The key point of this column is that the strength of a banking system ultimately depends on the strength of the sovereign behind it. This point was reinforced during the Global Crisis and the subsequent Euro Sovereign Debt Crisis. Well-known examples of weak sovereigns that could not back up their troubled banking systems are Iceland, Ireland, Portugal, and Cyprus. Governments are now reducing their potential exposures to the banking system by:

- Increasing capital substantially; and

- Imposing resolution plans, including bail-in arrangements.

Policymakers try to make us believe that these reforms will make the government as a backstop redundant. The most recent examples are the Fed and the FDIC, which rejected the resolution plans of some major banks because these plans assumed government aid, including lender of last resort (FT 2014). In a new paper, I argue that the assumption of no government aid is unrealistic (Schoenmaker 2014). It is an excellent example of time-inconsistency (Barro and Gordon 1983) -- the rule of no support will be overturned by governments when they need to maintain stability in crisis times.

The need for a fiscal backstop

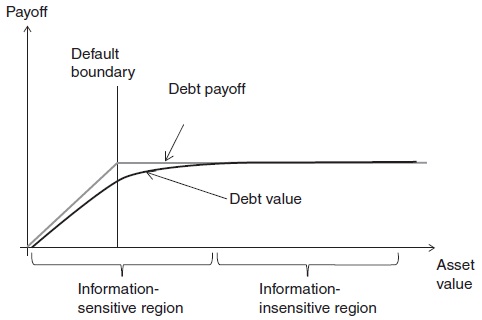

Why is a fiscal backstop so important? A fiduciary monetary system is fragile without government backing. Holmstrom (2010) illustrates the fragility of debt securities. As long as the value of the (underlying) assets is well above the default boundary (see Figure 1), the debt securities are perceived to be ‘safe’. The value of securities is insensitive to new information. There are no questions asked about the solvency, as the debt securities are fully liquid in the information insensitive region. Examples of such ‘safe’ securities are banknotes, government bonds, bank deposits, money market funds, and CDOs (prior to the emerging problems with subprime mortgages). Low volatility of the underlying collateral -- such as mortgages -- enhances the perceived safety. Once the assessment of the asset value drops towards the information sensitive region in Figure 1 due to new information (on neglected risks), fragility comes into play. The safety of the debt securities starts to be questioned, and investors start to sell them off, causing a drop in the value of these debt securities.

Figure 1. Debt and information sensitivity

Note: The graph illustrates that when the value of the underlying assets is well above the default boundary, the debt securities are perceived to be safe and insensitive to information about the asset values.

Source: Holmstrom (2010)

But banking assets, such as loans, are inherently risky. Rumours about the quality of a bank’s assets can easily cause a bank run, where depositors use the right to withdraw their deposits at demand. To prevent such runs, deposit insurance is introduced (Diamond and Dybvig 1983). The deposit insurance fund is then forming the underlying asset to bank deposits. But, in turn, a privately organised deposit insurance fund -- funded by premiums paid by member banks -- can run out of money. That may, in particular, occur during a severe financial crisis when multiple banks fail at the same time. A credible deposit insurance fund therefore needs the backing of the government (Gros and Schoenmaker 2014).

In times of stress, banks may also receive liquidity support from the central bank. Central banks can provide liquidity without a limit by expanding their balance sheet, but can only bear losses up to their capital (Goodhart and Schoenmaker 1995). Again, the government is behind the central bank and can replenish the central bank’s capital or provide a guarantee.

Crisis experience

The key role of government behind a country’s banking system was witnessed during the flight of deposits from the crisis-stricken Eurozone countries, such as Greece, Ireland, Portugal, Spain, and Italy. As the soundness of the banking system and the capacity of the government to back-up the banking system came into doubt, (wealthy) depositors transferred their deposits to banks in safer Eurozone countries. This is evidence that the soundness of the banking system depends on the soundness of the government behind it.

Concluding

In sum, the fiscal backstop -- whether directly or indirectly (through the deposit insurance fund and the central bank) -- ultimately determines the soundness of a banking system. The government can reduce but not eliminate its role as last resort to the banking system.

Credit agencies recognise the presence of a sufficiently strong and credible fiscal backstop. The overall ratings of financial institutions have two constituent parts based on their own financial strength and on the expected amount of government support.

References

Barro, R and D Gordon (1983), “Rules, Discretion, and Reputation in a Model of Monetary Policy”, Journal of Monetary Economics 12, 101-121.

Diamond, D and P Dybvig (1983), “Bank Runs, Deposit Insurance, and Liquidity”, Journal of Political Economy 91, 401-419.

Financial Times (2014), “Fed blow to global banks over ‘living wills’”, Financial Times: London, August 18, p.1.

Goodhart, C and D Schoenmaker (1995), “Should the Functions of Monetary Policy and Banking Supervision be Separated?”, Oxford Economic Papers 47, 539-560.

Gros, D and D Schoenmaker (2014), “European Deposit Insurance and Resolution in the Banking Union”, Journal of Common Market Studies 52, 529-546.

Holmstrom B (2010), “Comments on ‘The Credit Rating Crisis’”, NBER Macroeconomics Annual 24(1), 215-222.

Schoenmaker, D (2014), “On the need for a fiscal backstop to the banking system”, DSF Policy Paper No. 44, Duisenberg school of finance.