The last decade witnessed the introduction of major innovations in the monetary policy toolboxes of central banks. Shaken by the global financial crisis and faced with the threat of deflation, central banks turned to unconventional tools (e.g. quantitative easing, forward guidance, targeted lending operations, and negative policy rates) as they hit the effective lower bound of interest rates.

Monetary policy transmission during a prolonged period of negative rates

While the current literature provides evidence that the effectiveness of monetary policy diminishes when rates are extremely low (e.g. Borio and Gambacorta 2017), it has yet to clarify the overall impact of negative policy rates on banks. Conceivably, prolonged negative interest rates may prompt banks to alter their practices, so the observed immediate impact of negative rates on which the current literature focuses may differ from medium-to-long-term impacts. Indeed, banks can benefit in the short run from capital gains when negative rates are implemented as it helps them make up for negative rates on their reserves on deposit with the central bank (Balloch et al. 2022). Such capital gains, however, are insufficient over the long haul and makes it hard for banks to maintain profitability.

Ulate (2021) proposes a dual mechanism whereby policy rate cuts exert downward pressure on loan rates (bank lending channel) and reduce bank profitability and equity (net worth channel). Whether lending rates actually fall after a policy rate cut is dictated by the relative importance of these two channels. In the two-channel model by Abadi et al. (2023), banks benefit from capital gains on their long-term assets (capital gains channel) and suffer from compressed profit margins (net interest income channel). The reversal rate is the rate below which the net interest income effect of further interest rate cuts outweighs the capital gains effect (Repullo 2020, Kok et al. 2021).

In both of these theoretical papers, the probability of the appearance of the reversal rate increases if interest rates are kept low for a prolonged period. Notably, the empirical literature has yet to provide support for this theoretically demonstrated reversal effect of monetary policy.

Low for long

In our recent paper (Fungáčová et al. 2023), we analyse bank-level data from the euro area to elucidate the transmission of monetary policy to bank lending rates. In comparison to the earlier literature, our dataset has two major advantages. First, our sample is long enough, enabling us to analyse the impact of the ‘low-for-long’ period. We define the low-for-long period to start at the beginning of 2016, when the ECB made a major change in its forward guidance by committing to keep rates “at present or lower levels for an extended period of time.” Following this policy announcement and a further interest rate cut to -0.4%, the interest rate expectations of the market changed significantly and some banks started to claim negative interest rates on their retail deposits.

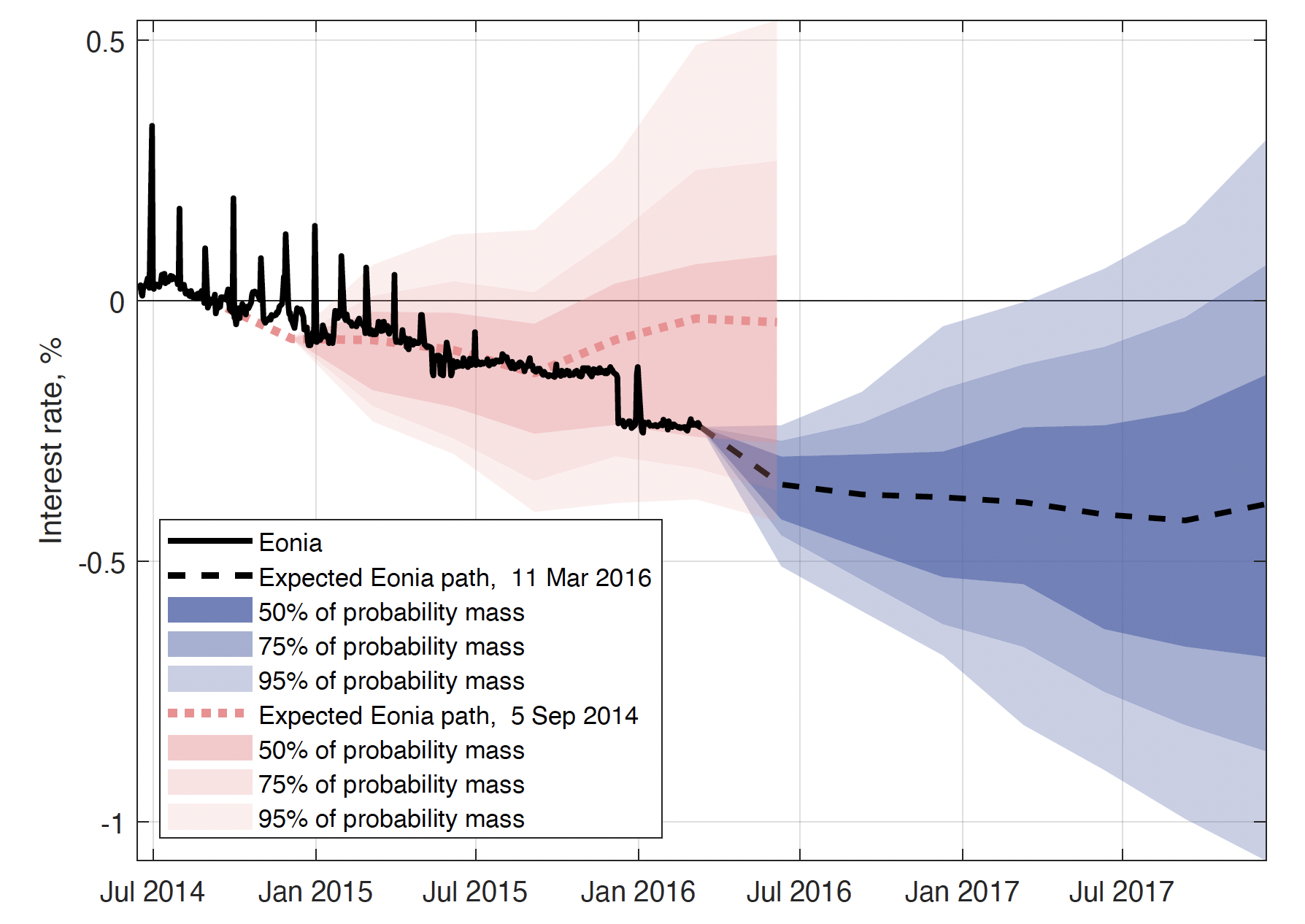

Figure 1 shows the expected path and probability distribution of the Euro Overnight Index Average (Eonia) rate after the January 2016 change in forward guidance and subsequent rate cut in March. Looking at Figure 1 below, we see that, unlike after the first rate cut into negative territory in 2014, market participants in 2016 priced in a prolonged period of negative interest rates.

Second, we utilise detailed data on corporate lending rates of various maturities. This enables us to look beyond the average lending rates and allows us to show that changes in monetary policy transmission vary across lending rates of different maturities.

Figure 1 Expected Eonia paths (forward rates) and their probability distributions derived from interest rate options

In search of the reversal rate

We first study the transmission of the overall monetary policy stance measured by the shadow rate (Krippner 2015). Our results show that during the low-for-long period, the ECB’s overall monetary policy stance became contractionary for short-term lending rates but remained expansionary for long-term lending rates.

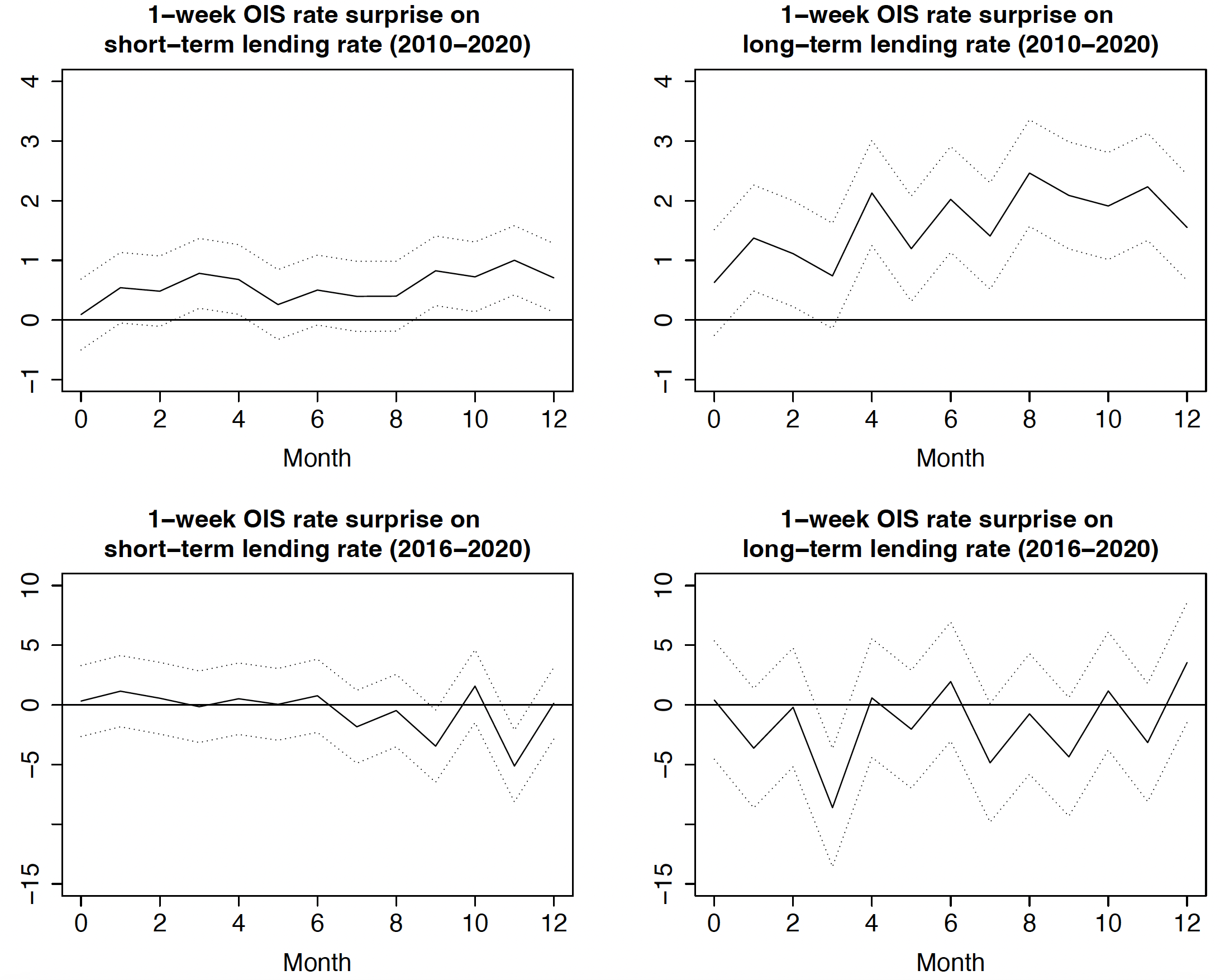

To account for different monetary policy shocks, we next turn to local projections. We look at the impact of different monetary policy tools separately (short-term interest rates, longer-term refinancing operations, and quantitative easing) by using high-frequency proxies for monetary policy shocks. These results provide evidence that it was the conventional monetary policy that became contractionary for bank lending during the low-for-long period. Figure 2 shows the policy impact on bank lending rates at different maturities after a one unit policy rate surprise during the full decade 2010–2020 observation period (upper panel) and during the low-for-long period beginning in 2016 (lower panel).

Figure 2 Effects of a short-term rate shock

Notes: This figure shows the effect of a short-term rate shock proxied by the one-week rate surprise on short- and long-term lending rates during the full January 2010–December 2020 observation period (upper panel) and the January 2016–December 2020 low-for-long period (lower panel). Local projection estimations. Lighter lines represent 90 % confidence intervals.

For the full observation period, the impact of policy rate surprise is positive. Thus, a rate increase (decrease) raises (lowers) bank lending rates for both short- and long-maturity loans. In line with Abadi et al. (2023), however, lending rates in low-for-long period respond by moving in the ‘wrong’ direction. In other words, we find evidence of the reversal rate in the euro area after the fourth rate cut to -0.40% in 2016. At this point, market participants apparently became convinced by ECB forward guidance that negative rates were a persistent phenomenon.

We also provide evidence that unconventional measures subsequently helped sustain the ECB’s ability to keep its accommodative stance in place. In particular, (targeted) longer-term refinancing operations ((T)LTROs) boosted bank lending for long-term loans. Indeed, (T)LTROs likely contributed most to preserving an overall expansionary monetary stance for long-term lending during the low-for-long period.

Even though we find that the ECB’s monetary policy was not necessarily fully expansionary for bank lending during the period of negative rates, it does not mean that the policy was not expansionary when it comes to inflation. Monetary policy also transmits to economic growth and prices via channels other than bank lending (e.g. asset prices). It is therefore important that future studies consider whether negative interest rate or low-for-long policy is inflationary even when it was not expansionary for bank lending.

References

Abadi, J, M K Brunnermeier and Y Koby (2023), “The reversal interest rate”, American Economic Review 113(8): 2084-2120.

Balloch, C, Y Koby and M Ulate (2022), “Making sense of negative nominal interest rates”, Federal Reserve Bank of San Francisco Working Paper Series 2022-12.

Borio, C and L Gambacorta (2017), “Monetary policy and bank lending in a low interest rate environment: diminishing effectiveness?”, Journal of Macroeconomics 54: 217-231.

Fungáčová, Z, E Kerola and O Laine (2023), “Monetary policy transmission below zero”, Bank of Finland Research Discussion Paper (11).

Kok, C, M Rottner and M Darracq Pariès (2021), “The reversal interest rate: A new motive for countercyclical macroprudential policy”, VoxEU.org, 2 May.

Krippner, L (2015), Zero lower bound term structure modeling: A practitioner’s guide, Springer.

Repullo, R (2020), “The reversal interest rate: A critical review”, VoxEU.org, 4 November.

Ulate, M. (2021), “Going negative at the zero lower bound: The effects of negative nominal interest rates”, American Economic Review 111(1): 1-40.