The introduction and subsequent diffusion of container shipping in the second half of the 1950s marked a major innovation in transportation. By allowing increased mechanisation and inter-modality, ‘the box’ increased efficiency and became a major force behind the expansion of international trade in the post-war period (Levinson 2008, Bernhofen et al. 2016). Nonetheless, there exists no systematic evidence, except for a few engineering studies, on how much cheaper container shipping is compared to its alternative – traditional breakbulk shipping of goods in bags, bales, packed in cartons or pallets in a ship’s hold. Understanding the mechanisms through which containerisation reduces transportation costs is an important step towards evaluating the impact of reduced transport costs on trade and welfare. In recent research, we provide the first such analysis using micro-level data on Turkish maritime exports at the firm, product, and destination level in 2013 (Cosar and Demir 2017).

We start by documenting novel facts that guide our modelling and estimation. Despite a remarkably fast diffusion of the container technology across countries (Rua 2014), there is still an important margin of modal choice for firms between container and breakbulk. In our data, the average share of containerised exports at the firm-product-destination level is slightly above 50% (even after dropping fully breakbulk and fully containerised flows from the data). This is consistent with what we observe in the aggregate Turkish and US data: as of 2013, only 40% and 53% percent of Turkish and US maritime exports (in terms of value) were containerised, respectively. While container usage displays wide dispersion across all three dimensions of the data (firm, product, and destination country), a large part of the overall variation is due to the firm margin. In particular, within each product-destination category, container usage is increasing in shipment size, firm size, total exports volume and labour productivity. Within a firm and across destination countries, container usage is increasing in distance to the destination.

Motivated by these facts, we build a heterogeneous firms trade model following Melitz (2003) which we augment to feature the mode-of-shipping decision of exporters. Container shipping has a higher fixed cost but a lower marginal distance cost, making it cheaper for larger shipments beyond a breakeven distance.1 The model delivers a simple expression that relates firms’ export revenues to mode of transport and to destination distance, all of which are observed in the data. We estimate this expression by controlling for firm selection into container shipping, i.e. only the more productive firms find it profitable to use container technology.

Results

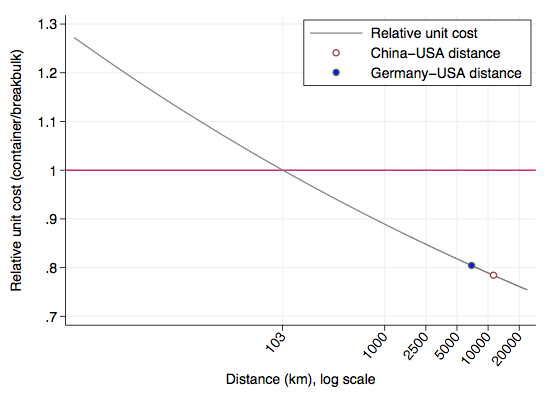

Figure 1 summarises our baseline estimate for the variable cost of container shipping relative to breakbulk. The intercept above one captures the higher ‘first-mile’ cost of container shipping, which we estimate as 1.27 (i.e. the first mile of container shipping is 27% more expensive). The estimated distance elasticity for container shipping is smaller than for breakbulk shipping. Therefore, as the cost of an extra mile is lower in a container, the relative variable cost declines with distance. This rationalises the observed pattern in the data that container usage is increasing in distance. The breakeven distance of 103 km is quite short, which is consistent with the observation that we observe containerised shipments even between nearby countries. For the distance between China and the US – the pair with the largest trade flow in the world – cost savings from containerisation reach 22%. For the distance between Germany and the US, the cost savings are estimated to be 19.5%. We corroborate these results using direct measures on insurance and freight charges on US imports, disaggregated by mode of transport.

Figure 1 Relative unit cost of container shipping

Source: Cosar and Demir (2017).

Next, we back out the fixed cost of container shipping relative to breakbulk by using additional information from our data. We find this to be 70% higher for containerised shipments on average. Given the additional fixed cost, container shipping is profitable only for large shipments. This result is in line with the observation that container usage is increasing in shipment size, firm size and productivity within a product-destination country.

Discussion and policy implications

Having estimated the structural cost parameters of container shipping relative to its alternative, we use the quantified model to address two big questions. First, by how much would maritime trade be lower in the absence of ‘the box’? Second, how much additional increase in trade could we expect if further efficiency improvements lead to the full adoption of ‘the box’?

The answer to the first question is “a lot” – current trade levels could decrease by about a third if container technology did not exist. For remote trade partners, gains from containerisation would reach 78%. The answer to the second question is “not much” – if containerisation became cheap enough to be preferred by all exporters, trade would increase by about 9%. This low future potential reflects the importance of accounting for firm selection. Even if costs decline further, new containerised exporters are going to be less productive and ship smaller volumes.

The implication for policymakers is that while containerisation has potentially large benefits starting from a low base, returns to further investments in infrastructure may be disappointingly low if usage has reached a significant level. We believe our framework and estimates can be used to assess the expected impact of large-scale investments in container ports on trade volumes.

References

Bernhofen, D, Z El-Sahli and R Kneller (2016), “Estimating the effects of the container revolution on world trade”, Journal of International Economics 98:36-50.

Cosar, K and B Demir (2017), “Shipping inside the box: Containerization and trade”, CEPR Discussion Paper No. 11750.

Levinson, M. (ed.) (2008), The Box: How the shipping container made the world smaller and the world economy bigger, Princeton: Princeton University Press.

Melitz, M (2003), “The impact of trade on intra-industry reallocations and aggregate industry productivity”, Econometrica 71(6): 1695-1725.

Rua, G (2014), “Diffusion of containerization”, Finance and Economics Discussion Series 2014-88, Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board, Washington, D.C.

Endnotes

[1] Differences in fixed costs between modes of shipping could be due to various factors. For instance, container links among ports are less frequent than breakbulk links, inducing exporters to spend additional effort to better manage production timelines and inventory scheduling. Another source is the importance of transaction-specific scale in container shipping – if the shipment size is large enough to fill a container (full-container load), firms can schedule door-to-door shipping services. Otherwise, if the shipment is less-than-container load, exporters have to purchase additional services from freight-forwarders who consolidate and store shipments at ports. Due to the cargo handling involved, such services typically involve additional costs.