Improving productivity dynamics and growth potential is high on the EU's policy agenda (Schnabel 2022, European Commission 2023a). Reforms play a crucial role in the EU’s review of economic governance (European Commission 2023b, Friis et al. 2022). Structural reforms can address fundamental obstacles in product and labour markets, reduce tax-related distortions, encourage innovation, and improve education and skills, yielding long-term benefits. They can thereby contribute to macroeconomic stability and healthy public finances and help tackle the long-term challenges in the EU, notably the demographic transition, digitalisation, and the implementation of climate policies.

Model-based benchmarking

In a recent paper (Pfeiffer et al. 2023), we apply a benchmarking approach to quantify the potential impact of structural reforms in EU member states. We start by collecting key structural indicators across five policy areas: (1) market competition and regulation, (2) taxation, (3) skills and education, (4) labour markets (e.g. participation rates), and (5) research and development (R&D). Improving the performance measured by these indicators is a key goal of many economic reforms.

We then map these indicators into an endogenous growth model and simulate what would happen if each country closed half of the distance between its current status and the best performers in the EU in each of these areas. Our model accounts for the supply-side channels through which reforms in these areas may promote growth. It features distortions in product and labour markets. Unlike standard models that rely on exogenous technological progress, innovation in our model arises endogenously and is susceptible to reforms and policy. The model also distinguishes between low-, medium-, and high-skilled labour, allowing us to simulate human capital and educational reforms.

The model-based analysis usefully complements empirical estimates, which often face identification challenges (e.g. Égert and Gal 2018, de Haan and Wiese 2022). Our setup captures macroeconomic dynamics, in particular feedback effects and explicit transmission channels. In fact, the macroeconomic effects of structural policies may be quite different from those in specific sectors, and failing to acknowledge the general equilibrium channels can reduce incentives for undertaking reforms (De Grauwe et al. 2018, Gersbach 2004). Moreover, typically, studies examine the growth effects of a single reform, and the literature is mostly concerned with deregulation, such as product and labour market reforms (e.g. Duval and Furceri 2018). By contrast, our approach encompasses potential synergies and interactions between reforms. Moreover, considering the EU's high level of economic integration, we adopt a multi-country perspective. In the single market, economic policies in one country can have significant spillover effects on the economies of other countries. In general, larger policy-oriented models, such as our model, are useful because they can quantify a more comprehensive set of (competing) transmission channels and reforms (for applications to Italy see, for example, Mocetti et al. 2022 or D'Andrea et al. 2023).

However, despite these advantages, stylised simulations are not directly applicable to assessing concrete reform measures in a particular country. This is due to the difficulty in quantifying the depth and scope of the measures and mapping them onto model variables. First, while ambitious reforms can imply large aggregate effects, structural reforms typically work at the microeconomic level. Models have limited entry points for reforms in policy simulations, given their limited set of exogenous variables and structural parameters. Second, ex-ante assessments are even more challenging because sufficiently detailed information on the ambition and implementation of particular reforms is typically not yet available. Finally, while it would be beneficial to have explicit cost assumptions for assessing specific policy measures, we focus on exogenous changes utilising a closing-the-gap methodology, enhancing the generality of our findings.

Unleashing potential via reforms: The macroeconomic impact of closing performance gaps

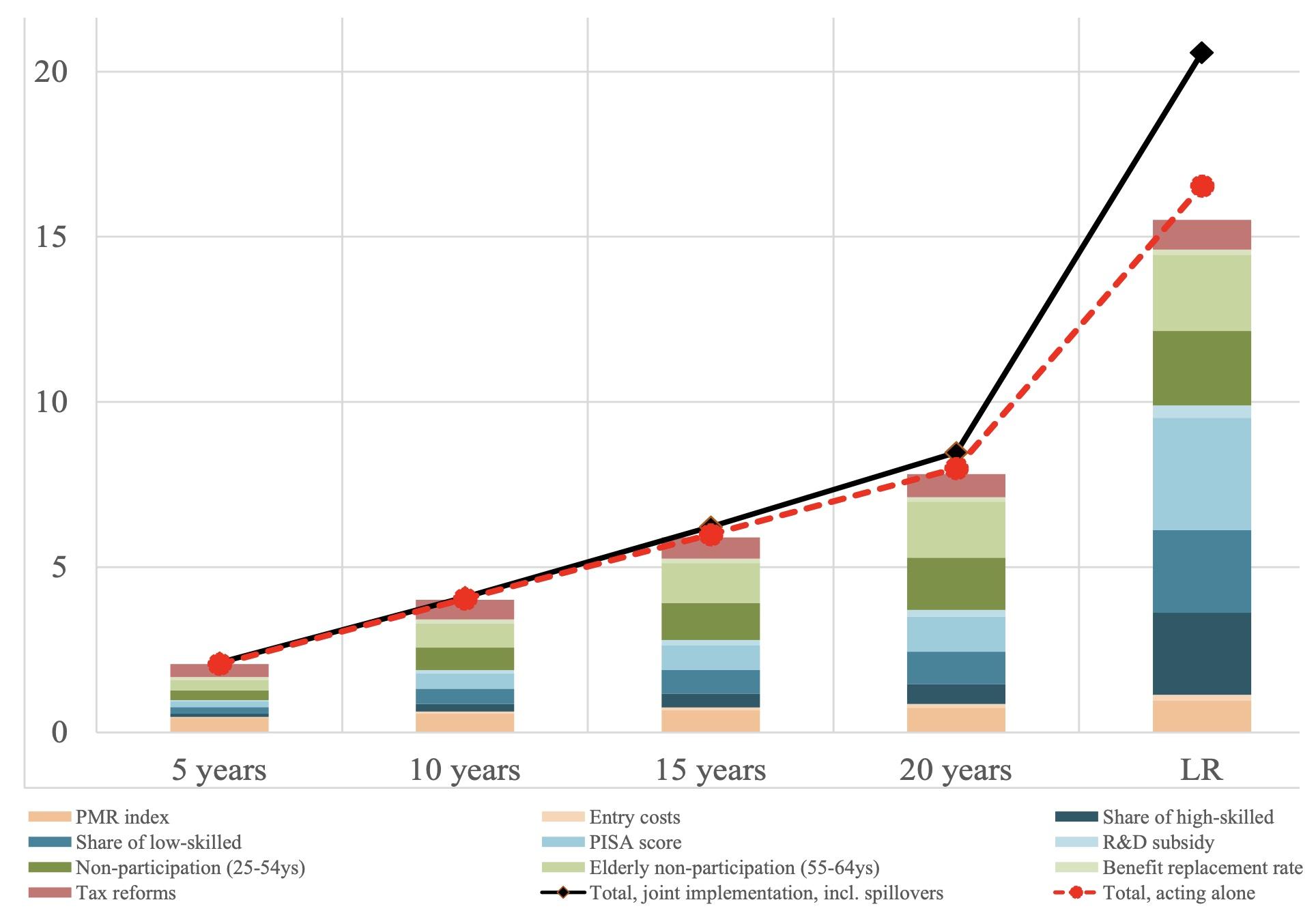

Ambitious reforms can yield significant long-term improvements in growth potential and key macroeconomic variables. Figure 1 shows that by closing half of the gap with top performers in all member states, the EU's real GDP level could increase by more than 20% in the long run. In our paper, we also discuss the broader macroeconomic impact. For example, the growth-inducing effects boost tax revenue and lower debt ratios. Sizable employment gains are mainly driven by those reforms that boost labour force participation (depicted as blue bars in Figure 1). Together with skill-enhancing education reforms, these policies are also central to growth in private consumption, while reductions in entry costs and enhanced product market deregulation spur private investment.

Figure 1 Dynamic GDP effects of closing half of the performance gaps across the EU (% deviation)

Note: This graph shows simulation results for the EU-27, aggregating the individual countries. Bars depict effects per reform (implemented in one country at a time and aggregated into a synthetic EU-wide effect), in deviation from a no-policy change baseline. The black line refers to a simulation covering all reforms and countries simultaneously, while red lines report results obtained from simulations run one country at a time (all reforms), thereby ignoring spillover effects arising from joint reform implementation. “LR” reports long run results (i.e., the new steady state).

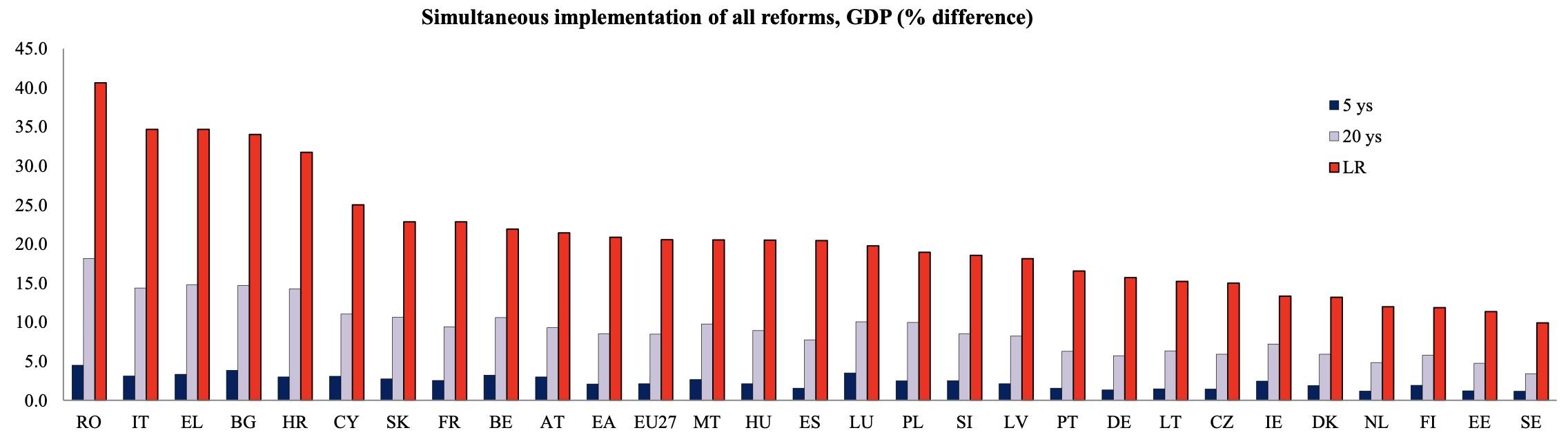

Figure 2 summarises the distribution of GDP effects among the EU's member states. Some countries with the most extensive scope for reform experience considerably larger effects, reaching more than 40% in the long run. Improving the performance across all reform areas considered in our analysis implies real convergence in productivity and GDP per capita. The simulation results show that closing half of the gaps leads to the largest GDP gains in Romania, Bulgaria, Greece, and Italy, while Sweden, Finland, Estonia, and the Netherlands witness the smallest increases. In line with the identified gaps, the potential GDP gains observed in the study could thus reduce income disparities in the EU. Compared to Southern European member states, Central and Eastern European countries generally have a more favourable tax structure (with a higher share of indirect taxes) and higher participation rates. Therefore, they may benefit less from reforms in these areas.

Figure 2 Joint implementation of all reforms across the EU, by member state

Note: This graph reports the level of real GDP in percent deviation from a no-policy change baseline. The simulations assume that all countries simultaneously close half of their respective gaps to the best three performing EU Member States. The results refer to a simulation covering all reforms and countries simultaneously.

Moreover, while stylised, the model exercise gives a sense of the most promising areas for reform across the member states and the EU. In the short to medium run, competition and regulation, tax, and labour market reforms dominate in terms of GDP effects (depicted in Figure 1 as red and green bars, respectively). In the longer run, progress on closing the gaps in terms of human capital (blue bars) yields the most significant gains. For example, closing half of the gaps in educational quality, as measured by PISA scores, and human capital could increase EU GDP by almost 10% relative to the baseline in the long run. These effects are permanent and imply lasting improvements in the standard of living in the EU. Notably, the rich cross-country analysis also offers country-specific insights for all Member States.

We find considerable synergies across reforms, as shown by the difference between the bar graphs (individual reforms) and the red dashed line (all reforms combined) in Figure 1. The combined growth effect of implementing a range of reforms is greater than the sum of individual reform effects. For instance, a society with higher skills benefits more from reducing entry barriers to innovative activities. Additionally, reforms generate positive spillover effects across member states, increasing growth potential beyond the simple sum of national actions, as shown by the difference between the dashed red and solid black line in Figure 1. These positive spillovers arise without explicitly considering the EU's broader ‘added value’, such as political economy considerations, economies of scale, or coordination gains. However, in the short run, net spillover effects remain modest for supply-side policies due to competitiveness gains and demand spillover offsetting each other.

Nonetheless, it is essential to recognise that harvesting the benefits of reforms can take time, as policies often only fully unfold their effects in the medium to long run and require design and implementation time. Skill and education reforms, in particular, feature long lags because new graduates who have benefited from education reforms enter the labour market only gradually. Therefore, delays in addressing these gaps imply that countries need to catch up even more.

Conclusion

We conclude with a note of caution, acknowledging the stylised nature of our assumptions and simulations. While closing half of the gap to the best performers in our analysis implies significant reforms, real-world reforms in practice tend to be less ambitious. Moreover, by design, our simulations assume substantial improvements as measured by our structural indicators without specifying the precise details of the reforms. However, the actual impact is contingent upon various factors, including the reform design, associated costs, and the execution process. Thus, the potential impact of reforms may vary, and could be smaller than our analysis suggests. Finally, economic disparities are multifaceted. The results should not be narrowly interpreted as if reforms should be limited to the areas identified in this analysis.

Despite these inherent challenges and uncertainties, our benchmarking exercise highlights the vital role of reforms for sustainable economic growth and reducing disparities among member states.

References

D’Andrea, S, S D’Andrea, G Di Bartolomeo, P D’Imperio, G Infantino and M Meacci (2023), “Structural Reforms in the Italian National Recovery and Resilience Plan: A macroeconomic assessment of their potential effects”, Luiss SEP Working Paper 5/2023.

De Grauwe, P, Y Ji and N Campos (2018), “Reforms are too important to be left to reformers”, VoxEU.org, 10 October.

De Haan, J and R Wiese (2022), “The impact of product and labor market reform on growth: Evidence for OECD countries based on local projections”, Journal of Applied Econometrics 37(4): 746-770.

Duval, R and D Furceri (2018), “The effects of labor and product market reforms: The role of macroeconomic conditions and policies”, IMF Economic Review 66: 31-69.

Égert, B. and P Gal (2018), “The Quantification of Structural Reforms”, The Political Economy of Structural Reforms in Europe, 132.

European Commsision (2023a), “NextGenerationEU”.

European Commission (2023b), “Proposal for a Regulation of the European Parliament and of the Council on the effective coordination of economic policies and multilateral budgetary surveillance and repealing Council Regulation (EC) No 1466/97”, 023/0138 (COD).

Friis, J W, R Torre and M Buti (2022), “How to make the EU fiscal framework fit for the challenges of this decade”, VoxEU.org, 10 November.

Gersbach, H (2004), “Structural reforms and the macroeconomy: The role of general equilibrium effects”, in R Solow (ed.), Structural Reform and Economic Policy, Palgrave Macmillan UK.

Mocetti, S, A Notarpietro and E Ciapanna (2022), “The macroeconomic effects of structural reforms: An empirical and model-based approach”, VoxEU.org, 1 July.

Pfeiffer, P, J Varga and J in ‘t Veld (2023), “Unleashing Potential: Reform Benchmarking for EU Member States”, European Economy Discussion Papers (192).

Schnabel, I (2022), “Finding the right mix: monetary-fiscal interaction at times of high inflation”, Key note speech at the Bank of England Watchers’ Conference, November.