There are seemingly contradictory findings about the effect of social media on individual welfare (DellaVigna and La Ferrara 2015). On the one hand, existing work has found large user valuations for social media platforms, consistent with the large amount of time spent on these platforms (2.5 hours daily in the US, see Kemp 2022). In particular, the average social media user requires substantial monetary compensation to deactivate his/her individual account (Allcott et al. 2020, Mosquera et al. 2020). At the same time, recent research links social media to hate crimes (Müller and Schwarz 2021, Jiménez-Durán et al. 2022), misinformation (Allcott and Gentzkow 2017, Zhuravskaya et al. 2017, Acemoglu and Ozdaglar 2021), and adverse mental health (Braghieri et al. 2022), all of which meaningfully decrease consumer well-being.

In a new paper (Bursztyn et al. 2023), we show that social spillovers to non-users can explain facts that seem to be at odds with one another. Prior research has demonstrated that how an individual values a product changes based on the number of others who use the same product. People enjoy going to dinner more when they go with friends, and prefer watching a television show if those around them watch the same show. While this body of work focuses on the change in value an individual derives from others when they use a product, it generally ignores the impact that others’ use has when they don’t use the product. It’s possible that products like social media affect not only the utility of consumers, but also the utility of non-consumers. For example, not using social media can lead to actual social exclusion.

We test for these negative consumption spillovers to non-users and paint a more accurate picture of the welfare effects of social media. Our findings reveal that large shares of consumers who use Instagram and TikTok are worse off than if the platforms did not exist. We argue that a negative non-consumer surplus – the utility that someone derives from others’ consumption of a product when they themselves do not consume it – pushes up the cost of non-consumption, which explains why consumers can simultaneously have a large individual willingness to pay while wishing the product not to exist.

Experimental design and results

We design a large-scale experiment aimed at measuring consumer welfare in the presence of both network effects and consumption spillovers. Network effects capture the degree of complementarity between individual and others’ consumption, wherein the utility gain from product use increases with the number of other consumers who use it as well. Consumption spillovers to non-users, on the other hand, capture the extent to which non-user utility changes directly in response to others’ consumption, and works through mechanisms such as social exclusion and fear of missing out (FOMO).

Our experiment focuses on TikTok and Instagram and is administered to 1,000 college students. We begin by measuring the amount of money that users would accept to deactivate their accounts for four weeks, while keeping others’ social media use constant. This measure corresponds to the standard notion of ‘individual consumer surplus’ used in economics and in prior research on social media. We next measure how much users value their own accounts when other students at their university are asked to deactivate their accounts as well. Finally, we measure users’ preferences over the deactivation of accounts of all participating students, including themselves, which gives a welfare measure that accounts for consumption spillovers to non-users.

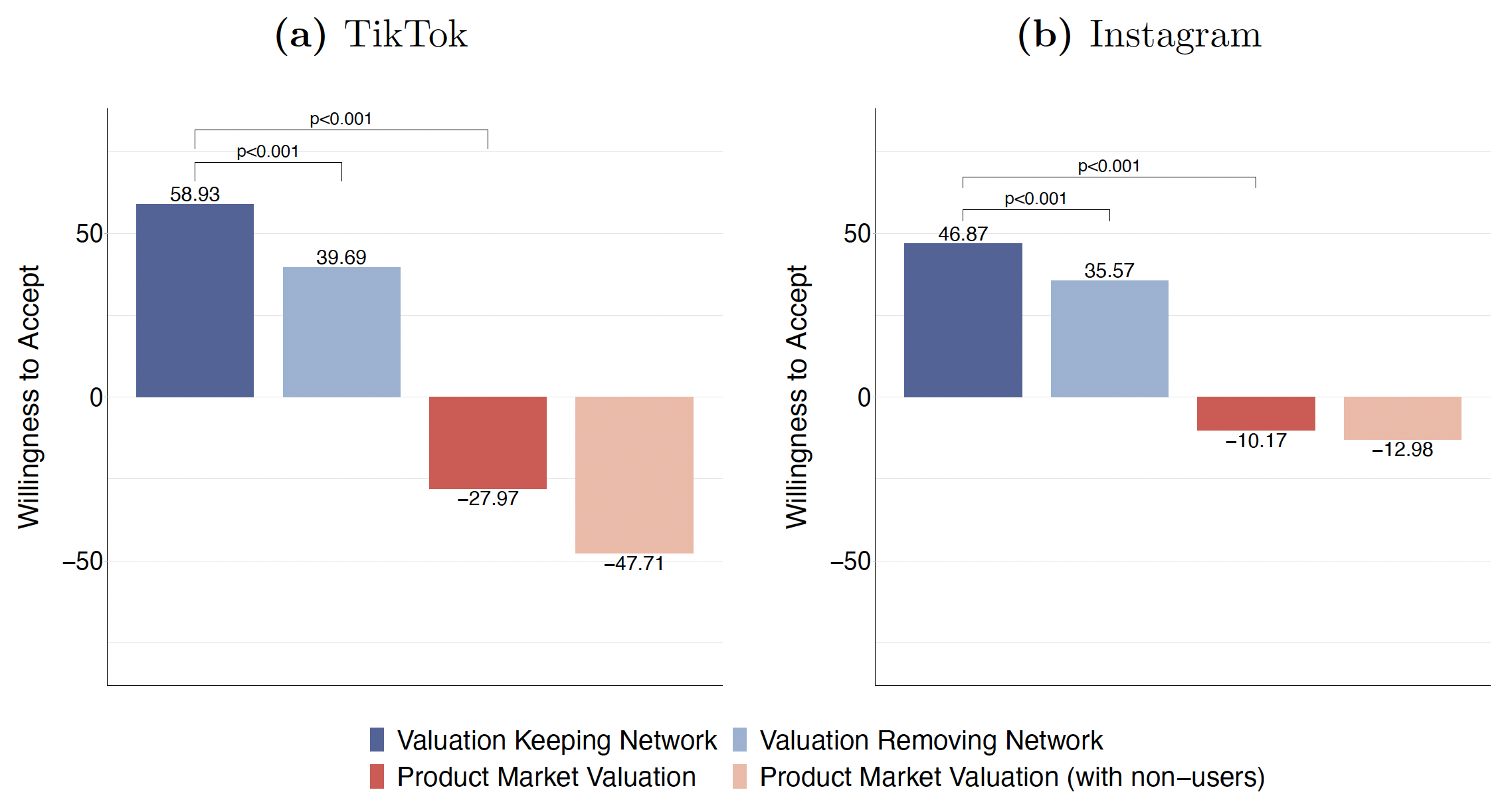

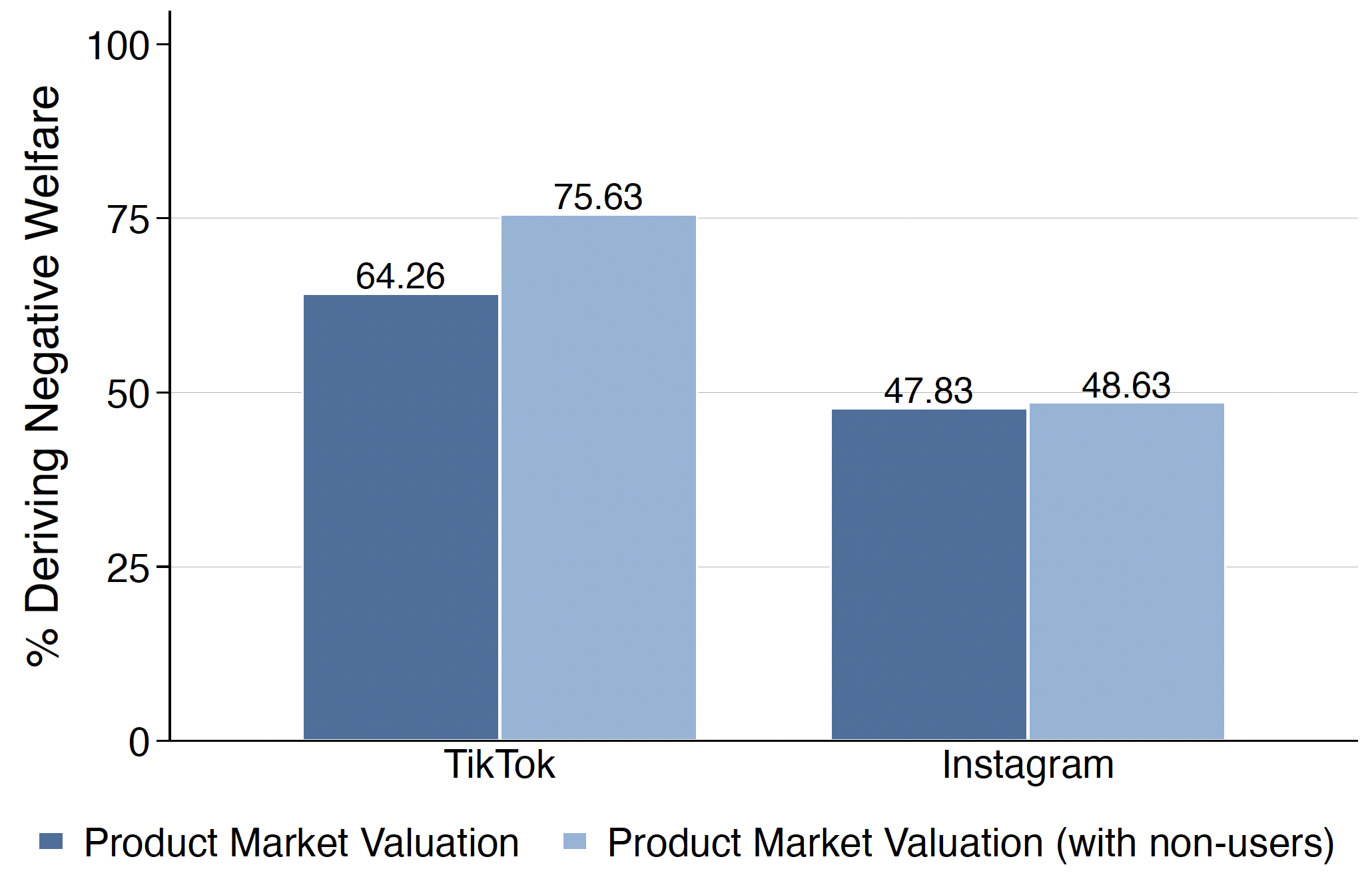

Our main results reveal a ‘product market trap,’ where a large share of consumers continue to use social media platforms despite deriving negative welfare from them. On average, users would need to be paid $59 to deactivate TikTok and $47 to deactivate Instagram. At the same time, users would be willing to pay $28 and $10 to have others, including themselves, deactivate TikTok and Instagram, respectively. Sixty-four percent of active TikTok users and 48% of active Instagram users experience negative welfare from the products’ existence; they find it individually optimal to use the product even if they would prefer it not exist. Finally, we provide evidence of positive network effects: users value TikTok and Instagram 33% and 24% less, respectively, when their peers deactivate their accounts compared to when they do not.

Figure 1 Consumer surplus across welfare measures

Notes: Figure 1 presents average valuations for the different welfare measures. Panel (a) presents the results for TikTok and Panel (b) presents the results for Instagram. The first three bars in each panel represent valuations exclusively for active users. The dark blue bar denotes Valuation Keeping Network; the light blue bar denotes Valuation Removing Network; the red bar denotes Product Market Valuation for users. The pink bar represents the average Product Market Valuation of active users and non-users. Respondents who agree with their elicited valuations and those who pass all of the attention checks are included. Reported p-values correspond to one-sided t-tests testing the null hypothesis that individual welfare estimates are lower than the aggregate welfare estimate.

Figure 2 Fraction with negative welfare across welfare measures

Notes: Figure 2 presents the percent of respondents with a negative Product Market Valuation across TikTok and Instagram. The dark blue bars represent exclusively active users and the light blue bars represent the active users and non-users. Respondents who agree with their elicited valuations and those who pass all of the attention checks are included.

FOMO markets

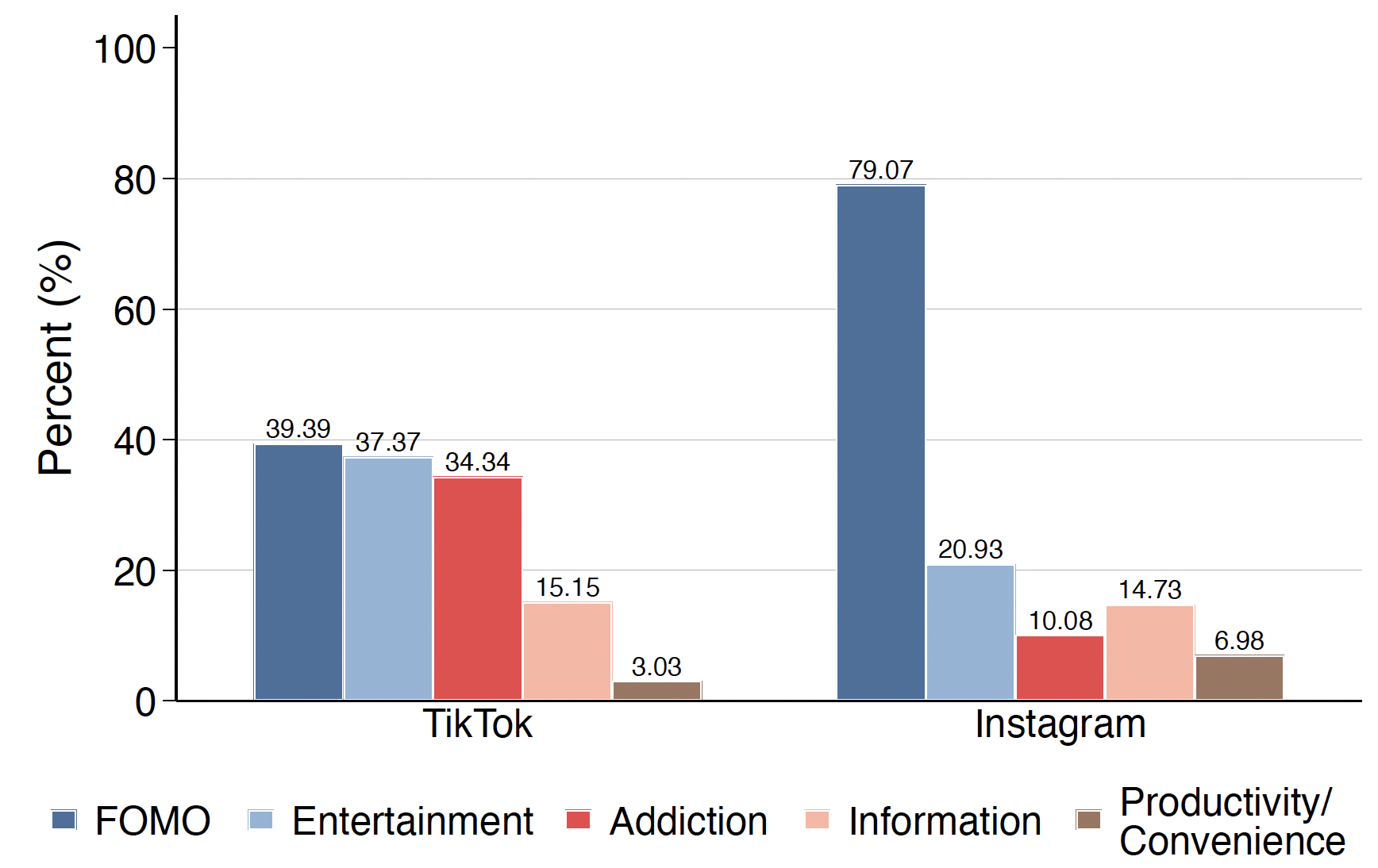

In additional survey questions, we show that large shares of active users of TikTok and Instagram would prefer to live in a world without these platforms. To understand why active users might prefer a world without social media, we asked them about their reasons for using the platforms. The primary motive, evident in both TikTok and Instagram users, is the fear of missing out. When queried about how they would feel if they alone had to deactivate their accounts, many expressed negative emotions, especially the fear of missing out. This data reinforces the importance of considering non-consumer surplus when evaluating the welfare effects of social media platforms. These spillovers to non-users may arise from anticipated social exclusion that would actually occur in case of deactivation, or from misperceptions or other psychological biases.

Figure 3 Motives for social media consumption despite a preference to live in a world without it

Notes: Figure 3 presents the fraction of respondents mentioning di↵erent motives in their open-ended responses. Active users who said that they prefer to live in a world without the platform were asked the following open-ended question: “You mentioned you would prefer to live in a world without [platform]. Why do you still use it?”. “FOMO” denotes responses mentioning the fear of missing out or related social concerns. “Entertainment” denotes responses mentioning the entertainment value of the platform. “Addiction” denotes responses indicating the addictive nature of the platform and self-control problems. “Information” denotes responses mentioning informational purposes such as following the news or keeping abreast of college events. “Productivity” denotes responses mentioning productivity benefits, such as using the platform for business purposes. Nonsensical responses are dropped from the analysis and the categorization of the open-ended answers is not mutually exclusive. Respondents who agree with their elicited valuations and those who pass all of the attention checks are included.

Product market traps in other domains

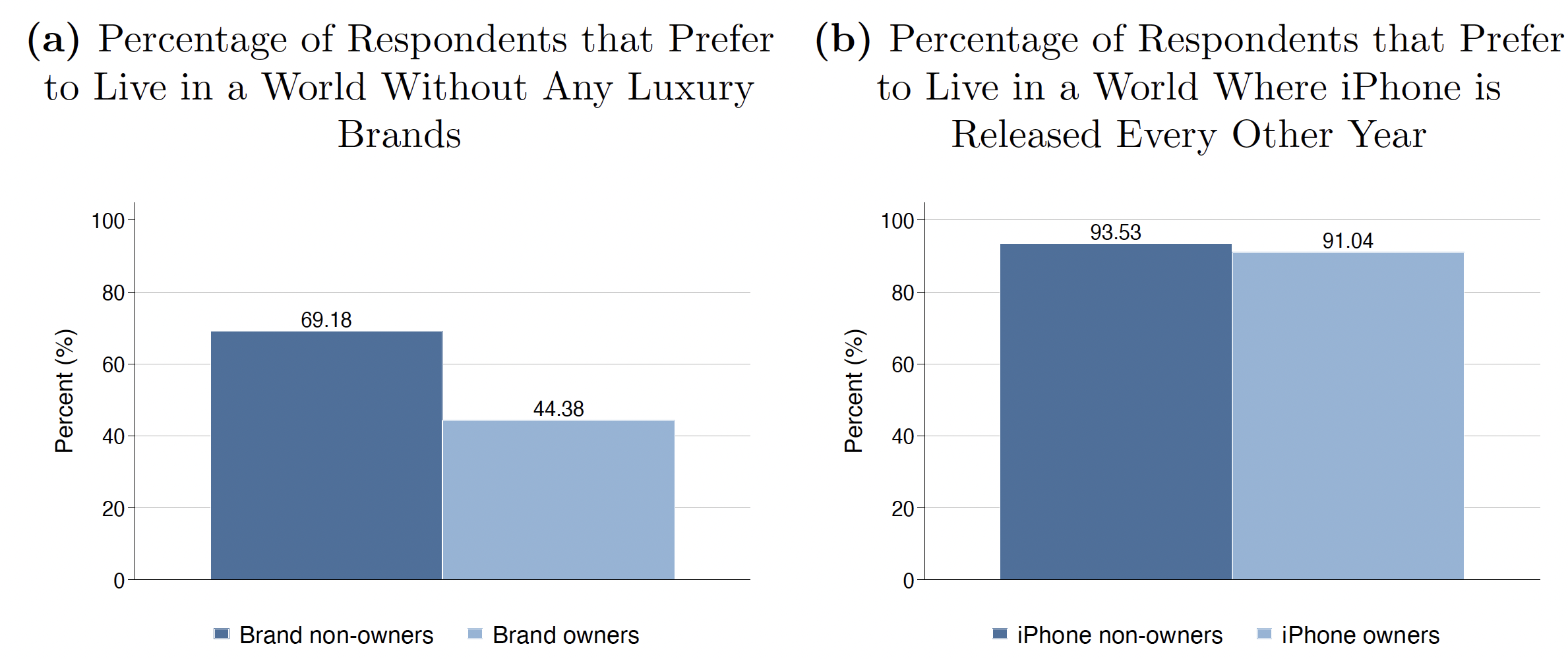

Building on these results, we explore whether product market traps exist in other domains. We field online surveys with consumers concerning their views on luxury goods, where positional externalities are a plausible driver of consumption spillovers to potential non-consumers (Frank 1985a, 2000, 2012). We find that among respondents who own luxury brands that they themselves bought (e.g. Gucci, Versace, Rolex), 44% prefer to live in a world without any of those brands altogether. Among respondents who do not own such brands, the fraction preferring to live in a world without them is 69%. Among iPhone owners, a striking 91% of respondents indicate that they would prefer Apple to release the iPhone every other year rather than every year. Among respondents who do not own iPhones, this fraction is even larger, at 94%. Taken together, these findings underscore the relevance of product market traps above and beyond social media.

Figure 4 Luxury and vintage goods

Notes: Panel (a) of Figure 4 displays the fraction of respondents preferring to live in a world without any luxury brands separately for brand owners and brand non-owners. Panel (b) displays the fraction of respondents that prefer to live in a world where Apple releases the new iPhone every other year rather than every year, separately for Phone owners and iPhone non-owners.

Implications

Our research challenges the standard argument that the mere existence of a product implies positive welfare for its consumers. Put differently, even though a product exists and is widely consumed does not necessarily mean that it’s beneficial to consumers. This suggests a heightened need to assess whether different products create traps for consumers and whether they generate positive welfare. For instance, large tech companies commonly use tools that might decrease non-consumer surplus, such as increasing the salience of being a non-consumer or tying together messaging apps and social media platforms and thus increasing the cost of not being a user. Platform economies of scale, which provide a basis for large platforms, are typically rationalised by positive user network effects. Our work shows that those economies of scale may also result from increasing non-user spillovers in platform size. If non-user spillovers are sufficiently large, this could provide an economic basis for reigning in platform sizes, on top of more traditional concerns related to market power and advertiser pricing.

References

Acemoglu, D and A Ozdaglar (2021), “Misinformation: Strategic sharing, homophily, and endogenous echo chambers”, VoxEU.org, 30 June.

Allcott, H, L Braghieri, S Eichmeyer and M Gentzkow (2020), “The welfare effects of social media”, American Economic Review 110(3): 629–76.

Allcott, H and M Gentzkow (2017), “Social media and fake news in the 2016 election”, Journal of Economic Perspectives 31(2): 211–36.

Braghieri, L, R E Levy and A Makarin (2022), “Social media and mental health”, VoxEU.org, 22 July.

Bursztyn, L, B R Handel, R Jimenez and C Roth (2023), “When Product Markets Become Collective Traps: The Case of Social Media”, NBER Working Paper 31771.

DellaVigna, S and E La Ferrara (2015), “Economic and social impacts of the media”, VoxEU.org, 28 July.

Frank, R H (1985), “The demand for unobservable and other nonpositional goods”, American Economic Review 75(1): 101–116.

Frank, R H (2000), Luxury Fever: Money and Happiness in an Era of Excess, Princeton University Press.

Frank, R H (2012), The Darwin Economy, Princeton University Press.

Jiménez-Durán, R, K Müller and C Schwarz (2022), “The Effect of Content Moderation on Online and Offline Hate”, VoxEU.org, 23 November.

Mosquera, R, M Odunowo, T McNamara, X Guo and R Petrie (2020), “The economic effects of Facebook”, Experimental Economics 23, 575–602.

Müller, K and C Schwarz (2021), “Fanning the flames of hate: Social media and hate crime”, Journal of the European Economic Association 19(4): 2131–67.

Zhuravskaya E, S Guriev, E Henry and O Barrera (2017), “Fake news and fact checking: Getting the facts straight may not be enough to change minds”, VoxEU.org, 2 November.