Editor’s Note: The column is based on a paper that was written before Alberto Alesina’s untimely death; his name is included among the authors in recognition of his intellectual contribution.

Given record high debt-to-GDP ratios in developed and several emerging economies in the presence of long-term real interest rates above their pre-pandemic levels, fiscal contraction will become necessary some time again. While a large literature, often discussed here on Vox (Barro and Redlick 2009, Alesina et al. 2012, DeLong and Bradford 2012, Taylor 2013), has debated the consequences of fiscal shocks for income growth and debt sustainability (Cherif and Hasanov 2013, Born and Pfeifer 2015), how they depend on the underlying state of the economy (Auerbach and Gorodnichenko 2010, Ramey and Zubairy 2015, Alesina et al. 2016) and whether deficit expansions have consequences of the same magnitude as deficit reductions (Barnichon and Matthes 2015), we ask what the electoral consequences are: the polls are the ultimate constraint on democratically elected policymakers.

On the one hand, voters may dislike austerity of any type because it reduces disposable income in the short run. Thus, governments may delay implementing it until it is the only option left to avoid a sovereign debt crisis, which often happens in a recession. But the literature has found that a recession is the worst moment to implement austerity: Auerbach and Gorodnichenko (2012) estimate larger spending multipliers in recessions than in expansions. Hence, kicking the can of austerity down the road, hoping to avoid its electoral consequences, can make them worse.

On the other hand, fiscal policy has important distributional consequences that may make some forms of austerity appealing to voters. For example, raising wealth or corporate taxes may be received well by the electorate which benefits from the services paid with these taxes. As an example, in a referendum in September 2022, Swiss citizens voted to increase VAT effective from January 2024. Symmetrically, permanently reducing government expenditures signals lower future taxes, which can find support among voters who believe they receive less from the government than they contribute, either because of inefficiency or deliberate redistributive policies. In another words, tax hikes or spending cuts can be appealing to the median voter depending on the level of inequality and their view on the optimal size of government. In a recent paper (Alesina et al. 2024), using a dataset which comprises thousands of austerity measures announced by 14 advanced economies over a time span of 30 years, we focus on the following questions:

- Do voters react to tax hikes differently than to expenditure cuts?

- Is austerity politically more costly during recessions?

- Do voters care about consistency with electoral promises?

Our investigation reveals that the conventional narrative oversimplifies how voters respond to austerity. The specifics of how austerity is implemented – whether through tax hikes or expenditure cuts – and the economic manifesto of the implementing government play a critical role in shaping voter reactions.

Tax hikes invariably alienate voters…

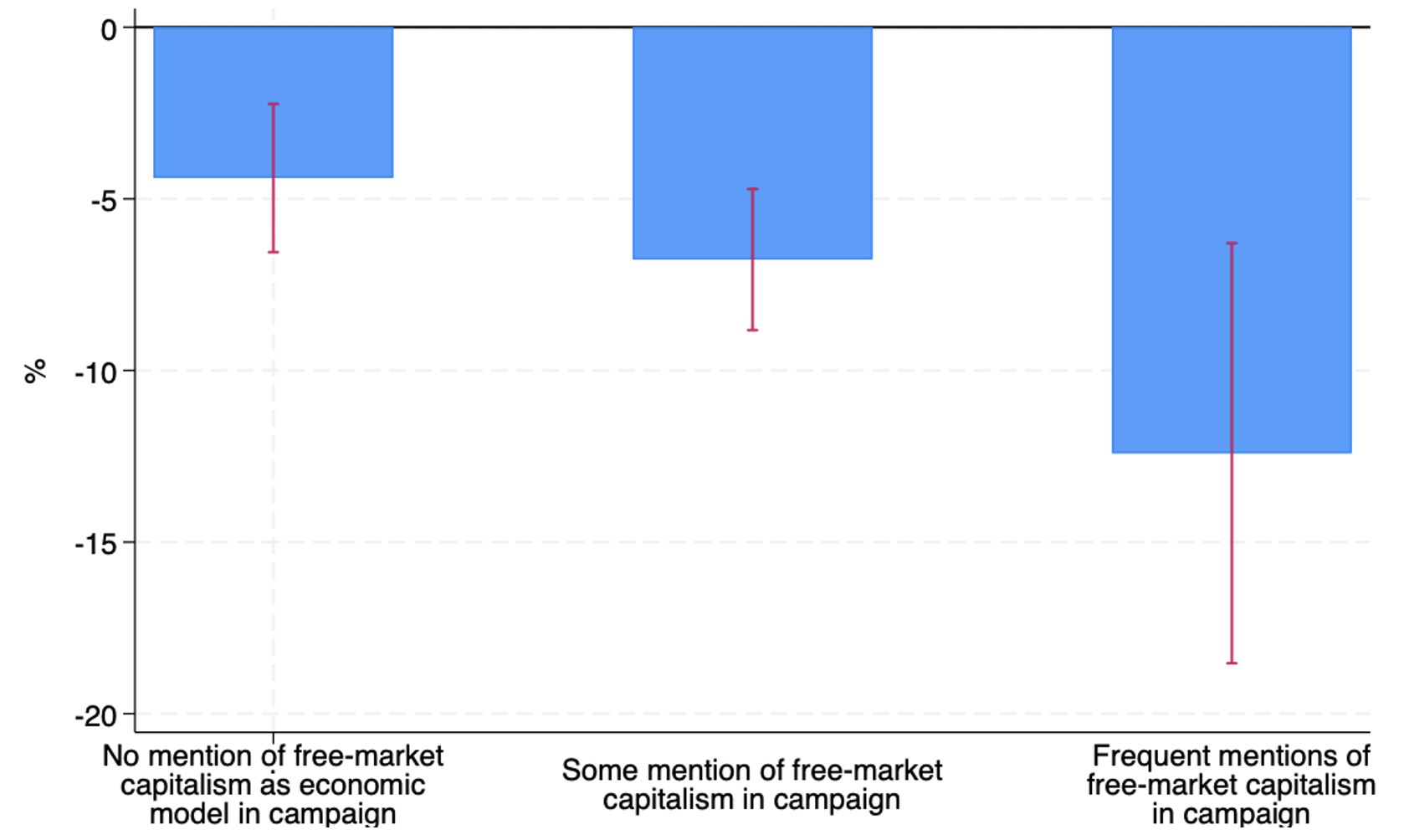

We find that tax hikes are associated with an important reduction in the vote share of the main governing party: Oo average, an austerity package worth 1% of GDP is associated with a reduction in the vote share of about 7%. This negative effect is considerably larger if the government that introduced it had previously campaigned on a free-market platform in the election that brought it into power. In other words, free-market (and small-state) parties see their vote share reduced drastically when they form governments that raise taxes to consolidate the budget. But we also find that parties that did not campaign on a free-market platform (and might even favour a large size of government) still see their vote share reduced if they decide to reduce the budget deficit by increasing taxes, albeit to a lesser degree. Governments on average seem to act as if they were aware of the cost of taxation, by frontloading tax-based adjustments in their first year of term, especially after they have won a large majority in the parliament.

Figure 1 Change in the vote share of the main governing party after a tax-based consolidation package worth 1% of GDP

Note: Red whiskers are 90% confidence bands.

… but expenditure cuts may attract votes

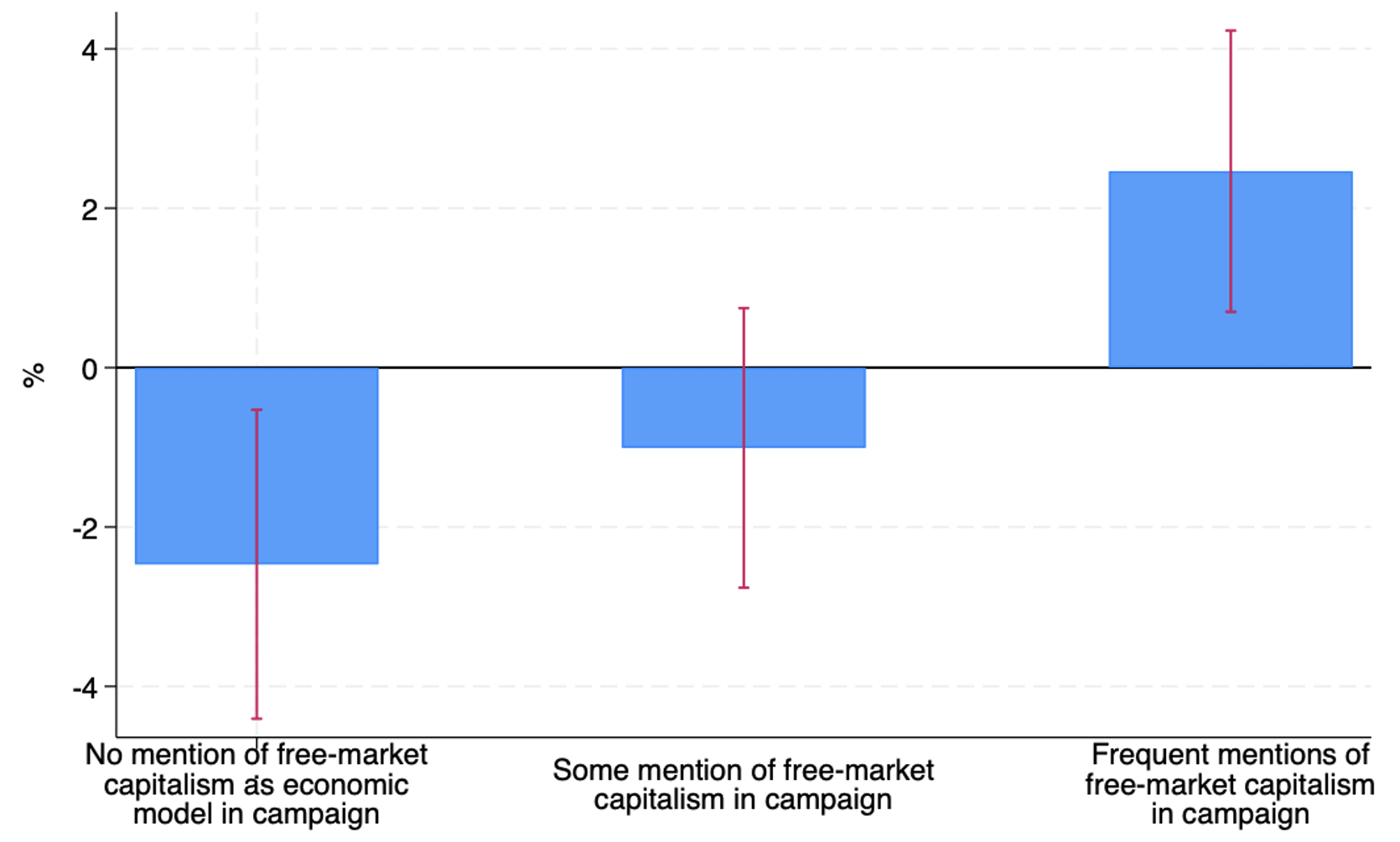

Turning to expenditure cuts, our findings challenge the notion that all forms of austerity are politically harmful We find that, on average, expenditure cuts are not associated with any significant change in the vote share of the government introducing it. But when we take into account economic manifestos, we find that this matters a great deal. Parties that campaigned on a free-market platform gain vote share after forming a government that announces an austerity package consisting of expenditure cuts. This result is completely flipped for parties that did not campaign on a free-market platform: they lose votes after expenditure-based austerity.

Figure 2 Change in the vote share of the main governing party after an expenditure-based consolidation package worth 1% of GDP

Notes: red whiskers are 90% confidence bands

These results suggest that ideology and consistency of political actions with those promised in a manifesto are important in explaining the electoral consequences of austerity. We confirm this intuition by considering political ideology instead of economic manifestos: right-leaning parties lose vote share after tax-based austerity, but can gain votes after expenditure-based austerity. Conversely, left-leaning parties lose votes after expenditure-based austerity, but their electoral fallout is limited in case of tax-based austerity. However, consistency with promised policies is important even conditioning on political ideology. We find that left-leaning governments can limit the electoral cost of expenditure-based consolidations if they campaigned less on a big-state platform.

Austerity during a recession is more costly at the polls

We also find that austerity, in particular tax-based austerity, is more detrimental to the electoral fortunes of the government when it is announced during an economic downturn. This highlights a critical aspect of the electoral cost of austerity: timing austerity during booms can save, if not improve, the electoral fortunes of governments.

Implications

Recent studies have linked the rise in populism to the austerity measures introduced after the Great Recession of 2007-2009 (Klein et al. 2022) which may have increased the vote for Brexit (Fetzer 2019). Our study has a more nuanced implication, suggesting that electoral risks can be navigated, and sometimes even turned to an advantage, through strategic, ideologically consistent, and well-timed policy decisions. In particular, the ideological congruence between a government's policy actions and its electoral promises can go a long way in mitigating the electoral cost of austerity. When austerity is in alignment with a party's pre-election manifesto, particularly for parties that have campaigned on reducing government spending or advocating for fiscal responsibility, such measures can be seen as the fulfilment of electoral commitments rather than a betrayal. Hence, fiscal responsibility can be politically viable if announced in a consistent and timely manner.

References

Alesina, A, G Ciminelli, D Furceri and G Saponaro (2024), “Austerity and elections”, CEPR Discussion Paper 18859.

Alesina, A and F Giavazzi (2012), “The Austerity question: how is as important as how much”, VoxEU.org, April.

Alesina, A, C Favero, F Giavazzi, A Miano and G Azzalini (2016), “The ‘how’ and the ‘when’ in fiscal adjustments”, VoxEU.org, December.

Auerbach A and Y Gorodnichenko (2010), “Measuring the output responses to fiscal policy”, VoxEU.org, September.

Auerbach, A J and Y Gorodnichenko (2012), “Measuring the output responses to fiscal policy”, American Economic Journal: Economic Policy 4(2): 1–27.

Barro, R and C Redlick (2009), “Design and effectiveness of fiscal-stimulus programmes”, VoxEU.org, October.

Barnichon R and C Matthes (2015), “Stimulus versus Austerity: The Asymmetric Government Spending Multiplier”, CEPR Discussion Paper 10584.

Born, B and J Pfeifer (2015), “Does Austerity pay off?”, VoxEU.org, February.

Cherif, F and R Hasanof (2013), “Self defeating fiscal shocks”, VoxEU.org, May

DeLong, J B (2012), “Spending cuts to improve confidence? No, the arithmetic goes the wrong way”, VoxEU.org, 6 April.

Fetzer, T (2019), “Austerity caused Brexit”, VoxEU.org, April.

Gabriel R D, M Klein and A S Pessoa (2022), “The political disruptions of fiscal austerity”, VoxEU.org, December.

Ramey V and S Zubairy (2015), “Government spending multipliers in good times and in bad: Evidence from US historical data”, VoxEU.org, January.

Taylor, A (2013), “When is the time for austerity?”, VoxEU.org, July.