The macroeconomic implications of zombie firms returned to the forefront of the public debate during the Covid-19 pandemic, as concerns emerged that unprecedented public support to firms may have helped zombie firms stay afloat, thus delaying a necessary creative destruction process. The existence of zombie firms is not a new phenomenon, dating back to Japan’s lost decade starting in the 1980s, a period when lending to unproductive and unviable firms played a key role in amplifying the economic stagnation by misallocating capital away from the most productive firms (Peek and Rosengren 2005, Caballero et al. 2008, Giannetti and Simonov 2013). Similar findings have been found during the 2010s European sovereign debt crisis, when weak banks ‘kicked the can down the road’ by evergreening zombie loans (Storz et al. 2017, Acharya et al. 2020, Blattner et al. 2023).

What is special about the current environment is that zombification has been increasing over time, particularly since the global crisis and the Covid-19 pandemic. Furthermore, the current context of rapidly tightening financial conditions creates additional challenges for the healthy firms competing with zombie firms. In a new paper (Albuquerque and Iyer 2023) we build a novel dataset on global zombie firms to assess and compare the incidence of zombification between listed and private firms for a large set of advanced and emerging markets. Although we find that the increase in the number of zombie firms does not bode well for the global recovery, we also find that strengthening the banking sector, tightening macroprudential policies, and developing insolvency regimes can help to mitigate the congestion effects from zombie firms.

The rise of nonfinancial zombie firms worldwide

In perfectly competitive markets, unproductive and unviable zombie firms would exit the market, allowing healthy firms to operate more efficiently, while promoting the entry of new productive firms. But, as the literature has documented, misaligned incentives on the part of lenders (banks, investors, or governments) allow zombie firms to avoid immediate default (Caballero et al. 2008).

We use balance sheet data from S&P Compustat for listed firms in 63 countries (32 emerging markets and 31 advanced economies) over 2000-2021, and the Bureau van Dijk ORBIS dataset for private firms, covering 43 countries (26 advanced economies and 17 emerging markets) over 1997-2020.

Although zombie firms are not directly observable in the data, the literature has come up with several definitions, ranging from a concept of subsidised interest rates from lenders (Caballero et al. 2008, Acharya et al. 2019), to old firms that do not generate enough operating revenues to meet their interest payment obligations (McGowan et al. 2018), and combined with lack of growth opportunities (Banerjee and Hofmann 2022), or to distressed firms with negative sales growth (Favara et al. 2022).

In this column, we identify zombie firms with three balance sheet indicators, similarly to Favara et al. (2022), which capture firms that are most likely in financial distress and are persistently unprofitable (Albuquerque and Iyer 2023). Zombie firms have an interest coverage ratio (ICR) below one, their leverage ratio is above the median firm in the same industry, and they have experienced negative real sales growth. These indicators need to persist for at least two consecutive years to minimise misclassification from cyclical fluctuations. Our definition strikes a good balance between being simple and easy to implement for both listed and private firms, but still being able to serve as a reasonable approximation for the universe of zombie firms relative to other definitions in the literature.

Our definition does not rely on a subsidised interest rate concept from Caballero et al. (2008). While this may have been applicable in the Japanese context during the 80s/90s, recent literature has argued that it may be challenging to identify zombies based on financing conditions more favourable than high-rated firms (Kulkarni et al. 2021, Banerjee and Hofmann 2022, Faria-e-Castro et al. 2022): (i) the low-interest rate environment, which characterised most of the period over the last two decades, would imply banks charging zero or even negative interest rates to zombie firms, which seems unlikely and (ii) while it is plausible that banks may offer lower interest rates to zombies than what banks’ credit risk models would suggest (based on zombies’ balance sheets), it is still likely that banks would charge higher interest rates than those offered to high-rated firms.

We find that zombie firms are typically characterised by substantially weaker balance sheets than non-zombies within the same industry and country. For instance, zombie firms exhibit lower total factor productivity (TFP), are less profitable, invest less, hold limited liquid assets, tend to be smaller, are at higher risk of default, and are more dependent on bank loans.

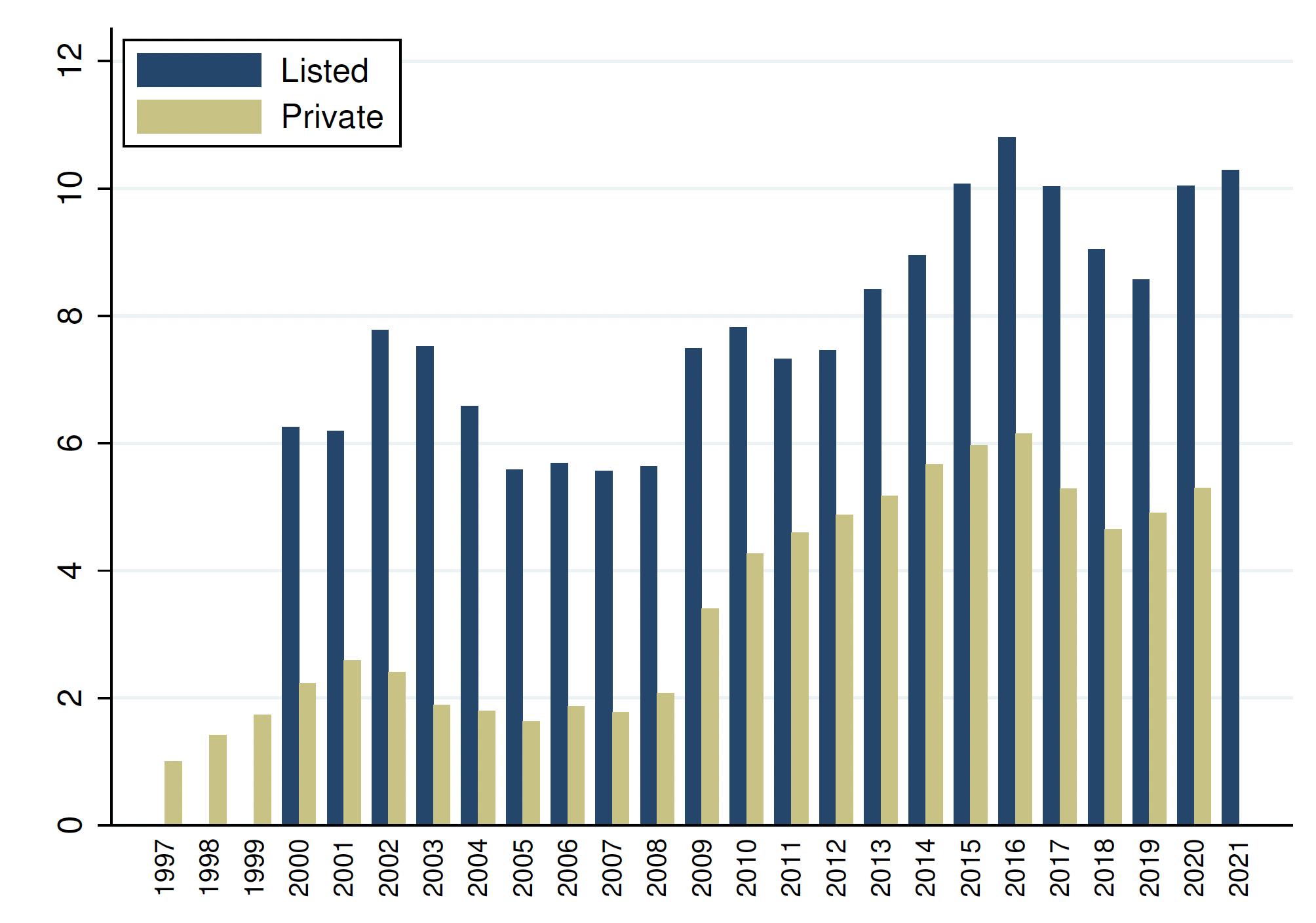

Figure 1 shows several interesting patterns. First, the share of zombie firms for both listed and private firms has increased steadily over the last two decades, especially evident after the global crisis. This was possibly motivated by a prolonged period of low interest rates, ample liquidity, and ‘search-for-yield’ behaviour. Zombie firms account for over 10% of all listed firms in 2021, and for 5.3% of all private firms in 2020. Second, after the temporary downward trend from 2016, the share of zombie firms picked up again since the Covid-19 pandemic, presumably on account of the unprecedented policy support and easy financing conditions. Third, the incidence of zombification is smaller among private firms. This surprising result is likely explained by the substantially higher exit rates of private firms compared to those of listed firms (Albuquerque and Iyer 2023). Our conjecture is that (i) weak private firms are more likely to exit the market than weak listed firms and (ii) private zombie firms tend to exit the market at a faster pace than listed zombies. These two forces lead to an overall lower zombification rate among private firms.

Figure 1 Share of zombie firms for listed and private firms

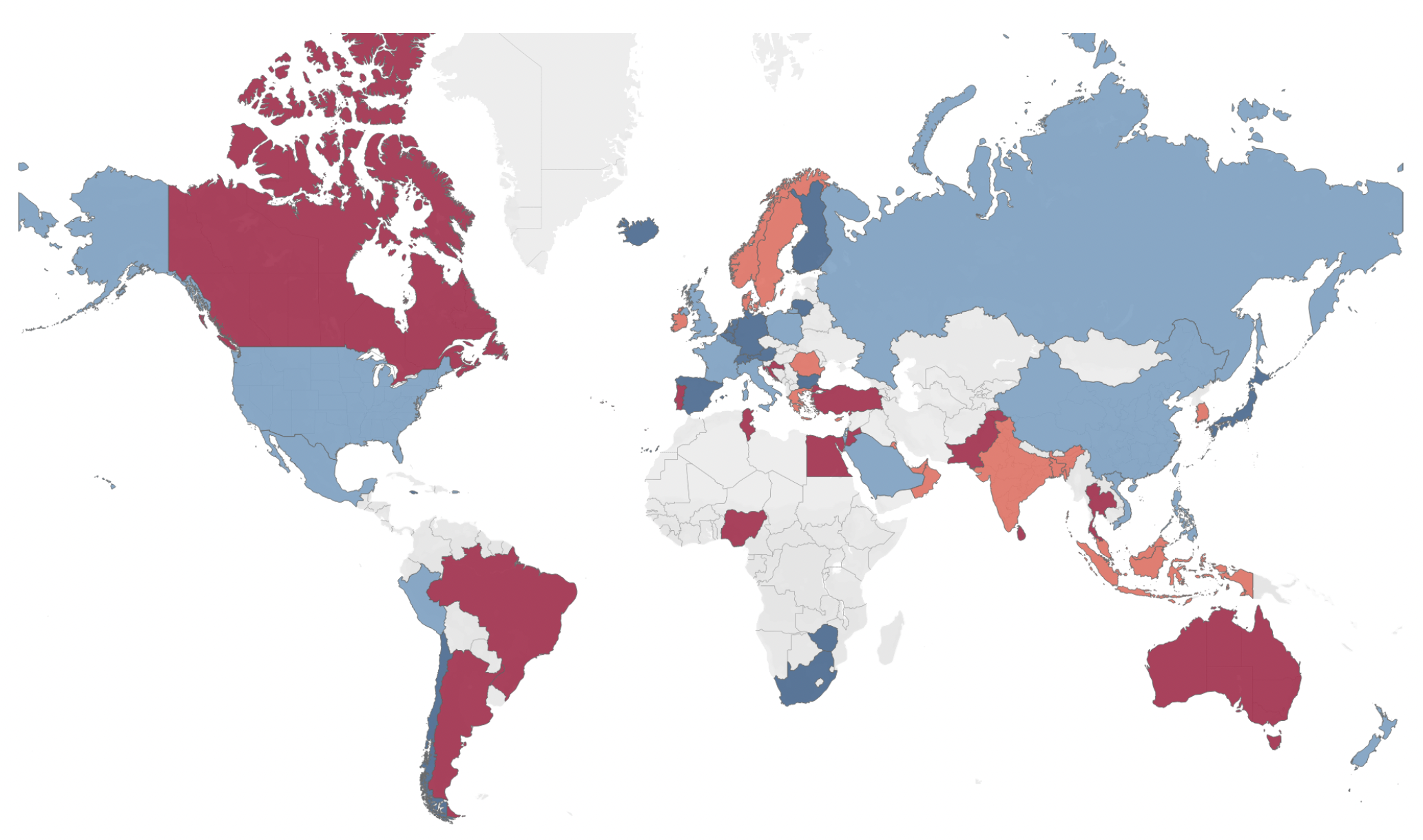

Zombie shares vary widely across countries (Figure 2): we show in the paper that zombification tends to be more prevalent in countries with a looser macroprudential stance, less-prepared corporate insolvency frameworks, weaker GDP growth, and lower interest rates. Zombie firms are more prevalent in non-tradable industries, such as in real estate, energy sector, information technology, materials, and consumer discretionary, industries which tend to be more financially vulnerable, less productive, experience more credit-fuelled booms, and face weaker growth opportunities (Albuquerque 2023, Müller and Verner 2023).

Figure 2 Share of listed zombie firms in 2021

Notes: Dark (light) blue colours refer to the first (second) quartiles of the country zombie shares in 2021, and orange (red) colours to the third (fourth) quartiles.

Zombie firms affect healthy firms’ financial performance through both the extensive and intensive margins

It is well-understood that the presence of zombie firms generates important negative congestion effects on healthy firms, weighing on their productivity and growth (Peek and Rosengren 2005, Caballero et al. 2008, McGowan et al. 2018, Acharya et al. 2019, Banerjee and Hofmann 2022). We add to this literature by first tracing out the dynamics of congestion effects over time, to assess the medium-term effects and not only the short-term ones as done in the related literature. Second, we extend the analysis of congestion effects to non-zombies’ credit conditions. Third, we explore congestion effects also through the extensive margin, i.e. the probability of firms exiting or entering sectors populated with zombie firms.

We regress firms’ balance sheet indicators on an interaction term between a non-zombie dummy and the asset-weighted industry zombie share (Caballero et al. 2008). The coefficient on this variable indicates the change in the non-zombies’ performance of a given indicator relative to zombies as the share of zombie firms increases in each country-industry pair. We add firm fixed effects to control for permanent differences between firms, and country-sector-time fixed effects to absorb all country-industry time-varying shocks that may differentially affect firms. We also include firm-specific control variables.

We find strong statistical evidence of congestion effects to non-zombies as the industry share of zombies increases, for both listed and private firms. Healthy firms in industries with a higher share of zombie firms experience a reduction in their investment growth, employment, sales, and total factor productivity relative to zombie firms in the same industry. We also find that congestion effects have become more prominent since the global crisis, suggesting that deep recessions accompanied by financial crises, together with substantial fiscal and monetary support, may have played a role in amplifying the negative congestion effects (McGowan et al. 2018, Banerjee and Hofmann 2022).

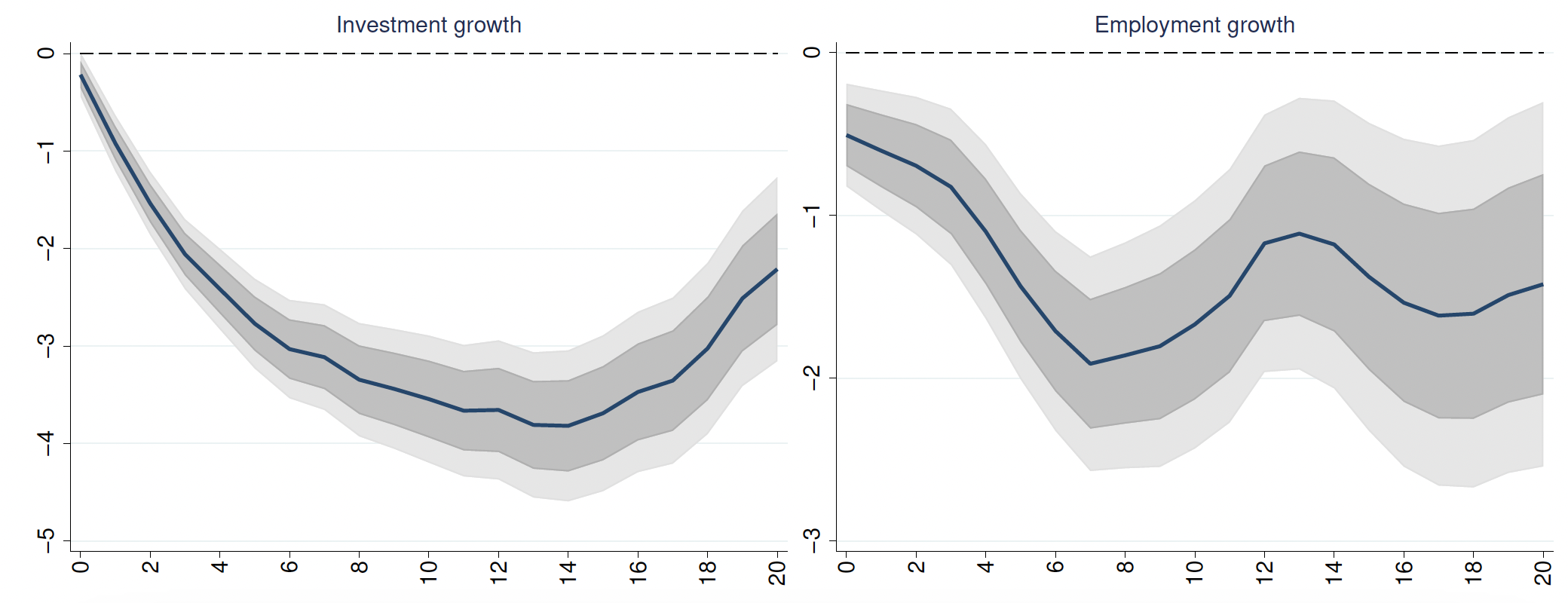

We find that congestion effects are quite persistent over time: healthy firms that operate in industries with a one-standard deviation higher zombie share experience on average investment growth up to four percentage points lower and employment growth up to two percentage points lower over the medium term, which is economically important (Figure 3). Overall, by not exiting the market, the survival of zombie firms reduces the profits, investments, and growth opportunities of healthy firms.

Figure 3 Dynamics of non-zombies’ investment and employment in industries with a higher zombie share

A) Listed firms

B) Private firms

Notes: Cumulative impulse responses over 20 quarters (Panel A) and over five years (Panel B) of non-zombies’ investment and employment growth to a one-standard deviation increase in the industry asset-weighted share of zombie firms. The blue line is the average response, and dark (light) grey areas the associated 68% (90%) confidence bands.

What is less discussed in the literature is the effect of zombies on credit conditions for the healthy firms. One of the exceptions is Andrews and Petroulakis (2019), who find that credit is less available for healthy firms that operate in industries with a higher share of zombie firms in four EU countries between 2009 and 2013. We expand on this in our sample, using the change in the real stock of debt as a proxy for credit growth, to find that congestion effects also materialise as lower credit for healthy listed and private firms, in line with banks’ incentives to evergreen zombie loans.

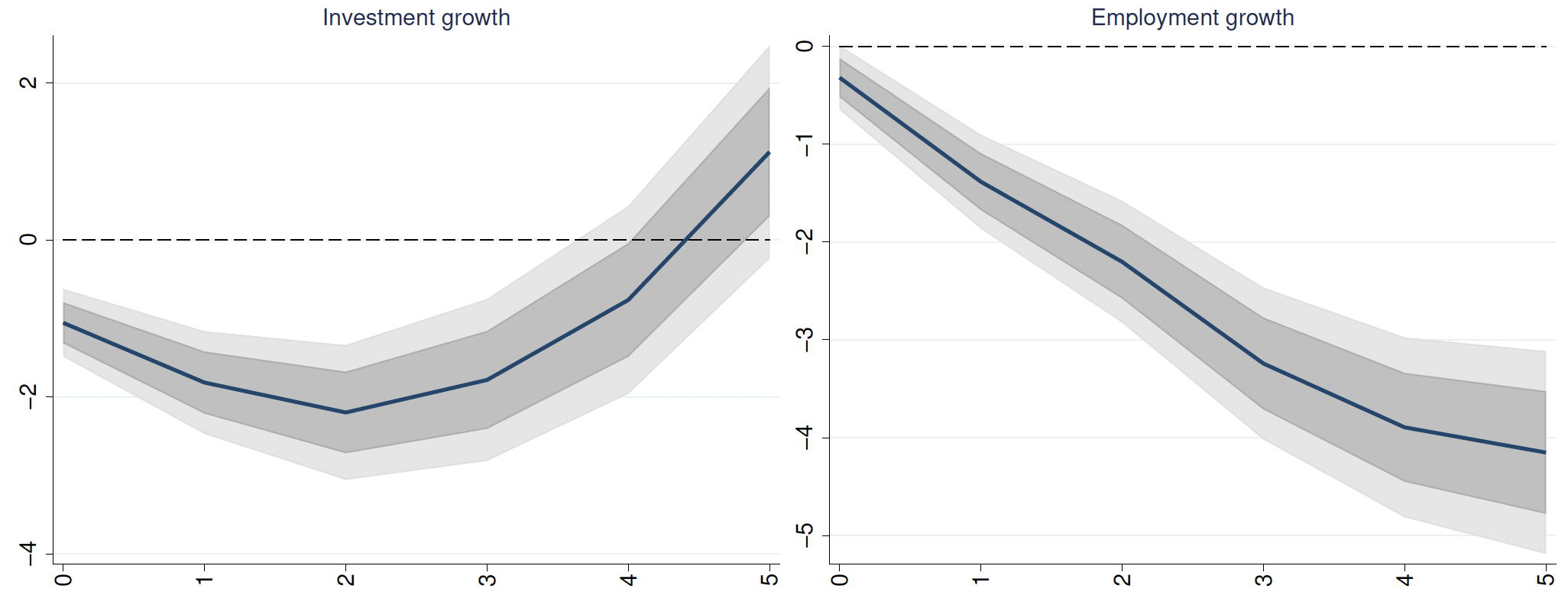

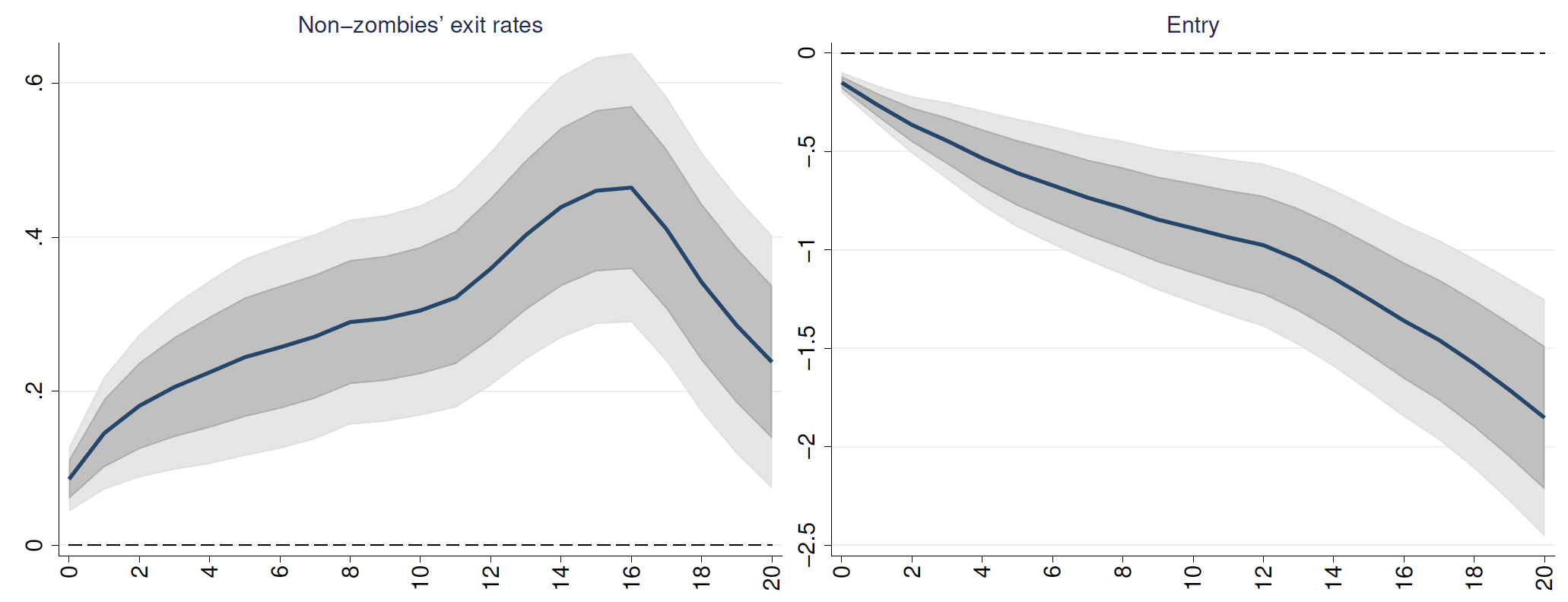

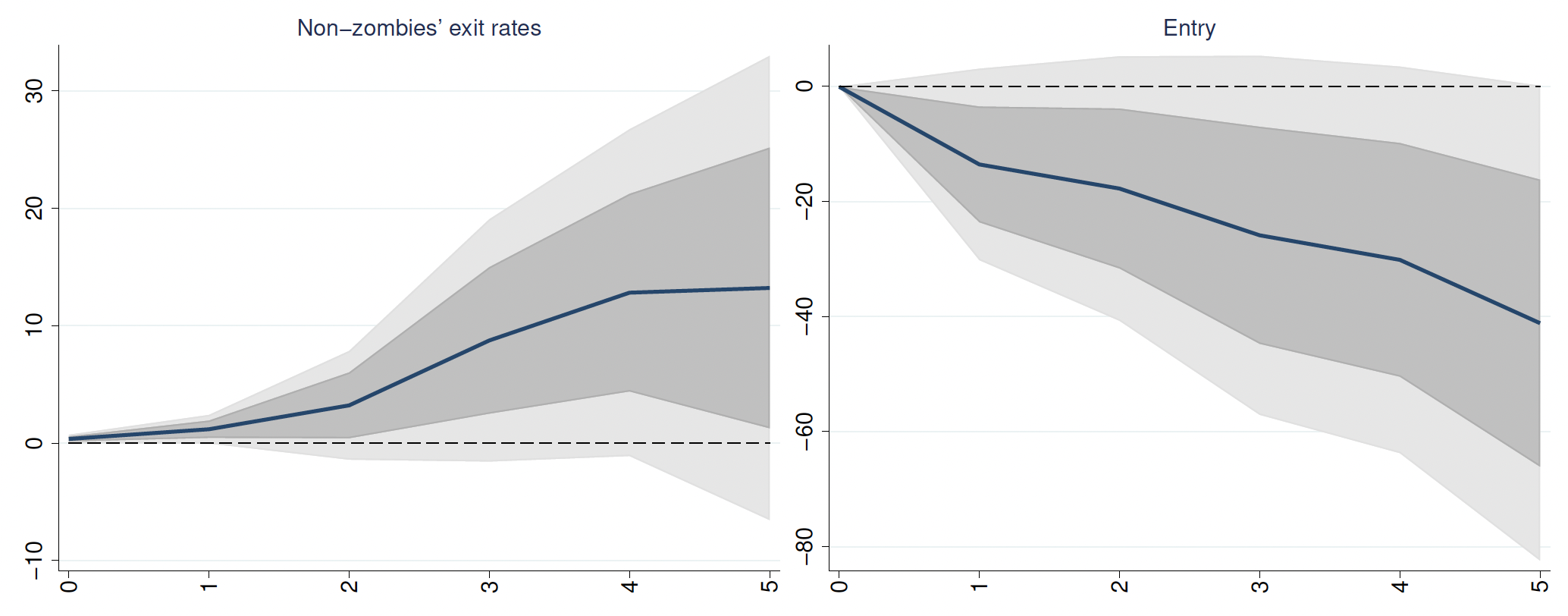

While these effects along the intensive margin are important, we also document non-negligible congestion effects through the extensive margin. Aggregating the data at the industry level, we show that industries with a greater share of zombie firms tend to affect the industries’ creative destruction process (Figure 4). Firm entry rates tend to be lower and healthy firms exit rates tend to be higher, as non-zombie firms may need to clear a higher productivity threshold to compensate for depressed market prices and high wages.

Figure 4 Congestion effects: Exit and entry rates at the industry-country level

A) Listed firms

B) Private firms

Notes: Cumulative impulse responses over 20 quarters (Panel A) and over five years (Panel B) of non-zombies’ exit rates and entry rates of all firms to a one-standard deviation increase in the industry asset-weighted share of zombie firms. Blue lines and dark (light) grey areas refer to the average response of exit and entry rates and associated 68% (90%) confidence bands.

Stronger regulatory frameworks help mitigate zombie practices

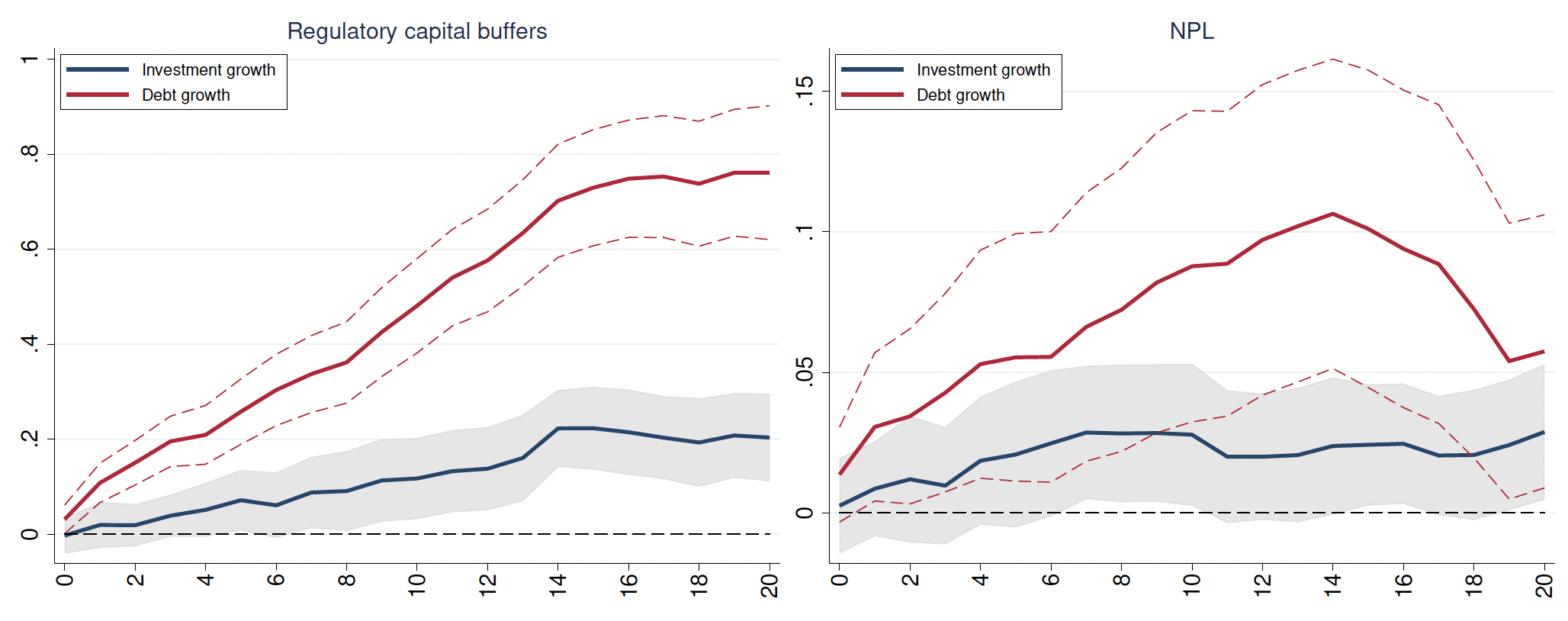

We draw on the literature that has argued for tighter bank supervision and regulation to improve the health of the banking sector (Giannetti and Simonov 2013, Acharya et al. 2020, Blattner et al. 2023). We indeed find that non-zombies that operate in countries with high regulatory capital buffers and low non-performing loans (NPLs) tend to experience smaller falls in investment and debt growth relative to zombies in the same country and sector (Figure 5). Increasing banks’ capital buffers by one standard deviation would mitigate the congestion effects on non-zombies’ investment growth by 0.2 percentage points after five years, which is around 10% of the estimated congestion effect from Figure 3. In novel results, we also find reduced congestion effects from tighter macroprudential policies, particularly actions that focus on constraints on credit supply, and on improving bank capital.

Figure 5 Congestion effects: Dynamics of listed non-zombies’ investment and debt following an improvement in selected bank health indicators

Notes: Cumulative impulse responses of non-zombies’ investment growth (blue line) and debt growth (red line) to a one standard deviation increase (decrease) in the banks’ regulatory capital buffer (NPLs) for a given zombie industry share. The grey area and dashed red lines are the 90% confidence bands.

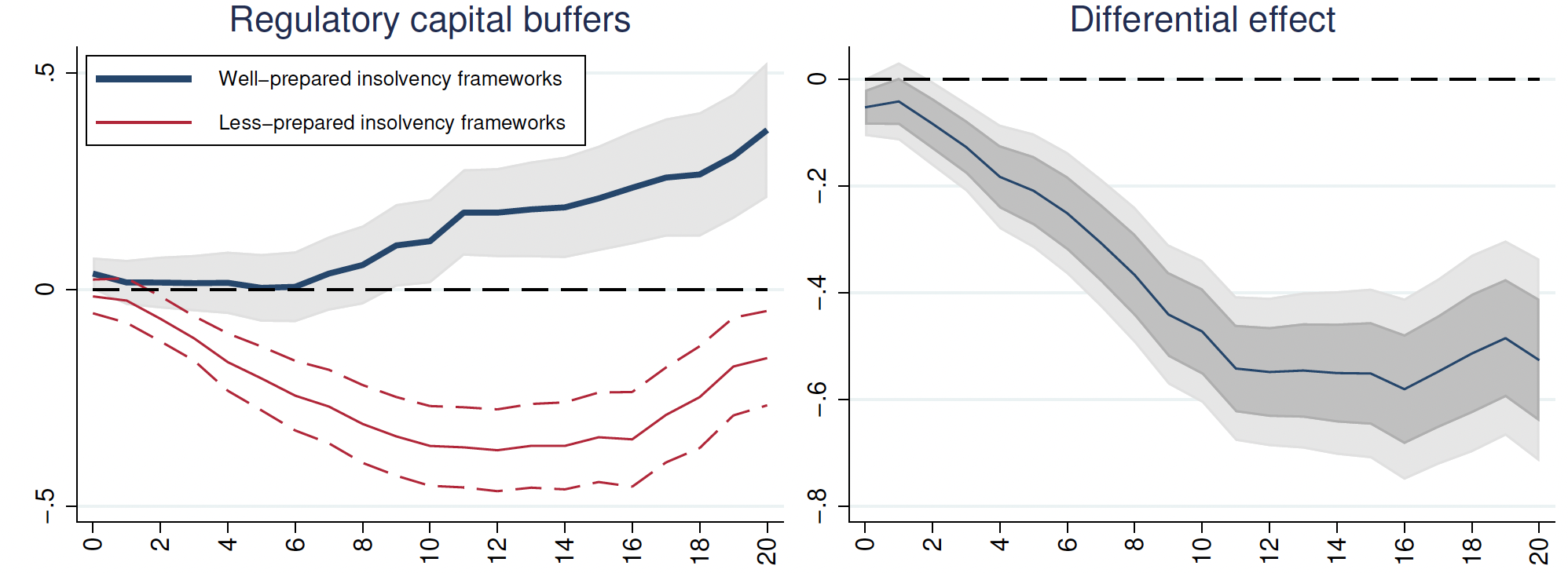

Strengthening the banking sector may not be enough to mitigate congestion effects if insolvency regimes are weak and costly for the lenders. To account for cross-country differences in insolvency regimes, we resort to the crisis preparedness indicator from Araujo et al. (2022), measuring countries’ preparedness to handle a large-scale restructuring of corporates. Figure 6 shows that healthy firms’ investment growth does not improve in countries with less-prepared frameworks when the regulatory capital buffer increases, only in countries with well-prepared insolvency frameworks. This result speaks to the incentives facing banks, as banks’ lower expected recovery value of loans to zombies could potentially promote evergreening incentives.

Figure 6 Congestion effects: Dynamics of non-zombies’ investment following an improvement in capital buffers for well-prepared and less-prepared insolvency regimes

Notes: Cumulative impulse responses of non-zombies’ investment growth to a one standard deviation increase in banks’ regulatory capital buffer for a given zombie industry share. Left panel: solid blue (red) line with the respective 90% confidence bands refer to the average response for well-(less-)prepared insolvency frameworks, computed as countries above (below) the median sample of the Araujo et al. (2022) crisis preparedness indicator. Right panel: dark (light) grey areas refer to the 68% (90%) confidence bands of the difference between less- and well-prepared insolvency regimes.

Discussion

The increased zombification in the world economy is associated with important trade-offs for policymakers. On the one hand, public support, including credit guarantees and forbearance, may be important to reduce insolvencies in the short term, and contain the collapse in aggregate demand during periods of large financial shocks. But, on the other hand, untargeted policy support combined with lax macroprudential and supervisory measures, as well as deficient insolvency frameworks, may delay a necessary creative destruction with negative consequences for long-term productivity growth.

Authors’ note: The views expressed in this column represent only our own and should therefore not be reported as representing the views of the International Monetary Fund, its Executive Board, or IMF management.

References

Acharya, V V, L Borchert, M Jager and S Steffen (2020), “Euro area bank bailout policies after the global financial crisis sowed seeds of the next crisis", VoxEU.org, 10 August.

Acharya, V V, T Eisert, C Eufinger and C Hirsch (2019), “Whatever It Takes: The Real Effects of Unconventional Monetary Policy”, Review of Financial Studies 32(9): 3366–3411.

Albuquerque, B (2023), “Corporate debt booms, financial constraints and the investment nexus”, SSRN Working Paper 3827924.

Albuquerque, B and R Iyer (2023), “The Rise of the Walking Dead: Zombie Firms Around the World”, IMF Working Papers 23/125.

Andrews, D and F Petroulakis (2019), “Zombie firms, weak banks, and depressed restructuring in Europe”, VoxEU.org, 4 April.

Araujo, J D, J Garrido, E Kopp, R Varghese and W Yao (2022), “Policy Options for Supporting and Restructuring Firms Hit by the COVID-19 Crisis”, IMF Departmental Paper 2022/002.

Banerjee, R and B Hofmann (2022), “Corporate zombies: anatomy and life cycle”, Economic Policy 37(112): 757–803.

Blattner, L, L Farínha and F Rebelo (2023), “When losses turn into loans: The cost of weak banks”, American Economic Review 113(6): 1600–1641.

Caballero, R J, T Hoshi and A K Kashyap (2008), “Zombie Lending and Depressed Restructuring in Japan”, American Economic Review 98(5): 1943–77.

Faria-e-Castro, M, P Paul and J M Sanchez (2022), “Evergreening”, Federal Reserve Bank of St. Louis Working Paper 2022-024.

Favara, G, C Minoiu and A Perez (2022), “Zombie Lending to U.S. firms”, SSRN Working Paper 4065886.

Giannetti, M and A Simonov (2013), “On the Real Effects of Bank Bailouts: Micro Evidence from Japan”, American Economic Journal: Macroeconomics 5(1): 135–67.

Kulkarni, N, S Ritadhi, S Mukherjee and K Waldock (2021), “Unearthing Zombies”, SSRN Working Paper 3495660.

McGowan, M A, D Andrews and V Millot (2018), “The walking dead? Zombie firms and productivity performance in OECD countries”, Economic Policy 33(96): 685–736.

Müller, K and E Verner (2023), “Credit Allocation and Macroeconomic Fluctuations”, Review of Economic Studies, forthcoming.

Peek, J and E S Rosengren (2005), “Unnatural Selection: Perverse Incentives and the Misallocation of Credit in Japan”, American Economic Review 95(4): 1144–1166.

Storz, M, M Koetter, R Setzer and A Westphal (2017), “Do we want these two to tango? On zombie firms and stressed banks in Europe”, ECB Working Paper 210.