The world is ageing rapidly. By 2030, 34 countries will have a share of 65+ year-olds higher than 20% of the total population. Against this background, in the last decades governments have tried to increase the labour force participation of older individuals, often by raising the statutory retirement age (Boulhol and Geppert 2018). A much discussed and studied potential side effect of these policies is that older workers may crowd out younger cohorts in the labour market (Boeri et al. 2016, Gruber and Wise 2010, Maestas et al. 2016).

Much less is known about the impact of these policies on the economic outcomes and choices of businesses. On the one hand, the greater presence of older workers may hamper firms’ productivity and future growth if older workers are less innovative or less willing to take risks (Aksoy et al. 2015, Engbom 2019). On the other hand, older workers have substantial job experience, and an increasing number of studies suggests that departures of senior colleagues may be detrimental to co-worker’s productivity (Jaeger and Heining 2020, Sauvagnat and Schivardi 2020). Moreover, the ageing of the labour force has been associated with increases of productivity-enhancing automation at the industry level (Acemoglu and Restrepo 2018). Hence, firms may benefit from increased employment of experienced older workers.

In a recent paper (Carta et al. 2021), we provide an overall evaluation of these issues. We study the effects on firms’ input levels, wages, value added, capital, and labour productivity of an unexpected pension reform implemented in Italy in 2012. This reform sharply increased the full retirement age – by three years on average – for workers aged 55 or above. This implied an exogenous increase in mature workers’ labour supply through a reduction in their retirement rate, as Italian employees tend to retire from work and claim their pension as soon as they become eligible for the benefit. Moreover, similar workers were affected differently by the change in the pension rules, as the delay in eligibility was determined by the complex interaction of three observable characteristics (gender, age, and years of paid social security contributions). As a result, the change in quit rates varied widely, even across firms sharing an ex ante similar occupational structure.

Findings

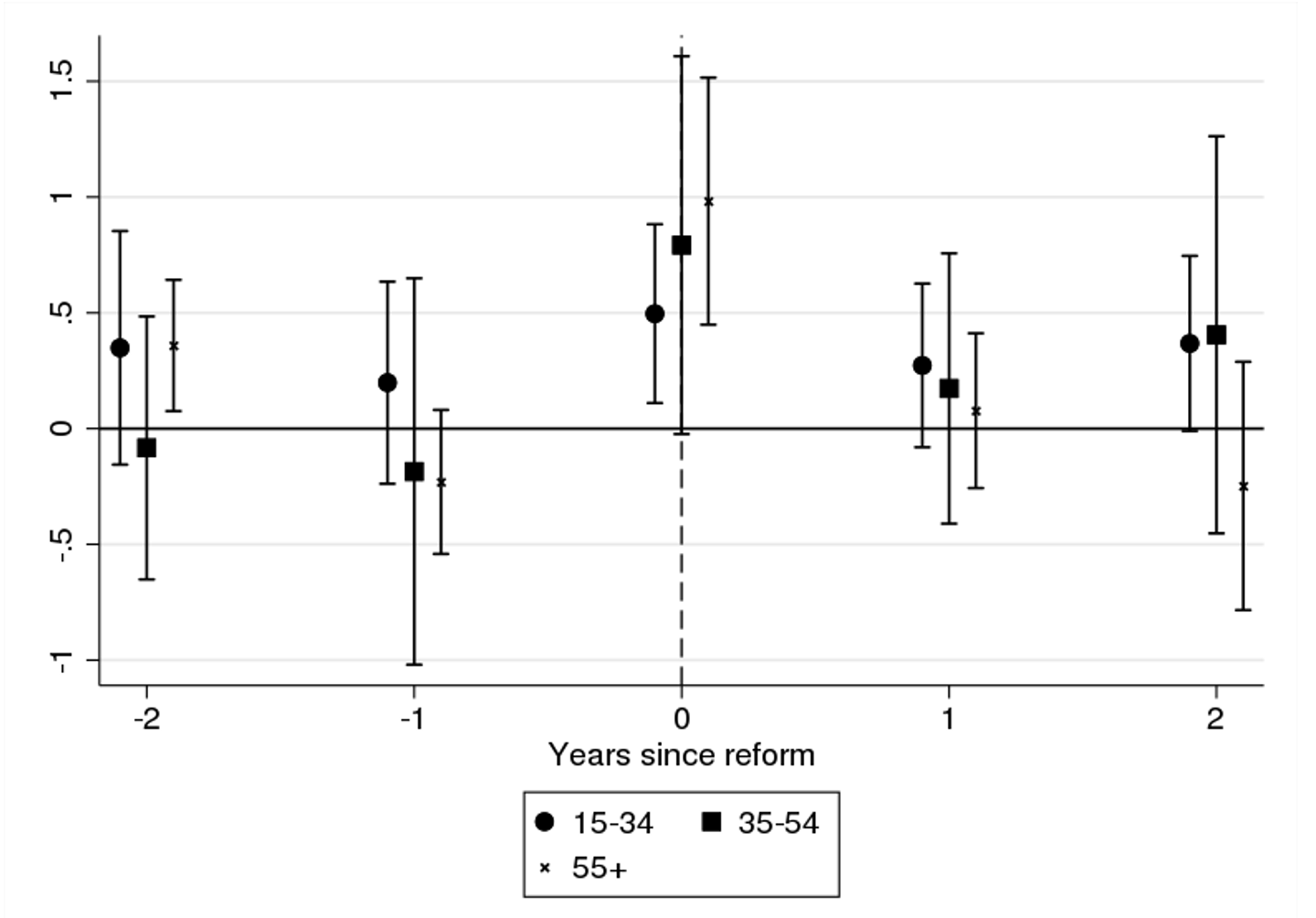

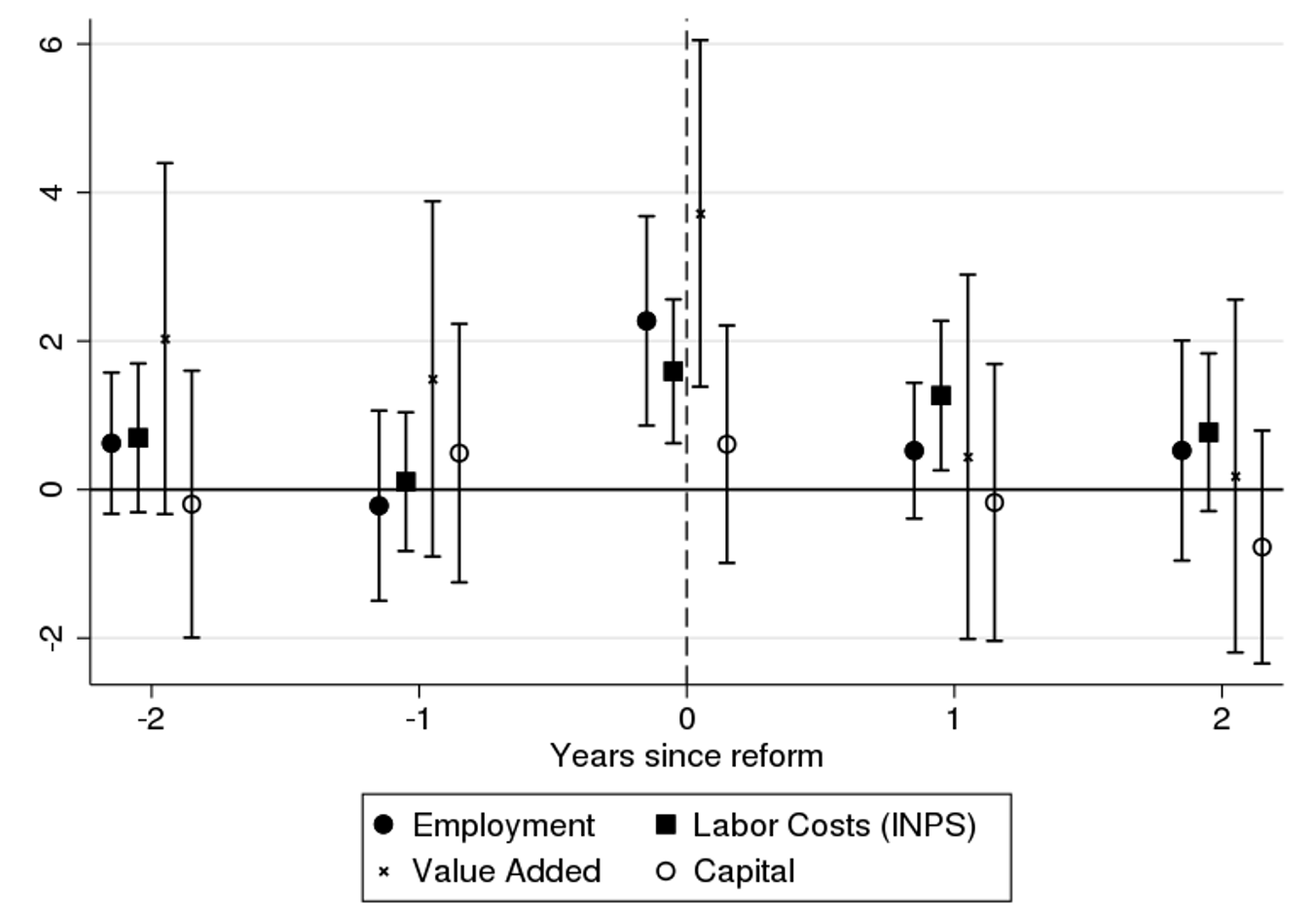

We find that an exogenous 10% increase in the number of older workers implies a 1.8% increase in the number of young workers, and a 1.3% increase for middle-aged workers, sustained over three years. Hence, older and younger workers seem to be complements in the firms we study (Figure 1). Second, while total labour costs and value added also increase, a key finding is that this occurs proportional to employment – i.e. labour costs per worker and value added per worker are unaffected (Figure 2). Therefore, the reform led to an expansion in output and employment in affected firms at constant average labour cost and average labour productivity. Finally, we do not detect any significant effect of an increase in the number of older workers on wages. While this may be because the Italian institutional setting features rather rigid wages, this would only enhance potential negative consequences if older workers were to represent a burden to the firm. Since our identification strategy relies on the exogenous variation of employment of older (55+) employees across otherwise identical firms, it does not allow us to detect economy-wide wage changes. To circumvent this problem, we analysed the change in employment and mean wages by age over time. While this shows the reform led to clear shifts in employment rates among older workers, we find no reduction in wages for those nearing retirement.

Figure 1 The effect of the reform on the change of employment among workers of different age classes: Assessing pre-existing trends and dynamic effects

Notes: The graph reports estimates of an instrumental variable regression in which the dependent variable is the year on year variation in employment due to alternatively 15-34, 35-54 and 55+ workers; the main independent variable is the 55+ employment variation between 2012 and 2011 (the reform year is 2012), instrumented with the change in the share of a firms' employees losing eligibility to retire. The regression controls for sector by year fixed effects, share of 15-34 and share of 35-54 workers at the beginning of the sample (Year 2010).

Figure 2 The effect of the reform on the change on firm’s outcomes

Notes: The graph reports estimates of an instrumental variable regression in which the dependent variable is the year on year variation in total employment, value added, labor costs and capital alternatively; the main independent variable is the 55+ employment variation between 2012 and 2011 (the reform year is 2012), instrumented with the change in the share of a firms' employees losing eligibility to retire. The regression controls for sector by year fixed effects, share of 15-34 and share of 35-54 workers at the beginning of the sample (Year 2010).

Policy implications

Our results provide evidence of the presence of complementarities between workers of different age classes. The fact that employment and value-added increase at constant labour productivity suggests that firms are able to absorb older workers without difficulties, at least in the short term. These findings are hard to reconcile with the notion that additional older workers are a burden on firms. Instead, the findings appear to be more consistent with the view that older workers have skills and other attributes coveted by firms that may be difficult to replace in the labour market, as suggested by a large empirical literature on skill-accumulation in labor economics, and in line with recent related work on hiring frictions (Jaeger and Heining 2020, Schivardi and Sauvagnat 2020).

Certainly, it does not appear that an increase in older workers at the firm level is a barrier to investment or lowers labour productivity. This is consistent with findings in Acemoglu and Restrepo (2018) that show older workers in the US as being complements to technologies and automation. In a paper on worker-level outcomes related to our paper, Bianchi et al. (2020) study the effect of the same reform we analyse on workers' careers within the firm. They find that the reduction in the quit rate of older workers’ leads to a reduction in the wage growth of their colleagues not of retirement age. Our results imply that older workers’ firm-specific skills are hard to replace by hiring outsiders. As a result, internal promotions more easily take place in case of retirement, in line with Bianchi et al. (2020). Our findings on firm-level outcomes suggest that these freshly promoted workers are not as valuable to the firm as the older workers they replace.

Generalising our results requires some caution. First, since the effective retirement age in Italy is not very high (62 for men and 61 for women, compared to 65 and 63.6 at the OECD level), the non-negative effects on firms' outcomes we identified might be driven by the fact that incumbent older workers are not too old, and are still productive. Second, to implement our causal research design (and for reasons of data quality), in our main results we focus only on large firms, which are less likely to be credit constrained and perhaps more able to expand employment. While we show our findings are robust in a broader sample that includes the population of Italian firms, a separate analysis with high-quality economic data for smaller firms may be fruitful for future work. Finally, by design, our analysis is equipped neither to capture market-level responses nor to isolate longer-term relationships between population ageing and economic outcomes.

Authors’ note: The views expressed here are those of the authors and do not necessarily reflect those of the Bank of Italy.

References

Acemoglu, D and P Restrepo (2018), “Demographics and automation”, mimeo.

Aksoy, Y, H Basso, T Grasl and R Smith (2015), “Demographic structure and the macroeconomy”, VoxEU.org, 8 April.

Bianchi, N, G Bovini, J Li, M Paradisi and M Powell (2020), “Career spillovers in internal labor markets”, mimeo.

Boeri, T, P Garibaldi and E Moen (2016), “Increases in the retirement age and labour demand for youth”, VoxEU.org, 8 September.

Boulhol, H and C Geppert (2018), “Population ageing: Pension policies alone will not prevent the decline in the relative size of the labour force”, VoxEu.org, 4 June.

Carta, F, F D’Amuri and M T von Wachter (2020), “Workforce aging, pension reforms, and firm outcomes”, NBER, working paper 28407.

Engbom, N (2019), “Firm and worker dynamics in an aging labor market”, FED Minneapolis, working paper 756.

Gruber, J and D A Wise (2010), Social security programs and retirement around the world: The relationship to youth employment, Chicago, IL: University of Chicago Press.

Jaeger, S and J Heining (2020), “How Substitutable Are Workers? Evidence from Worker Deaths”, MIT, mimeo.

Maestas, N, K J Mullen and D Powell (2016), “The Effect of Population Aging on Economic Growth, the Labor Force and Productivity”, NBER, working paper 22452.

OECD (2015), “Ageing and Employment Policies – Statistics on average effective age of retirement”.

Sauvagnat, J and F Schivardi (2020), “Are executives in short supply? Evidence from deaths' events”, mimeo.