Productivity in the UK has grown by only 0.9% per year since 2008, raising concerns about the state of the UK economy and its future. The May 2022 CfM survey revealed that most economists believe the UK will continue to suffer from low growth in the upcoming decade due to UK-specific structural challenges. Among these structural issues is its tax system, which has been characterised as “complicated, inefficient and beset with perverse incentives that do little to raise revenue” (Tetlow and Marshall 2019a). The UK tax system is a patchwork of policies enacted by successive governments, rather than a carefully designed system (Tetlow and Marshall, 2019b). Delestre (2023) provides a useful summary of the state of the system.

UK tax revenue, at 32% of GDP, is also slightly below the average of the G7 (36%) and the OECD (34%), and considerably lower than other western European countries (average tax revenue amongst the EU14 was 39% of GDP) (IFS TaxLab 2023). With an ageing population, there is likely to be increased demand for healthcare, adult social care, and pensions, which would put additional strain on public finances and further stretch the tax system (Tetlow and Marshall 2019a).

One of the biggest criticisms of the current tax system is its complexity, particularly regarding income taxes. With separate systems of income tax and National Insurance contributions (NICs) along with various rules and exemptions, the current income tax system is inefficiently organised. A common example of this complexity is the ‘hidden’ 60% effective marginal tax rate that people must pay if their annual income falls between £100,000 and £125,140 due to the loss of personal allowance, despite a statutory income tax of 40%. Similarly, employees face different effective marginal tax rates depending on how their income is structured. For instance, the effective marginal tax rates for employees in the top income bracket (earning more than £125,140) can vary significantly, peaking at 53.4% when employer NICs are included or 54.5% paid on income from dividends, falling to 47% paid on self-employment income, 45% on rental income, 28% on gains from property, and as little as 0% if an employee keeps their income in a company and then emigrates (Resolution Foundation 2023). Broome et al. (2023) suggest equalising tax rates on different kinds of income and removing very high marginal rates, through higher dividend and capital gains taxes and higher top National Insurance rates for the self-employed, offset by indexing capital gains to inflation, a cut in employer National Insurance, reinstating the personal allowance above £100,000, and abolishing the High Income Child Benefit Charge.

Politicians frequently rely on NICs to raise taxes, even though these are regressive and aren’t earmarked for social spending purposes. Economists therefore view NICs are as merely another tax on labour (but not capital) and not part of a system of social insurance (Mirrlees et al. 2018).

Another major criticism of the current taxation system is the extensive possibilities for tax avoidance. Advani and Summers (2020) find that individuals in the highest tax bracket (earning more than £125,140) pay far less than the 45% marginal income tax implied by their statutory rate. Individuals receiving £10 million have effectively paid just a 21 per cent tax rate on average. This is due to the much lower tax rates on dividends and capital gains, as well as various deductions and reliefs offered under the current system. The authors suggest that up to £20 billion could be raised if all taxable income and gains were taxed at the existing headline rates applicable to earnings. An alternative could also be replacing the current income tax system with an Alternative Minimum Tax of 35% on remuneration (income and gains) above £100,000, which would raise around £11 billion.

Property tax is another aspect of the UK tax system that needs overhaul. Council tax bands in England are still based on property values in April 1991. As a result, properties are in increasingly arbitrary tax bands that may bear little relation to current reality. Adam et al. (2020) find that the most valuable properties in 1991 (Band H) attract just three times as much tax as the least valuable properties (Band A), despite being worth at least eight times as much in 1991 and typically even more now, since prices have risen most in areas where they were already highest. As such, council tax is extremely outdated and highly regressive with respect to property value. One suggestion for reform is to replace the tax with an annual proportional property value tax based on up-to-date house valuations with tax rates chosen such that each authority raises the same amount as it did with council tax (The Editorial Board 2023b).

Stamp duty is another example of a UK tax that is considered to be a ‘bad tax’ by economists (see Best and Kleven’s 2017 analysis in this regard). Economic theory suggests that transactions taxes are inefficient and Scanlon et al. (2017) find that stamp duty reduces household mobility. This harms mobility and thus an efficient allocation of labour. A number of think tanks and politicians have called for the scrapping of stamp duty.

Economists have also pointed out the need to re-evaluate certain aspects of corporation tax in the UK. While the UK has the lowest corporation tax rate (25%) among the G7, its permanent investment allowances are among the least generous across advanced economies, and they also create distortions that hinder its economic performance (The Editorial Board 2023a). One solution to this issue includes making ‘full expensing’ – which allows businesses to deduct 100% of plant and machinery investment expenses from their taxable profits – permanent. Broadening the scope of full expensing would also increase business investment (The Editorial Board 2023a).

Under the current tax regime, debt interest payments can be deducted from taxable corporate income, whereas equity financing receives no such treatment. This has resulted in a bias in the corporation tax system towards debt, leading to businesses loading up on debt (The Editorial Board 2023a). Higher corporate indebtedness leads to lower investment and innovation, and greater economic volatility (Lopez-Garcia et al. 2023). Curbing the amount of interest that can be deducted from taxable corporate income could be one way of addressing this issue (The Editorial Board 2023a).

The final aspect of the UK tax regime that needs to be addressed is the value added tax (VAT). The UK raises a similar amount of revenue from VAT vis-à-vis the OECD average. However, unlike other countries, zero VAT rates and exemptions are applied to an unusually wide array of goods and services in the UK (Mirrlees et al. 2018). Consequently, the headline VAT rate in the UK is much higher than in other OECD countries, amplifying its distortionary effect. Moreover, the VAT exemptions in the UK can give rise to a number of bizarre anomalies. For instance, cakes and biscuits are normally zero rated, but a chocolate-covered biscuit is subject to standard rate VAT at 20%. As a result, a gingerbread man with chocolate eyes is zero rated, but if he has chocolate trousers he is subject to VAT at 20% (Clougherty et al. 2020).

Broadening the VAT base could lead to much higher tax revenues, reduced complexity and much lower market distortion. Mirrlees et al. (2018) suggest that if almost all zero and reduced rates of VAT in the UK were removed, the government could (in principle) compensate every household to leave them as well off as they were before and still have about £3 billion of revenue left over.

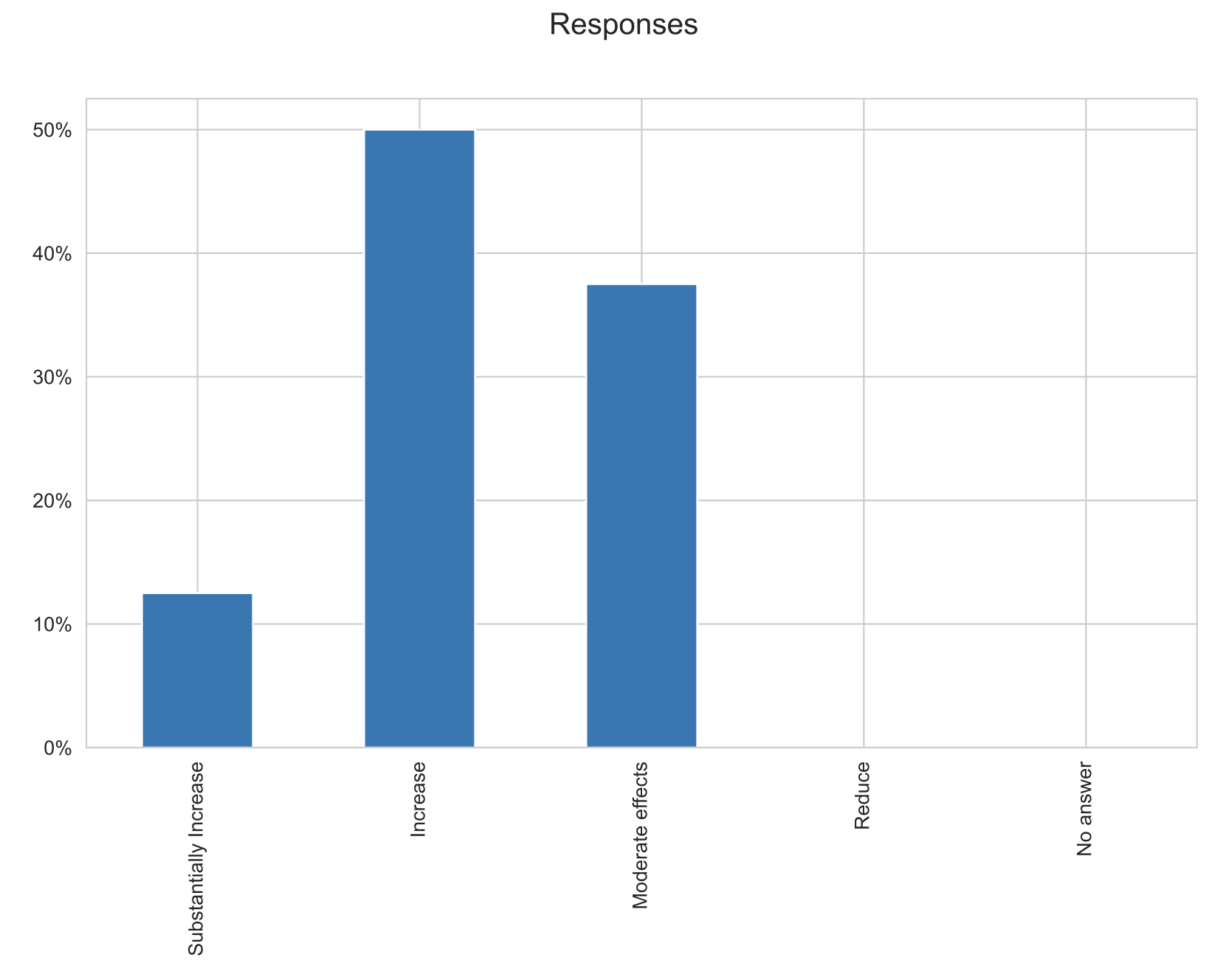

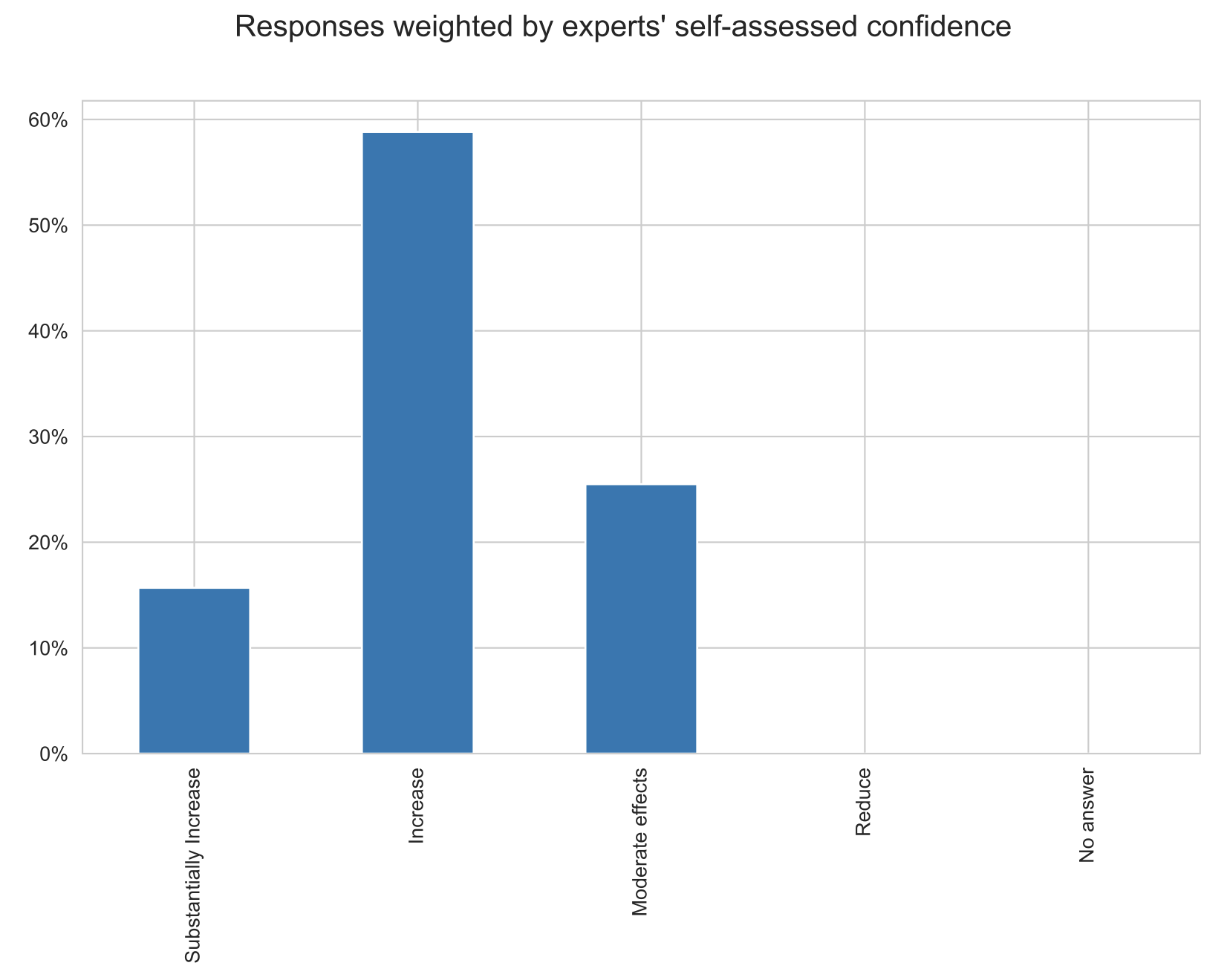

The September 2023 CfM-CEPR survey asked the members of its panel to evaluate the effect of tax reform on the UK’s growth over a five-year horizon and identify the tax in the greatest need of reform. The survey contained two questions. The first asked the panellists whether a well-designed tax reform had the potential to boost UK economic growth over a five-year horizon. The second asked them which aspect of the UK tax system they would prioritise.

Question 1: How would a major, well-designed, tax reform, affect economic growth in the UK over a 5-year horizon, relative to its current trajectory?

Twenty-four panel members responded to this question. The majority of the panel (62%) believes tax reform will have a positive impact on economic growth in the UK in the short term, with 12% stating it would have a substantial impact. The remainder of the panel (38%) believes it will only have a moderate effect on economic growth over the next 5 years.

There is a consensus amongst almost two-thirds of the panel that tax reform will increase economic growth in the UK. Most panel members believe that this is likely due to the potential positive impact that tax reform will have on private investment levels in the UK. This view is summed up by Martin Ellison (University of Oxford): “What we really need is tax reform to reduce dynamic efficiencies so that investment rises and long-term growth is secured. Those benefits will take longer than 5 years to materialise, but are much more important in welfare terms.” Nicholas Oulton (London School of Economics) highlights the importance of the issue, stating that there is an “urgent need” to boost private investment so improving incentives to invest (such as lower corporate tax rates) should have “top priority.” Patrick Minford (Cardiff Business School) argues that tax reform could potentially boost productivity in the UK as well. He points out that the higher marginal tax rates could have contributed to a “decline in entrepreneurial incentives”, which have reduced productivity growth. Jagjit Chadha (National Institute of Economic and Social Research) identifies an alternative channel through which tax reform could boost growth – reductions in the UK’s “structural fiscal deficit”. He contends that if tax reform could help in eliminating such a deficit, it would support a “stronger growth path.” He also calls for greater “clarity and consistency” in the tax regime to “support private sector investment and activity.”

The remaining panel members believe that tax reform is unlikely to significantly affect economic growth, but could have some welfare benefits by reducing the income gap. Andrea Ferrero (University of Oxford) summarises this view: “I believe that a well-designed tax reform can have a major effect on inequality, in particular, correcting the regressive aspects highlighted in the question. I'm much less convinced that such a reform can have large effects [on] economic growth.”

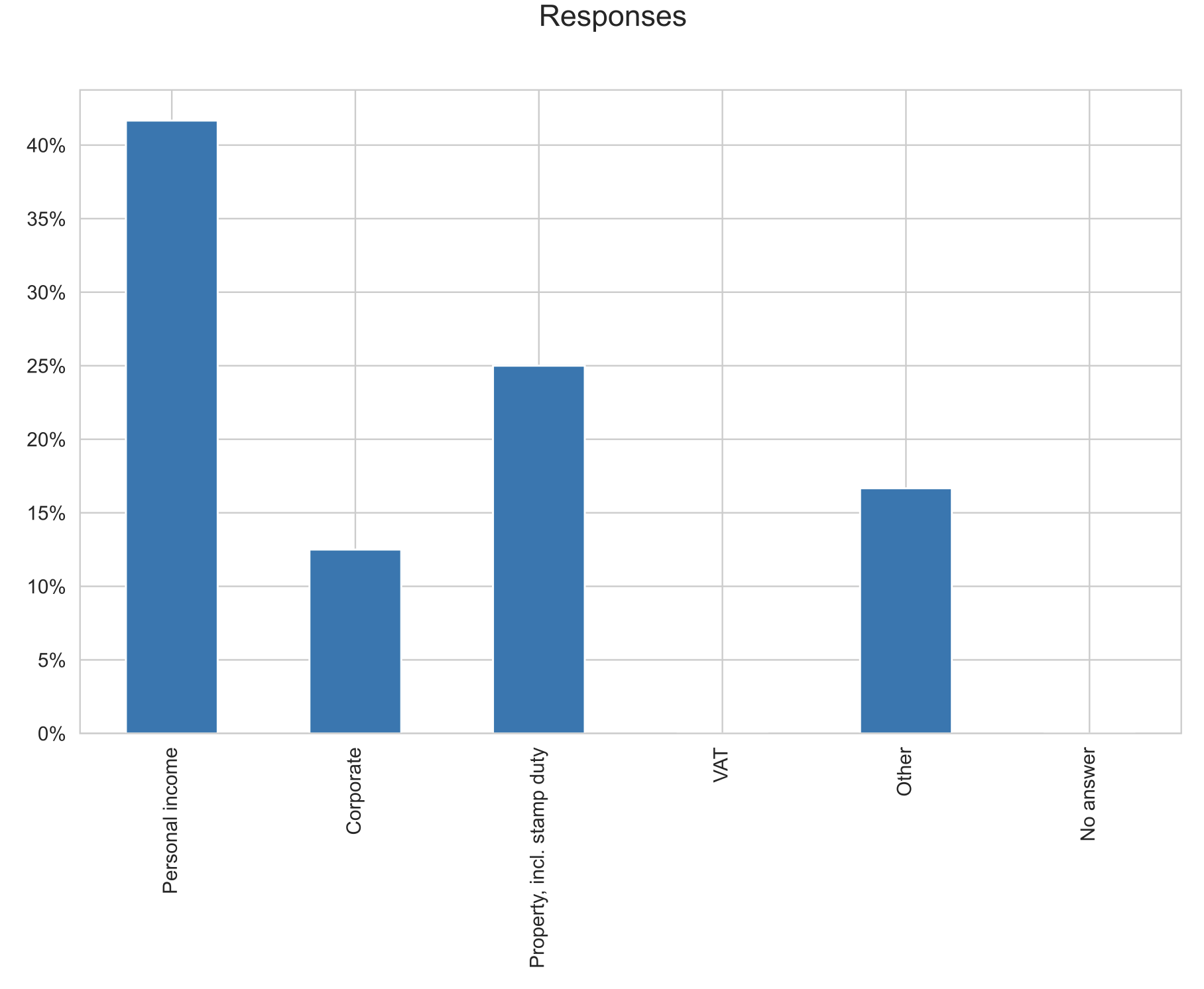

Question 2: Which of the following taxes is in greatest need for overhaul?

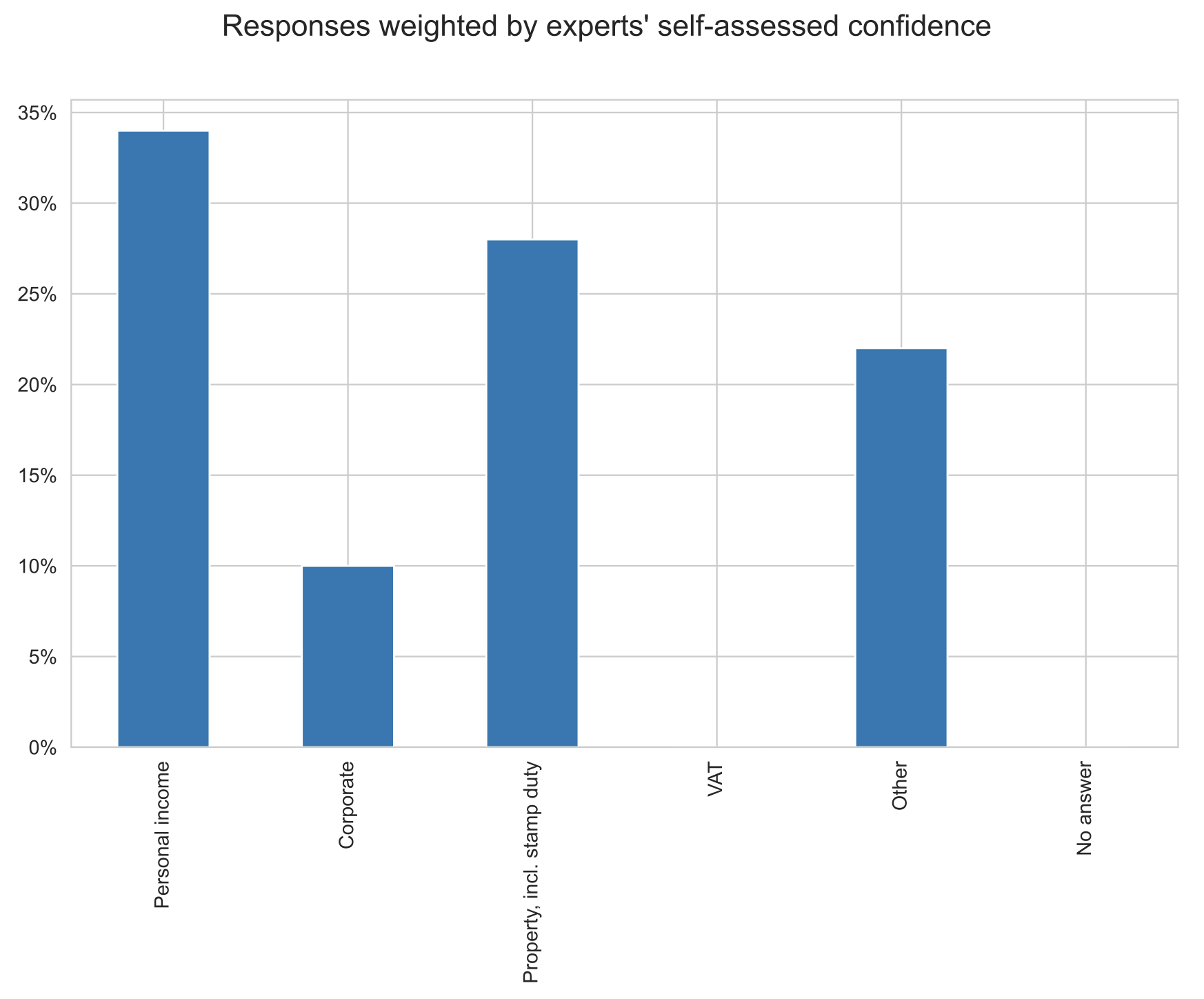

Twenty-four panel members responded to this question. Most of the panel (42%) has identified personal income tax as the tax in the most dire need of reform, with the remainder of the panel split between property tax (25%), corporate tax (12%) and other taxes (17%). Yet, almost all of the panel agree that a complete overhaul of the tax system is required, with all taxes in urgent need of revision.

Nearly all panellists believe that all aspects of the UK tax system should be updated to reflect the needs of a modern economy. Jagjit Chadha summarises this viewpoint: “I think the whole system has been tinkered to the point where we need to have a radical overhaul, so that it matches 21st century economic activity and public expenditure requirements. In the end, our revenues, broadly speaking, have to match our spending requirements and these for the moment look elevated.” Seconding this argument, Andrea Ferrero points out that the correction of a particular tax “cannot be pursued in isolation” and that an “adjustment of the whole system” is required.

Several economists have highlighted the need to reform personal income taxes due to their high marginal rates. Patrick Minford characterises the high marginal income tax rates as “disincentivising” and stresses the need for reform along with “cuts in corporate income tax.” Martin Ellison adds that personal income taxes and NICs offer the “most potential bang-per-buck for well-designed reform.” He argues that "reforming NICs and removing opportunities for tax evasion” should be prioritised over “regularising the hidden marginal tax rates faced by those with annual incomes in excess of £100k”, as this affects only “3% of the population.”

References

Adam, S, L Hodge, D Philips and X Xu (2020), “Revaluation and reform: bringing council tax in England into the 21st century”, Institute for Fiscal Studies, 20 March.

Advani, A and A Summers (2020), “How much tax do the rich really pay? New evidence from tax microdata in the UK”, CAGE Policy Briefing No. 27.

Broome, M, A Corlett and G Thwaites (2023), Tax planning How to match higher taxes with better taxes, Resolution Foundation.

Best, M C, H Jacobsen Kleven (2018), “Housing Market Responses to Transaction Taxes: Evidence From Notches and Stimulus in the U.K”, The Review of Economic Studies 85(1): 159-193.

Clougherty, T, D Bunn, E Asen and J Heywood (2020), A framework for the future reforming the UK tax system, Tax Foundation.

Delestre, I (2023), “British tax system is in need of reform,” Taxation Magazine, 11 September.

IFS TaxLab (2023), “How do UK tax revenues compare internationally?”, Institute for Fiscal Studies.

Lopez-Garcia, P, R Setzer and R Barrela (2023), “How high corporate debt stifles investment”, The ECB Blog, 18 Januart.

Mirrlees, J A, S Adam and Institute For Fiscal Studies (2018), Tax by Design: The Mirrlees Review, Oxford University Press.

Resolution Foundation (2023), “Britain needs better taxes, rather than just higher ones, to boost fairness and economic growth”, Resolution Foundation, 28 June.

Scanlon, K, C Whitehead and F Blanc (2017), A taxing question: Is Stamp Duty Land Tax suffocating the English housing market?, Report for Family Building Society.

Sikka, P (2022), "The UK’s tax system is regressive, rewards the wealthy and is in urgent need of reform”, Left Foot Forward, 1 April.

Smith, J and E Ilzetzki (2022), “Prospects for UK economic growth”, VoxEU.org, 8 June.

Tetlow, G and J Marshall (2019a), Taxing times: the need to reform the UK tax system, Institute for Government.

Tetlow, G and J Marshall (2019b), Taxing times, Institute for Government.

The Editorial Board (2023a), “Britain’s corporation tax system needs a long-term fix”, Financial Times, 13 August.

The Editorial Board (2023b), “Britain’s inefficient and unfair property levies need reform”, Financial Times, 28 August.