First posted on:

Finance: Research, Policy and Anecdotes, 27 January 2019

The topic of bank resolution in the euro area is in the headlines again, with possible controversial actions in two countries that often find themselves at opposite sides of the argument – Italy and Germany. Both threaten to undermine the progress that the euro area has made over the past years to a Single Market in banking and thus a more sustainable currency union.

In Italy, there are – not surprisingly – more bank failures. On 2 January, the ECB appointed temporary administrators at Banca Carige, based in Genoa, after shareholders were unable to secure additional equity. The problems in Banca Carige are not new, but the can had been kicked down the road until late last year. The Italian government seems to stand ready to pour money into Banca Carige via the instrument of precautionary recapitalisation (as also applied to Monte dei Paschi in Siena in 2017) even though this bank cannot really be considered a systemically important financial institution. Also, guarantees of Carige’s bondholders go through the Italian deposit insurance scheme, thus transferring contingent liabilities to the rest of the Italian banking system. However, the bail-out goes beyond this specific case. According to news reports, Italy’s government has set up a €1.6 billion fund to compensate investors who have lost their money in a string of recent bank liquidations. This will pay junior bondholders up to 95% of the original value of the investment and shareholders up to 30%. While this arrangement is almost exclusively for retail investors, it certainly extends the financial safety net far beyond what has been agreed under the new European bail-in rules. And even if one can make the case for compensation for retail investors that were mis-sold junior securities in banks, there is no case to be made to compensate equity holders!

Ultimately, the Italian-style bank resolution over the past two/three years is a big step backwards to the era of bailouts. It is also a reflection of the failed politics of kicking the can down the road when it comes to bank resolution – the Italian government had ample opportunity to clean up its banking system before the BRRD came into force; however, it is also a failure on the European level that new rules come into place for a continuously weak banking system whose structural deficiencies have not been addressed yet.

While Italy thus undermines the bail-in principle of the banking union, the German government is going even a step further, trying to ‘renationalise’ banking sector policies, thus actively undermining the Single Market in Banking. In the spirit of industrial policy and creating national champions, thereseem to be government efforts under way to facilitate a possible merger of Deutsche Bank and Commerzbank, the two largest privately owned banks in the fragmented German market. While the argument of consolidation and reducing overbanking might make sense, the creation of a national champion as explicitly aimed at by the Minister of Finance seems mistaken, if not dangerous. Such a bank would be considered German and active political involvement in its creation would immediately raise further bailout expectations in case things do not work out as planned. It also undermines level playing field within the euro area – fiscally strong countries such as Germany can support their banking systems, while others cannot. This also shows the hypocrisy of German commentators when criticising bailouts in Italy (as politely pointed out by Isabel Schnabel in this German commentary).

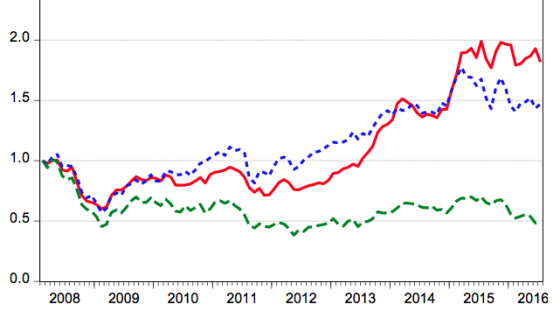

Both the Italian and the German actions counter the enormous progress made over the past years towards a single regulatory framework for the euro area. Let’s remind ourselves – the most immediate reason for the banking union was to cut the link between sovereign and bank fragility (a target which has not really been achieved, but this is for another day); however, the broader objective is that of creating a Single Market in Banking, without which the euro area would not be a sustainable currency union. However, this implies a move away from national champions and purely national actions.

The euro area has made big strides towards a Single Market in Banking with the establishment of the Single Supervisory Mechanism and the Single Resolution Mechanism. Important elements – most notably a European Deposit Insurance Scheme – are still missing. However, a Single Market in Banking is not only about the legal framework but political actions. Both the Italian and the German governments have shown over the past weeks that they are not willing to ‘walk the talk’. Not only have the lessons of the global financial crisis been forgotten, but also the lesson of the euro area crisis that national financial safety net and national banking sector policies undermine the euro area!