Mergers are often viewed as an immediate way of improving financial stability during banking crises. The recent turmoil in the Swiss and American banking systems ended with mergers that married healthy banks with troubled banks, and acquisitions of troubled institutions also featured prominently in the resolution of the Global Crisis of 2007-08. Vice Chair of the Board of Governors of the Federal Reserve, Michael Barr, has expressed concern about the risks that mergers pose for financial stability, and has opined that “these risks may be difficult to assess, but this consideration is critical” (Barr 2022). But what do we know about the effects of mergers during crisis periods?

Shedding light on this question is crucial for understanding policy choices during crises, but because crises are characterised by both mergers and failures, their theoretical effects are ambiguous. On the one hand, financial crises could have cleansing effects, potentially removing risks associated with poorly managed financial institutions from the system through closures, and perhaps even leading to productivity-enhancing reallocations that can occur during periods of slack (Gropp et al. 2020, Foster et al. 2016). In policy circles, this view dates back at least to the ‘liquidationists’ of the 1930s, which included Secretary of the Treasury Andrew Mellon, who according to US President Herbert Hoover, argued in favour of “purging the rottenness out of the system” during the Great Depression (Hoover 1951). On the other hand, due to contagious bank runs and panics, it is possible that less risky banks also close, furthering market instabilities and inefficiencies (Trautmann et al. 2014). And just as important, it is also well documented that mergers among financial firms increase during crisis periods (Wheelock 2011). As a result, rather than risk leaving the system, it may simply get redistributed. Weak or poorly managed financial institutions may be absorbed by remaining firms, leading to a shift in the location of risk, but not resulting in an overall reduction of risk in the financial system – an outcome that can be exacerbated by regulatory interventions meant to save ‘too big to fail banks’ during crises (Ratnovski et al. 2014).

Since risk can either rise or fall in the financial system based on which firms close and how they do so (failure, merger, etc.), understanding how risk changes is ultimately an empirical question, but one fraught with both data and methodological hurdles. For example, drawing inferences about the relationship between mergers and risk using data from recent crises (such as the Global Crisis of 2007-08) is challenging because financial institutions are incentivised to merge given the existence of implicit regulatory backstops in the financial system (for example, ‘too big to fail’ policies may encourage banks to engage in mergers that increase moral hazard) and because regulators can compel them to do so during crises (for example, through so-called ‘shotgun marriages’ and as seen in the recent merger between UBS and Credit Suisse). Further, regulators are often quick to instruct and support financial institutions to build liquidity and capital buffers, endogenously changing the composition of balance sheets. Methodological challenges are similarly daunting because researchers must jointly account for the bank survival selection mechanism as well as the nonrandom type of bank closure in order to understand the mechanisms driving changes in risk.

In new research (Mitchener and Vossmeyer 2023), we surmount these challenges by constructing a comprehensive, systemwide data set from a period that predates widespread government safety nets and federal regulatory bank merger policies – the US Great Depression – and developing new empirical methods that account for crisis-induced changes in firm-specific and systemic risk as well as the role that mergers and failures play in redistributing risk. Using a microeconomic data set that covers the entire commercial banking system, more than 24,000 banks, we examine changes to the financial system just prior to the Depression and after the conclusion of the financial distress of the early 1930s. We introduce bank-level measures of balance-sheet risk (akin to a measure of distance to default) and systemic risk, and track all consolidations, absorptions, and failures that occur during the period of the financial crisis. We then develop a multivariate incidental truncation model that jointly considers bank closure, the type of closure, and changes to bank risk.

Our econometric model and data allow us to estimate relationships between failures, mergers, and risk for the entire banking system, and precisely model the redistribution of risk. We show that, in the year following the conclusion of the banking crisis, balance sheet risk and system risk are higher, on average, across all surviving banks. The raw data show a 33% increase in systemic risk. A key mechanism driving this change during our sample period is acquisitions. High-risk exiting banks were often absorbed by larger, more connected acquiring banks, redistributing risk to once healthier banks. We find that for each bank acquired, risk at acquiring banks increases by 25%. Since roughly 10% of the banks surviving the Great Depression were acquirers, this mechanism affected more than 1,500 banks – providing a plausible channel through which risk rose in the wake of the crisis.

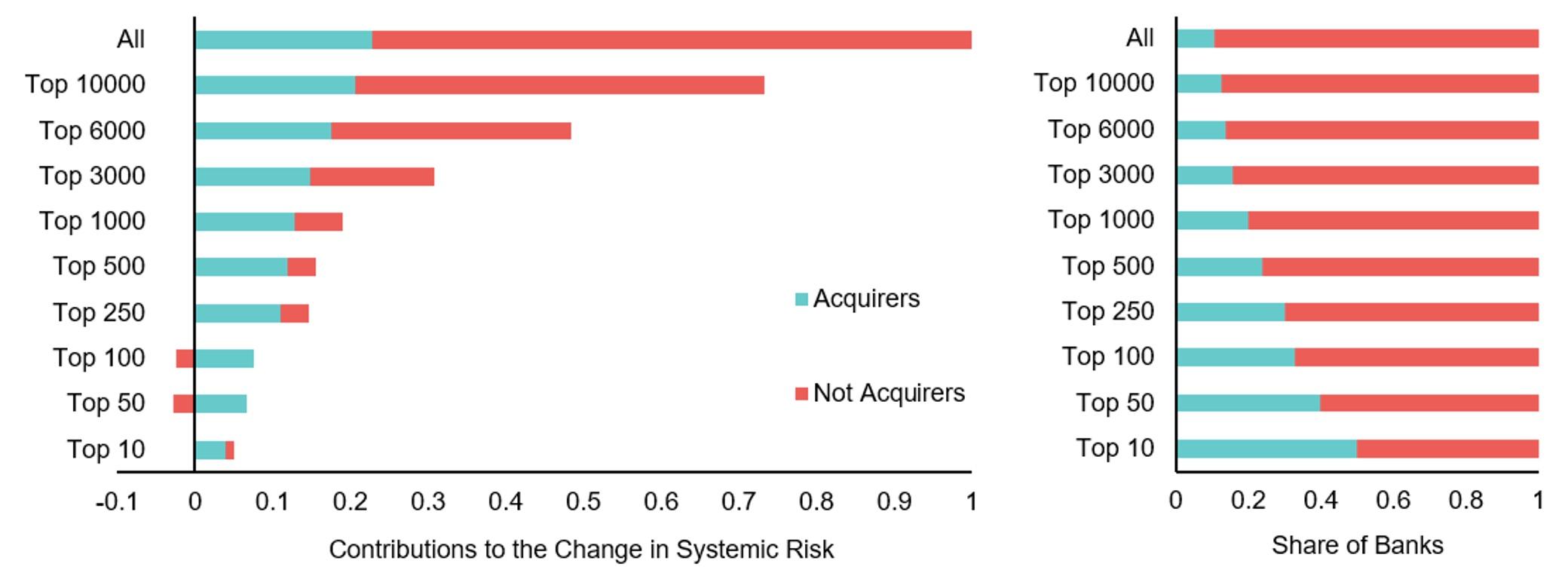

The left panel of the below figure demonstrates the contribution to the change in systemic risk for banks that acquired other financial institutions and those that did not make acquisitions. The right panel displays the proportion of banks that are acquirers for various sub-samples of banks based on asset size. For the largest 100 banks, the 33 acquiring banks that acquired another bank contributed 8% of the total change in systemic risk, whereas the 67 banks that did not acquire another bank actually reduced systemic risk by 2%.

Figure 1 Contributions to changes in systemic risk by acquiring and non-acquiring banks

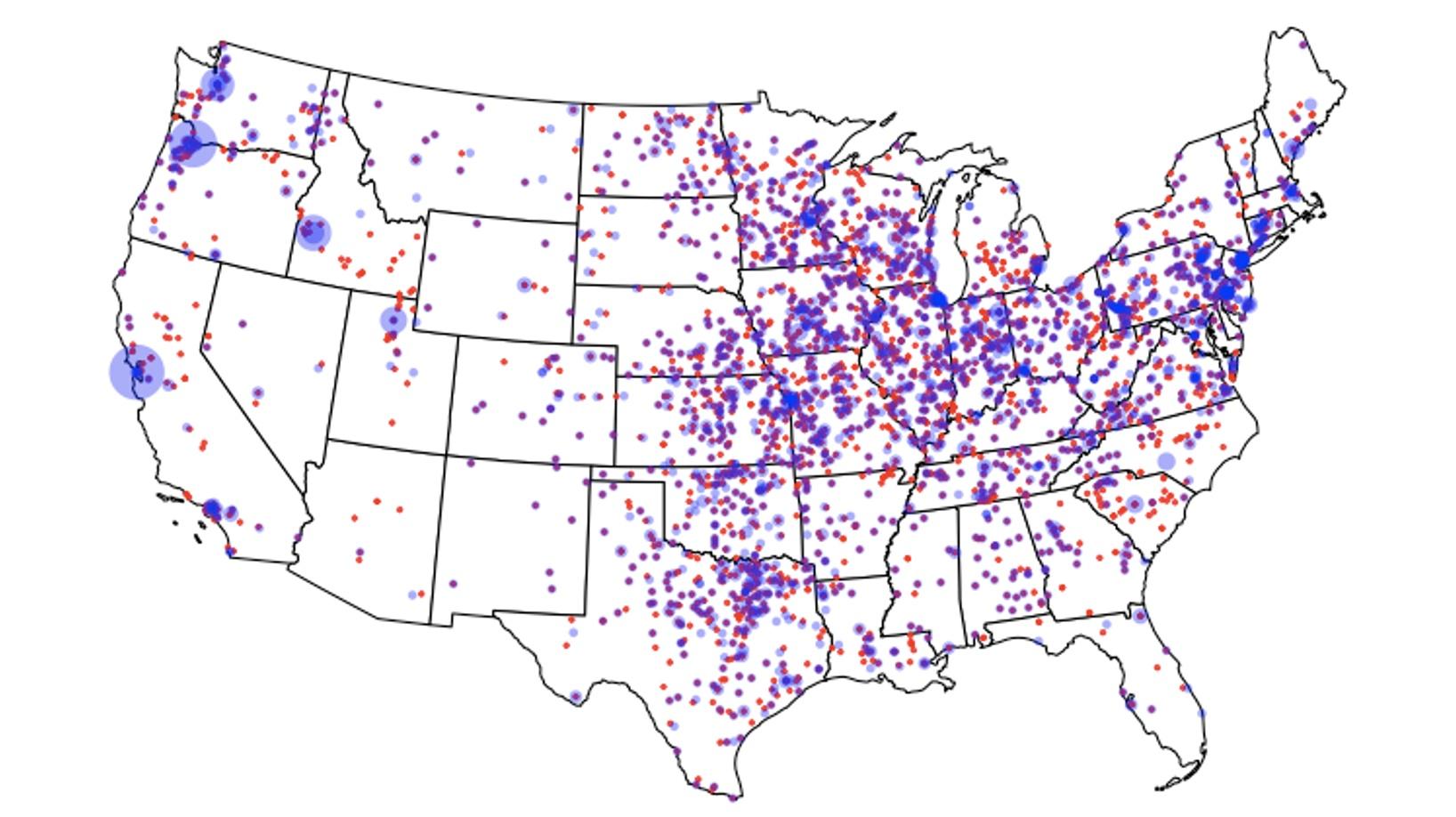

While much of the increase in systemic risk occurred at the largest banks, we find that acquirers across the size distribution positively influenced risk changes. Moreover, mergers on the periphery, between smaller and medium-sized banks often located in the same city, figured prominently in raising balance-sheet risk. The below figure presents the location of all merger activity, where exiting banks are in red and acquiring banks are in blue. The size of the blue dot represents the number of acquisitions in an area, where a larger dot implies more acquisitions. While acquirers were more likely to be larger institutions, merger and acquisitions activity was prevalent across the US.

Figure 2 Location of merger activity

From the macro perspective, we do not find support for ‘cleansing effects’ – at least in the immediate aftermath of a financial crisis. We show that in a mostly unfettered and unregulated environment, and even when more than 6,000 banks were allowed to fail, risk is not quickly purged from the system. Instead, we find that risk remains in the system, and even increases, shifting to once healthier banks through mergers.

Our study suggests that a careful consideration of the financial stability risks of mergers is particularly important during periods of banking turmoil and may be especially critical if policymakers employ the common regulatory solution of ‘marrying’ good banks with bad banks.

References

Barr, M (2022), “Making the Financial System Safer and Fairer”, Brookings Institution, 7 September 2022, Washington D.C.

Foster, L, C Grim and J Haltiwanger (2016), “Reallocation in the Great Recession: Cleansing or Not?”, Journal of Labor Economics 34, S293.

Gropp, R, S Ongena, J Rocholl and V Saadi (2020), “The Cleansing Effect of Banking Crises”, CEPR Discussion Paper No. 15025.

Hoover, H (1951), The Memoirs of Herbert Hoover - The Great Depression, 1929-1941.

Mitchener, K M and A Vossmeyer (2023), “How do Financial Crises Redistribute Risk?”, NBER Working Paper 31537.

Ratnovski, L, H Tong and L Laeven (2014), “Are Banks Too Large?”, VoxEU.org, 31 July.

Trautmann, S, R Vlahu and M Brown (2014), “Exploring the Transmission Channels of Contagious Bank Runs”, VoxEU.org, 10 April.

Wheelock, D (2011), “Banking Industry Consolidation and Market Structure: Impact of the Financial Crisis and Recession”, Federal Reserve Bank of St. Louis Review 93