On 23 June, the uncertainty over whether the UK will remain or leave the EU will be resolved. If the referendum is in favour of remaining, plainly the current UK government will not decide to exit. And if the referendum is in favour of leaving, it would be difficult to for the government to decide to remain a member.

How might the outcome impact on asset prices? Given the arguments put forth in the debate, one would guess that an outcome in favour of the UK remaining an EU member would cause asset prices to rise, and an outcome in favour of departing would trigger a fall of asset prices (Dhingra et al. 2016). Since the foreign exchange market is highly liquid, one would expect the outcome of the referendum to have a particularly large effect on sterling. But how much might sterling move?

In this column, we show how to get a handle on this question by looking at the relationship between daily changes in the sterling exchange rate and bookmakers’ odds of the outcome of the referendum.

Briefly, the estimates suggest that an outcome in favour of remaining might appreciate sterling by 5%; an outcome in favour of leaving might depreciate sterling by 15%. In interpreting these estimates it should be kept in mind that they are surrounded by a wide margin of uncertainty. Moreover, the size of this effect depends on any policy measures announced – in the UK and abroad – around the time of the referendum.

The odds of Brexit

There are several potential sources of information about the probability of Brexit. One is to use survey data (Gerlach 2016). However, with voting intentions varying sharply across socioeconomic groups, it is crucial that their relative importance in the survey sample is identical to that in the broader population. This is difficult to achieve and one reason why surveys did not accurately predict the outcome of the referendum for Scottish independence and the last general election.

Another possibility is to use bookmakers’ odds. These have two advantages: they are available continuously, and, since they involve financial gains and losses, there are good reasons to believe that they reflect accurately the views of those participating in the market. We therefore use them here.

Odds data are based on calculations by the Centre on Constitutional Change at the University of Edinburgh, using data provided by the website www.oddschecker.com. Oddschecker lists data from companies that have offered odds on the referendum. The 25 companies providing data started to do so at different points in time and at different frequencies, in one case offering several daily updates of the odds.

To use the odds to calculate the probability of the outcomes, they have been adjusted for the bookmakers’ profit margin. The data spans the period 12 May 2015 to 20 May 2016. From November 2015 onward, data are daily. Before that date there are missing observations, which we set equal to the most recently observed value.

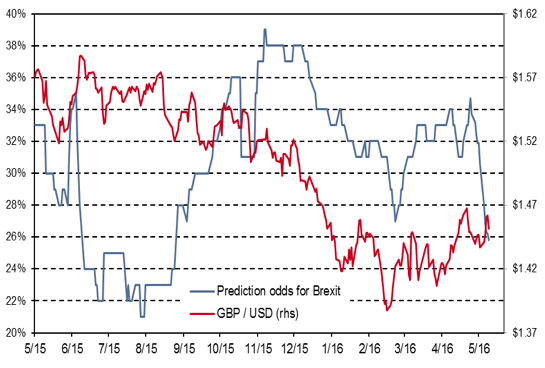

The figure below shows the calculated probabilities of Brexit and the pound/US dollar exchange rate. The two series show little correlation in the second half of 2015, but that may merely reflect the fact that there are other variables beyond the probability of Brexit that impact on the exchange rate.

The effects of Brexit

To study the effects of the outcome of referendum on sterling, we regressed the daily percent change of the dollar/sterling exchange rate on:

- The change in the Bookmakers’ odds (quoted yesterday to account for information lags);

- The percent change in the euro/dollar exchange rate (to control for US developments); and

- The percent change of an energy price index (to control for other factors impacting on the sterling exchange rate).

The model is fitted on data from January 4 to May 20, 2016 and a constant is included.

Results

The results indicate that the changes in bookmakers’ odds have economically and statistically important effects on the dollar/pound exchange rate: a 1 percentage point decline in the probability of Brexit is estimated to appreciate the exchange rate by 0.2%.

Furthermore, a 1% depreciation of the euro against the dollar is associated with a 0.5% depreciation of sterling against the dollar, and a 1% increase in energy prices appreciates sterling by 0.05%. These latter two effects are also statistically highly significant.

Table 1 Regression results

| |

Odds |

Dollar-euro |

Energy prices |

|---|

| Parameter |

0.21 |

0.57 |

-0.05 |

| t-stat. |

(3.51) |

(4.73) |

(3.20) |

Notes: R-sq. = 0.34; DW = 1.87. Newey-West standard errors.

At the end of the sample, bookmakers price in a 26% probability of Brexit. We may assume that this probability is priced into the exchange rate already. Therefore, the expected appreciation of sterling if the outcome is for the UK to remain an EU member is 0.2 × 26% = 5.2%. The expected depreciation if the outcome is to leave the EU is 0.2 × 74% = 14.8%.

It is important to recognise that these estimates are surrounded by considerable uncertainty: a 95% confidence band suggests an appreciation of between 2.2-8.4% in case the outcome of the referendum is for the UK to remain in the EU. In the case of the opposite outcome, a 95% confidence band suggests a depreciation of between 6.3-24.2%.

These are estimates of the direct effect of the outcome of the referendum on the exchange rate. These effects could be amplified by other factors. For instance, the uncertainty unleashed by a decision to leave the EU could trigger a much larger depreciation than suggested here. Similarly, it is possible that if the outcome is for the UK to leave the EU, policy changes that have a large impact on the exchange rate may be announced. The estimates provided above should thus be interpreted with a grain of salt.

Conclusions

There are good reasons to expect sterling to move abruptly in the foreign exchange markets in response to the outcome of the referendum. The size of the change depends on the size of the surprise, which in turn depends on the probability of Brexit before the referendum. Movements between 5-15% seem plausible.

References

Dhingra, S., H. Huang, G. I. P. Ottaviano, T. Sampson and J. Van Reenen (2016), “The consequences of Brexit for UK trade and living standards,” VoxEU.org, 4 April.

Gerlach, S. (2016) “What Brexit surveys really tell us,” VoxEU.org, 6 May.