The challenges caused by growing income inequality have led policymakers to revisit the minimum wage policies in their toolbox. For instance, Germany introduced a minimum wage in 2015, which increased from €8.5 to €12 per hour (gross) in 2022. In the US, the Raise the Wage Act will gradually increase the US federal minimum wage to $17 per hour by 2028. But minimum wage hikes remain controversial reforms. Do they really support low-wage workers, reducing wage inequality (Dustmann et al. 2021)? Or do they lead to the destruction of low-wage jobs, excluding low-productivity workers from the labour market (Neumark et al. 2014, Meer and West 2016)?

The vast literature studying the employment effect of minimum wage hikes remains largely inconclusive (see Manning 2021 for a discussion). Estimating employment elasticity is particularly crucial in Central and Eastern Europe for at least three reasons. First, income inequalities in the region are very large; second, most of these countries regularly implement biting minimum wage hikes (e.g. 20% increase in Ukraine in 2021, 25% increase in Latvia between 2013 and 2015, 96% increase in Hungary between 2000 and 2002); and third, the share of minimum-wage workers is much larger in the region than in other EU countries.

The third observation regarding the peculiar wage distribution should be interpreted with a grain of salt: labour markets in the region are characterised by the prevalence of so-called ‘envelope wages’, whereby unreported cash-in-hand complements the official wage (European Commission 2020). In other words, the official wage for many workers is only a fraction of their total wage. Besides undermining public finance, this form of labour tax evasion distorts competition at the expense of tax-compliant firms, and reduces workers’ entitlement to social security benefits.

In this setup, minimum wage policy can become a fiscal policy tool: a minimum wage hike pushes firms to convert part of the envelope into official wage to comply with the new level, so that they remain under the tax authorities’ radar (Tonin 2011). From an employment perspective, unreported wages may hence act as a buffer to absorb minimum wage shocks.

At the same time, not all firms are tax evaders, and some firms genuinely pay their employees at the minimum wage. In a recent paper, we investigate whether compliant and tax-evading firms exhibit a different employment response following a minimum wage hike (Gavoille and Zasova 2023). For this purpose, we use a combination of administrative and survey data from Latvia, where the minimum wage rose sharply in 2014 and 2015. Envelope wage is a major issue in the Latvian labour market. Seven percent of employees in Latvia (more than in any other EU country) admitted having received an envelope wage (European Commission 2020). Putnins and Sauka (2015) estimate that 34% of total wages in the Latvian private sector are paid by envelope.

Detecting labour tax-evading firms

Studying firms’ employment response conditional on labour tax evasion requires a firm-level classification. Detecting firms involved in envelope wage payments is not a trivial task. We use supervised machine learning techniques to construct a classification of Latvian firms. It relies on three key ingredients: a classification algorithm, firm-level information to use as predictors, and a sample of firms for which we know the ‘true’ type (to train the algorithm). The main difficulty is obtaining a sample of firms from which we can distinguish the tax-evading from the compliant.

As tax evasion is not directly observable, we construct a sample based on (strong) assumptions. We consider firms owned by a Nordic company as compliant. DeBacker et al. (2015) provide evidence that tax-morale culture is imported in foreign-owned firms. Denmark, Finland, Norway, and Sweden are considered as benchmarks for legal compliance and regularly achieve top rankings in tables such as the Corruption Perception Index (CPI). In another paper, we show that employees of foreign-owned firms in Latvia are less likely to receive envelope wages than employees of domestic firms (Gavoille and Zasova 2021). For the subsample of labour tax evading firms, we use those paying a suspiciously low wage to their employees. In practice, we estimate a wage equation for a subsample of employees, regressing their administrative wage on a large set of individual characteristics. We are then able to track firms whose employees are paid much lower than what we predict (typically, employees who are supposed to receive a fairly high wage but are actually paid at the minimum wage) and consider these firms as tax evaders.

Using this sample of firms, we train an algorithm (gradient boosting) to disentangle evading firms from compliant firms based on their balance sheets. As with any financial manipulation, income underreporting is likely to generate artefacts in financial statements.

Applying the model to the whole population of firms (with more than six employees and focusing on four sectors), we estimate that 37% of the companies, covering 24% of employees, are labour tax evaders over the 2011–2013 period. Of course, the classification is admittedly based on strong assumptions. A series of checks nevertheless validates the relevance of the classification. For instance, workers switching from an evading to a compliant firm benefit from a large official wage increase. When comparing the stated wage by Labor Force Survey respondents to their official wage, we observe a large positive discrepancy for employees of evading firms.

A conditional effect on employment?

Equipped with this binary firm-level classification, we study the impact of the minimum wage hike on firm-level employment, conditional on compliance. Following Machin et al. (2003) and Harasztosi and Lindner (2019), we estimate the relationship between the share of workers affected by the hike and the percentage change in employment before and after the reform. The idea is that not all firms are impacted by the minimum wage hike in the same way: some firms have a lot of workers affected by the hike; others have none. The interaction between the bite of the minimum wage hike and the tax-evasion indicator enables us to study whether tax-evading firms react differently from compliant firms. If envelope wages are indeed used as a shock absorber, we should observe that employment consequences are smaller for evading firms than for compliant firms.

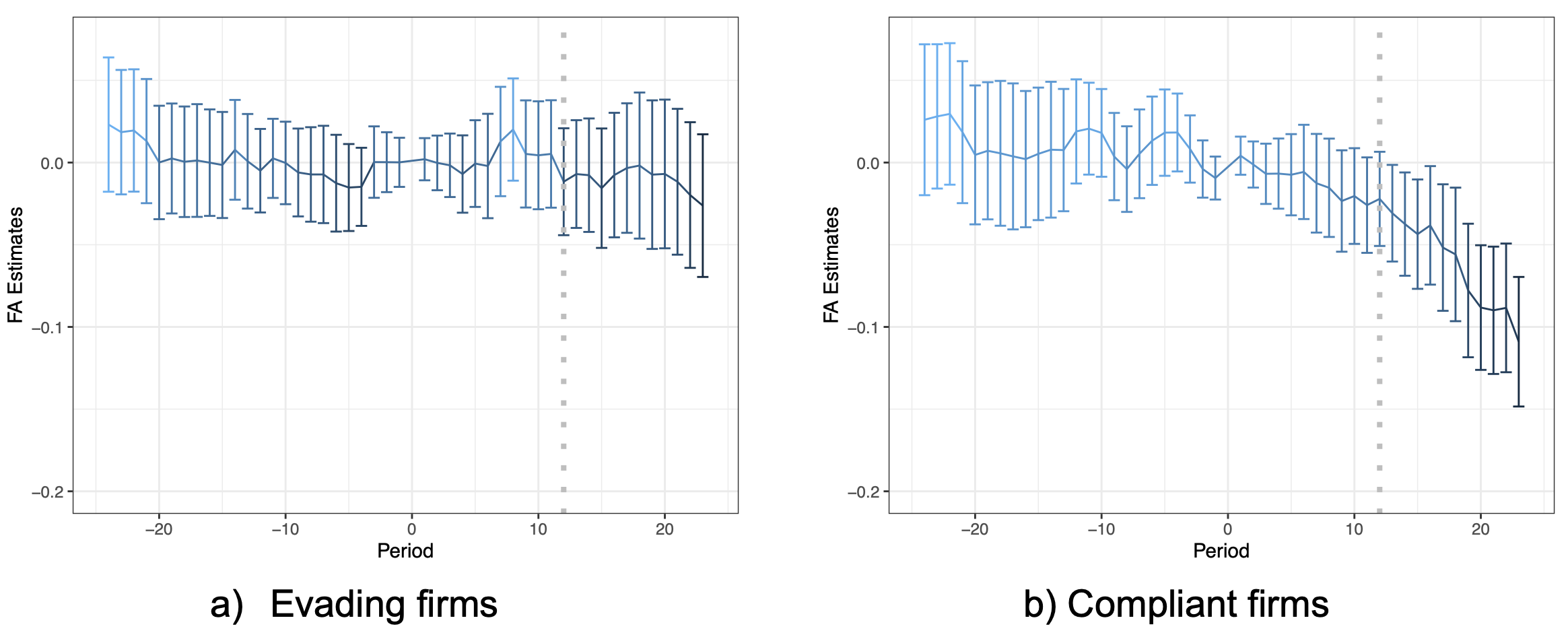

This is precisely what we observe. Figure 1 displays the (cumulative) employment effect between January 2013 (12 months before the minimum wage increase, period 0) and any other given month, for evading and compliant firms separately. In other words, it represents the difference in employment growth between a firm that has all its employees impacted by the hike, and a similar but not impacted firm. The dotted vertical lines indicate the introduction of the minimum wage increase. Tax-evading firms remained largely unaffected by the hike, the level of exposure to the minimum wage hike not being significantly related to changes in employment. At the same time, we find that a year after the reform, compliant firms employing only minimum wage workers had 11% lower employment growth than compliant firms with no workers affected by the policy. Our short-run estimates imply an employment elasticity with respect to the minimum wage for directly affected workers amounting to -1.01 for compliant firms and -0.35 for evading firms. This negative employment effect is driven by both the extensive (firm closure) and the intensive margins (hiring/firing decisions).

Figure 1 Employment effect of the minimum wage hikes

The difference in firm-reaction persists over time: three years after the minimum wage hike, employment in tax-evading firms remains insensitive to their initial level of exposure to the minimum wage shock, whereas employment growth in exposed compliant firms incurs a large decrease. At the same time, we show that average incomes similarly increase for exposed firms irrespective of type, as do average income tax and social security contributions. The minimum wage was de facto implemented, supporting the envelope wage conversion mechanism.

Conclusion

A trade-off emerges for policymakers in a context of widespread labour tax evasion: increasing the minimum wage has a positive effect on tax rules enforcement, helping to provide employees with social protection. This however comes at the cost of negatively affecting employment in tax-compliant firms exposed to the hike. To quantify this trade-off, we perform a simple back-of-the-envelope analysis which suggests that a year after the hike, the total number of employees is 1.5% lower than it would have been in the absence of the minimum wage increase. On the other hand, the actual aggregate wage bill is 0.5% larger than its counterfactual level, implying a modest positive fiscal effect (considering exclusively personal income tax and social security contributions). Note also that we document only short and medium-run partial equilibrium effects. One of the negative effects of labour tax evasion is a competition distortion. If raising minimum wage increases compliance, in the long run all compliant firms will benefit from a reduction in these distortions.

References

Ahlfeldt, G, D Roth and T Seidel (2022), “Optimal minimum wages”, VoxEU.org, 16 February.

DeBacker, J, T B Heim and A Tran (2015), “Importing corruption culture from overseas: Evidence from corporate tax evasion in the United States”, Journal of Financial Economics 117(1): 122–38.

Dustman, D, A Lindner, U Schӧnberg, M Umkehrer and P vom Berge (2021), “Reallocation effects of the minimum wage”, VoxEU.org, 7 October.

European Commission (2020), Special Eurobarometer 498: Undeclared work in the European Union.

Gavoille, N and A Zasova (2023), “What we pay in the shadows: Labor tax evasion, minimum wage hike and employment”, Journal of Public Economics (forthcoming).

Gavoille, N and A Zasova (2021), “Foreign ownership and labor tax evasion: Evidence from Latvia”, Economics Letters 207, 110030.

Harasztosi, P and A Lindner (2019), “Who pays for the minimum wage?”, American Economic Review 109(8): 2693–727.

Machin, S, A Manning, A and L Rahman (2003), “Where the minimum wage bites hard: Introduction of minimum wages to a low wage sector”, Journal of the European Economic Association 1(1): 154–80.

Manning, A (2021), “The Elusive Employment Effect of the Minimum Wage”, Journal of Economic Perspectives 35(1): 3–26.

Meer, J and J West (2013), “The minimum wage and employment dynamics”, VoxEU.org, 10 September.

Neumark, D, J Salas and W Wascher (2013), “Revisiting the Minimum Wage-Employment Debate: Throwing Out the Baby with the Bathwater?”, ILR Review 67(3): 608–48.

Putnins, T J and A Sauka (2015), “Measuring the shadow economy using company managers”, Journal of Comparative Economics 43(2): 471–490.

Tonin, M (2011), “Minimum wage and tax evasion: Theory and evidence”, Journal of Public Economics 95, 1635–51.