The prevalence of technology has empowered the public with vast amounts of knowledge but has also led to increased reliance on search engines for information filtering. According to a recent survey, Google alone receives over 8.5 billion searches daily. Furthermore, there is a growing concentration in the online search industry, with Google occupying a global market share of 91.38% in 2022. This vast user base provides Google with a significant advantage over its competitors, as it allows them to collect first-hand click-and-query data, which powers its algorithms to generate more accurate search results. Google creates network effects in the market – for instance, by achieving accurate results even for infrequently searched terms – leading to its own continued growth. This popularity makes Google attractive to advertisers; indeed, the ad business generates over $250 billion in annual revenue for Google.

In the economically and socially relevant market of search engines, a precise design feature of how searches operate on mobile phones plays a key role: the pre-set default. As pointed out by the recent US Department of Justice (DOJ) complaint against Google: “For a general search engine, by far the most effective means of distribution is to be the pre-set default general search engine for mobile and computer search access points. Even where users can change the default, they rarely do.” The argument in this DOJ case resonates with similar arguments in related cases across the globe: by operating as the default search engine for most search access points, Google not only accumulates more users but simultaneously blocks this critical channel for other search engines. Indeed, according to the Competition and Markets Authority (CMA) report in 2020, the percentage of mobile device manufacturers using Google as their default search engine exceed 99% in the UK in February 2020.

This leads to almost all mobile device owners automatically using Google unless they specifically choose an alternative. This default, dominant position has aroused antitrust concerns in various recent regulatory reports

and academic debates (Scott Morton and Dinielli 2020, Ostrovsky 2020).

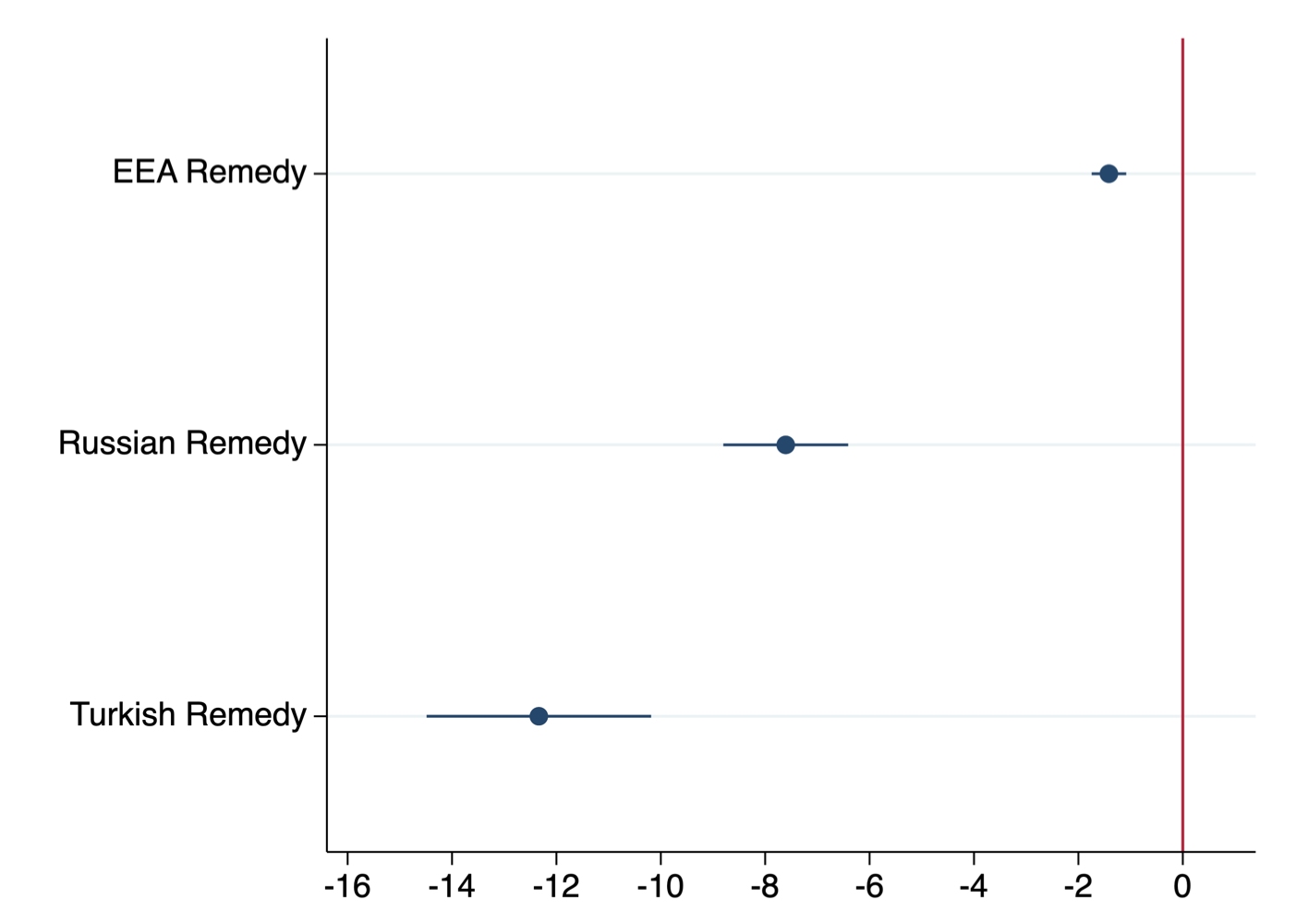

Despite regulatory efforts and heated discussions (Caffarra et al. 2018, Taylor and Cornière 2018, Varian 2018), there is surprisingly little empirical evidence on the default effect in the online search market. In a new paper (Decarolis et al. 2022), we use data from various sources to examine the role of default settings and determine which regulatory approach could help restore competition in the online search market. We investigate the effectiveness of three policy interventions – in the European Economic Area (EEA), Russia, and Turkey – all aimed at tackling Google’s default position on Android devices. Though the interventions induce a drop in Google’s market share, the magnitude of the impact varies across the three areas: less than 2 percentage points in the European Economic Area, 7 percentage points in Russia, and 12 percentage points in Turkey.

Remedies in the EEA, Russia, and Turkey

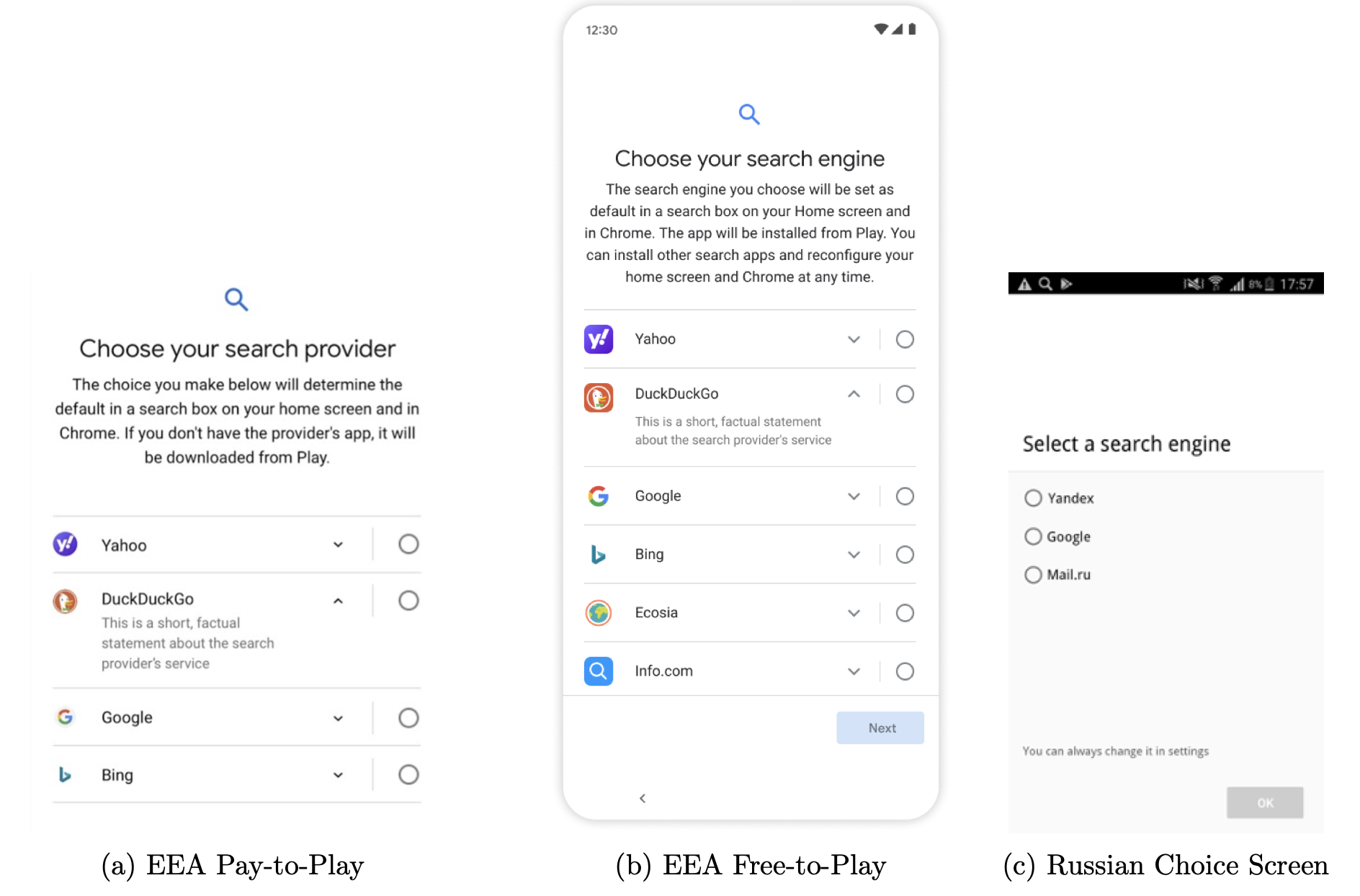

In the EEA and Russia, the intervention was based on the introduction of a choice screen that allows users to select their preferred search engine rather than having Google as their default (see Figure 1). Starting in March 2020, the choice screen appeared during the initial setup of new Android phones and tablets sold in the EEA (and the UK). Once a user chooses a search engine from the choice screen, it sets the search provider in a home screen search box; if Google Chrome is installed, it makes the selected search provider Chrome’s default search engine, and prompts the selected provider’s app to download. In the initial phase of the choice screen system in Europe, which lasted until summer 2021, search engines had to participate in a quarterly auction to appear on the choice screen, bidding the amount they were willing to pay Google each time a user selected them. The three highest bidders would appear for a country/quarter on the choice screen together with Google. In September 2021, the choice screen changed, becoming free for all eligible search providers to appear on it; accordingly, the list of search engines was extended from four to twelve.

Figure 1 Choice screen comparison

Unlike the choice screen in the EEA, the Russian choice screen was accessible to all Android mobile devices (not just those newly purchased) after August 2017. Moreover, the list of search engines displayed on the choice screen was shorter and fixed: in addition to Google, Mail.ru and Yandex appeared as well (see Figure 1). In Turkey, the intervention to limit the default role of Google was different. Rather than rely on choice screens, the Turkish Competition Authority (TCA) focused on relevant features of the contracts that Google offered to the mobile phone manufacturers (i.e. the original equipment manufacturers, or OEMs). In particular, the TCA required Google to remove any provision providing Google privileged access to the device’s search access points. The new contracts were designed to guarantee that the OEM would be free to set competing search engines on their devices, possibly selecting different search engines as the default for different search access points.

The remedy’s impact on the online search market

The empirical study of these three interventions indicates that, although all three triggered a drop in the Google market share on mobile searches, the impact was strong in Russia and Turkey but rather small in the EEA. This evidence is best summarised by the series of figures reported in this article.

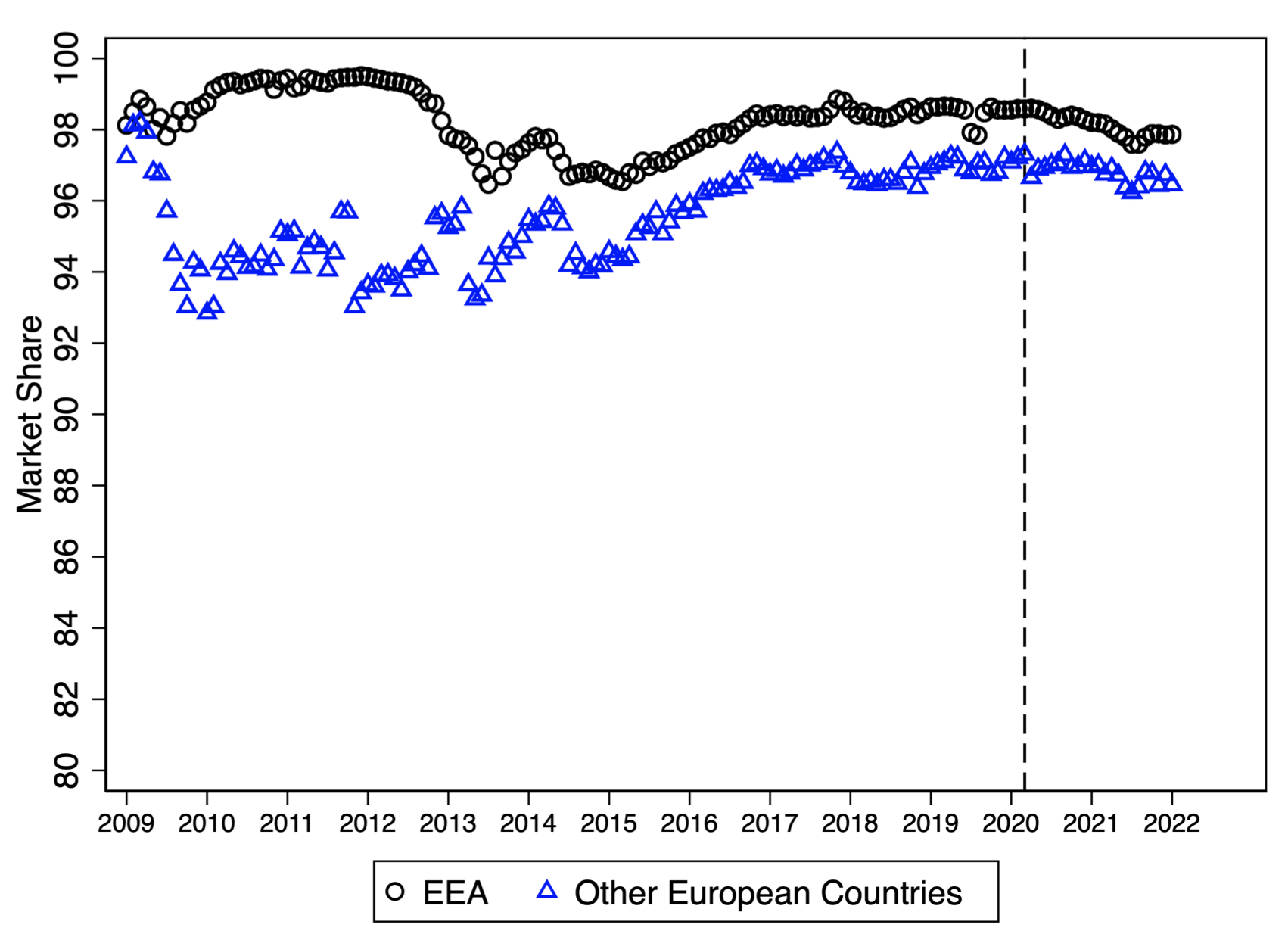

In Figure 2, we compare Google mobile market share in the EEA with that of other European countries outside the EEA. The dashed vertical lines correspond to the timing of the implementation of the choice screen auction in the EEA. It appears that Google’s mobile market share in the EEA declined after the remedy, but the difference is tiny. A very similar pattern is found with any other comparison group considered (including different sets of OECD countries). The econometric estimates confirm that the estimated causal effect is less than 2%.

Figure 2 Google’s mobile market share

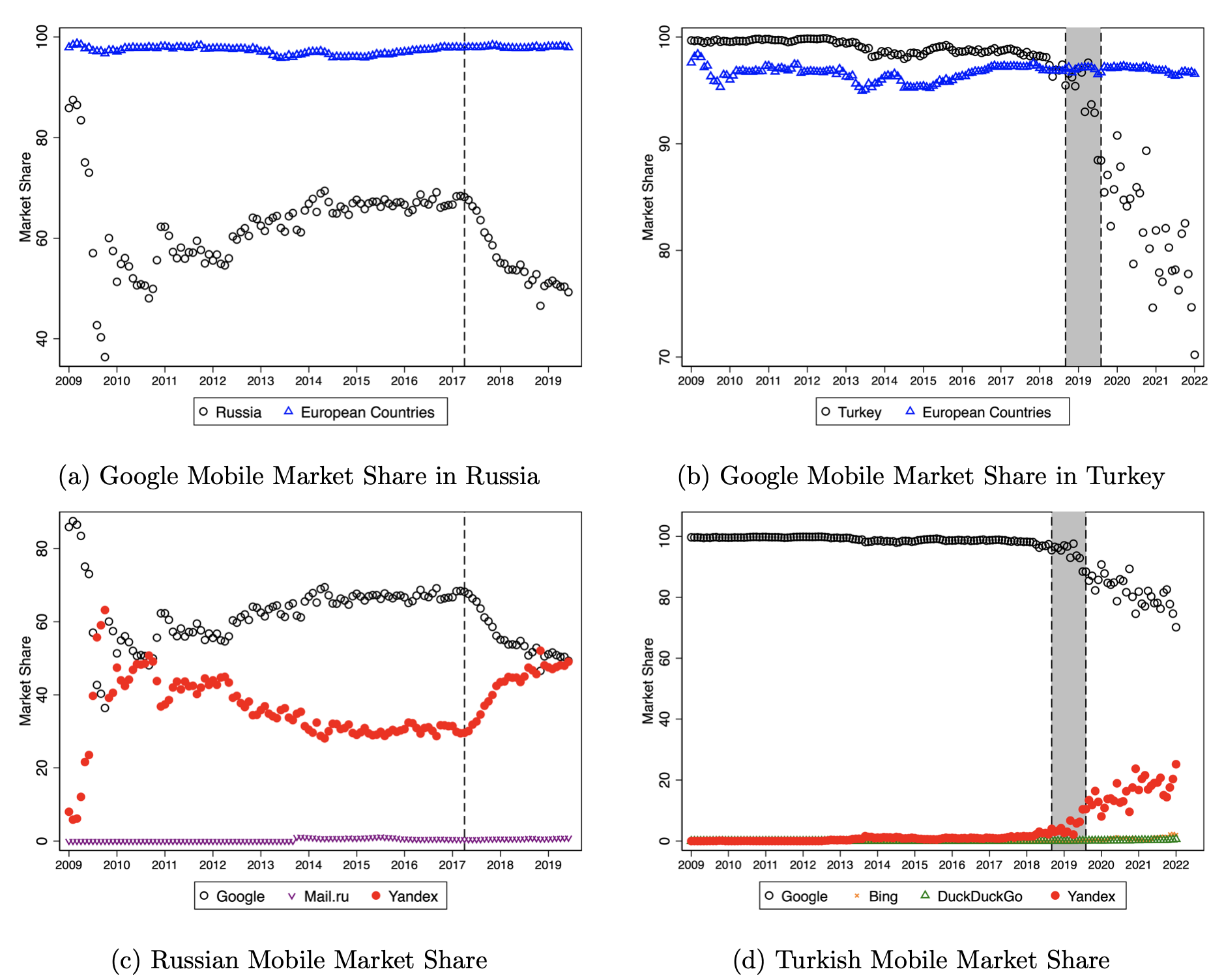

For Russia and Turkey, Figure 3 shows the evolution of the Google market share compared to that of a series of comparison countries (top panels) and the evolution of the market shares of Google and Yandex (bottom panels) within both Russian (left panels) and Turkey (right panels). The dashed lines correspond to the timing of the antitrust interventions, which had a complex implementation in Turkey that lasted several months, as discussed in the paper and summarised in the figure through the grey area covering this period. For both Russia and Turkey, it is clear that soon after the interventions were introduced, the Google market share dropped significantly, and that this corresponded to a gain in the Yandex market share. In terms of the econometric estimates, Figure 4 reposts the estimate of the baseline difference-in-differences model.

Figure 3 Russian and Turkish remedies

Notes: In Russia, the vertical line corresponds to the introduction of the choice screen. In Turkey, the vertical lines correspond to the TCA decision and to Google’s officially accepted contractual changes.

The study also investigates the demand and supply factors driving these results, as well as the response by advertisers. The most relevant insight is that user awareness of the search engines before the intervention plays a key role: search engines with higher brand awareness and stronger local market shares have both a higher probability of being selected in the choice screen and, when given the possibility of bidding for a slot, a higher willingness to be displayed to users. Finally, in terms of advertising, the findings indicate a response to the intervention in terms of advertising price, volume, and revenue; the magnitude of these responses across the EEA, Russia, and Turkey are roughly proportional to the intervention’s impact on Google’s market share.

Figure 4 Effects of intervention on Google market shares in EEA, Russia, and Turkey

Concluding remarks

Our findings indicate that public interventions aimed at minimising the default effect can diminish the share of the online search market held by gatekeepers. However, the effectiveness of these interventions varies significantly, depending especially on the presence of a viable competitor, but also on factors including nuances in intervention design, user preferences, and characteristics of the local market. The comparison of the three interventions indicates that interventions involving consumer choices have little impact on online search market competition unless there is a qualified challenger who can compete with the dominant company based on quality, or a rival who has the means and motivation to replace the dominant company by investing in the local market. These findings highlight the critical role of pre-set defaults in the online search market and the importance of comparable competitors in determining public intervention effectiveness.

References

Caffarra, C, O Latham, M Bennett, F Etro, P Régibeau and R Stillman (2018), “Google Android: European ‘techlash’ or milestone in antitrust enforcement?”, VoxEU.org, 27 July.

Decarolis, F, M Li and F Paternollo (2023), “Competition and Defaults in Online Search”, CEPR Discussion Paper No. 17779.

Ostrovsky, M (2020), “Choice screen auctions”, NBER Working Paper 28091.

Scott Morton, F and D C Dinielli (2020), Roadmap for an antitrust case against Facebook, Omidyar Network.

Taylor, G and A Cornière (2018), “On the economics of the Google Android case”, VoxEU.org, 15 August.

Varian, H (2018), “Google Android case: Milestone or millstone?”, VoxEU.org, 14 August.