The Covid-19 pandemic triggered the largest economic contraction since WW2 and induced governments to enact unprecedented support measures. Firms, in particular, benefitted from a wide array of programmes, ranging from transfers and equity injections to publicly guaranteed loans and debt moratoria. There is evidence that these economic measures helped prevent a significant spike in bankruptcies and firm closures – the number of firms that went bankrupt or exited the market after the pandemic is substantially smaller than in previous years (Banerjee et al. 2021, Djankov et al. 2021, Orlando and Rodano 2022).1

A key concern is the extent to which these measures ended up also benefitting non-viable but still active firms (‘zombie firms)’, thus altering the process of firm selection and resource reallocation (Leaven et al. 2020, Barnes et al. 2021, Demmou and Franco 2021). In a recent paper (Pelosi et al. 2022), we assess this concern empirically, studying the take-up by zombie firms of the most relevant support measures enacted in Italy. Because the policies are similar to those adopted in other major advanced countries, we argue our exercise has a reasonable degree of external validity.

In our analysis, we focus on three main measures adopted between March and May 2020: ‘grants (i.e. transfers given to eligible firms), debt moratoria, and public guarantee loan programmes. These measures are large – as of March 2021 (the end of our sample period), firms had received almost €7 billion of transfers, about €150 billion of loans were placed under moratoria, and banks had issued about €150 billion of publicly guaranteed loans.

Our study relies on granular administrative microdata on firm balance sheets and data on their take-up of the support measures from the Bank of Italy. These data allow us to (1) identify zombie firms based on pre-crisis balance sheet data and commonly adopted criteria, and (2) study the allocation of Covid-19 support measures by firm status, while accounting for the differential impact of the pandemic by firm size, industries and provinces.

The literature uses two main definitions of zombie firms. The first leverages the interest coverage ratio, which measures whether firms’ operating profits can cover interest expenses (Adalet McGowan et al. 2018; Banerjee and Hoffman 2018, Andrews and Petroulakis 2019). The second leans on receiving subsidised credit (Caballero et al. 2008, Acharya et al. 2019). We find that the first definition does a better job at classifying as zombie firms with lower productivity, low liquidity and capitalisation, and higher default probability (Z-score) than the definition based on subsidised credit. Moreover, the interest coverage ratio-based definition has the desirable property of identifying borrowers whose loans are more likely to be non-performing (NPL). Therefore, throughout the analysis, we rely on the definition of zombie firms based on firms’ profitability.

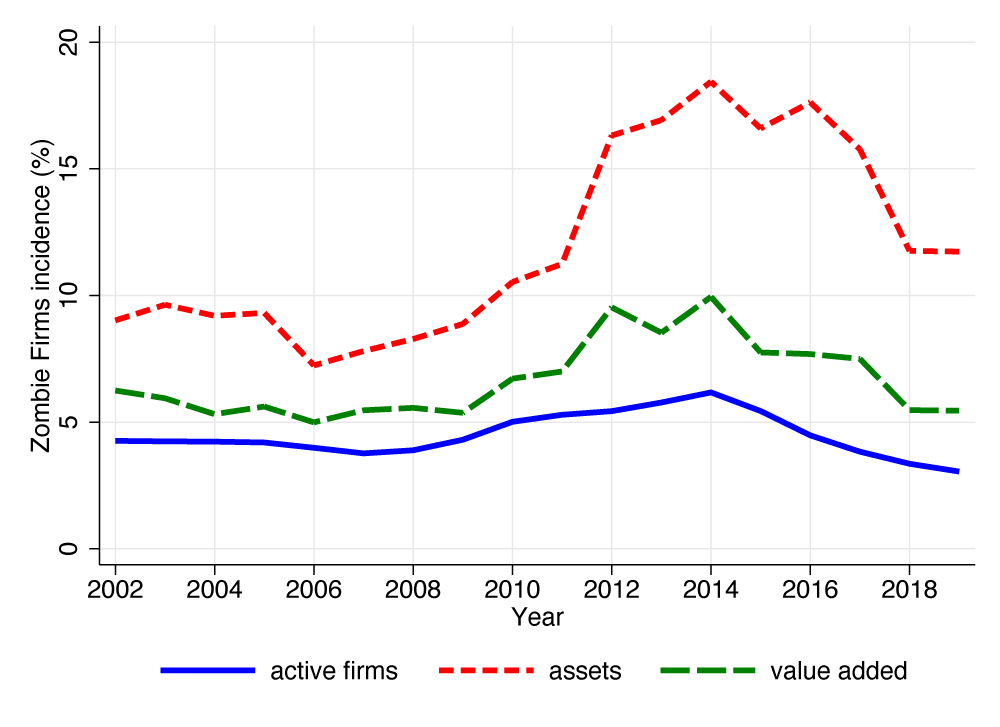

Using this definition, we find that at the end of 2019, zombie firms represented about 3% of all corporations (11% as shares of assets, 5.5% of value added), and their incidence was higher in industries that experienced a larger drop in revenues in 2020 (Figure 1). Interestingly, these numbers are in the same ballpark as those obtained by Favara et al. (2021) for the US.

Figure 1 Zombie incidence

a) Share by indicator

b) Zombie incidence and sales growth

Source: Authors’ computations on data from CERVED and the Italian Ministry of Economy and Finance.

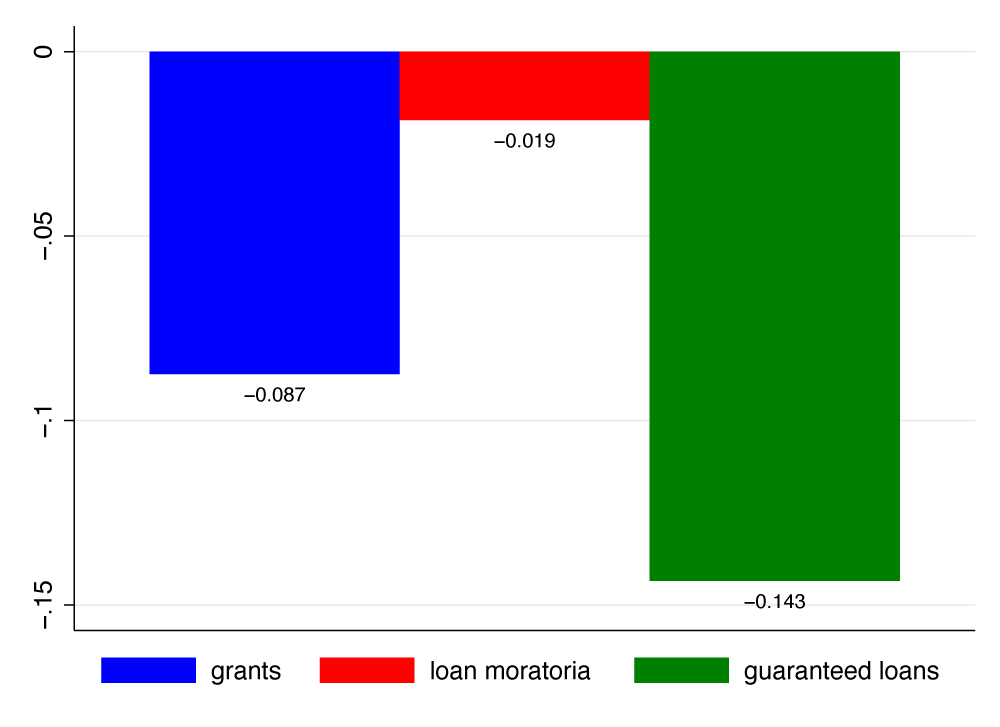

Our main finding is that zombie firms are less likely than healthy firms to access public support measures (Figure 2). Specifically, they were 8.7% less likely to obtain a grant and 1.8% less likely to put their debt into a moratorium. Furthermore, they were 14% less likely to receive loans guaranteed by the government, and those that did received loans that were on average 58% smaller than those granted to healthy firms. Finally, upon accessing a guaranteed loan, this was 12% more likely to be fully guaranteed.2

Figure 2 Zombie take-up of support measure

Source: Our computations on data from CERVED, Anacredit, Tesoreria telematica, Mediocredito centrale, and SACE.

As far as grants are concerned, the lower take-up by zombie firms depends on the measure's design. Firms were eligible for the grants if their revenues had fallen by at least one-third between April 2019 and April 2020. Because of their structurally low level of revenues, zombie firms were less likely to experience a loss of such magnitude during the pandemic. In fact, controlling for the growth in revenues between 2018 and 2019, we find that the take-up of the grants is similar for firms that had high growth in revenues in 2019 but were still zombies.

Understanding why zombie firms were less likely to access debt moratoria and guaranteed loans is less straightforward. We show that zombie firms’ lower take-up of moratoria depends on whether they obtained a guaranteed loan. Zombie firms that did not receive a guaranteed loan were more likely than healthy firms to use the moratoria. This finding suggests that zombie firms considered the two measures as substitutes.

Finally, zombie firms received fewer guaranteed loans than healthy firms. However, conditional on accessing a loan, zombies are more likely to receive a full guarantee. While zombies may have a lower demand for credit, their incentives to access cheap loans to substitute existing ones are plausibly high. On the bank side, there are contrasting incentives. On the one hand, banks may prefer to replace their existing loans to zombies with guaranteed loans and transfer the credit risk onto the government. On the other hand, banks earn lower interest income on guaranteed loans, and substitution of existing loans with guaranteed credit would reduce unit margins. Because the interest rate differential is likely higher for riskier than for safer firms, this channel would incentivise banks to grant fewer guaranteed loans to zombie firms.3 In addition, banks could still be liable for ‘reckless lending’ in case of default of a borrower that looked too weak at origination. This would likely induce banks to lend relatively less to zombie firms than to healthy ones.

We need to acknowledge two caveats when reading our results. The first is that other measures, such as labour furlough schemes or freezes in bankruptcy procedures, also contributed to keeping firms alive. Second, firms that were classified as zombies before the pandemic may not be so in the post-Covid world and vice versa. However, it is reasonable to think that firms characterised by lower productivity and profitability and a higher probability of default before the Covid-shock – i.e. those that we identify as zombies – are likely to also be non-viable after the shock.

Overall, our evidence suggests that zombie firms were less likely than healthy firms to take up grants, loan moratoria, and public guarantees on loans, thus suggesting that these measures did not contribute to a zombification of the economy. These findings are in line with those available for France (Cros et al. 2021).

References

Acharya, V V, T Eisert, C Eufinger, and C Hirsch (2019), “Whatever it takes: The real effects of unconventional monetary policy”, The Review of Financial Studies 32(9): 3366–3411.

Andrews, D and F Petroulakis (2019), “Zombie firms, weak banks, and depressed restructuring in Europe”, VoxEu.org, 4 April.

Adalet McGowan, M, D Andrews, and V Millot (2018), "The Walking Dead? Zombie Firms and Productivity Performance in OECD Countries", Economic Policy 33(96): 685–736.

Banerjee, R N and B Hofmann (2018), “The rise of zombie firms: causes and consequences”, BIS Quarterly Review, September.

Banerjee, R N, J Noss and J M V Pastor (2021), “Liquidity to solvency: transition cancelled or postponed?”, BIS Bulletin no. 40.

Barnes, S, R Hillman, G Wharf and D MacDonald (2021), “How businesses are surviving Covid-19: The resilience of firms and the role of government support”, VoxEU.org, 16 July.

Bénassy-Quéré, A, B Hadjibeyli and G Roulleau (2021), “French firms through the COVID storm: Evidence from firm-level data”, VoxEU.org, 27 April.

Caballero, R, T Hoshi, and A K Kashyap (2008), “Zombie lending and depressed restructuring in Japan”, American Economic Review 98(5): 1943–77.

Cascarino, G, R Gallo, F Palazzo, E Sette et al. (2022), Public guarantees and credit additionality during the covid-19 pandemic, Technical Report, Money and Finance Research group, Universita Politecnica delle Marche.

Cœuré, B (2021), “What 3.5 million French firms can tell us about the efficiency of Covid-19 support measures”, VoxEU.org, 8 September.

Cros, M, A Epaulard and P Martin (2021), “Will Schumpeter catch COVID-19? Evidence from France”, VoxEU.org, 4 March.

Demmou, L and G Franco (2021), “From hibernation to reallocation: Loan guarantees and their implications for post-Covid-19 productivity”, VoxEU.org, 14 November

Djankov, S and E Zhang (2021), “As COVID rages, bankruptcy cases fall", VoxEU.org, 4 February.

Favara, G, C Minoiu and A Perez (2021), US zombie firms how many and how consequential?, Technical Teport, Board of Governors of the Federal Reserve System.

Leaven, L, G Schepens, and I Schnabel (2020), “Zombification in Europe in times of pandemic”, VoxEu.org, 11 October.

Orlando, T and G Rodano (2022), “The impact of covid-19 on bankruptcies and market exits of Italian firms”, Bank of Italy Covid Papers.

Pelosi, M, G Rodano, and E Sette (2022), "Zombie firms and the take-up of support measures during Covid-19", Bank of Italy Occasional Paper 650.

Endnotes

1 Part of the reduction in bankruptcy procedures is due to a freeze in new filings active until July 2020. However, new bankruptcy procedures are below pre-pandemic levels even in the second half of 2020 and in 2021 (Orlando and Rodano 2022).

2 Loans smaller than €30,000 were eligible for a 100% guarantee.

3 See Cascarino et al. (2022) for evidence consistent with this hypothesis.