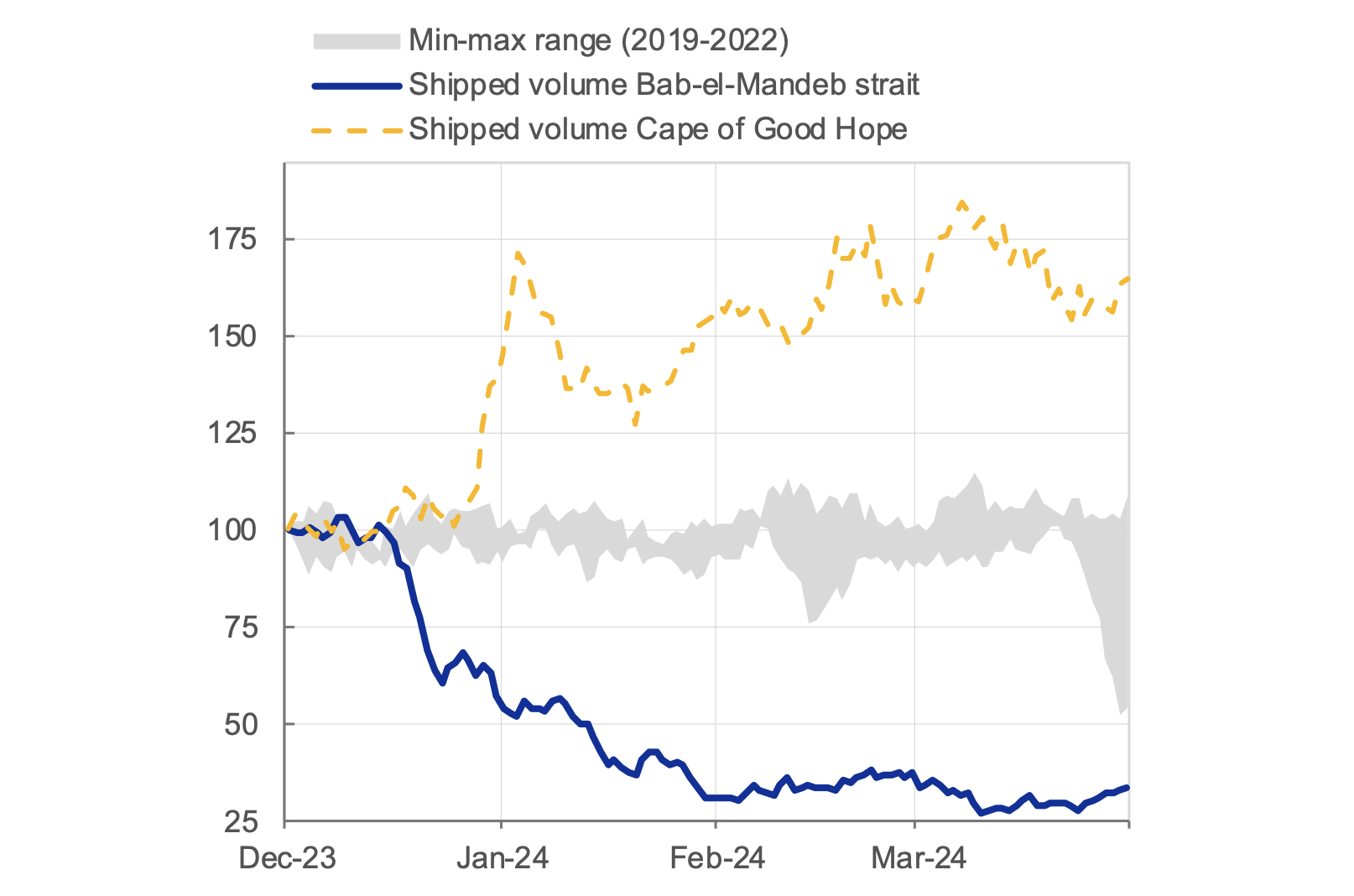

Since December 2023, major shipping companies have suspended services in the Red Sea. Following repeated attacks by Houthi rebels, transit volumes through the strait of Bab-el-Mandeb (the southern tip to the Red Sea for vessels heading for the Suez Canal) have dropped by 70% compared to December 2023 (Figure 1). As about 12% of global oil shipments and 10% of global seaborne trade transit through the Suez Canal, these disruptions can affect the global economy.

Figure 1 Transit volumes

(indices, 1 Dec. 2023 = 100)

Notes: 7-day moving average. Min-max range reports the historic evolution of shipped volumes from 2019 to 2022 in relation to shipped volumes on 1 December in a given year. Latest observation: 31 March 2024.

Sources: IMF Portwatch and authors’ calculations.

Turmoil in the Red Sea can increase oil prices, but effects appear limited so far

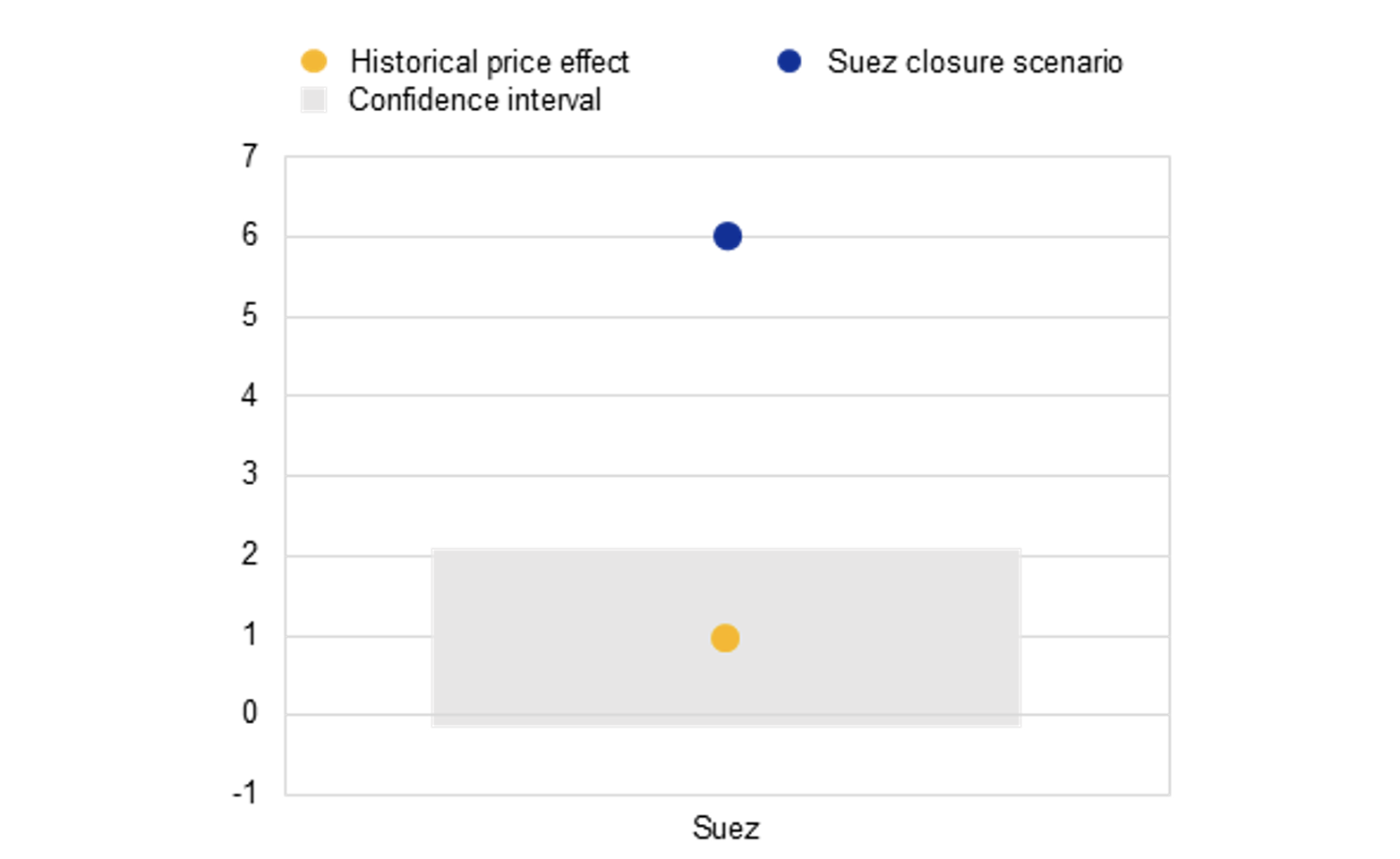

Delayed oil shipments may lead to higher oil prices via tighter global supply. However, after a short period of volatility, the Brent spot price has fallen and is currently below the level recorded after the first Houthi attacks. This is because only a few oil companies have completely suspended operations in the area. These developments are in line with estimates from a Bayesian VAR, where Red Sea shocks are identified with textual analysis, suggesting that disruptions in the Red Sea have limited oil-price impact (Figure 2).

More recently, risks of an escalation of the conflict to large oil-producing countries, such as Iran, have been a more relevant source of price pressures in the oil market (see Ferrari Minesso et al. 2024).

Figure 2 Oil price reaction to Red Sea disruptions

(percentage points)

Notes: Historical price effect (yellow dot) shows the estimated effect of a one standard deviation geopolitical tension shock, which is about the same size as the increase observed after the Houthi attacks (geopolitical tensions are proxied by the share of newspaper articles discussing tensions over the Suez passage). The elasticity is estimated using a monthly VAR model with Cholesky identification, including a text-based tension index, Brent oil prices, US stock prices, US dollar nominal effective exchange rate, and US 2-year yield. Chart shows 68% confidence interval; sample is 2004–23. Suez closure scenario (blue dot) as developed by Goldman Sachs, assuming 7mb/d of oil shipments redirected for a prolonged period over a longer route (15 days longer on sea).

Sources: Refinitiv, Factiva, Haver, and authors’ calculations.

Red Sea disruptions can also weigh on the global economy via higher shipping costs and lower trade, but effects are limited due to the improved state of supply chains

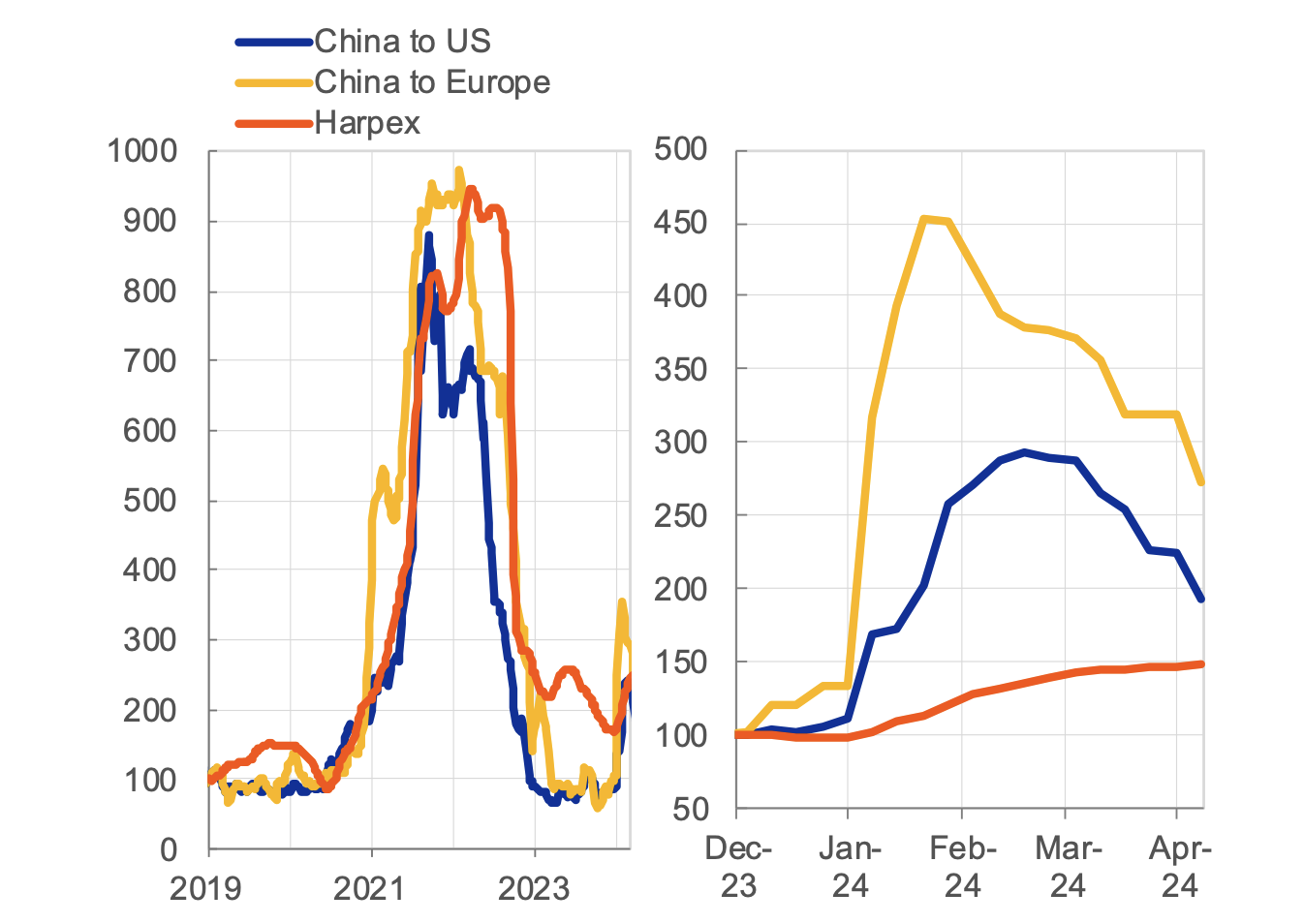

Trade volumes and shipping costs are impacted as vessels are rerouted around the Cape of Good Hope (Figure 1), extending journeys between Asia and Europe by 10–14 days. The trade literature documents that longer delivery times are linked to lower trade (e.g. Cosar and Thomas 2021, Hummels and Schaur 2013), and there is growing evidence that disruptions to supply in upstream goods can decrease output and revenues of downstream producers (e.g. Boehm et al. 2015, Barrot and Sauvagnat 2016, Kilian et al. 2021). As demand for global container shipping capacity rises, higher transportation costs could feed into consumer prices (Dunn and Leibovici 2024). Since December 2023, container freight costs have significantly increased along specific routes but remain well below the highs recorded in 2021–22 (Figure 4).

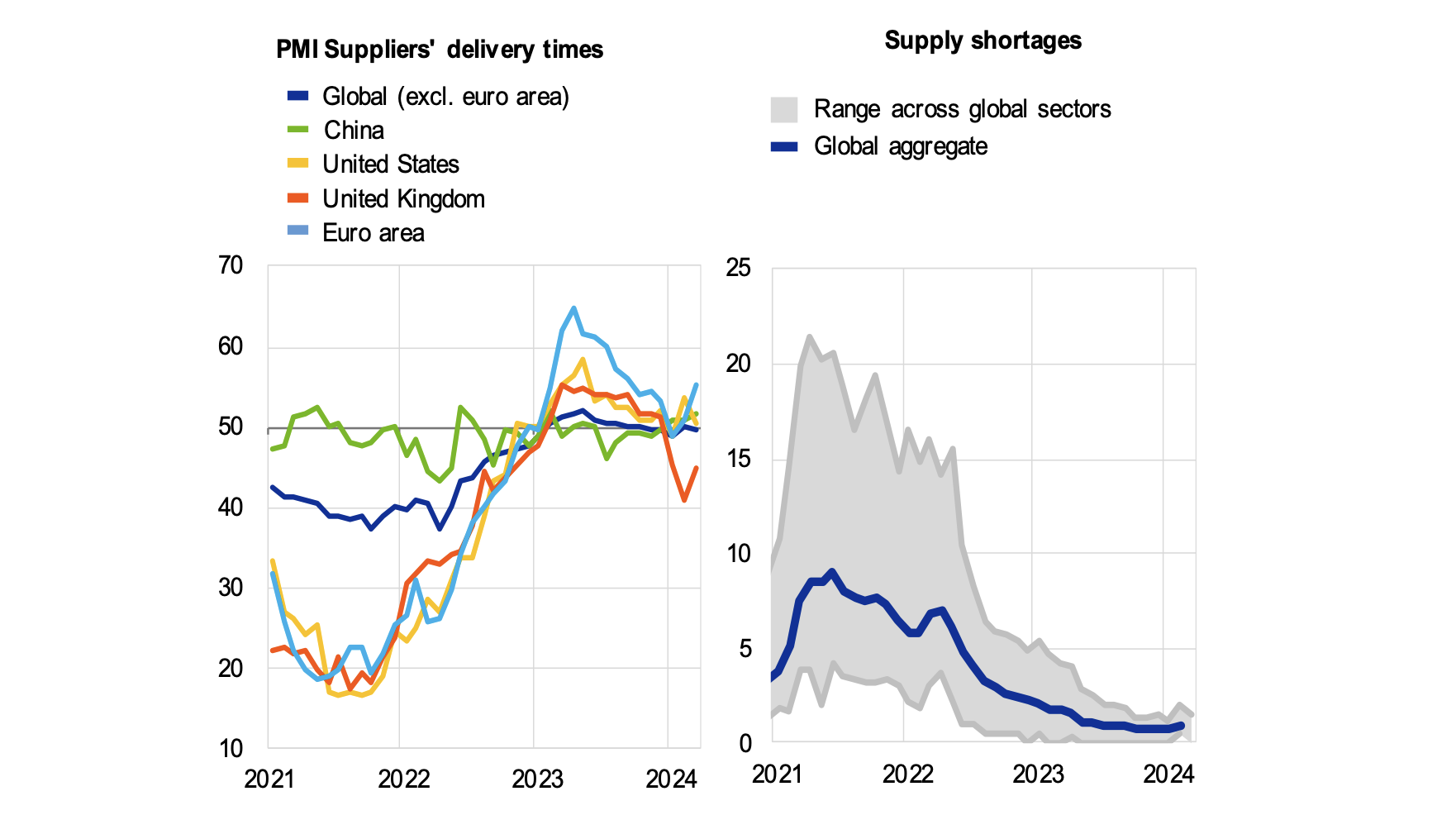

Shipping delays could also disrupt production via reduced availability of inputs, especially in industries relying on ‘just-in-time’ supply chains. Purchasing Managers’ Indices for suppliers’ delivery times rose at the turn of the year for countries more exposed to the disruptions but remained below their 2021–22 levels (Figure 3). More recent data, however, indicate that both freight rates and Purchasing Managers’ Indices have undergone a correction. The impact of longer shipping times has likely been cushioned by spare shipping capacities – due to weaker goods demand and availability of newly-produced vessels – and high inventory levels in manufacturing firms.

Figure 3 State of global supply chains

(left panel: diffusion indices; right panel: multiples of long-term average mentions)

Notes: The left panel shows manufacturing suppliers’ delivery times. The right panel shows S&P Global Supply Shortages Index, representing the incidence of managers reporting supply pressures in monthly Purchasing Managers’ Indices business surveys. A value equal to one denotes the long-term average of mentions. The shaded grey range represents minimum and maximum reported value across 20 manufacturing sectors. Latest observation: March 2024.

Sources: S&P Global and authors’ calculations.

Figure 4 Global shipping costs

(indices; left panel 1 January 2019 = 100, right panel 28 November 2023 = 100)

Notes: Freightos Baltic Index tracks directional freight costs for 40-foot equivalent unit shipping container prices between China and the US and between China and Europe, among others. The global charter rate (Harpex) is Harper Petersen Charter Rates Index, which tracks the cost of chartering container vessels operating on all routes globally. Latest observation: 4 April 2024.

Sources: Bloomberg, Freightos, Harper Petersen, and authors’ calculations.

Model-based estimates suggest that the repercussions on global and euro area trade are likely to remain limited

We quantify the effects on trade volumes using VAR models. Shipping disruptions are proxied by the Federal Reserve Bank of New York Global Supply Chain Pressure Index, and we exploit the obstruction of the Suez Canal by the ‘Ever Given’ in 2021 to calibrate the disruptions associated with a blockade of this maritime gateway.

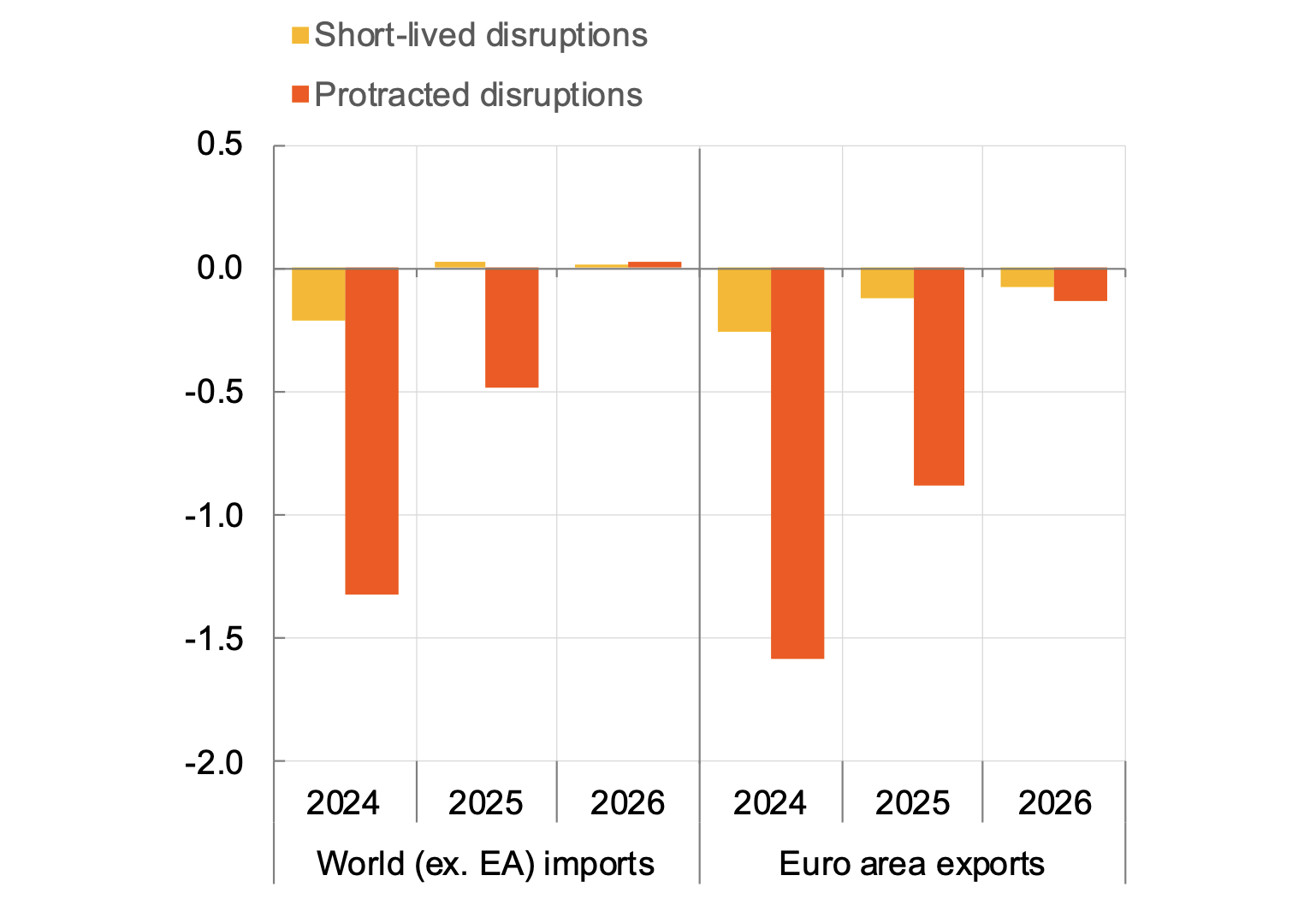

We simulate two scenarios: a short-lived disruptions scenario which assumes a gradual return to normal by the end of Q2 2024; and a protracted disruptions scenario which assumes a de facto closure of the Suez Canal with a gradual resolution only by the end of 2024.

With short-lived disruptions, world (ex. euro area) trade would only decrease by 0.2 percentage points in 2024 with no effects in 2025–26 (Figure 5). Under the protracted disruptions scenario, global trade would decrease by 1.3 percentage points in 2024 and by 0.5 percentage points in 2025. These effects reflect higher shipping capacity usage, a run-down of inventories amid longer trade disruptions, and a decline in trade due to more persistent increases in shipping prices.

The impact on euro area trade is larger. In the short-lived disruptions scenario, euro area export volumes would decrease by 0.3 percentage points in 2024 and 0.1 percentage points in 2025. In the protracted disruptions scenario, euro area export growth would be 1.6 percentage points lower in 2024 and 0.9 percentage points lower in 2025. This reflects a higher exposure of the euro area to disruptions in the Suez Canal, but also higher openness and integration in global value chains.

Figure 5 Trade impact

(percentage points in deviation from no disruptions)

Notes: Estimates are based on a structural Bayesian VAR identified with sign and zero restrictions. Shocks in each profile are based on rescaling the supply disruptions estimated to have been associated with the obstruction of the Suez Canal by the Ever Given in March 2021.

Sources: IMF Portwatch, Bloomberg, Eurostat, Haver, and authors’ calculations.

Effects on inflation are muted albeit more pronounced for the euro area, owing to its larger exposure to disruptions

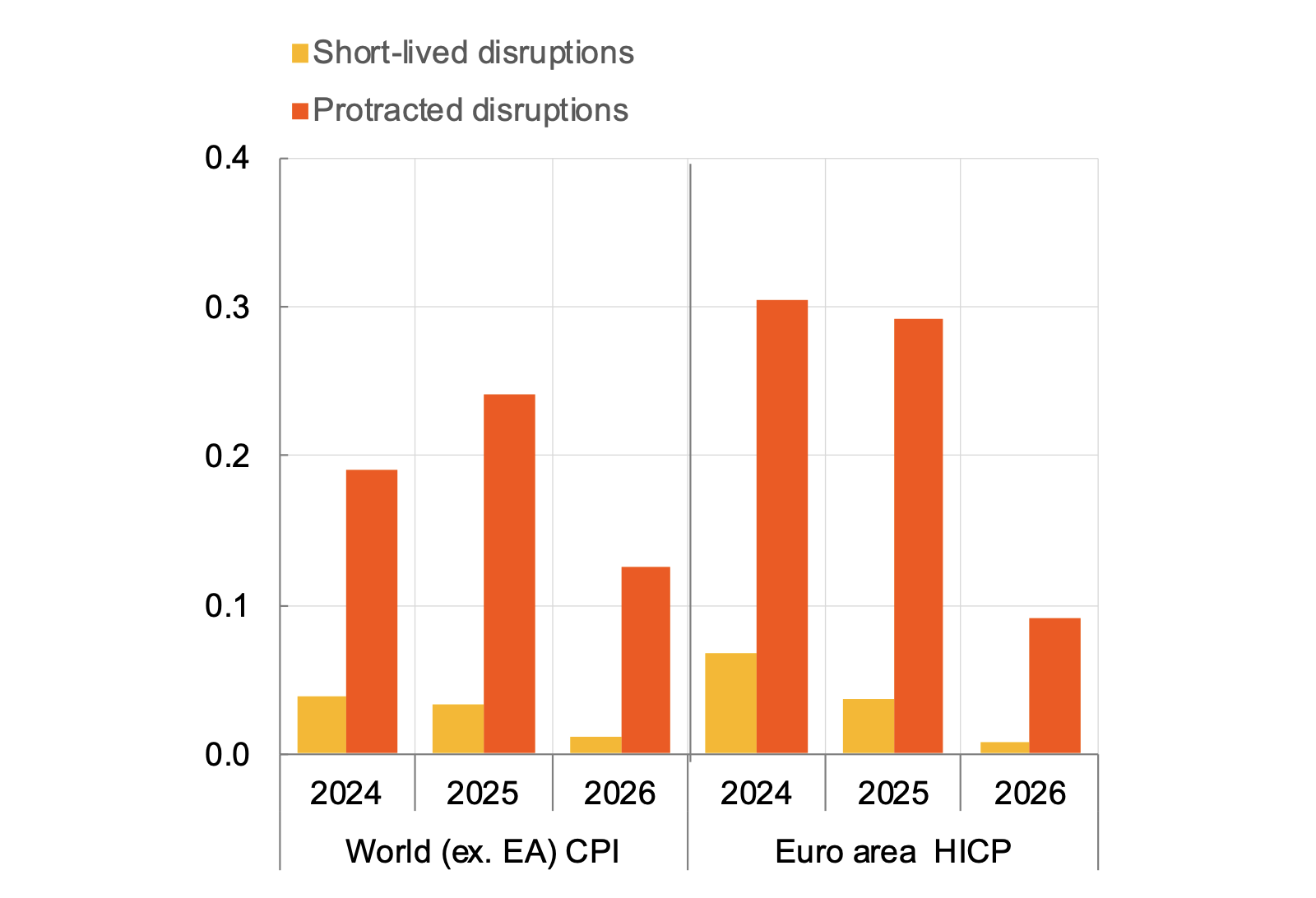

The inflationary impact of higher shipping costs is contained as maritime trade costs represent only a small share of total input costs. Moreover, shipping costs are based on contractual rates that are much less volatile than the spot rates presented above. Finally, a full pass-through of higher input prices to consumer prices appears unlikely, given weak demand and the ability of companies to absorb higher costs in profit margins.

In the short-lived disruptions scenario, the effect on global inflation is very small, with 0.04 percentage points in 2024, 0.03 percentage points in 2025, and no tangible effects in 2026 (Figure 6). The impact on euro area harmonised index of consumer prices is larger but also limited, amounting to 0.07 percentage points in 2024, 0.04 percentage points in 2025, and 0.02 percentage points in 2026 (Figure 6). Under the protracted disruptions scenario, global inflation would increase by another 0.18 percentage points in 2024 and 0.23 percentage points in 2025, while euro area harmonised index of consumer prices would register a more sizeable impact of around 0.30 percentage points in 2024 and 2025 (Figure 6).

Figure 6 Inflation impact

(percentage points in deviation from no disruptions)

Notes: Estimates are based on a structural Bayesian VAR identified with sign and zero restrictions. Shocks in each profile are based on rescaling the supply disruptions estimated to have been associated with the obstruction of the Suez Canal by the Ever Given in March 2021.

Source: IMF Portwatch, Bloomberg, Eurostat, Haver, and authors’ calculations.

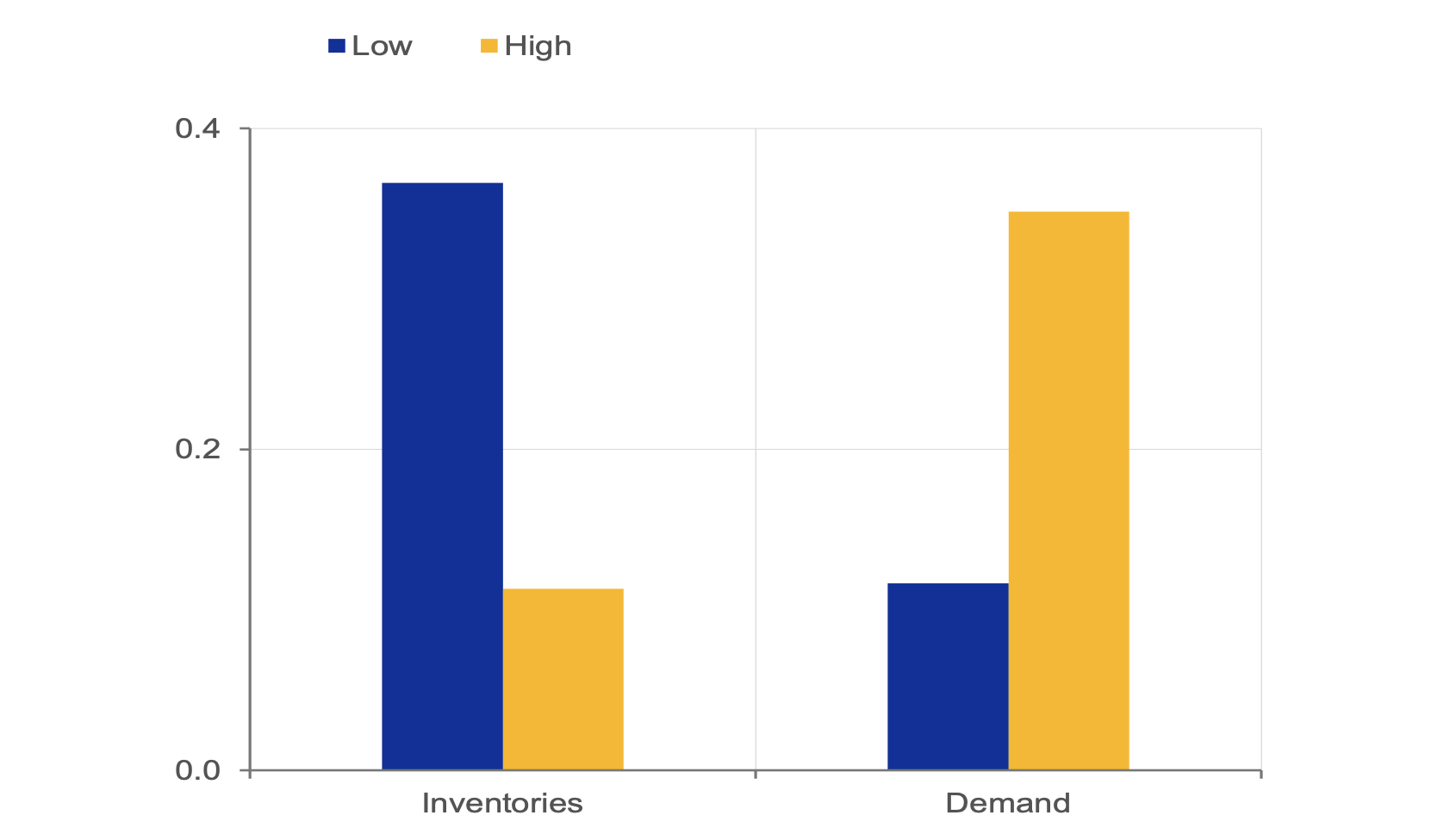

The price impact depends on economic conditions

The effect of higher freight rates is non-linear and depends on shipping capacity, global demand, and firms’ inventories. Figure 7 shows the elasticities of import prices to freight rates from a panel local projection model for euro area countries. Results show that higher firm inventory levels cushion the impact of freight rates, as supply disruptions have smaller effects when firms have adequate inventories (Alessandria et al. 2023, Lafrogne-Joussier et al. 2022). Second, when global demand is weak, the price impact of freight rate shocks tends to be subdued. This is the case at the current juncture, as firms report high inventory levels and global activity remains subdued. Nevertheless, the ongoing disruptions could signal rising geopolitical tensions, which could impact trade and price amid higher uncertainty and incentives for companies to improve supply chain resilience by reshoring or nearshoring their production (Di Sano et al. 2023, Attinasi et al. 2023a, 2023b, 2023c).

Figure 7 Elasticity of import prices to shipping rates

(percentage change)

Notes: Estimates from a panel local projection following Carrière-Swallow et al. (2022) of euro area countries’ import prices regression controlling for country fixed effects, lags of import prices, domestic output gap, domestic inventories, global output gap, oil prices, food prices, global demand, and their lags. Interaction terms with EC survey stock of inventories and a measure for global demand (global imports). Peak estimates (after 12 months).

Sources: Eurostat, Haver Analytics, DataStream, CPB, Bloomberg, IMF WEO, IMF Primary Commodity Price System and authors’ calculations.

Authors’ note: This column reflects the opinions of the authors and not necessarily those of the European Central Bank.

References

Alessandria, G, S Y Khan, A Khederlarian, C Mix, and K Ruhl (2023), “The aggregate effects of local and global supply chain disruptions, 2020–2022”, VoxEU.org, 12 March.

Attinasi, M-G, L Boeckelmann, and B Meunier (2023a), “Friend‐shoring global value chains: a model‐based analysis”, Economic Bulletin Box 2, European Central Bank

Attinasi M-G, L Boeckelmann, and B Meunier (2023b), “The economic costs of supply chain decoupling”, Working Paper Series 2839, European Central Bank

Attinasi, M G, L Boeckelmann, and B Meunier (2023c), “Unfriendly friends: Trade and relocation effects of the US Inflation Reduction Act”, VoxEU.org, 3 July.

Attinasi, M-G, L Boeckelmann, L Hespert, J Linzenich, and B Meunier (2024), “Global trade in the post-pandemic environment”, Economic Bulletin 1, European Central Bank.

Barrot, J, and J Sauvagnat (2016), “Input specificity and the propagation of idiosyncratic shocks in production networks”, Quarterly Journal of Economics 131.

Boehm, C, A Flaaen, and N Pandalai-Nayar (2015), “The role of global supply chains in the transmission of shocks: Firm-level evidence from the 2011 Tohoku earthquake”, VoxEU.org, 9 January.

Carrière-Swallow, Y, P Deb, D Furceri, D Jiménez, and J D Ostry (2022), “Shipping costs are an important, and understudied, driver of global inflation”, VoxEU.org, 8 November.

Cosar, K, and B Thomas (2021), “Disruption of seaborne trade in South East Asia: A quantitative analysis”, VoxEU.org, 4 January.

Di Sano, M, V Gunnella, and L Lebastard (2023), “Deglobalisation: risk or reality?”, The ECB Blog, 12 July.

Dunn, J, and F Leibovici (2024), “Shipping disruptions in the Red Sea: Local shock, global impact”, VoxEU.org, 20 March.

European Central Bank (2024), ECB staff macroeconomic March 2024 projections.

Federal Reserve Bank of New York (n.d.), Global Supply Chain Pressure Index.

Feyrer, J (2009), “The 1967–75 Suez Canal closure: Lessons for trade and the trade-income link”, VoxEU.org, 23 December.

Ferrari Minesso, M, M S Lappe, and D Rößler (2024), “Geopolitical risk and oil prices”, Economic Bulletin Box 8.

Hummels, D L, and G Schaur (2013), “Time as a trade barrier”, American Economic Review 103.

Kilian, L, N Nikos, and X Zhou (2021), “Container shipping and US business cycle fluctuations”, VoxEU.org, 15 July.

Lafrogne-Joussier, R, J Martin, and I Mejean (2022), “Supply chain disruptions and mitigation strategies”, VoxEU.org, 5 February.