Earnings inequality has increased sharply since the 1980s, with a large body of literature showing that this increase has been mainly between firms. This pattern seems to hold for several different countries such as the US (Song et al. 2019), the UK (Faggio et al. 2010), West Germany (Card et al. 2013) ,and Brazil (Alvarez et al. 2018).

However, in order to design effective policies, it is crucial to know whether the factors driving inequality are primarily rooted in industry-level dynamics or are connected to the heterogeneity across firms within the same sectors. In other words, is earnings inequality growing mainly between firms in the same industry, or between firms in different industries? While for the US the study by Haltiwanger et al. (2022) describes a major inequality growth between sectors, to the best of our knowledge no evidence exists for Europe.

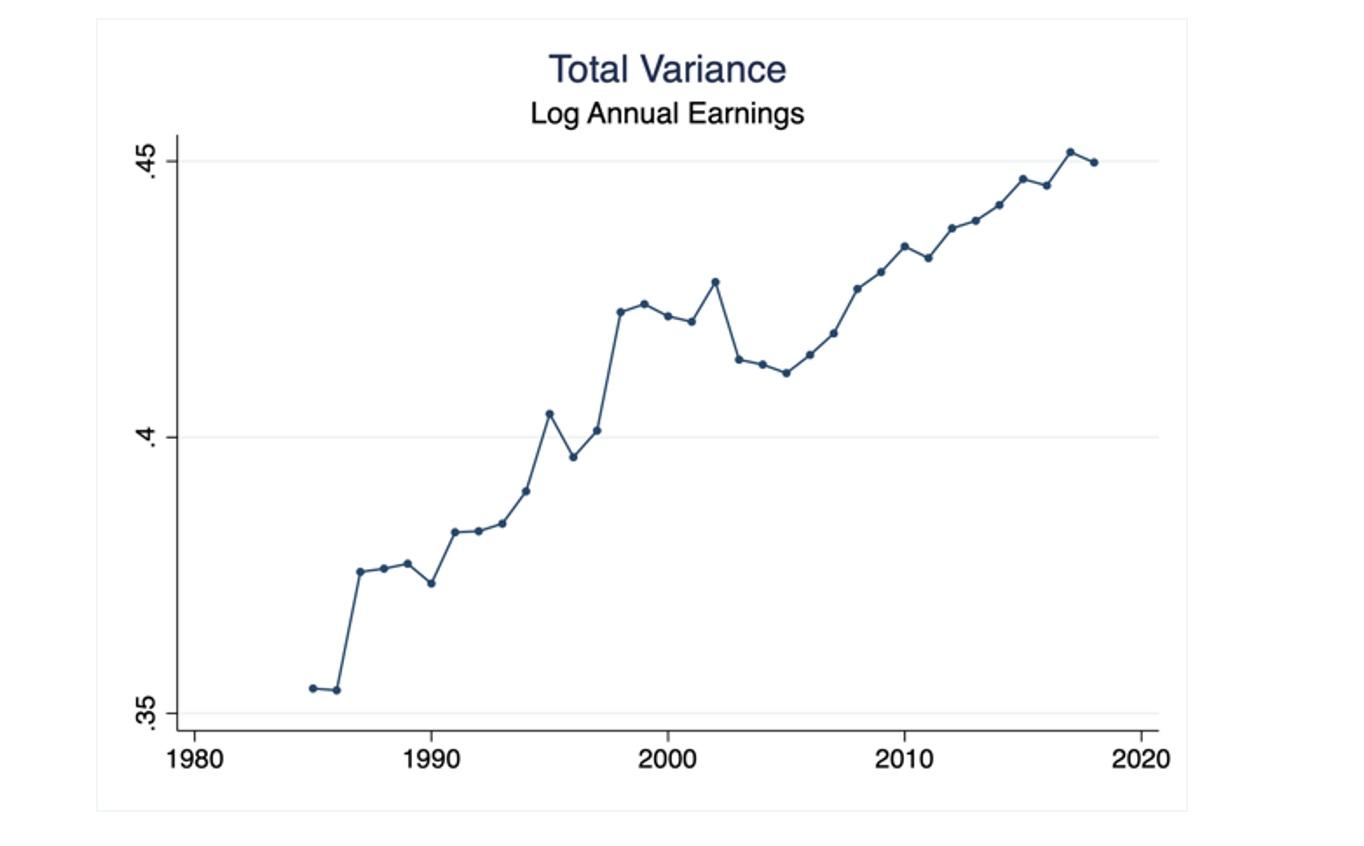

To investigate this issue, in a new paper (Briskar et al. 2023) we use a social security administrative dataset covering the universe of private-sector employment in Italy (excluding agriculture). Italy is an interesting case study as it is institutionally very different from the US, while sharing many features with most European countries. Real annual earnings in Italy in the last 30 years did not grow, but their dispersion increased significantly (Figure 1). Specifically, the variance of log annual earnings increased by approximately 10 log points, i.e. about half the size of the US increase.

Figure 1 Growth of earnings dispersion

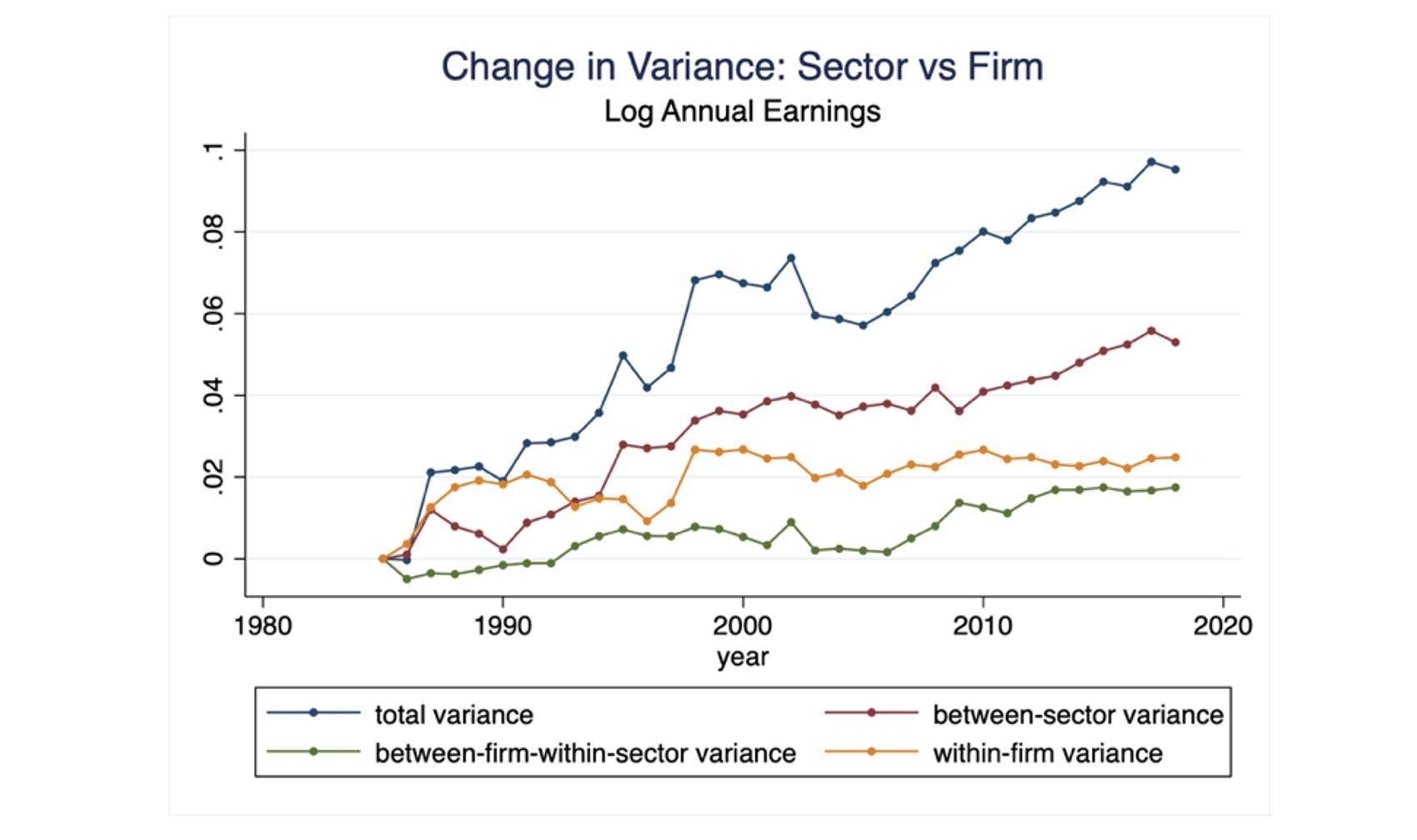

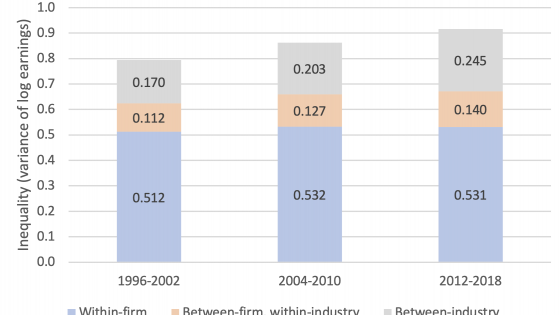

We perform several variance decompositions to assess the role of industries and firms in explaining the observed increase in earnings variance. Interestingly, like in the US, most of the increase in annual earnings variance between 1985 and 2018 took place between industries (55%), corresponding to approximately 5.3 log points. Less than half of it took place within firms (27%), and the remaining 18% between firms within the same industry (Figure 2).

Figure 2 Sector and firm: Full variance decomposition

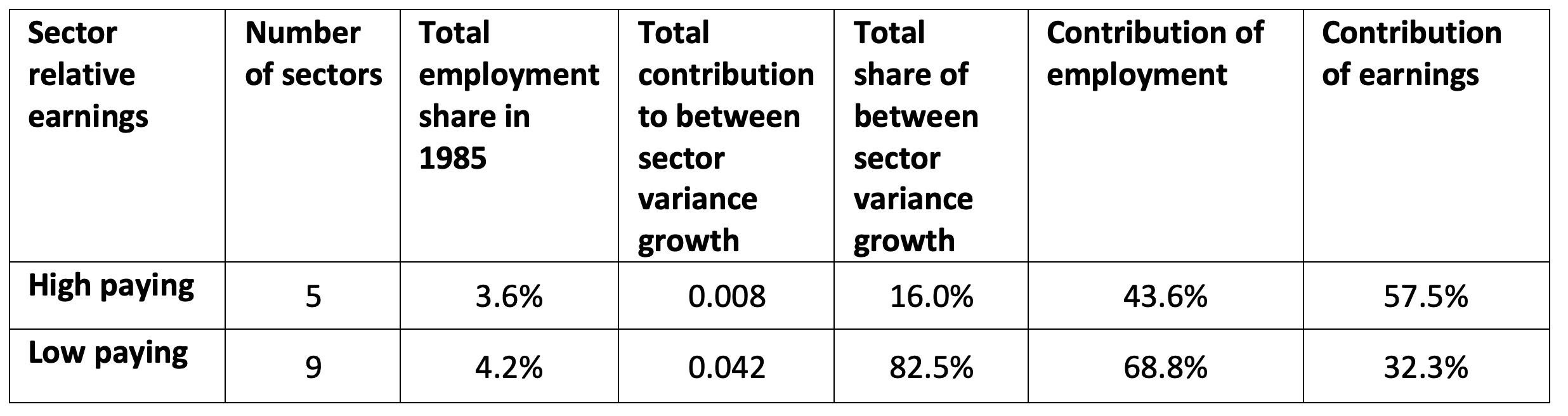

This large increase in the between-sector variance component is very concentrated, with a small number of industries playing a disproportionate role (14 out of 523 sectors). The concentration in Italy is even stronger than in the US, where 30 out of 301 sectors account for the total increase. (Haltiwanger et al. 2022). Moreover, and in contrast to the US, in Italy the key industries driving inequality are low-paying service sectors related to food and drink, accommodation, social care, cleaning of buildings and work agencies, which account for 4.2 log points out of the total 10 log point increase. These low-paying sectors contribute towards greater inequality mainly by attracting more employment (68.8%) and, to a certain extent, by displaying declining relative earnings (32.3%) (Table 1). In contrast, in the US the driving industries are equally split between low-paying and high-paying, although there is a clear overlap among the driving low-paying sectors in the two countries.

Table 1 Sector contributions to between sector variance growth of top 14 sectors

Note: The sector is high paying (low paying) if its average relative earnings are positive (negative) where the average is taken over the 1985 and 2018 values. The total contribution of a particular sector to between-sector variance growth is decomposed into the role of employment and earnings changes. To calculate the shares, we sum the employment and earnings components across sectors and divide each by the corresponding sum of the total contribution to between sector variance growth. Sectors are disaggregated at 4 digits.

In the second part of our analysis, we estimate a standard AKM model (Abowd et al. 1999) to quantify the extent to which inequality is driven by pay premia (the dispersion of average firm effects across sectors), between-sector sorting (the pattern of high-wage workers working in industries with high average firm effects), or between-sector segregation (the pattern of high-wage workers working together in the same industry). Our results show that most of the rise in Italian earnings inequality is due to an increase in the sorting of low-paid workers to low-pay industries and to increasing differences in average worker quality across industries (measured by average worker fixed effect), as low-paid workers cluster in the same industries.

Equivalently, workers with high earnings ability are more likely to work with other high-income workers in the same industry and are more likely to work in industries with particularly high firm pay premiums. Therefore, the growth of the between-sector variance is entirely due to the change in the allocation of workers across industries and not to increasing heterogeneity in firm wage policies across industries. This is in line with the findings of Haltiwanger et al. (2022) for the US.

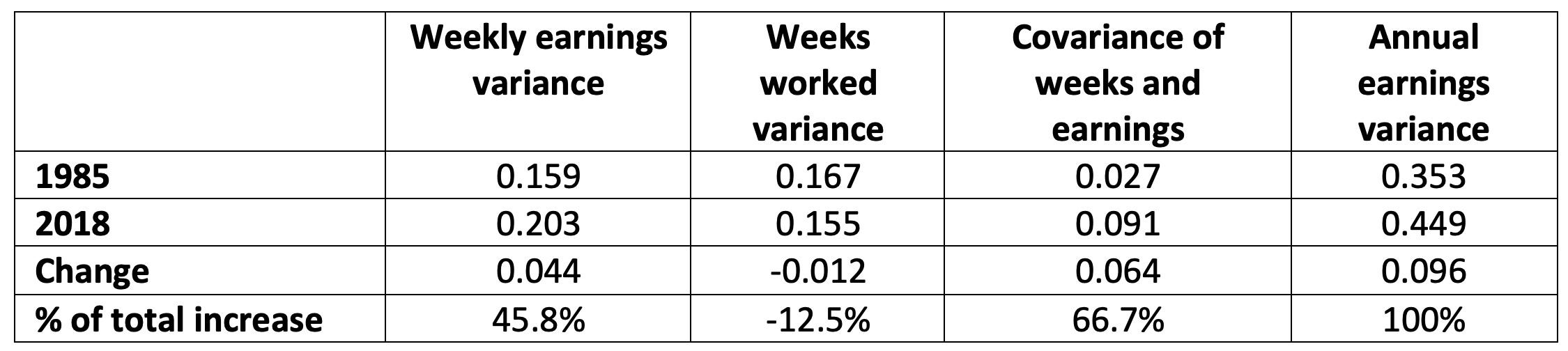

Finally, an innovative analysis developed in our study revolves around whether annual earnings inequality stems from higher dispersion in pay rates or variations in the number of weeks worked. This question holds relevance for Italy, given its highly segmented labour market and the potential divergent use of temporary contracts across industries. Our result reveals a notable surge in wage rate variation and in the association between the rate of pay and the number of weeks worked, i.e. increasingly, workers on higher rates of pay work more during the year and those on low pay work less (Table 2). These patterns are primarily attributed to the between-sector component, suggesting that the dispersion of annual earnings across industries grew due to both an increase in the dispersion of wage rates across industries, and an increase in the positive association between the average weeks worked and the average rate of pay across industries.

This evidence helps us rule out the hypothesis of the increased earnings dispersion being driven by the increased diffusion of temporary contracts.

Table 2 Decomposing annual earnings into full-time equivalent weeks worked and average weekly earnings

In conclusion, our research sheds light on the often-overlooked dynamics of earnings inequality, emphasizing the crucial role played by industry-level factors. The striking parallels between Italy and the US, despite differing institutional settings, suggest shared underlying forces. Beyond contributing to the ongoing discourse on earnings inequality, our findings lay the groundwork for policy interventions that address industry-specific forces driving these disparities.

Authors' note: The data used in this column were provided by the VisitINPS scholar project.

References

Alvarez, J, F Benguria, N Engbom, and C Moser (2018), “Firms and the decline in earnings inequality in Brazil”, American Economic Journal: Macroeconomics 10(1): 149–189.

Briskar, J, E Di Porto, J Rodriguez Mora and C Tealdi (2023), “The role of industries in rising inequality", IZA Discussion Paper 16693.

Card, D, J Heining, and P Kline (2013), “Workplace heterogeneity and the rise of West German wage inequality”, The Quarterly Journal of Economics 128: 967–1015.

Faggio, G, K Salvanes, and J Van Reenen (2010), “The evolution of inequality in productivity and wages: panel data evidence”, Industrial and Corporate Change 19(6): 1919–1951.

Faia E, G Ottaviano and S Spinella (2022), “Robot adoption, worker-firm sorting, and wage inequality: Evidence from administrative panel data”, VoxEU.org, 23 January.

Haltiwanger, J C, H R Hyatt, and J Spletzer (2022), “Rising inequality: Industries and mega firms”, VoxEU.org, 27 May.

Haltiwanger, J C, H R Hyatt, and J Spletzer (2022), “Industries, mega firms, and increasing inequality”, technical report, National Bureau of Economic Research.

Montana, J, J Silva and M Leitao (2022), “How firms reduce wage inequality”, VoxEU.org, 17 August.

Song, J, D Price, F Guvenen, N Bloom, and T von Wachter (2019), “Firming up inequality”, The Quarterly Journal of Economics 134: 1–50.