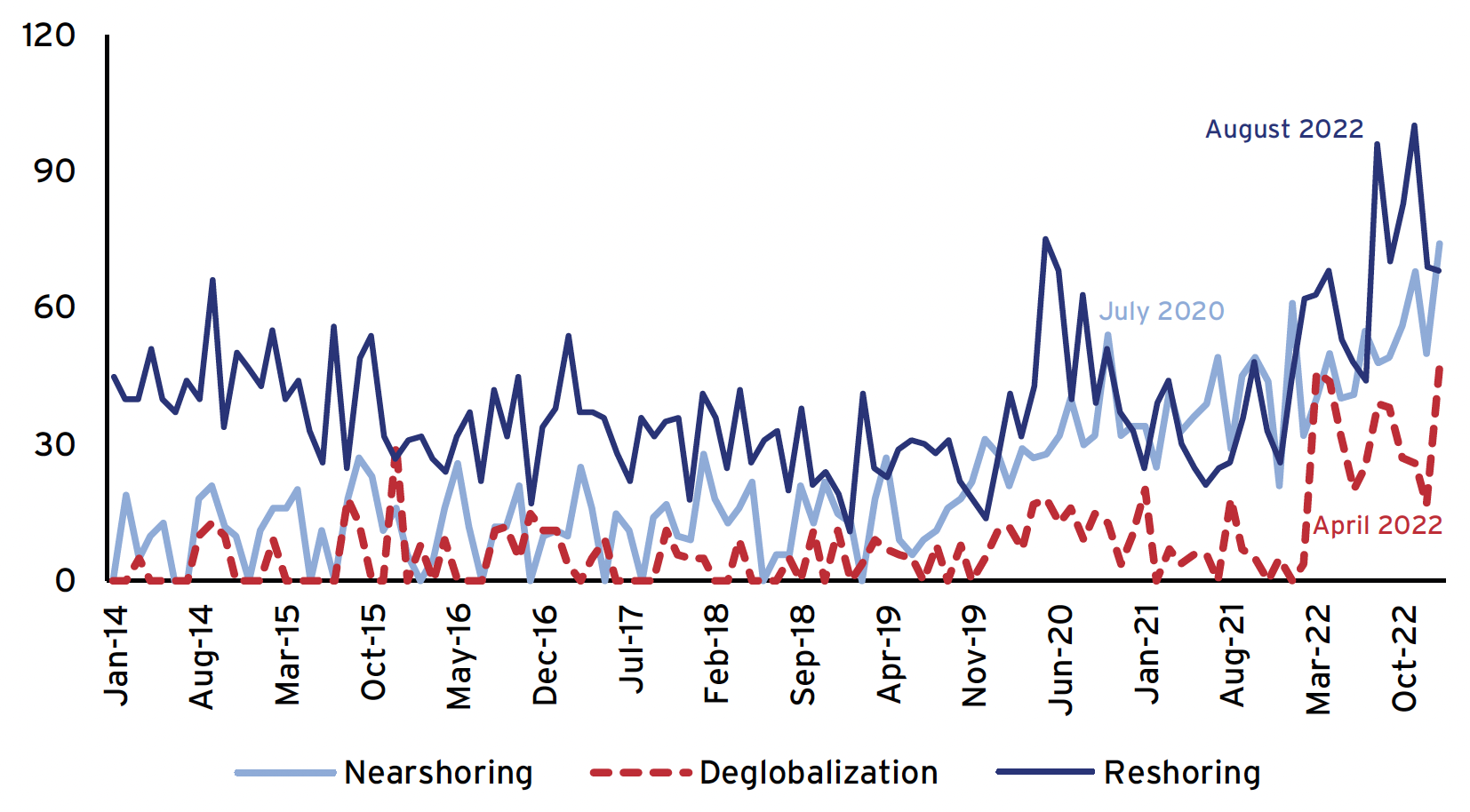

In the wake of US-China tensions, the supposed phenomena of reshoring, nearshoring, and deglobalisation are dominating the news. Google search trends show all three terms experiencing high levels of search activity since 2020 (Figure 1). The economic consequences of deglobalisation are a growing concern for policymakers (Aiyar et al. 2023, Aiyar and Ilyina 2023, Ottaviano et al. 2021) and economists have begun to estimate the economic costs for the world economy of different breakup scenarios (Bolhuis et al. 2023, Campos et al. 2023, Cerdeiro et al. 2021, Goes and Bekkers 2022, IMF 2023).

Figure 1 Google Searches for “nearshoring”, “deglobalisation”, and “reshoring”

Deglobalisation appears to be everywhere except in the (aggregate) trade statistics. Goods trade was at an all-time high in 2022, after years of slow growth. US imports in 2022 were close to 40% above pre-COVID levels, providing little support for the notion of reshoring. Even if we focus just on US-China bilateral trade relations, US merchandise imports from China in 2022 were more than 30% higher than levels in 2017, despite the tensions and the tit-for-tat tariffs imposed during the Trump administration.

In a recent paper (Freund et al. 2023), we investigate this disconnect between rhetoric and reality, focusing on the trade effects of the US-China trade war in 2018 and 2019.

In that period, US imposed tariffs on over 60% of imports from China, mostly at the 25% level (Bown 2023). We use granular trade and trade policy data from the US between 2017 and 2022 (i.e. pre- and post-trade war) and show that underneath the aggregate trends discussed above, trade and global supply chains are indeed responding to policy. US-China decoupling may be starting to take shape, but a close look at the data shows that this process may be unfolding in unexpected ways.

Five little-known facts about US-China decoupling

Let us start with a set of stylised facts illustrating how US trade policy is affecting trade and global supply chains.

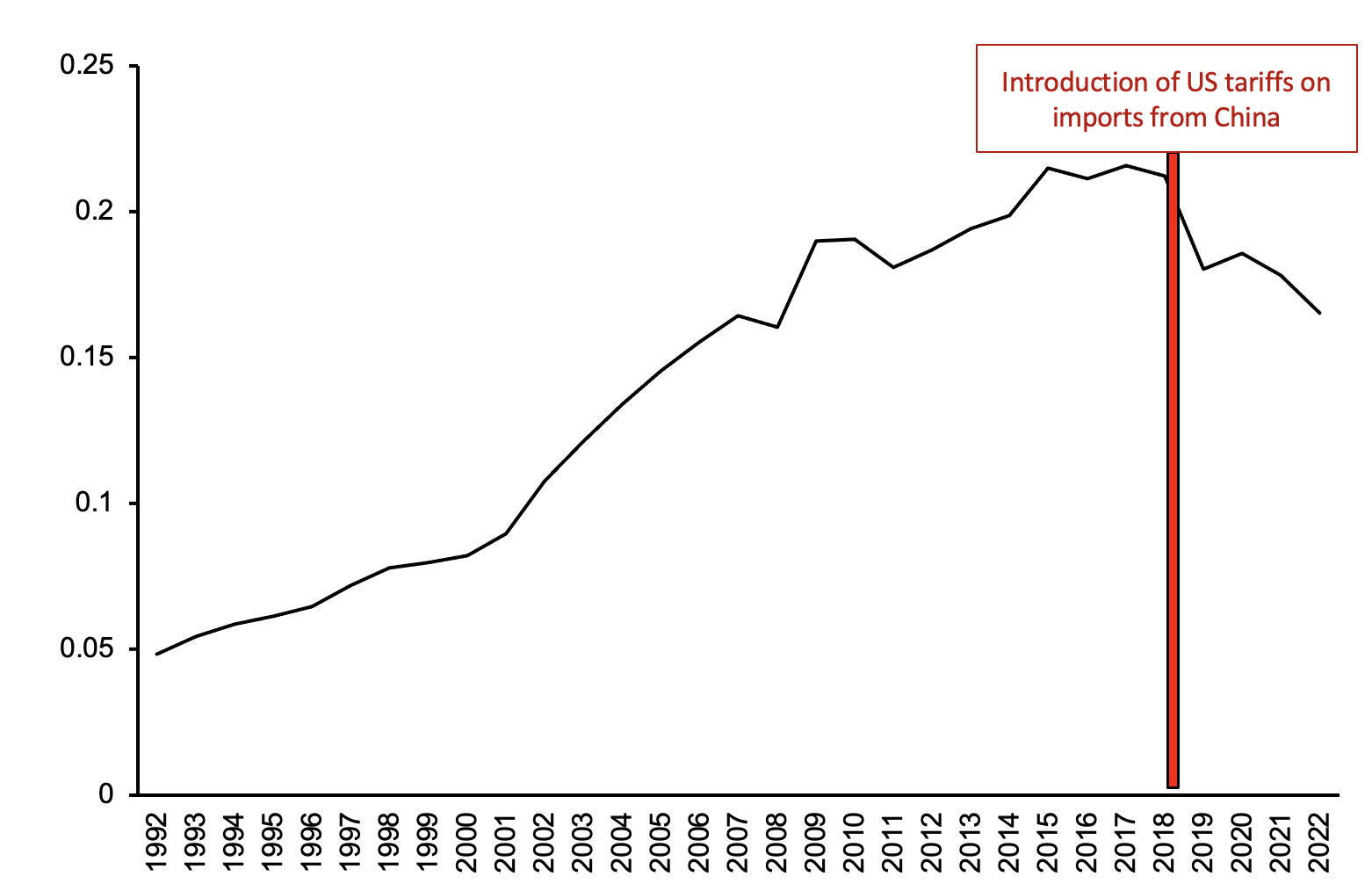

- First, US-China decoupling is happening as China’s share in US imports started declining in 2018 (Figure 2). China’s share in US imports fell from 21.6% to 16.3% between 2017 and 2022, and is now back at the level it was in 2007, before the global financial crisis. For strategic goods (i.e. the products the US government lists as Advanced Technology Products), this decline was dramatic, from 36.8% in 2017 to 23.1% in 2022 – a decline of over 13 percentage points.

Figure 2 China’s share of US imports

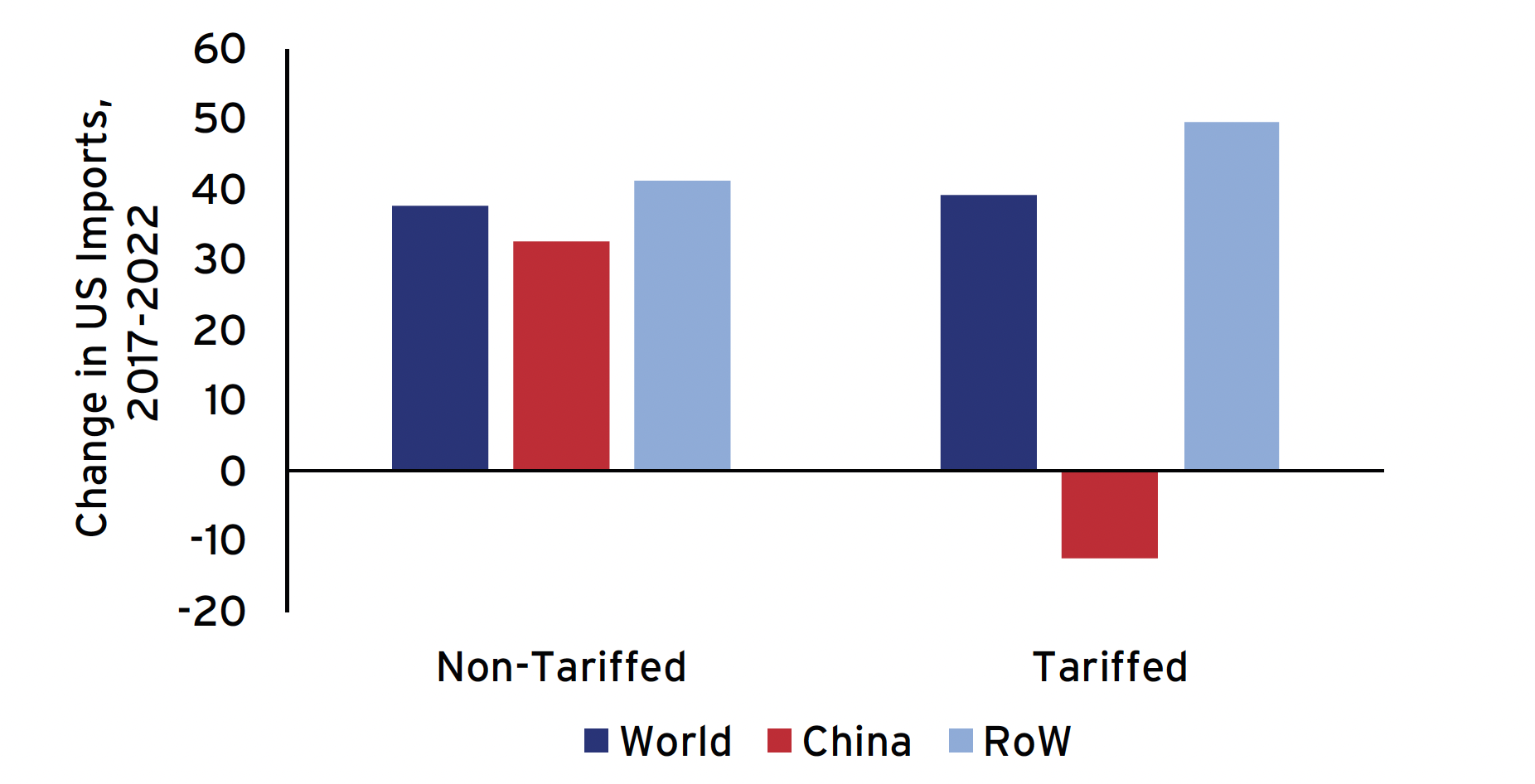

- Second, the decline in China’s share in US imports was concentrated in tariffed goods (Figure 3). In 2022, US imports from China in tariffed goods were 12.5% lower than in 2017, while imports from the rest of the world surged in those same products. No similar pattern can be detected in the products that were not hit by the tariffs, where the change in imports from China does not appear significantly different from the change in imports from the rest of the world. The sizeable reduction in China’s share in tariffed products and the increase in overall US imports together suggest that tariffs have induced importers to turn to new sources of supply.

Figure 3 Changes in US imports, tariffed and non-tariffed goods, 2017-2022

Source: US Customs

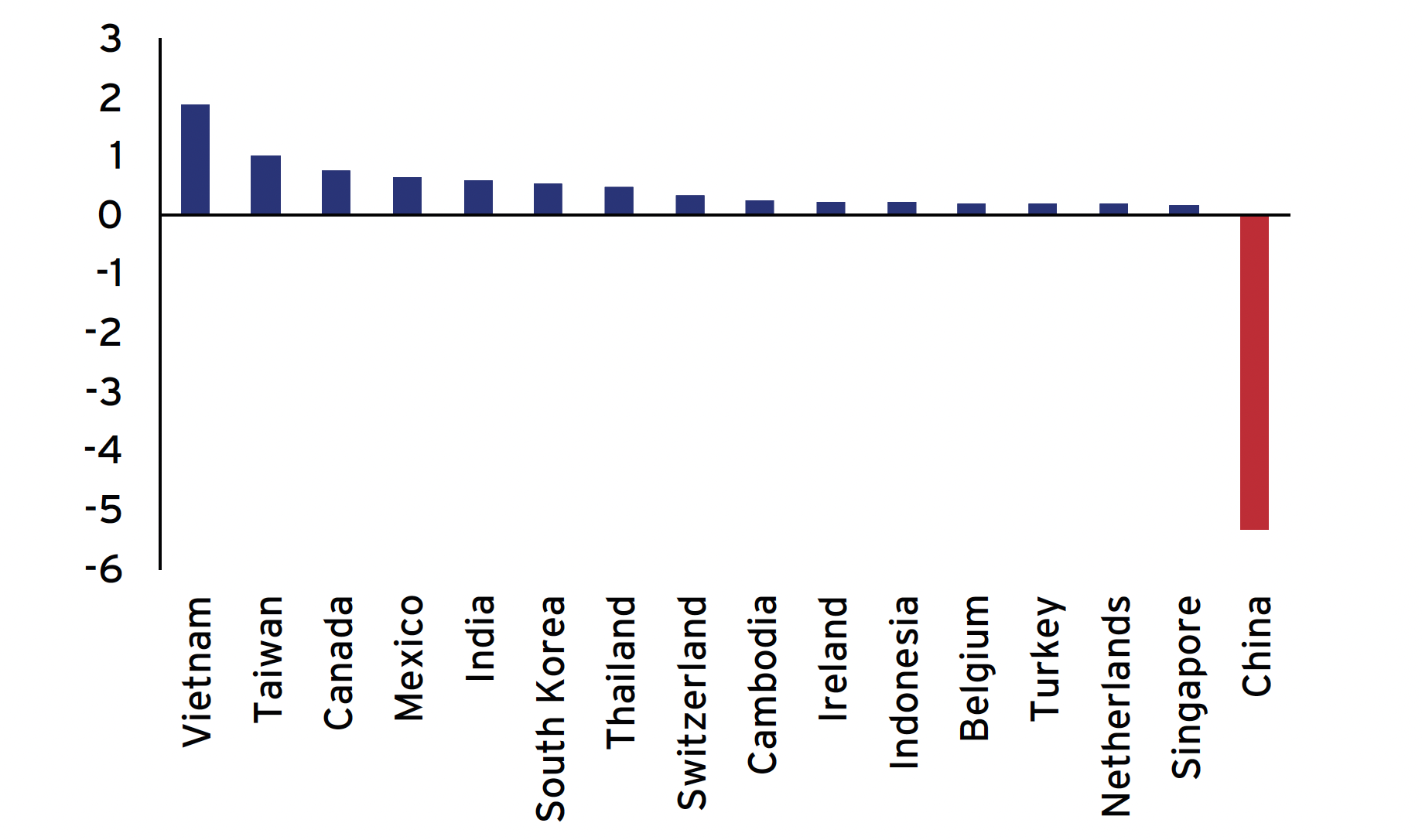

- Third, certain countries have more prominently replaced China in the US market (Figure 4). The figure shows prima facie evidence on the reshuffling of the top US trade partners from 2017 to 2022. Focusing on the overall shares, the countries with the biggest gains in market share were Vietnam (1.9 percentage points), Taiwan (1 percentage point), Canada (0.75 percentage points), Mexico (0.64 percentage points), India (0.57 percentage points), and Korea (0.53 percentage points). These six countries more than account for China’s 5.3 percentage point decline.

For strategic goods, Vietnam and Taiwan appear to have gained the largest market share in the US over the period.

Figure 4 Changes in US imports by partner country, 2017-2022

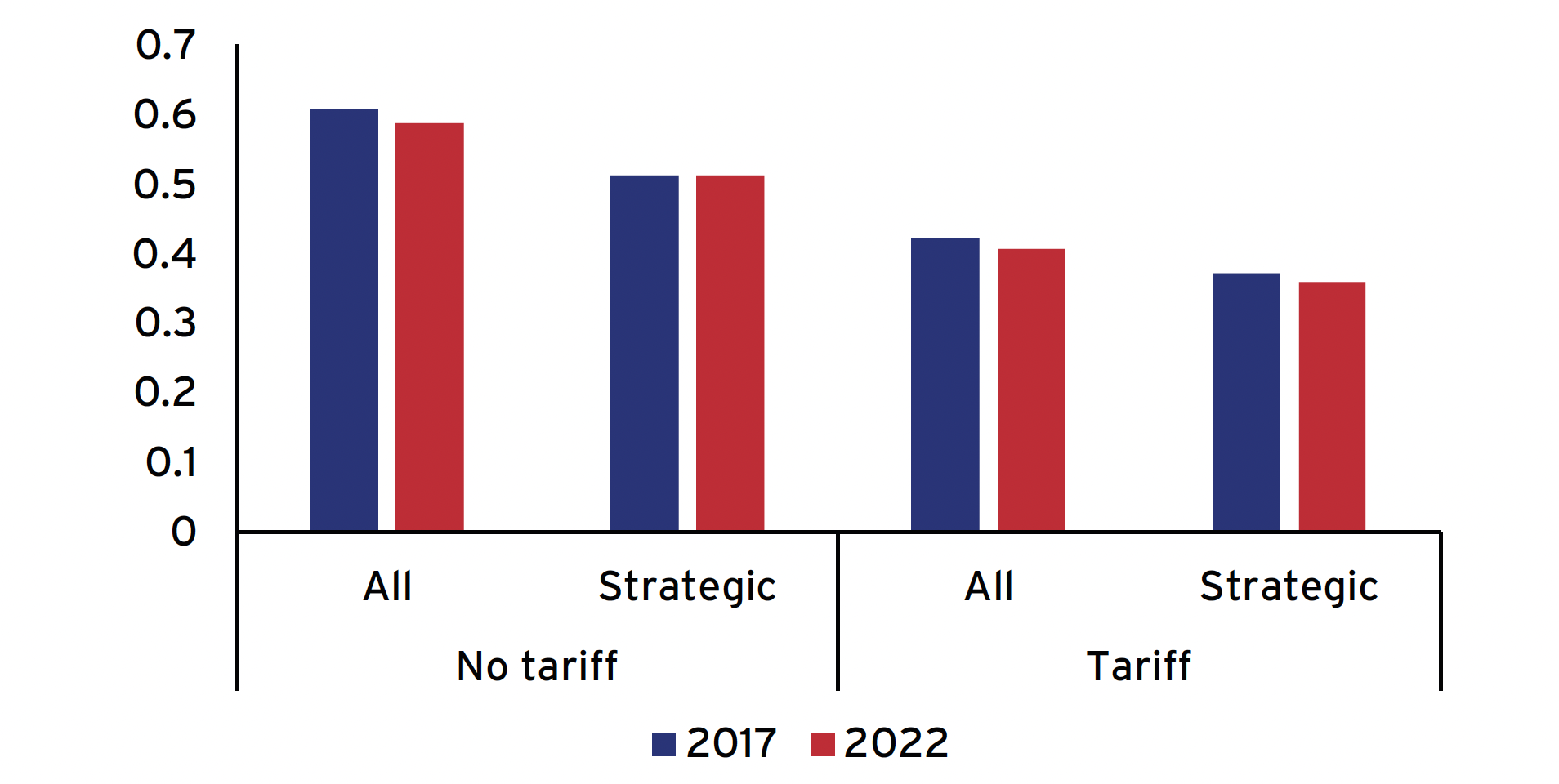

- Fourth, this reshuffling in US imports was not associated with an increase in diversification of US import sources (Figure 5). The average Herfindahl-Hirschman Indexes (HHIs) across products and time show little variation. Tariffed goods generally have a more diversified supplier base than non-tariffed goods (suggesting that limited diversification may not have been a key reason to impose the tariffs). But for both tariffed and non-tariffed products, HHIs have only marginally declined over the period, indicating that import diversification has remained fairly stable regardless of the imposition of the tariffs.

Figure 5 Average Herfindahl Indexes, tariffed and non-tariffed goods, 2017-2022

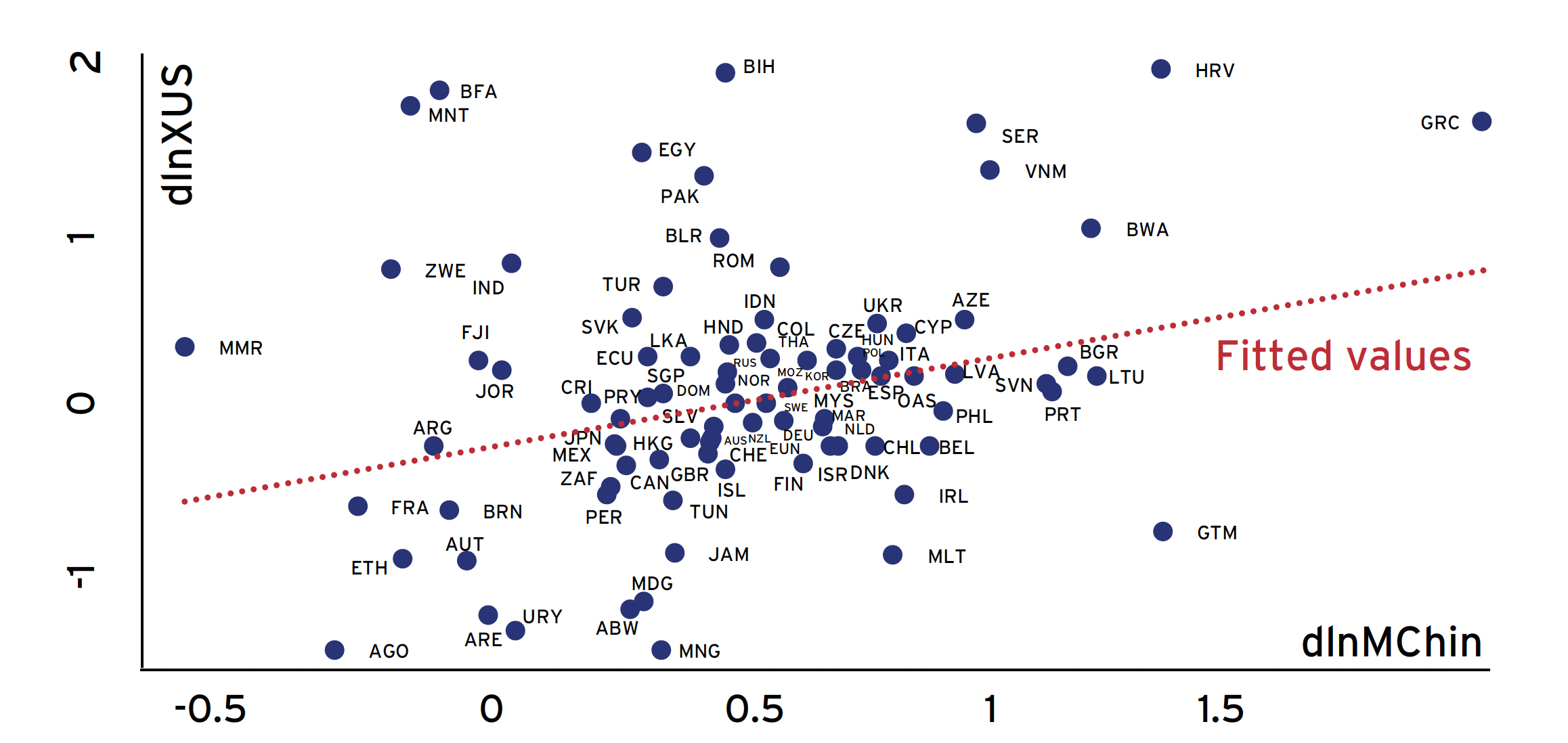

- Fifth, countries that exported more to the US, also increased their linkages with China (Figure 6). While China is being replaced by other exporters in the US market, the prima facie evidence points to the fact that US dependence on China may still be an issue. The figure shows that for electronics, the industry that contributed most to decoupling and which contains many strategic products, countries that increased exports to the US also increased imports from China in the sector. This high correlation suggests that linkages with China turn out to be especially important for those replacing China in the US market. Put differently, to displace China on the export side, countries have embraced industry-wide supply chains with China.

Figure 6 Trade in Electronics (HS85): Changes in exports to the US and imports from China

Tariffs are causing decoupling, but are not ending dependence on China

In our recent work, we investigate these issues exploiting 10-digit import data at the country level from US Customs for 2017 and 2022. The analysis relies on a simple identification strategy. First, we focus on differences between trade in tariffed and non-tariffed goods, controlling for product and market characteristics. Second, we examine the country characteristics that are associated with replacing China, especially in strategic sectors. Apart from the change in imports from China, we also investigate whether the tariffs led to a diversification of imports, reshoring, nearshoring or friendshoring.

We find that the tariffs led to a decline in imports from China and stimulated export growth in other countries. But US import diversification of tariffed goods, or of goods with declining import shares from China, did not increase markedly. Given that overall imports in these products grew at rates similar to those of other goods, there is also little evidence that the US re-shored production. When we focus on strategic industries, defined as the eleven 2-digit sectors where the US government’s list of Advanced Technology Products reside, we find the impact of US tariffs on imports from China is higher. Though there is weak evidence of an increase in import diversification, there is no robust evidence of re-shoring even for these products.

Finally, we investigate which countries picked up the slack as US imports moved away from China. We perform a difference-in-differences analysis, comparing shifts in trade patterns of products where the import share of China fell markedly with the shifts in other products, while controlling for exporter and product specific time-varying shocks. We find that countries with revealed comparative advantage in a product improved their market share. We find evidence that countries that saw faster export growth to the US in strategic sectors also had more intense intra-industry trade with China in those same sectors. This finding is consistent with the view that the reshaping of US imports away from China in strategic sectors may not have reduced dependence on China as much as import numbers suggest. These countries also experienced faster import growth from China at the 6-digit level, which could reflect trans-shipment or additional supply chain effects. Other (non-strategic) goods conformed more to the predictions of a gravity model, flowing to large, developing countries that could offer competitive wages.

Conclusion

The evidence in our research highlights the tension between efficiency and decoupling. A full reshuffling of global supply chains is not only a long-term process, it is also costly and could only be induced by pronounced and prolonged government intervention. Moreover, decoupling in direct trade may only serve to deepen the indirect linkages between US and China through the industrial supply chains of their trade partners.

Authors’ note: This column will also appear as a chapter in a forthcoming CEPR ebook on Geoeconomic Fragmentation, edited by Shekhar Aiyar, Andrea Presbitero, and Michele Ruta.The views expressed are those of the authors and they do not necessarily represent the views of the institutions they work for.

References

Aiyar, S and A Ilyina (2023), “Geoeconomic Fragmentation and the World Economy”, VoxEU.org, March .

Aiyar, S, J Chen, C H Ebeke et al. (2023), “Geoeconomic Fragmentation and the Future of Multilateralism”, IMF Staff Discussion Notes No. 2023/001.

Amiti, M, S J Redding, and D Weinstein (2019), “The Impact of the 2018 Trade War on U.S. Prices and Welfare”, Journal of Economic Perspectives 33(4): 187–210.

Bolhuis, M A, J Chen, and B Kett (2023) “Fragmentation in Global Trade: Accounting for Commodities”, IMF Working Papers, forthcoming.

Bown, C (2023), “US-China Trade War Tariffs: An Up-to-Date Chart”, Peterson Institute for International Economics, 6 April.

Campos, R, J Estefania Flores, D Furceri, and J Timini (2023), “Geopolitical fragmentation and trade”, VoxEU.org, July.

Cavallo, A, G Gopinath, B Neiman, and J Tang (2021), “Tariff Pass-Through at the Border and at the Store: Evidence from US Trade Policy”, American Economic Review: Insights 3(1): 19-34.

Cerdeiro, D A, J Eugster, D Muir, and S Peiris (2021), "Sizing Up the Effects of Technological Decoupling", IMF Working Papers 2021/069.

Fajgelbaum, P D, P K.Goldberg, P J Kennedy, and A K Khandelwal (2020), “The Return to Protectionism”, Quarterly Journal of Economics 135(1): 1–55.

Fajgelbaum, P D, P K Goldberg, P J Kennedy, A K Khandelwal, and D Taglioni (2023), “The US-China Trade War and Global Reallocations”, mimeo.

Flaaen, A, A Hortaçsu, and F Tintelnot (2020), “The Production Relocation and Price Effects of US Trade Policy: The Case of Washing Machines”, American Economic Review 110(7): 2103-27.

Flaaen, A and J Pierce (2019), “Disentangling the Effects of the 2018-2019 Tariffs on a Globally Connected U.S. Manufacturing Sector”, Finance and Economics Discussion Series No. 86, Federal Reserve Board.

Freund, C, A Mattoo, A Mulabdic and M Ruta (2023), “Is US Trade Policy Reshaping Global Supply Chains”, paper presented at the IMF conference on Geoeconomic Fragmentation, May.

Goes, C and E Bekkers (2022), “The impact of geopolitical conflicts on trade, growth, and innovation: An illustrative simulation study”, VoxEU, March.

Handley, K, F Kamal and R Monarch (2020), “Rising Import Tariffs, Falling Export Growth: When Modern Supply Chains Meet Old-Style Protectionism.” NBER Working Paper No. 26611.

IMF (2023), “Geoeconomic Fragmentation and Foreign Direct Investment”, Chapter 4 in World Economic Outlook.

Ottaviano, G, P Stanig and I Colantone (2021), “The globalisation backlash”, VoxEU.org, November.