The recent escalation in the accumulation of international reserves has sparked considerable discourse in the realm of international economics, despite it not being an entirely novel phenomenon (Arce et al. 2019). Typically, the cost-benefit model is applied to discern the relationship between fluctuations in international reserves and various macroeconomic indicators, including exchange rate intervention policies, real exchange rates, and commodity terms of trade shocks (Aizenman et al. 2008, Korinek and Serven 2016, Ahmed et al. 2023). International reserves are often viewed as a self-insurance mechanism, providing a buffer against external financial shocks. However, it is crucial to acknowledge that maintaining international reserves is not without cost, and while policymakers are keen on utilising this tool to mitigate external financial shocks, it necessitates careful consideration and strategic management (Obstfeld et al. 2008).

Our work (Aizenman et al. 2023) sets itself apart from existing literature in two significant ways. Firstly, it goes deeper into the characteristics of diverse country groups, providing a disaggregated view that goes beyond the global sample used for baseline analyses. This approach allows for a nuanced understanding of the varying impacts on advanced and developing economies, acknowledging that emerging countries are particularly susceptible to terms-of-trade shocks due to the nature of their exports. Secondly, we introduce a threshold approach, extending the current understanding of the nonlinear relationship between international reserves and real exchange rates. By integrating additional macroeconomic indicators and examining thresholds under various constraints, this column offers a comprehensive analysis that aids policymakers in navigating the intricate macroeconomic landscape, encouraging cautious and informed intervention strategies.

Effective terms of trade and international reserves

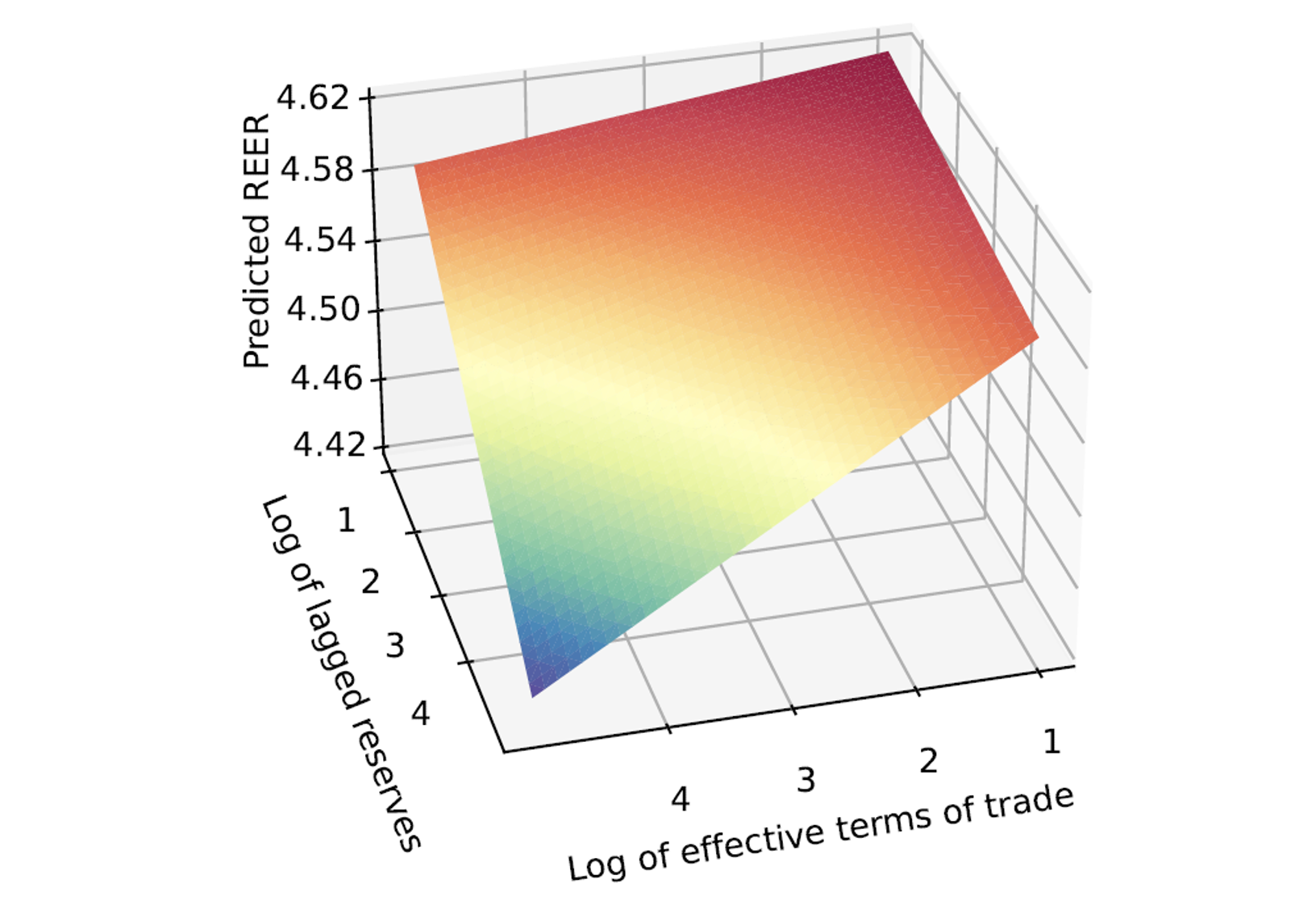

In the provided three-dimensional plot, we illustrate the complex relationship between effective terms of trade and lagged international reserves. This visual tool is essential for understanding the nuances of the interaction between two continuous variables, as it can be challenging to interpret the influence of one explanatory variable (effective terms of trade) at different levels of another explanatory variable (lagged level of reserves) on the real exchange rate. From the plot, we observe that the impact of terms of trade shocks is more significant in countries with a lower level of reserves, highlighted by the red areas. In contrast, the effect of trade shocks is mitigated in countries with higher reserve levels, indicated by the blue areas. The graphical representation provided proves to be a crucial asset for policymakers, as it vividly demonstrates the varying impacts that different quantities of international reserves can have on a nation's susceptibility to trade shocks. This visual aid makes the complex dynamics between the effective terms of trade and lagged international reserves more comprehensible, enhancing the policymakers’ ability to make well-informed decisions. The findings from this analysis highlight the necessity of adeptly managing international reserves, advocating for a judicious and enlightened strategy to fortify the nation’s economic fortitude and mitigate the detrimental repercussions of external shocks on the real exchange rate. By understanding the intricate relationship depicted in the graph, policymakers are better equipped to implement policies that ensure stability and reduce vulnerability in the face of trade-related disturbances.

Figure 1 The buffer effect based on three dimensions

Notes: Regions highlighted in blue signify a more robust buffer effect, meaning there is a greater dampening of real exchange rate appreciation following a terms-of-trade shock when reserve levels are elevated. Our regression analyses incorporate fixed effects for each year. Notably, the outcomes remain consistent even in the absence of these year-fixed effects. The results are similar when we use lagged or present values for all the explanatory variables.

Understanding the threshold for the policy implications

Previous research has suggested that holding foreign reserves can dampen the magnitude of exchange rate fluctuations due to capital flow movements, indicating a potential mitigation effect. Therefore, we anticipate a stronger buffer effect beyond a certain reserve threshold, which we aim to estimate from our data. Beyond this threshold, we expect the coefficient for the buffer effect to be negative. The results from the threshold regression analysis in Aizenman et al. (2023) provide a nuanced understanding of how the buffer effect of international reserves on exchange rate adjustments varies across different regions and levels of reserves.

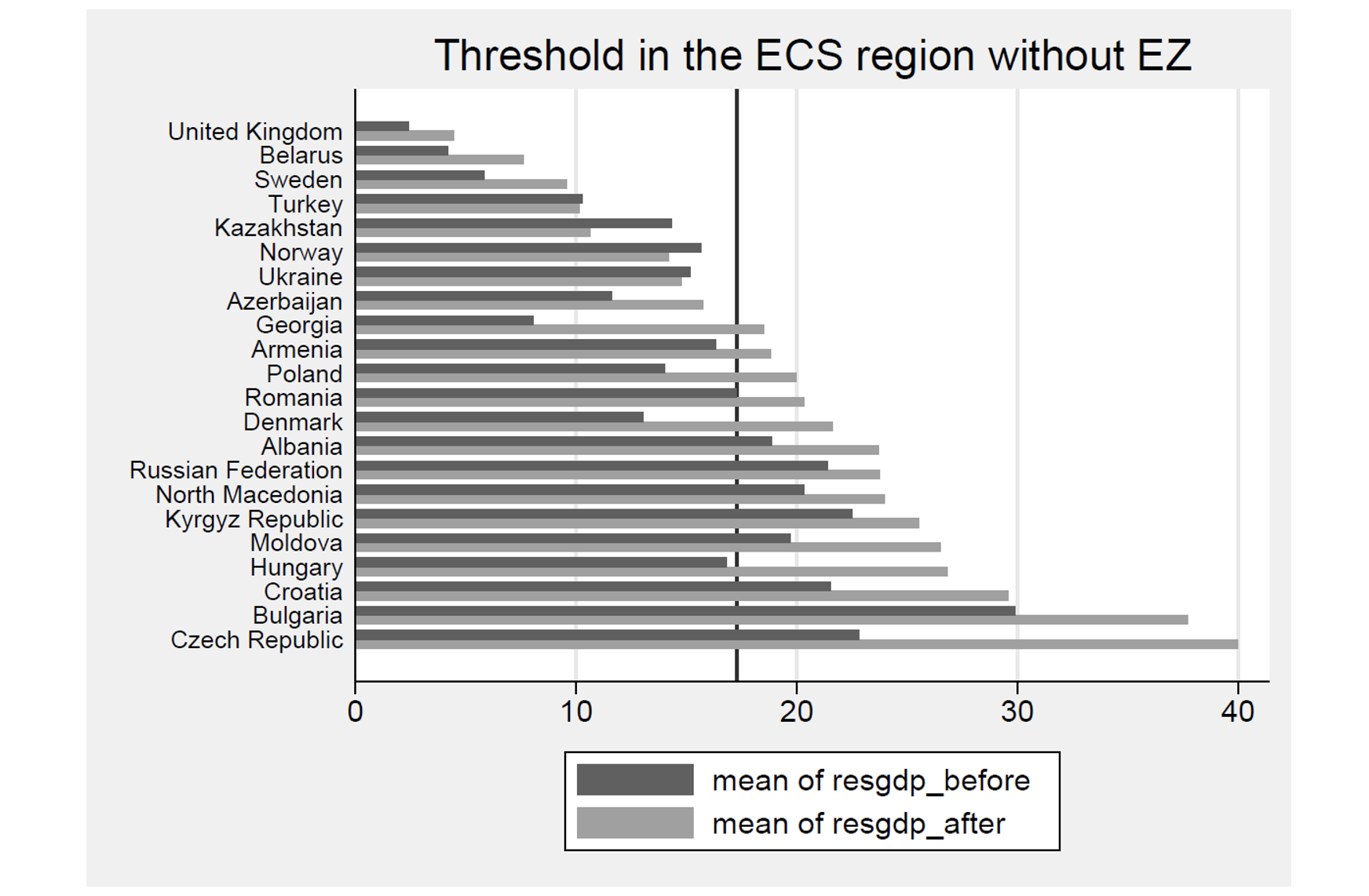

In the regions of Europe and Central Asia, as well as East Asia, Pacific, and South Asia, the analysis reveals a stronger buffer effect once international reserves surpass a certain threshold. Specifically, in the Europe and Central Asia region, this threshold is pinpointed at 17.28% of international reserves. This suggests that for observations – spanning different countries and time periods – that have international reserves exceeding 17.28%, there is a discernible and statistically significant buffer effect. This contrasts with scenarios where reserves are at or below this threshold. A notable trend observed in Figure 2 highlights that a considerable number of emerging and developing countries in the Europe and Central Asia region maintain an average international reserve holding above this critical threshold, particularly in the aftermath of the Global Crisis. This indicates a strategic shift, with countries like Hungary, Croatia, Bulgaria, and the Czech Republic substantially increasing their reserves after the euro area crisis, highlighting a heightened sense of caution and preparedness (Cheung et al. 2020, Bussière et al. 2015).

Figure 2 Threshold effect in the ECS region

Notes: We employ a subset of emerging and developing countries from the ECS region to juxtapose the identified threshold value (17.28% of GDP) in this area with the trajectory of international reserves holdings (average value) across the periods before and after the Global Crisis (GC).

Conversely, the regions of Latin America and the Caribbean (LAC), as well as the Middle East and North Africa (MENA), depict a different story. Here, the accumulation of international reserves generally falls below the threshold required for effective mitigation of real exchange rate fluctuations. Our analysis shows that the buffer effect's coefficient is negative before reaching the threshold and turns non-significant afterwards. This pattern indicates that in these regions, the level of international reserves held is not sufficient to activate the protective buffer effect, potentially leaving their economies more susceptible to exchange rate instabilities. These regional disparities underscore the critical importance of strategic reserve management, tailored to the unique economic and financial realities of each region, to enhance economic resilience and safeguard against exchange rate volatilities.

We offer insight into how different levels of financial development and openness can influence a country's response to positive term-of-trade shocks and their subsequent impact on the real exchange rate. In instances where countries exhibit a low level of financial development, the repercussions on real exchange rate appreciations tend to be more contained, revealing a modest buffer effect in these scenarios. Conversely, for countries with an intermediate level of financial openness, and potentially lower financial development, the impact on real exchange rate appreciations tends to be more pronounced. This situation highlights a significant buffer effect, supporting the hypothesis that countries utilise international reserves as a safeguard against the adverse effects of terms-of-trade shocks. On the other end of the spectrum, countries with high financial openness seem to experience more limited consequences from positive terms-of-trade shocks. Interestingly, we do not observe a buffer effect in this category, suggesting that these countries, typically characterised by advanced financial systems, are able to mitigate the effects of terms-of-trade shocks on their exchange rates through their financial infrastructures.

Conclusion

The primary objective of this column was to gain insights into the implications of maintaining international reserves in open economies. Our findings, particularly during the 2000s and 2010s, indicate that increased international financial integration did not lead to a reduction in the accumulation of reserves. Instead, it appears that international reserves serve as a substitute for the presence of robust financial institutions. Consequently, an alternative policy approach could involve focusing on the development of sound financial institutions as a means to reduce the reliance on accumulating international reserves (Folkerts-Landau et al. 2022).

References

Ahmed, R, J Aizenman, J Saadaoui and G S Uddin (2023), “On the Effectiveness of Foreign Exchange Reserves During the 2021-22 US Monetary Tightening Cycle”, Economics Letters 233(12): 111367.

Aizenman, J, S H Ho, L D T Huynh, J Saadaoui and G S Uddin (2023), “Real exchange rate and international reserves in the era of financial integration”, NBER Working Paper 30891.

Aizenman, J and D Riera-Crichton (2008), “Real exchange rate and international reserves in an era of growing financial and trade integration”, The Review of Economics and Statistics 90(4): 812-815.

Arce, F, J Bengui and J Bianchi (2019), “A macroprudential theory of foreign reserve accumulation”, NBER Working Paper 26236.

Bussière, M, G Cheng, M D Chinn and N Lisack (2015), “For a few dollars more: Reserves and growth in times of crises”, Journal of International Money and Finance 52: 127-145.

Cheung, Y W, S Steinkamp and F Westermann (2020), “Capital flight to Germany: Two alternative measures”, Journal of International Money and Finance 102: 102095.

Folkerts-Landau, D, P Garber and M Dooley (2022), “Seizures of foreign exchange reserves will not weaken the dollar’s role as dominant reserve currency”, VoxEU.org, 12 May.

Korinek, A and L Serven (2016), “Undervaluation through foreign reserve accumulation: Static losses, dynamic gains”, Journal of International Money and Finance 64: 104-136.

Obstfeld, M, J Shambaugh and A Taylor (2008), “Reserve accumulation and financial stability”, VoxEU.org, 11 Oct.