Total debt in Latin America and the Caribbean rose to an estimated US$5.8 trillion from under $3 trillion in 2008, or to 117% from around 60% of GDP. Total debt in the five largest economies is around 140% of GDP.

While lower than in many advanced economies, emerging and developing economies face higher interest rates (with real rates typically greater than growth rates), higher interest payments, and greater risks, and the higher debt levels imply a greater drag on growth. Rogoff et al. (2021) provide a general discussion of the rise of debt in developing countries after COVID-19, while Corsetti and Codogno (2022) consider debt sustainability challenges in Europe.

Public debt had grown before the pandemic in Latin America and the Caribbean to an average 58% of GDP and then soared to 72% of GDP with the exceptional fiscal programmes to support families and firms through the crisis.

The strong 2021 and 2022 recovery prompted a fall in debt ratios, but low expected growth for 2023 will make similar declines more challenging to achieve. Inter-American Development Bank (IDB) projections – which assume growth rates rise after 2023 and are based on estimated historical fiscal reaction functions – indicate fiscal consolidation and a gradual fall in debt to about 62% of GDP by 2032.

In the recent IDB flagship report, Dealing with debt (Powell and Valencia 2023),

we suggest that fiscal consolidation should be swifter than this baseline and that the region should not just target sustainability but bring debt down to a prudent level, defined as a level of debt that is sustainable even in the face of a certain intensity of shocks.

Sustainability is not easy to assess, as it depends on assumed future actions including fiscal policy. Estimated fiscal reaction functions drawing on the historical relationship between fiscal outcomes, debt levels, and other variables suggest that, on average, debt in the region is sustainable. But that does not mean sustainability is guaranteed in all cases, and there are significant risks.

In addition, at higher debt levels, it is more difficult for countries to generate higher required primary surpluses if needed to guarantee fiscal sustainability.

According to three methodologies, a prudent debt level for the typical country in Latin America and the Caribbean is between 48% and 55% of GDP, depending on country characteristics.

The region does not have to aim for that immediately; rather, countries should articulate a credible plan that brings debt down over time.

A prudent level of debt would reduce risks, lower interest rates and interest payments, make space for more public investment, and stimulate private investment. Indeed, we found that for Latin America and the Caribbean, debt above a threshold of 60% of GDP is a drag on investment and growth for the typical country.

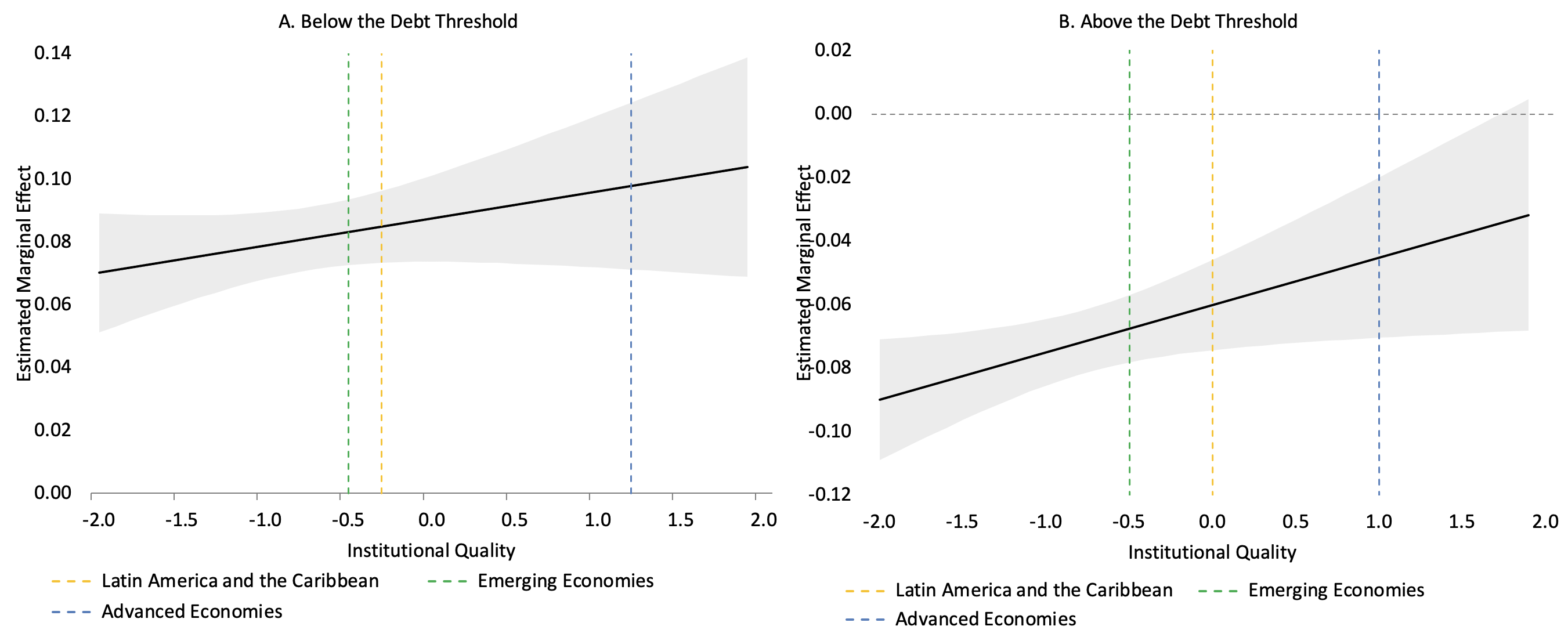

Interestingly, if institutional quality is higher, the drag on growth when debt is above the threshold is greater, and when debt levels lie below the threshold, debt has a more beneficial impact on growth (Figure 1).

Figure 1 The marginal effect of debt on growth, below and above the debt threshold

To bring debt down to a prudent level in ten years would require an additional fiscal effort of about 1.4% of GDP, which is about one and a half times the yield of the average tax reform in the region. Still, there are many ways to realise this objective and the best path again depends on country characteristics.

Boosting growth would be ideal. Improving public investment frameworks and mechanisms for attracting private investment in infrastructure would be a great first step.

In a pre-pandemic analysis, the IDB estimated potential fiscal savings of over 4% of GDP from greater efficiency in spending (Izquierdo et al. 2018). Given higher levels of spending today, that is surely an underestimate. Moreover, it is an average; efficiency gains in those countries with high spending levels, which also tend to have high debt, are surely greater. There are also significant potential savings from efficiency improvements in tax systems. For those countries with low tax takes, typically in Central America, widening the tax base would bring significant rewards.

The region needs to improve institutions more widely. Less than half of the countries in Latin America and the Caribbean had a fiscal rule as the pandemic hit. Fiscal rules were suspended in countries that had them, and there is an opportunity to improve the quality of those rules as countries seek re-compliance. More generally, a framework that can deliver a credible medium-term fiscal strategy would be extremely valuable and highly complementary to reducing debt to prudent levels over several years. That might involve reforms to fiscal and other institutions.

The region has reduced debt in the past. Several countries were successful in boosting growth and/or improving fiscal balances (Powell and Valencia 2023: Chapter 9). But the most common way to reduce debt was through inflation. Still, on closer inspection, there were several successful inflation episodes with moderate inflation and independent central banks that could keep expectations anchored and real interest rates low, providing yet another reason to ensure central banks remain independent and inflation expectations kept under control.

Debt composition is as important as the level of debt. Latin America and the Caribbean made substantial improvements during the 2000s with several countries opening or enhancing debt management offices, applying more sophisticated techniques, reducing the share of dollar debt, and extending maturities in both local and foreign currency instruments. But those advances stalled even before the pandemic. Debt spikes are compounded by currency mismatches and around a quarter of the Inter-American Development Bank’s borrowing countries face debt service of over 5% of GDP (21% of fiscal revenues) and half of over 2.5% of GDP (11% of fiscal revenues). There are many tradeoffs but a renewed emphasis to improve debt composition would lower risks (Powell and Valencia 2023: Chapter 6).

In some cases, debt became unsustainable. Five countries in the region already restructured since 2020.

The region has been at the forefront of innovations in debt restructuring since the 1980s, and recent restructurings highlight innovations in different dimensions. But many unresolved issues remain, including the controversial way in which new-generation collective action clauses were deployed and the rising challenges of creditor coordination, given an increase in the diversity of instruments and creditors. Deeper discussion is also warranted on whether – and if so, how – to best link debt and climate challenges. In addition, many debt restructurings have not restored private market access and there have been numerous examples of repeated restructurings. The 2023 IDB report recommends a regional forum, to complement international efforts that largely focus on low-income countries, to discuss these and other issues (Powell and Valencia 2023: Chapter 10).

Latin America and the Caribbean face stiff challenges, and given the uncertain outlook, inaction is a risky strategy. Rather, concerted action is required to bring public debt levels down to prudent levels and to improve fiscal institutions and debt composition. A regional forum to discuss issues related to debt restructuring, and debt and climate challenges, merits serious consideration.

References

Bohn, H (1998), “The behavior of US public debt and deficits”, Quarterly Journal of Economics 113(3): 949–63.

Bohn, H (2007), “Are stationarity and cointegration restrictions really necessary for the intertemporal budget constraint”, Journal of Monetary Economics 54(7): 1837–47.

Cavallo, E, A Powell, and T Serebrisky (eds.) (2000), From structures to services: The path to better infrastructure in Latin America and the Caribbean, Inter-American Development Bank, Development in the Americas Flagship Report.

Corsetti, G, and L Codogno (2022), “Shifts in expectations may undermine debt sustainability”, VoxEU.org, 3 November.

Esteves, R, and B Eichengreen (2022), “Up and away: Inflation and debt consolidation in historical perspective”, VoxEU.org, 15 November.

Izquierdo, A, C Pessino, and G Vuletin (eds.) (2018), Better spending for better lives: How Latin America and the Caribbean can do more with less, Inter-American Development Bank, Development in the Americas Flagship Report.

Powell, A, and O Valencia (2023), Dealing with debt: Lower risk for higher growth in Latin America and the Caribbean, Inter-American Development Bank, Development in the Americas Flagship Report.

Rogoff, K, F Ohnsorge, C Reinhart, and M Ayhan Kose (2021), “Developing economy debt after the pandemic”, VoxEU.org, 3 November.

Valencia, O, D A Parra, J Camilo Diaz (2022), “Assessing macro-fiscal risk for Latin American and Caribbean countries”, Inter-American Development Bank Working Paper No. 1346.