After the global financial crisis, the inflation-indexed ten-year Treasury bond rate – a forward-looking measure of the long-term real interest rate – fell dramatically from an average of over 2% during the years 2003–7, to a near zero percent average from 2012 to 2021. From peak to trough, the drop was more than 3.5%. Low real rates propelled a huge global runup in equity and housing prices; they also had an outsized influence on the debate on fiscal policy and government debt (e.g. Holston et. al. 2017, Blanchard 2019), as well as on monetary policy; the spectre of ultra-low real rates played a key role in the Federal Reserve’s 2021 decision to dramatically change its monetary framework.

There is a now a large academic literature proposing reasons why the ultra-low rates should be expected to persist, given long-term secular trends in demographics, productivity, and inequality. Persistent low real rates play a central role in Summers’ influential theory of secular stagnation (Rachel and Summers 2019).

Based on the large empirical literature on the time series behaviour of real rates, the idea that low rates would indefinitely persist did not seem unreasonable; and existing research almost universally fails to reject the presence of a unit root (e.g. Nelson and Plosser 1982, Rose 1988, Hamilton et al. 2016).

In our recent paper (Rogoff et al. 2022), we challenge this view. Exploiting important recent advances in the reconstruction of historical real interest rate dynamics (Schmelzing 2020, 2022), as well as advances in the data on prices, growth, and demographics, we revisit the debate on whether major shocks to real interest rates should be expected to subside over time. The novel element of our approach is to look at very long time periods (700 years), and to use long-maturity rather than short-maturity interest rates.

Whereas previous research had mainly focused on post-WWII data (albeit a few papers go back as much as 150 years), our paper looks at 700 years of annual data for eight countries: Italy, Spain, the Netherlands, the UK, France, Japan, Germany, and the US, and also constructs a global real rate (constructed either by GDP weights or by weighting countries equally). Part of the reason we focus on long-term rates is that long-term interest rate data go back far longer than short rate data; widespread and consistent issuance of short-term consolidated sovereign debt begins only in the late 19th century. Also, the long-term interest rate is arguably much more important for the economy. In our main analysis, we form expected inflation using a seven-year weighted average of past inflation rates (following the classic work of Homer and Sylla 2005), but our results are robust to different constructs (as in Eichengreen et al. 2021), including a time series model to form inflation expectations (as in Hamilton et al. 2016).

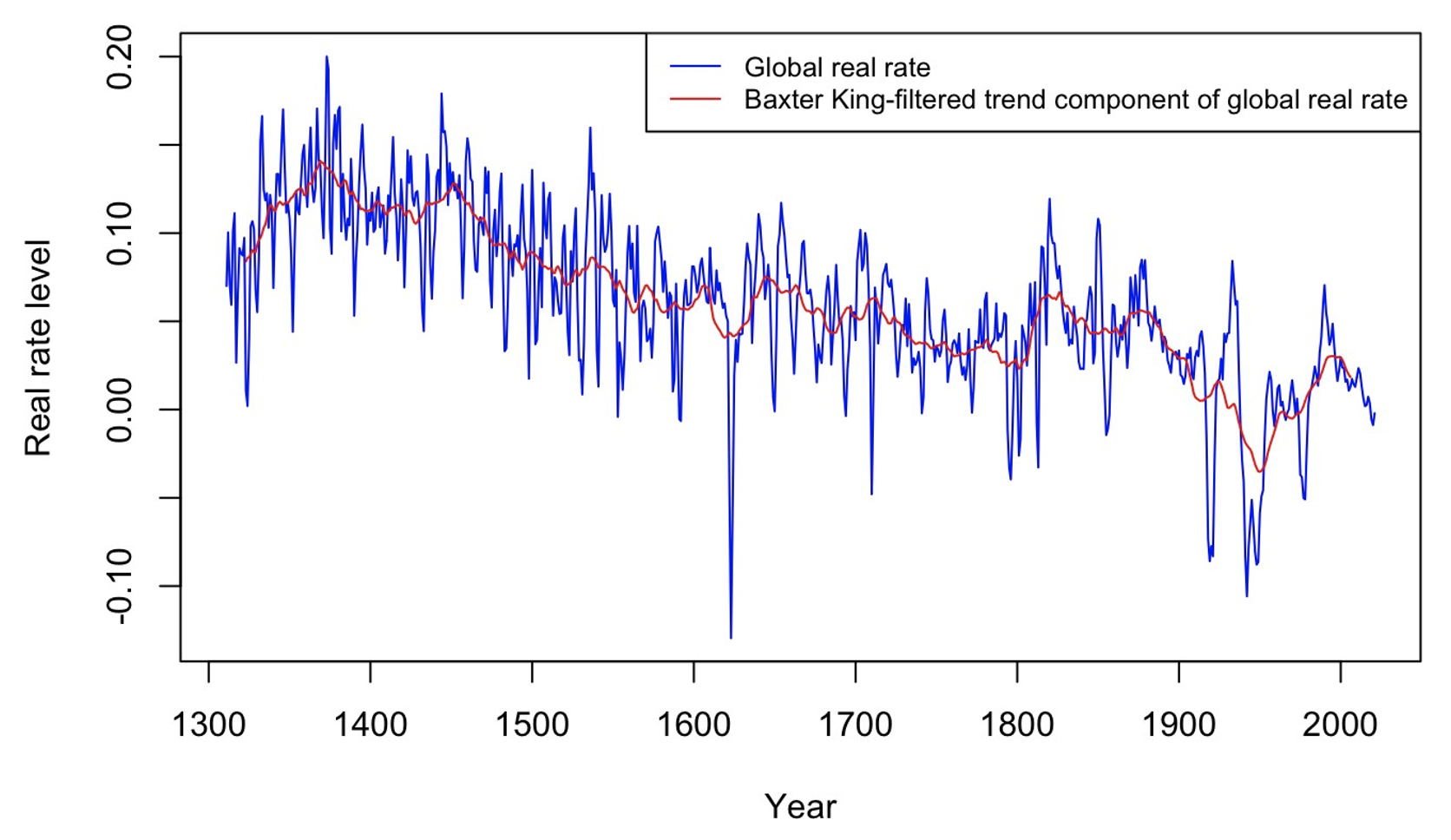

Our central result is that for both the eight individual country series, and for the globally weighted average, real interest rates are trend stationary; we consistently reject the presence of a unit root at high levels of significance across a wide range of specifications. Importantly, real interest rates do indeed show a gentle but consistent downward trend of 1.6 basis points per year since the 14th century: a trend that of course does not rule out temporary deviations – including the 350 basis points (peak to trough) decline that happened after the global financial crisis over just a few years. Figure 1 gives smoothed version of our main global series using a Baxter-King bandpass filter, tuned to bring out very long-term fluctuations.

Figure 1 The global real interest rate versus its Baxter-King-filtered long-run trend, 1311-2021

Source: Rogoff et al. (2022). The figure displays the progressively lagged global real rate series (raw data, blue line), together with the Baxterand King (1999) filtered long run trend of the same series, extracting fluctuations with cycles of length more than 100 years (red line).

As far as the speed of reversion to trend, we find half-life estimates ranging across countries of one to six years; the half-life is the amount of time it is expected to take for 50% of the shock to dissipate. This is a wide range, but it does not encompass decades.

We also test extensively for structural breaks in the mean and the trend. This is important as it has been widely conjectured that an important break occurred around 1981. There is also a literature suggesting that the founding of the Federal Reserve in 1913, followed by the outbreak of WWI caused a shift (e.g. Mankiw and Miron 1986). Looking at the long time span however, the only break points that show up strongly and consistently across countries and specifications are the Black Death (1349) and what we term the ‘Trinity Default’ in 1557-8 when France, Spain, and the States General (Netherlands) all defaulted and set off decades of financial chaos. We do not find any evidence of a break in real interest rate dynamics around 1694 (where Douglass North and Barry Weingast argue the Glorious Revolution led to critical changes in financial institutions). A break in 1981 is found for a couple of the series (including the US) when we truncate the data to include only the last 150 years, but it is not significant when we consider longer horizons. There is stronger evidence for a break in 1914, but again much less strongly than the literature would suggest.

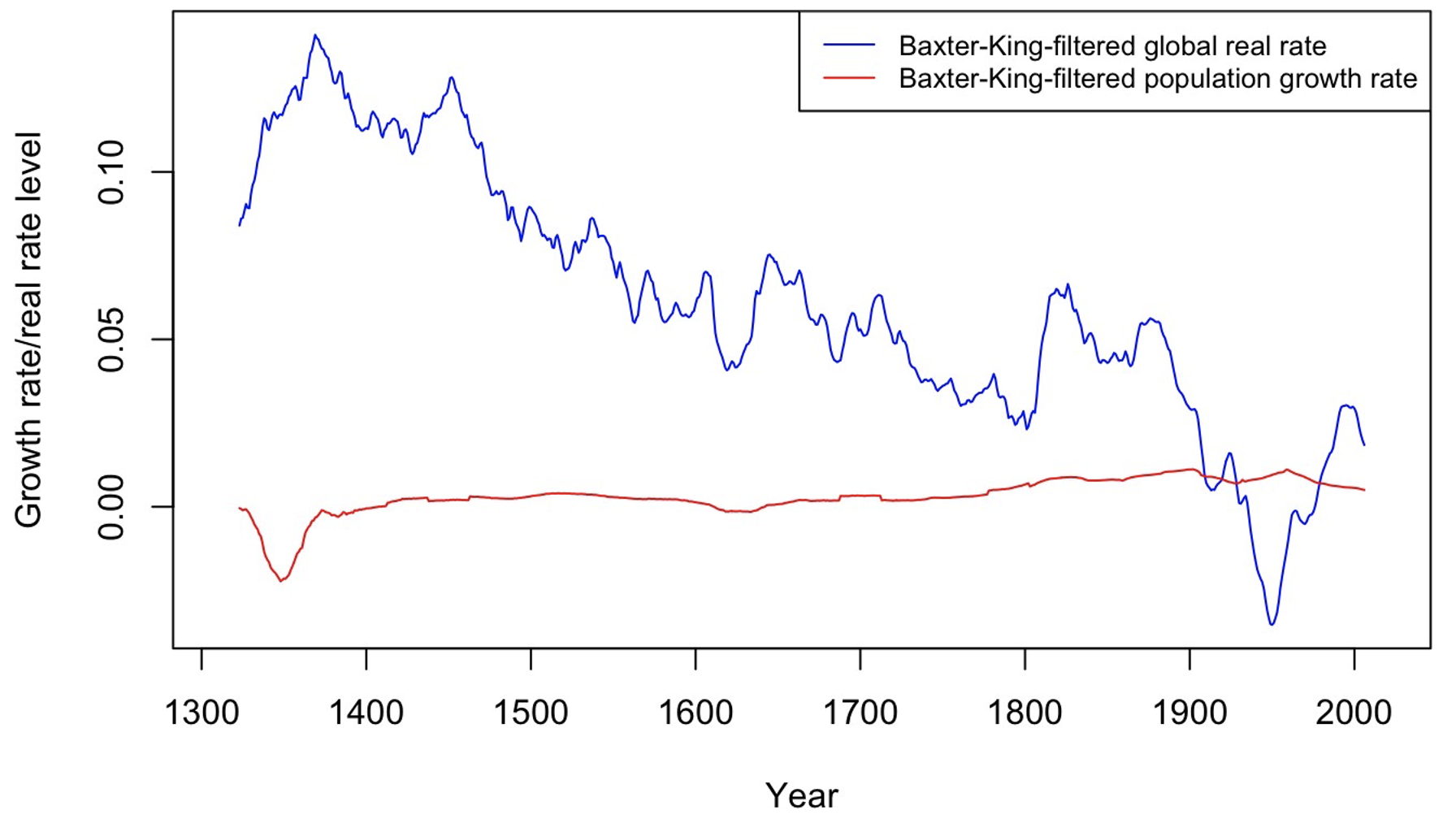

What of the large literature aimed at showing that weak demographics and growth can explain the post-global crisis real interest rate fall? A look at centuries of data gives a radically different perspective. In fact, long-term trends in demographics and output growth are both negatively correlated with the real interest rate, not positively correlated as most of the recent literature posits. Figure 2 illustrates this point for population growth; the positive correlation – quite evident over the past few decades – appears an aberration over the longer sample. We view this evidence as supporting our main hypothesis that the post-global crisis interest rate fall likely reflects cyclical factors more than secular ones. Relatedly, the fact that long-term trends in real interest rates and growth are negatively correlated is relevant to the debate on whether a future rise in interest rates might undermine debt sustainability in highly indebted economies; a rise that is not triggered by higher growth is much more destabilising.

Figure 2 A comparison of Baxter-King-filtered aggregate population growth rates and real interest rates, 1311-2021

Source: Rogoff et al. (2022). The aggregate population growth rate covers identical eight country sample, with country constituent seriesweighted according to GDP-weights of the sum of country outputs. Sources include Malanima (2011) for Northern Italy; Pfister (2021) for Germany; de la Escosura et al. (2022) for Spain (‘compromise estimate’); Dupaquier (1988) and Ridolfi (2019) for France; van Zanden and van Leeuwen (2012) for Holland; Broadberry and Fouquet (2015) for the UK. The red line displays the (filtered) long-run trend of the aggregate population growth rate. The blue line displays the (filtered) long-run trend of the global real rate.

Our paper leaves open the question of why there is a persistent downward trend in real rates over centuries; declining sovereign risk and rising liquidity are candidate factors, but we do not presume an answer. Partial default through unanticipated inflation has been especially widespread over the past century and is happening again as these words are being written. But our core result that long-term real interest rates are stationary does not require us to take a stand on the issue of why long-term real rates have gently declined over time.

One cannot preclude the possibility that short-term real rates are nonstationary even though long-term rates are stationary. For example, it is possible that the term premium and the liquidity value drive a non-stationary wedge between short and long rates. In fact, using our methodology and running similar regressions for short rates on the same (relatively) short samples on which the extant literature focuses, we, too, cannot reject non-stationarity.

The existing view that the post-global crisis fall in rates is secular, is deeply entrenched. The just-published October 2022 IMF World Economic Outlook notes that “real interest rates generally not yet reverted to pre-pandemic levels”. Nevertheless, our long-term study of long-term real rates offers a very different perspective that, at the very least, needs to be considered in the critical debate on the future path of real rates, and what it means for fiscal policy, monetary policy, and asset markets. There have been prolonged episodes of very low real interest rates in the past, and in fact we identify four such cases, but all of them eventually came to an end. Of course, today’s ten and 30-year inflation indexed Treasury rates have already risen dramatically in recent months and already exceed 1.5%. A global recession may bring them down again below zero again, but our analysis suggests that over the medium-term, reversion to trend – a slight downward trend that has been in existence since the dawn of modern financial markets – is the norm, but sharp drops such as occurred after the global crisis tend to be temporary, not secular.

References

Baxter, M and R G King (1999), “Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series”, The Review of Economics and Statistics 81(4): 575-593.

Blanchard, O (2019), “Public Debt and Low Interest Rates”, American Economic Review 109(4): 1197-1229.

Broadberry, S and R Fouquet (2015), “Seven centuries of European economic growth and decline”, Journal of Economic Perspectives 29(4): 227-244.

de la Escosura, P, C Alvarez-Nogal and C Santiago-Caballero (2022), “Growth recurring in preindustrial Spain?”, Cliometrica 16(2): 215-241.

Dupaquier, J (1988), Histoire de la population francaise, 4 vols., Presses Universitaires de France.

Eichengreen, B, A El-Ganainy, R Esteves and K Mitchener (2021), In Defense of Public Debt, Oxford University Press.

Hamilton, J D, J Hatzius, E Harris and K D West (2016), “The Equilibrium Real Rate: Past, Present, and Future”, IMF Economic Review 64(4): 66–707.

Holston, K, T Laubach and J Williams (2017), “Measuring the Natural Rate of Interest: international trendsand determinants”, Journal of International Economics 108(S1): 59–75.

Homer, S and R Sylla (2005), A History of Interest Rates, University of Rutgers Press.

International Monetary Fund (2022), World Economic Outlook, October.

Nelson, C R and C R Plosser (1982), “Trends and random walks in macroeconomic time series: Some evidence and implications”, Journal of Monetary Economics 10(2): 139-62.

Malanima, P (2011), “The long decline of a leading economy: GDP in central and northern Italy, 1300-1913”, European Review of Economic History 15(2): 169-219.

Mankiw, N G and J Miron (1986), “The Changing Behavior of the Term Structure of Interest Rates”, Quarterly Journalof Economics 101(2): 211–228.

Pfister, U (2021), “Economic growth in Germany, 1500-1859”, University of Muenster Historical Seminar Working Paper, 1-42.

Rachel, L and L S Summers (2019), “On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation”, Brookings Papers on Economic Activity (1): 1–54.

Ridolfi, L (2019), “Six Centuries of Real Wages in France from Louis IX to Napoleon III: 1250-1860”, Journal of Economic History 79(3): 589-627.

Rogoff, K, B Rossi and P Schmelzing (2022), “Long-Run Trends in Long-Maturity Real Rates: 1311-2021”, NBER working paper 30475, October.

Rose, A K (1988), “Is the Real Interest Rate Stable?”, Journal of Finance 43(5): 1095–1112.

Schmelzing, P (2020), “Eight Centuries of Global Real Rates, R-G, and the ’suprasecular’ decline, 1311-2018”, Bank of England Staff Working Paper 845.

Schmelzing, P (2022), “Eight centuries of global real rates, R-G, and the ’suprasecular’ decline, 1311-2021”, mimeo.

van Zanden, J L and B van Leeuwen (2012), “Persistent but not consistent: The growth of national income in Holland, 1347-1897”, Explorations in Economic History 49(2): 119-130.