“As is often the case, we are navigating by the stars under cloudy skies.”

Jerome H. Powell, Jackson Hole Economic Symposium, 25 August 2023

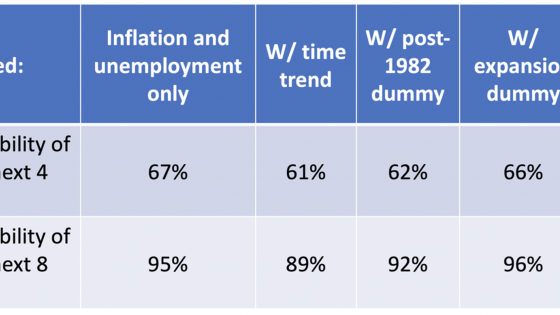

While existing economic models offer valuable insights into national recessions (Estrella and Hardouvelis 1991), predicting regional downturns remains a significant challenge. We propose a novel measure for assessing the build-up of economic risks at the regional level using spatial variation in bank liquidity (Iyer et al. 2023). We find that an increase in deposit rates offered by banks within a region is associated with contractions in economic activity. At the onset of a downturn, deposit growth slows down, prompting banks to increase deposit rates to support their balance sheet. This increase in deposit rates reflects the liquidity squeeze experienced by banks, which in turn serves as an indicator of an impending economic contraction. Deposit rates, being forward-looking, have better predictive power than other variables.

Real-time measure of predicting risk

Economic and financial risks do not typically materialise overnight. Generally, there is a gradual and heterogeneous build-up of risks across different regions within an economy, sometimes triggering a national recession or a crisis. While understanding the spatial heterogeneity in the build-up of risks at the regional level is crucial from a policy perspective, measurement of these risks in real-time is often difficult. Empirically, it has been challenging to obtain reliable measures that capture spatial differences in risks at a regional level.

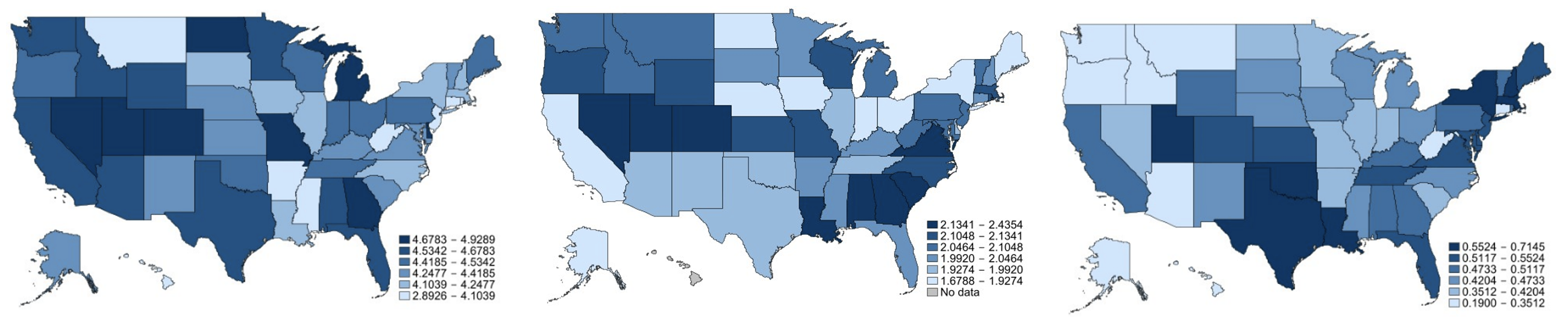

Figure 1 Deposit rates across states and time, 2006Q4 (left), 2009Q1 (centre) and 2017Q4 (right)

In our paper, we present a novel real-time measure for assessing the build-up of regional economic and financial risks, using spatial variation in bank liquidity. Our main idea centres around the relationship between regional economic activity and deposit growth in local banks. As there is a contraction in regional economic activity, corporate profits and household incomes decline. This, in turn, impacts the deposit growth of banks operating within the region, exerting pressure on the liability side of their balance sheet. If banks expect the economic shocks to be short-lived, they are likely to use short-term funding in response to these transitory liquidity shocks. However, if banks anticipate a more persistent economic decline, which directly affects their future liquidity needs, they would need to raise more long-term funding to weather the shock. Consequently, in response to a more persistent economic slowdown, banks may increase their deposit rates to attract additional deposits to manage their liquidity shortages.

Bank deposits and economic activity

For illustration of the relation between bank deposit rates and economic activity, we first examine whether higher deposit rates in 2006 are associated with lower GDP growth two years ahead in 2008. To measure local deposit rates, we exploit the geographic variation in deposit rates across banks, with a particular focus on single-state banks primarily operating regionally.

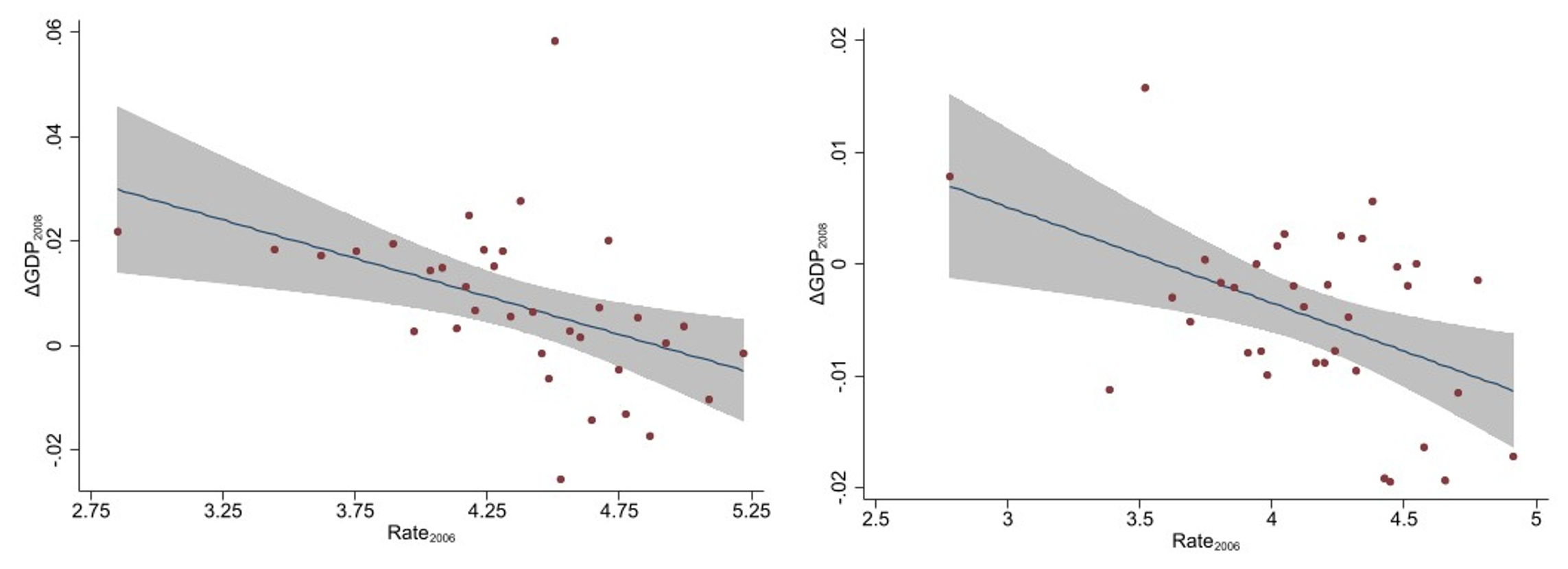

As shown in Figure 2, there is a clear association between deposit rates and future GDP growth at the county and state levels, respectively. We find that higher deposit rates offered by banks are associated with lower GDP growth at both the county and state levels.

Figure 2 2006 Deposit rates predict 2008 GDP growth: County (left) and state (right)

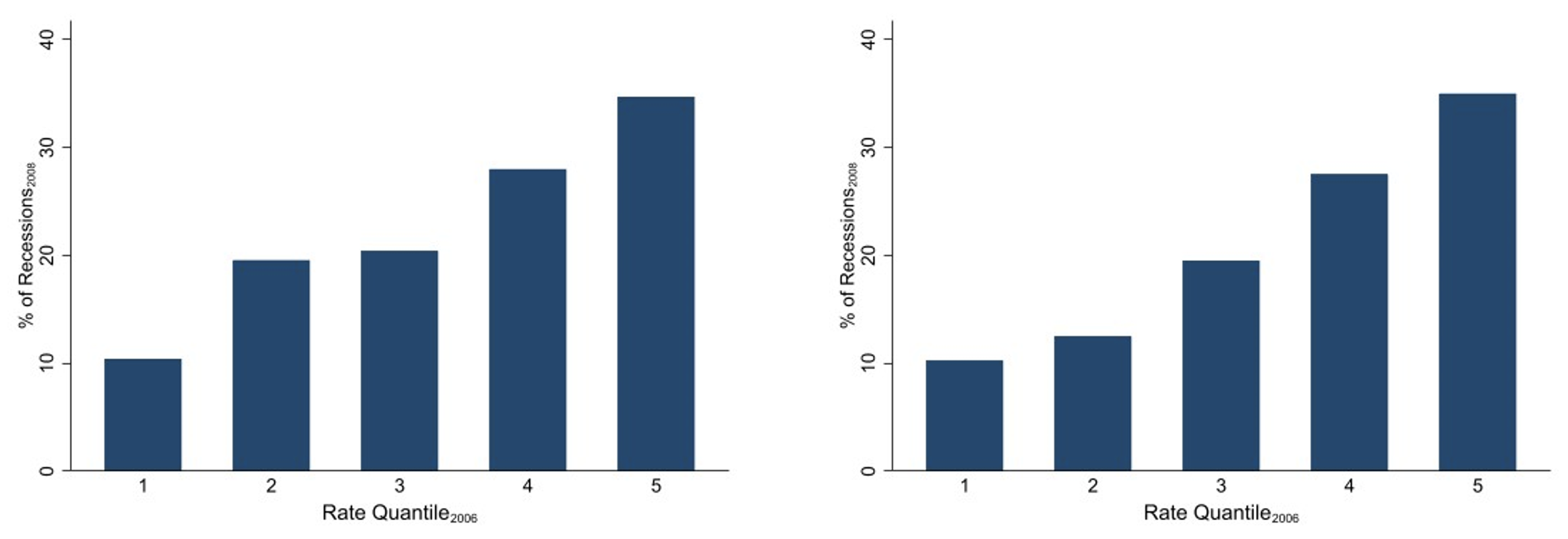

Moreover, in Figure 3, we sort regions into quintiles based on the deposit rate offered by banks in 2006 and explore whether recession risk is higher in counties and states with higher deposit rates. Again, we observe a meaningful association between deposit rates and recession risk, where higher quintiles of deposit rates in 2006 are linked to a higher risk a county or state experiences a larger than 2% drop in GDP in 2008. This robust pattern demonstrates the relation between deposit rates and economic activity cross-sectionally.

Figure 3 2006 deposit rates predict 2008 recessions: County (left) and state (right)

We build on these findings and examine whether deposit rates offered by local banks operating within a county help predict economic activity over a longer time horizon. Our findings reveal that when regional banks operating within a county increase their deposit rates, it is associated with a slowdown in economic activity in that region up to two years ahead. This relationship allows us to predict regional variation in economic activity, effectively capturing the build-up of economic risk. Specifically, we find that an increase in deposit rates at the county level serves as an early indicator of changes in economic activity across various dimensions such as lower GDP growth, reduced firm creation, and higher loan delinquencies. Even in periods without monetary policy changes, credit booms, or imminent national recessions, the increase in deposit rates at the county level remains associated with a slowdown in economic activity within those regions.

To delve deeper into the underlying mechanism behind our results, we investigate whether banks that increase deposit rates experience liquidity stress. Our findings indicate that banks that increase deposit rates experience a decline in deposit growth in the preceding quarters, indicating liquidity stress. This slowdown in deposits is observed for both insured and uninsured deposits. Moreover, the effect varies based on the magnitude of the rate hike. Banks that raise rates by more experience more pronounced declines in deposit growth in the preceding quarters. To complement these findings on bank deposit growth, we also examine aggregate deposit growth at the county level. Our analysis reveals that counties that experience a more substantial decline in economic activity exhibit lower deposit growth compared to other counties. In addition, as an economic downturn approaches, banks tend to increase their reliance on insured deposits to support their balance sheets, narrowing the gap between uninsured and insured deposit rates.

We further validate the link between deposit rates offered by banks and local liquidity conditions. However, one of the challenges is that it is difficult to pin down the exact timing of the downturn. Furthermore, economic activity could be affected by other factors like monetary policy, banking structure, etc. To cleanly validate the link between deposit rates offered by banks and local economic activity, we use two quasi-natural experiments. First, we examine the impact of natural disasters and the shale gas boom on deposit rates. Second, we test whether single-state banks increase deposit rates in regions that are more vulnerable to import competition. Together, our results validate that deposit rates effectively capture the liquidity stress of banks during economic contractions.

Summary

The granularity of our indicator – deposit rates – allows for prediction of localised downturns at regional levels. Our market-based measure is both easy to construct and utilise, providing a useful tool for regional authorities to obtain early warning signals of an economic contraction and implement stabilisation policies.

Importantly, our approach using deposit rates presents several advantages over other indicators used in the existing literature.

- Deposit rates are readily available in real-time, providing a more current assessment compared to other indicators that are measured with lags or that rely on proprietary information (e.g. Ahir and Loungani 2014).

- Deposit rates are forward-looking, reflecting banks' expectations of future local economic conditions based on their lending and deposit-taking activities. By contrast, other indicators often tend to be backward-looking (e.g. Domash and Summers 2022).

- Deposit rates are available at a more granular level than existing measures (e.g. Fendel et al. 2019), aiding our understanding of risk build-up at regional levels – an aspect that has been relatively underexplored in previous research.

References

Ahir, H and P Loungani (2014), “There will be growth in the spring’: How well do economists predict turning points?”, VoxEU.org, 14 April.

Domash, A and L H Summers (2022), "Overheating conditions indicate high probability of a US recession", VoxEU.org, 13 April.

Estrella, A and G A Hardouvelis (1991), "The Term Structure as a Predictor of Real Economic Activity", The Journal of Finance 46(2): 555-576.

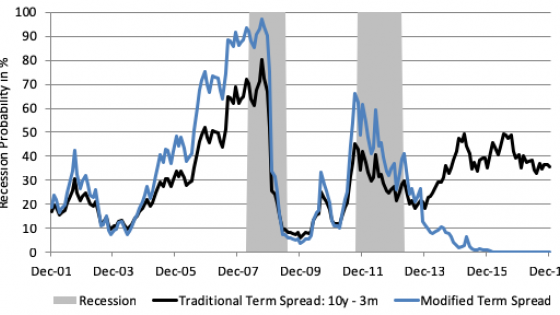

Fendel, R, N Mai, and O Mohr (2019), "Predicting recessions using term spread at the zero lower bound: The case of the euro area", VoxEU.Org, 17 January.

Iyer, R, S Kundu, and N Paltalidis (2023), "Canary in the Coal Mine: Bank Liquidity Shortages and Local Economic Activity", CEPR Discussion Paper No.17633.