After decades of deepening economic integration across nations and regions, spurred by the rise of global value chains (GVCs), the COVID-19 pandemic and the Russian invasion of Ukraine have disrupted international production networks (Attinasi et al. 2022). The size and changing nature of these shocks exacerbate the risk of a reversal of international economic integration, referred to as ‘geoeconomic fragmentation’ (Aiyar et al. 2023, Baldwin et al. 2023).

In many advanced countries, policymakers and enterprises took actions to mitigate the exposure of GVCs to dependencies on critical inputs. Public initiatives aimed at diversifying GVCs and enhancing their resilience included tax incentives, subsidies, and public loans to support new investments, as well as encouraging ‘on-shoring’ and ‘reshoring’ of multinational corporations’ foreign activities. Export restrictions on specific strategic products have also been implemented. The more frequent ‘weaponisation’ of supply interdependencies, related to the increased geopolitical risk, could trigger sharp economic losses and inflationary pressures (Aiyar et al. 2023, Caldara et al. 2023). In this new environment, in order to assess the impact of different decoupling scenarios on economic activity, identifying foreign dependencies becomes key (Ioannou et al. 2023).

Our study

In a recent paper (Borin et al. 2023), we identify a set of foreign sourced critical inputs and quantify, through a parsimonious model of firm production, the impact on the Italian economy of disruptions in the supply of these inputs. In our exercise, we assume that the disruption arises from a flaring up of geopolitical tensions, but our methodology can be applied to other kinds of shocks.

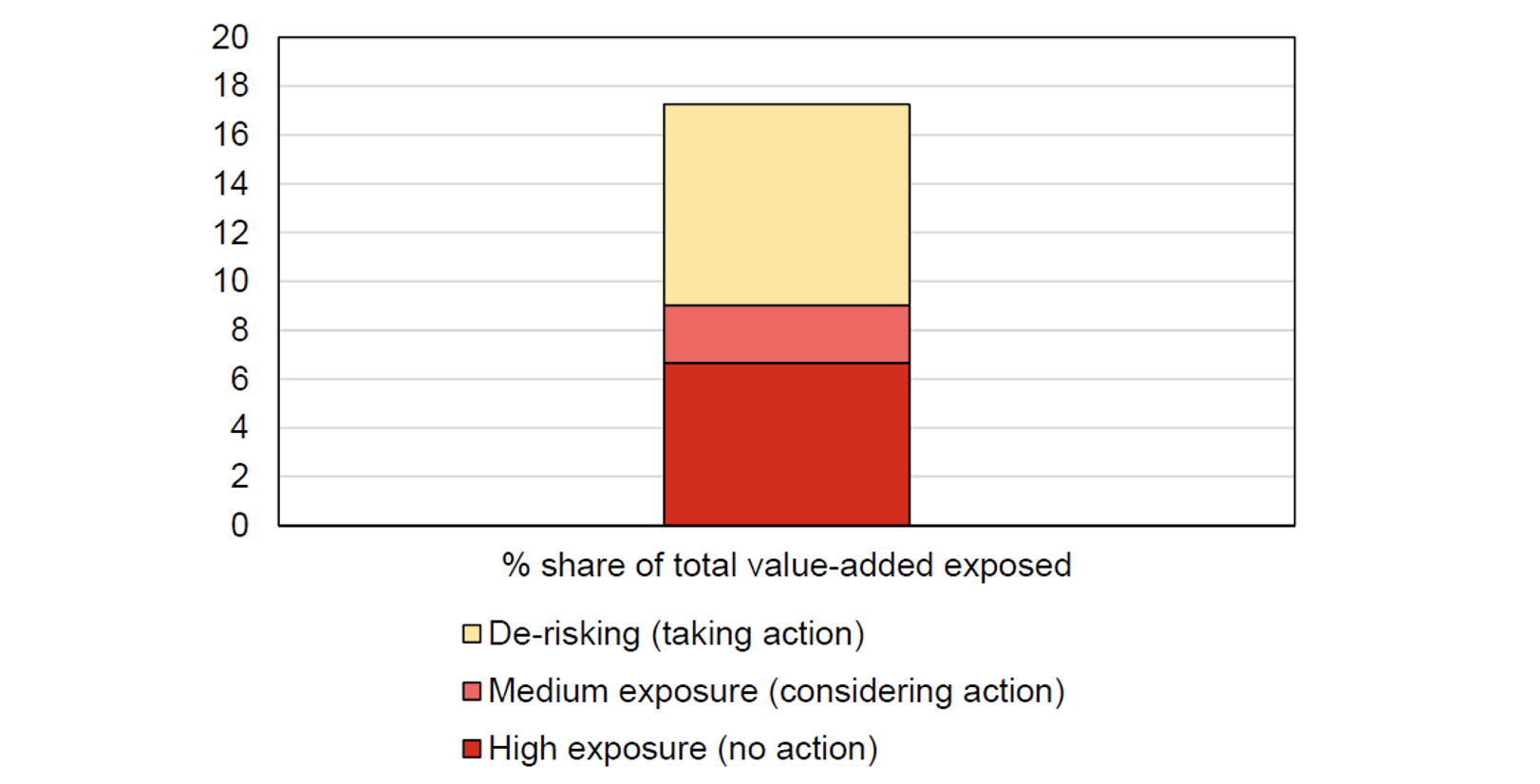

As a starting point, to assess the relevance of foreign critical inputs, we rely on a unique Bank of Italy survey collecting information from firms on their exposure to critical inputs from China. Almost 18% of Italian manufacturing value-added is produced by firms depending, directly or indirectly, on Chinese imported inputs deemed critical for their activity and difficult to substitute. Importantly, 7% of value-added in manufacturing is produced by firms relying on hard-to-substitute Chinese inputs that have no immediate plans to reduce such dependencies through supply differentiation or reshoring/nearshoring (Figure 1).

Figure 1 Exposure to a cut in supply of critical inputs from China

Source: Own elaboration on Bank of Italy survey data.

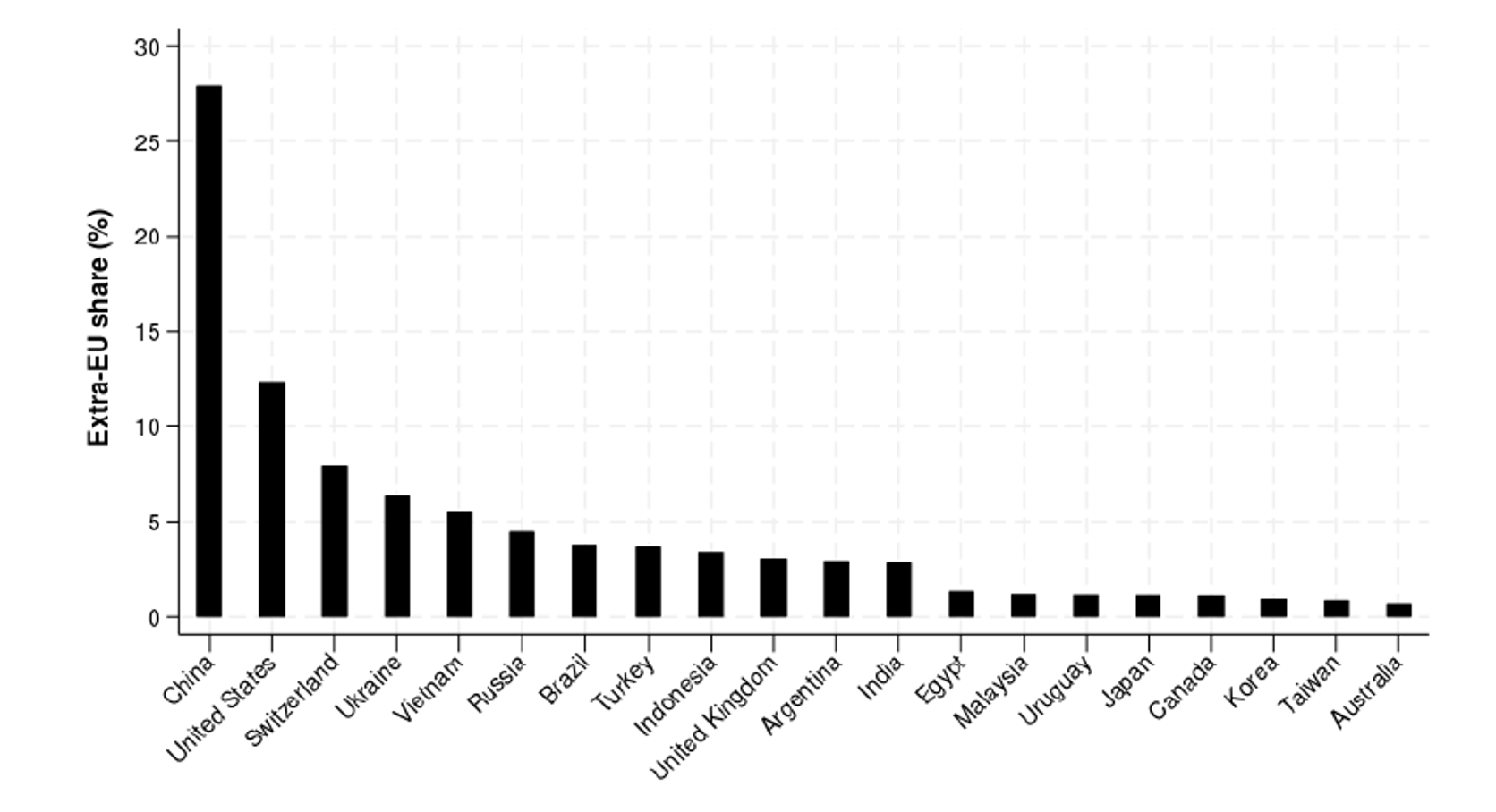

To provide a more complete picture of foreign input dependence, we use Italian transaction level customs data to identify foreign dependent products (FDPs), defined as inputs with a concentrated and substantial share of imports from extra-EU countries, and that cannot be easily replaced domestically, adopting a methodology similar to that proposed by the European Commission (2021). We recover a list of 515 FDPs defined at the HS8-digit level. These critical inputs come mainly from China, but the exposure is also sizable vis-à-vis other economies at a relatively high risk of experiencing interruptions to supplies (Figure 2).

Figure 2 Extra-EU import share of FDPs by source country

Note: The bars represent the share of each extra-EU country’s exports of FDPs in Italian imports of FDPs from all extra-EU countries.

Having identified FDPs, we match this information with firm-level foreign transaction data and balance sheet data and analyse the characteristics of the firms that rely on FDPs. We uncover four stylised facts:

- Firms importing FDPs account for a sizeable share of the economy. Around 17,000 firms in our data use FDPs (about 2% of limited liability firms). Around half of these, producing 24% of Italian manufacturing value-added, import FDPs from high-risk countries (defined as those who voted differently from Italy and major Western countries on the UN resolution on peace in Ukraine).

- While FDPs account for just about 5% of firms’ total purchases, this average masks substantial heterogeneity.

- There is limited diversification of sourcing, as measured by the number of sourcing countries, both for FDPs and for non-FDPs.

- Firms importing FDPs are larger and more productive than firms importing non-FDPs from extra-EU countries.

The effect of import disruptions

Drawing from Bachmann et al. (2022), we then build and calibrate a firm-level partial equilibrium model to assess the effect of supply disruptions entailed by a sudden drop in imports of FDPs from high-risk countries. In our model, firms combine labour, capital, and intermediates through a Cobb-Douglas production function. Importantly, intermediates are produced using FDPs and non-FDPs with a constant elasticity of substitution (CES) function. Our baseline scenario consists of a halving of the supply of FDPs from high-geopolitical-risk countries. Exploiting firms’ heterogeneous exposure to sourcing FDPs from high-risk countries, we assess how geoeconomic fragmentation might affect firms, regions, sectors, and the total economy. In this way we contribute to filling the gap between the studies providing macro assessments of the impact of decoupling that abstract from the product-level dimension (Felbermayr et al. 2023, Attinasi et al. 2023, Javorcik et al. 2023) or from the micro structure of imports (Berthou et al. 2023), and policy-oriented work mapping foreign dependencies with granular trade data (Arjona et al. 2023) that typically lack analyses of the aggregate effects of high foreign dependence.

To calibrate the model, we recover the values of the parameters from our micro data and account for uncertainty on the elasticity of substitution between FDPs and non-FDPs, thus offering a range of estimates. Our partial equilibrium framework is appropriate to study short-run effects of fragmentation scenarios, as factors of production other than FDPs are held constant and the elasticity of substitution between intermediates is assumed to be relatively low (Peter and Ruane 2023).

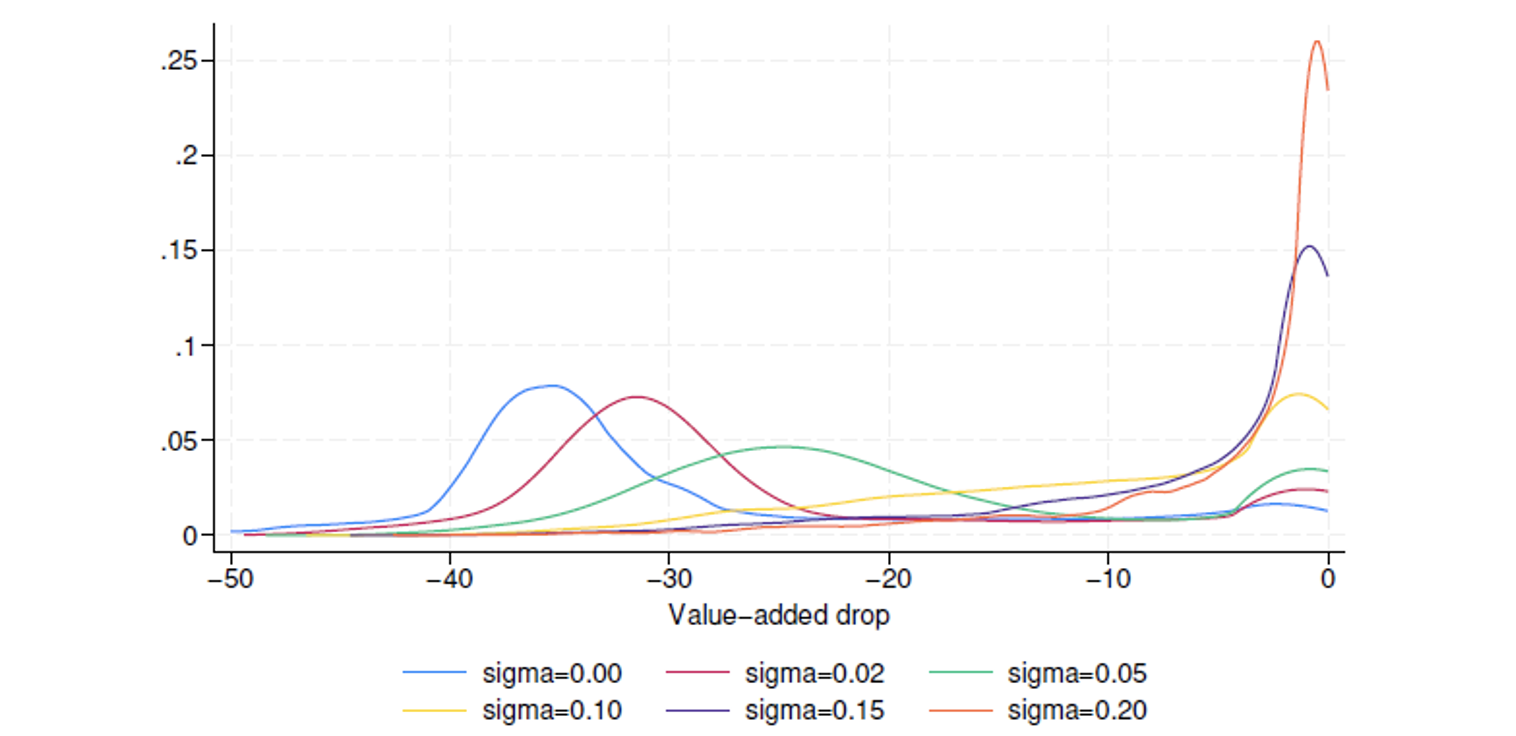

We find that the impact of geoeconomic fragmentation largely depends on two dimensions: (1) the degree of substitutability between FDPs and non-FDPs, and (2) firm-level characteristics (i.e. exposure to the shock and expenditure on FDPs). For a given firm-level exposure to the shock and expenditure on FDPs, when FDPs cannot be substituted with non-FDPs, the median drop in value-added reaches 35% (Figure 3, blue line). Conversely, when FDPs and non-FDPs are easy to substitute, the median value-added drop is lower than 2% (Figure 3, orange line). In addition, assuming a low yet plausible elasticity of substitution, the loss in value-added ranges widely, from 40% for the most exposed firms with a high share of expenditure on FDPs over total purchases of inputs (first decile, Figure 3 green line in Figure 3) to 0.3% for less exposed firms with a relatively lower share of expenditures on FDPs (ninth decile, Figure 3, green line).

Figure 3 Distribution of value-added change for different degrees of substitutability between FDPs and non FDPs (%)

Note: The figure reports the distribution of value-added changes (in %) due to a 50% cut in FDPs from high-risk countries. We include manufacturing firms only.

Heterogeneity of impact

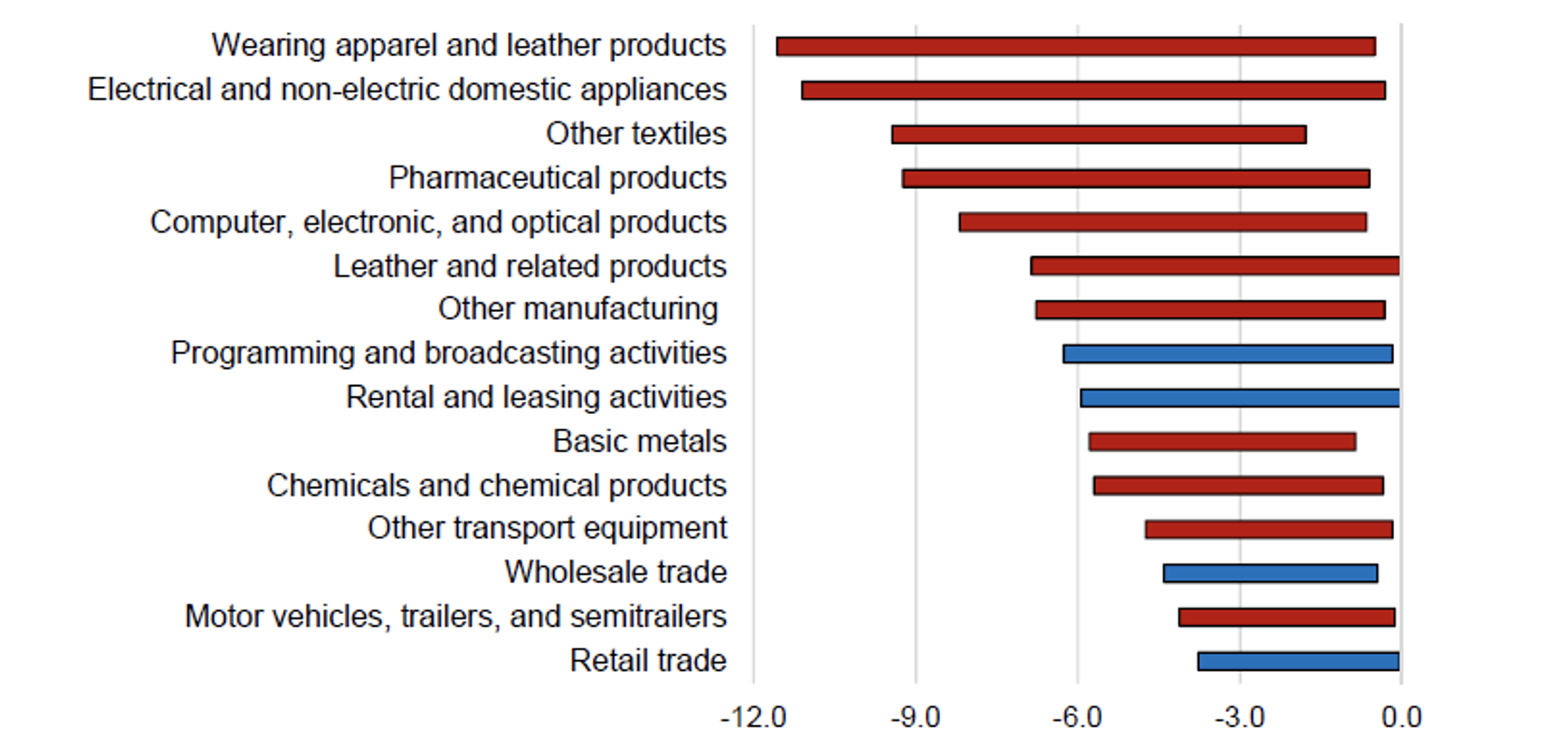

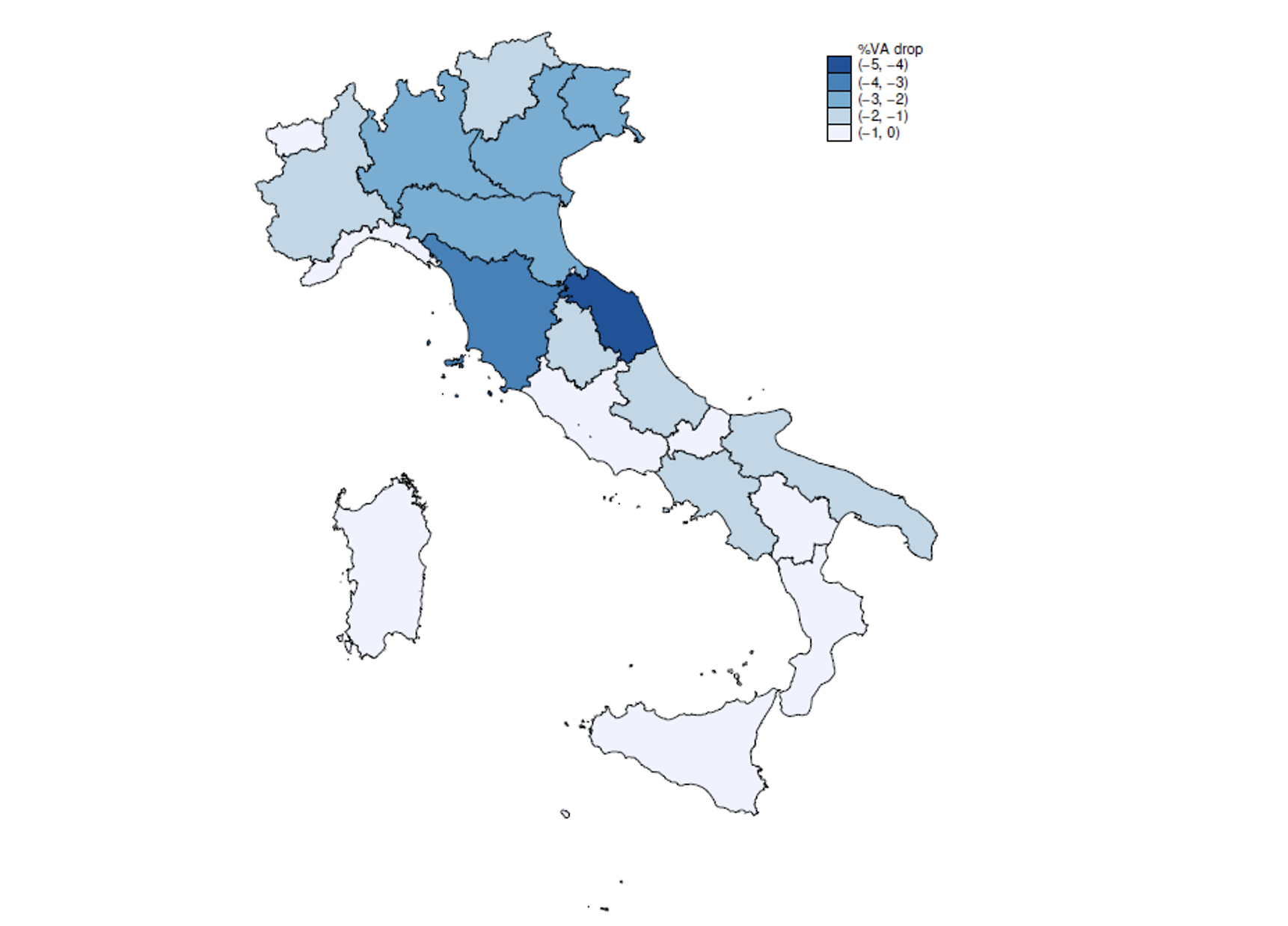

The impact is very heterogeneous across sectors and Italian regions. Value-added would drop by almost 11% for the wearing apparel products and domestic appliances industries, and by more than 8% for the other textiles, pharmaceutical products and computers, electronic and optical products industries (Figure 4). Unsuprisingly, output losses are greater for regions heavily reliant on inputs from high-risk countries (Figure 5).

Figure 4 Value-added change by sector (%)

Note: The figure reports the value-added change (in %) across the most exposed sectors from a 50% drop in FDP supply from high-risk countries. Red (blue) bars refer to manufacturing (services) industries. ranges from 0 (lower bound of the impact reported in the chart) to 0.5 (upper bound of the impact reported in the chart).

Figure 5 Value-added change by region with no substitution between FDPs and non-FDPs (%)

Note: The figure reports the value-added change (in %) across regions coming from a 50% drop in FDP supply from high-risk countries ( = 0).

Figures 4 and 5 show that the effects are concentrated in specific sectors and regions, and the aggregate effect is muted. In fact, aggregating the firm-level effects using value-added weights, we find that the Italian economy could experience a drop in GDP of at most 2%. This somewhat modest impact at the aggregate level is reminiscent of the argument that aggregate production function could be Cobb-Douglas even if firms have Leontief technologies (Houthakker 1955, Jones 2005).

Conclusion

We show that micro-level data are essential for accurately assessing the potential losses caused by shortages in specific inputs, exemplifying the biases from using aggregate (e.g. industry level) data. In the aftermath of the Covid-19 outbreak, many called for increased data sharing and cooperation (Biancotti et al. 2020). Today, promoting international cooperation by encouraging public agencies to share granular firm-level transaction data is essential to equip governments and institutions with the necessary tools to evaluate fragmentation risks.

Authors’ note: The views expressed in the paper are those of the authors and do not necessarily reflect those of the Bank of Italy.

References

Aiyar, M S, A Presbitero and M Ruta (eds) (2023), Geoeconomic Fragmentation: The Economic Risks from a Fractured World Economy, London and Paris: CEPR Press.

Arjona, R, G W Connell and C Herghelegiu (2023), “The EU’s strategic dependencies unveiled”, Voxeu.org, 23 May

Attinasi, M G, L Boeckelmann and B Meunier (2023), "The Economic Costs of Supply Chain Decoupling", ECB Working Paper No. 2023/2839.

Attinasi, M G, R Gerinovics, V Gunnella, M Mancini and L Metelli (2022), “Global supply chains rattled by winds of war”, VoxEU.org, 8 June.

Bachmann, R, D Baqaee, C Bayer, M Kuhn, B Moll, A Peichl, K Pittel and M Schularick (2022), “What if? The Economic Effects for Germany of a Stop of Energy Imports from Russia”, ECONtribute Policy Brief 28/2022.

Baldwin, R E, R Freeman and A Theodorakopoulos (2023), "Supply chain disruptions: shocks, links and hidden exposure", Voxeu.org, 29 November.

Berthou A, A Haramboure and L Samek (2023), “Granular production networks: Mapping and testing product-level vulnerabilities”, OECD STI Working Paper, forthcoming.

Biancotti, C, A Rosolia, F Venditti and G Veronese (2020), “Saving economic data from Covid-19”, Voxeu.org, 12 April.

Borin, A, G Cariola, E Gentili, A Linarello, M Mancini, T Padellini, L Panon and E Sette (2023), "Inputs in geopolitical distress: a risk assessment based on micro data", Bank of Italy Occasional Papers 819.

Caldara, D, S Conlisk, M Iacoviello and M Penn (2023), “Do geopolitical risks raise or lower inflation?”, Federal Reserve Board of Governors.

European Commission (2021), "Strategic dependencies and capacities", Commission Staff Working Document, 352.

Felbermayr, G, H Mahlkow and A Sandkamp (2023), “Cutting through the value chain: The long-run effects of decoupling the East from the West”, Empirica 50(1): 75-108.

Houthakker, H S (1955), "The Pareto distribution and the Cobb-Douglas production function in activity analysis", The Review of Economic Studies 23: 27–31.

Ioannou, D, J J.Perez, H Geeroms, I Vansteenkiste, P F Weber, A M Almeida, I Balteanu, I Kataryuniuk and M G Attanasi (2023), "The EU’s Open Strategic Autonomy from a Central Banking Perspective. Challenges to the Monetary Policy Landscape from a Changing Geopolitical Environment", Working Paper series, ECB.

Javorcik, B S, L Kitzmueller, H Schweiger and M A Yıldırım (2022), ‘Economic costs of friend-shoring’, EBRD Working Paper 274.

Jones, C I (2005), "The shape of production functions and the direction of technical change", The Quarterly Journal of Economics 120: 517–549.

Peter, A and C Ruane (2023), "The aggregate importance of intermediate input substitutability", Technical report, National Bureau of Economic Research.