of labour and specialisation. This ability contrasts sharply with import-substitution policies under which labour-abundant developing countries produce the entire spectrum of manufacturing goods and experience high and rising capital/labour ratios.”

The experiences of South Korea, Taiwan, Brazil and most recently China offer broad support to this claim. Increasing shares of industry in GDP in general and of labour-intensive manufactures in particular accompanied the adoption of outward-oriented strategies in these countries. Exports of unskilled-labour-intensive products such as apparel, footwear, toys and numerous light manufactures expanded rapidly.

India’s recent engagement with the world economy has produced a contrasting pattern, however.1 Contrary to the impression in many circles, India’s industrial and services sectors are almost as open as those of China. The simple average of industrial tariffs is 12% compared with 9% in China. The highest industrial tariff rate (with tariff peaks in several sectors) has been brought down to 10%. In fiscal year 2005-06, custom duty as a proportion of merchandise imports was just 4.9%. With some negative-list exceptions—most notably multi-product retail—the goods and services sectors are quite open to foreign investment. Only in exceptional cases such as insurance and media the sectoral cap on foreign investment caps are below 51% and in most cases go up to 100%. While this opening-up has been accompanied by acceleration in growth to 6.3% during the last two decades and to almost 9% in the last four years, India’s experience differs from that of China in at least three important respects. First, while India has seen the share of agriculture in the GDP decline, it has not experienced perceptible rise in the share of manufactures. Second, exports out of and direct foreign investment (DFI) into India have not seen the same rapid expansion as that seen in the case of China. Finally, fast-growing exports from India have been either capital-intensive or skilled-labour intensive. The shift in favour of unskilled-labour-intensive products traditionally observed in response to the adoption of outward-oriented polices has not happened in India.

Indian exceptions

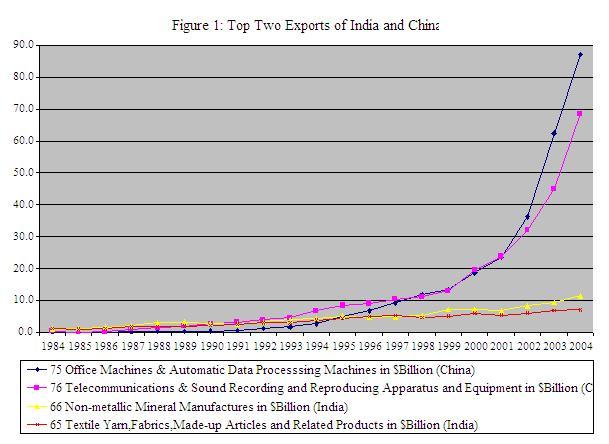

The share of manufacturing in the GDP in India has been stagnant at 17% since the early 1990s. In China, this share stood at a hefty 41% in 2006. India’s leading and fast-growing exports, such as engineering goods, petroleum products, gems and jewelry, and software, are either capital-intensive or skilled-labour intensive. The share of textiles and textile products in total merchandise exports has declined to 15% in 2005-06 from 20% in 2003-04. Within this category, unskilled-labour-intensive ready-made garments account for only half of the exports. In contrast, the export pattern of China quickly adjusted to its factor endowments after it began opening up its economy in the late 1970s and early 1980s. First, exports of textiles, apparel, toys, sports goods and footwear surged. Then in the 2000s, with rising skill endowments, it moved into more sophisticated assembly operations such as office machinery, telecommunications and electrical machinery.

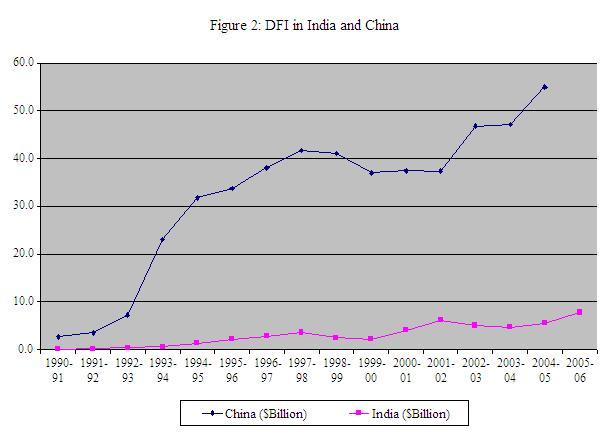

The most dramatic difference between India and China lies in the magnitude of international economic engagement. One measure of this difference is that the annual expansion in China’s trade has been larger than India’s total annual trade during last several years. For instance, China’s merchandise exports expanded by $169 billion to $762 billion in 2005 in comparison to India’s total merchandise exports of $103 billion in 2005-06. Equally dramatic are Figures 1 and 2 with the former showing the evolution of China and India’s two largest merchandise exports and the latter depicting DFI inflows.2

What holds back India?

How do we explain these differences in the response to trade openness of two economies with very similar factor endowments? The key to answering this question is the poor response of large-scale labour-intensive manufacturing including assembly and processing activities in India. As per the conventional wisdom, these activities have served as the magnet for DFI and a conduit for rapid expansion of exports in China. But this has not happened in India. Large-scale labour-intensive manufacturing activities have been virtually absent from India. Apparel factories employing thousands of workers under a single roof found in China are non-existent in India.

The explanation for the poor performance of large-scale labour-intensive manufacturing is, in turn, to be found in the domestic policy regime—both past and present. Until the late 1980s, large Indian firms were confined to a positive list of capital-intensive sectors. Even in these sectors, their size was limited through licensing based on the perceived size of the domestic market by the authorities. The same applied to foreign companies. These restrictions were largely ended by the mega reforms of 1991 and those that immediately followed them.

But this was insufficient to stimulate large-scale labour-intensive manufacturing. In the late 1960s, India had also adopted the policy of reserving labour-intensive manufactures for the exclusive production by small-scale enterprises. Even after years of steady relaxation, the small-scale enterprises face a ceiling of 50 million rupees (approximately $1.25 million) on investment in plant and machinery. The small-scale industry list grew over time and by the late 1980s came to include virtually all labour-intensive products.

As long as this reservation was in force, high-quality labour-intensive manufactures that could compete on the world markets had no chance of emerging in vast volumes. The bulk of the small-scale enterprises operated in the protected domestic market. The problem was finally recognized in the late 1990s and the government began to gradually trim the Small Scale Industy list. Even then progress was slow and the number of reserved items fell from 821 in 1998-99 to 114 in March 2007.

Most labour-intensive products including toys, footwear, sports goods and apparel have now been off the reservation list for some years. More importantly, even for products still on the list, large-scale production has been permitted since at least March 2000 as long as the enterprise exports 50% or more of its output. This latter change means that firms predominantly interested in exporting their output have been free of such restrictions since March 2000. Yet, labour-intensive manufacturing has remained stubbornly unresponsive.

The most important factor that still holds back large firms from entering these products is a set of draconian labour laws in India. Under these laws, it is virtually impossible for a firm with 100 or more employees to fire the workers even in the face of bankruptcy. It is equally difficult for the firms to reassign the workers from one task to another. These provisions impose very low worker productivity or a high real cost of labour. Large-scale capital-intensive sectors such as automobiles, where labour costs are a tiny proportion of the total costs, can profitably operate in such an environment. But the same is not true of large-scale labour-intensive sectors labour. Few foreign manufacturers are willing to enter India outside of a small subset of capital- and skilled-labour intensive sectors.

Two additional factors have held back the labour-intensive manufacturing in India: costly power and poor transport infrastructure. Not only do firms pay a much higher price for power in India than elsewhere in the world, they also face much greater uncertainty of supply. Likewise, despite considerable improvement, the transportation network in India remains unreliable and inefficient. The time taken to clear the goods entering and existing the ports and to move the goods between ports and manufacturing sites, which is so critical for assembly and processing activities, is much higher and more variable in India than in the competing countries such as China.

India’s path to modernisation

While high growth has helped India bring its poverty ratio (the proportion of the poor below the official poverty line) down from 36% in 1993-94 to 27% in 2004-05, its transition to a modern economy remains problematic: it must still move the vast majority of its workforce out of farming into non-farming activities. With the services leg doing all of the walking, the economy can only limp along towards this transition. For a more rapid transformation, India must walk on two legs. That means more rapid growth of the labour-intensive manufacturing.

References

Krueger, Anne O. 1985. The Experience and Lessons of Asia’s Super Exporters,” in Vittotio Corbo, Anne O. Krueger, and Fernando Ossa, editors, Export Oriented Development Strategies, Boulder and London: Westview Press.

Panagariya, Arvind. 2008. India: The Emerging Giant, New York: Oxford University Press.

Prasad, Eswar and Shang-Jin Wei. (2006). ‘Understanding the Structure of Cross border Capital Flows: The Case of China,’ presented at the conference, “China at Crossroads: FX and Capital Markets Policies for the Coming Decade,” held at the Columbia University on February 2-3, 2006.

Footnotes

1 This article is based on chapters 12 and 13 of the author’s forthcoming book “India: The Emerging Giant” (OUP, USA) to be published in January 2008.

2 Sources: India: Foreign Direct Investment Policy, April 2006, Department of Industrial Policy & Promotion, Ministry of Commerce, Government of India combined with the Reserve Bank of India Handbook of Statistics on the Indian Economy 2005, Table 157.

China: Prasad and Wei (2006, Table 6).