New data on export insurance and guarantees suggest that export credit agencies (ECAs) have played an important role in preventing a complete drying up of trade finance markets during the current financial crisis. These efforts have complemented the support provided by international financial institutions and regional development banks and indicate that the call by the G20 leaders and the international community to ensure the availability of trade finance during the crisis has been largely followed through (Auboin 2009a,b).

But not all countries are equipped with ECAs or similar institutions and trade finance shortages may have likely persisted in a number of developing countries, especially when they are dependent on external finance. History has shown that countries with export sectors more dependent on external finance grow significantly less than other sectors during banking crises (Iacovone and Zavacka 2009a,b). In the case of Africa, evidence seems to confirm that dependence on trade credit can explain part of the fragility of African exports to financial crisis (Berman and Martin 2009).

Learning from trade finance surveys

Statistics on trade finance are notoriously scarce.

Surveys of 88 major banks in 44 countries by the IMF in cooperation with the BAFT conducted in December 2008, March 2009 and August 2009 support the view that the cost of trade finance has increased and that the supply of trade financing instruments has dried up in late 2008-early 2009 (IMF/BAFT 2009).

Although the survey finds that the demand for trade activities is the major driving factor behind these developments, about 40% of respondents acknowledge that the lower availability of trade finance instruments in their institution has played a notable role in the fall of trade finance volumes. In the most recent survey, respondents suggest that recovery was underway in some regions, but that trade finance markets have not fully bounced back.

In early 2009, a World Bank survey of 402 firms and 75 banks and other financial institutions in 14 developing countries indicated that trade finance has become more expensive and less available, with the banks becoming more risk averse and selective in the supply of credit (Malouche 2009).

Moreover, a survey undertaken by the International Chamber of Commerce (ICC 2009) on a sample of 122 banks in 59 countries from March 2009 (updated in September 2009) confirms that trade has decreased both as a result of the recession and tighter credit conditions, although the peak of the impact of the financial crisis on trade finance appears to have been reached in the first half of 2009.

The surveys also detected an increased need for more guarantees and insurance to facilitate the release of trade finance funds.

Learning from Berne Union data

The Berne Union is the leading association for export credit and investment insurance worldwide. Its members represent all aspects (private and public) of the export credit and investment insurance industry. Recent data suggest that export credit insurance volumes underwritten by Berne Union’s members have dropped sharply during the crisis (Chauffour et al 2009).

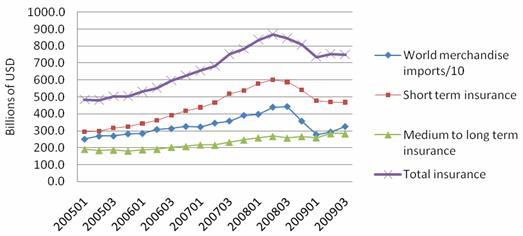

Figure 1 shows that, mirroring trade volumes, total insurance commitments of a large sample of Berne Union’s members have grown at a steady pace during the past few years before dropping between Q2 of 2008 and Q1 of 2009. Total insurance volumes have recovered side by side with trade volumes since Q1 2009.

Figure 1. World trade and trade insurance volumes

Export credit insurance volumes dropped less than trade

Intuitively, a growing volume of trade will produce an increase in the demand for trade finance, insurance and guarantees, independently of any change in the risk environment. This is likely to be the main reason why the export insurance business has grown steadily over the past few years. Similarly, the fall in trade volumes during Q2/2008 - Q1/2009 can be seen as a proximate factor explaining the drop in overall insurance commitments.

It is striking that insurance volumes have fallen by much less than global merchandise trade volumes during this period – a drop of 15% compared with 36%. This development seems consistent with the findings of earlier surveys.

Since the outbreak of the financial crisis, traders have resorted to more formal, bank intermediated instruments to finance trade in order to reduce the high probability of default in “open account” financing. In addition, the increase in bank counter-party risk may have led to a substitution of export credit insurance for other trade finance products such as letters of credit. These factors could account for a greater relative demand for external credit insurance and guarantees in spite of the substantial rise in risk premia and the cost of insurance.

Figure 1 also illustrates the evolution of the composition of export credit insurance volumes over time. Short-term insurance commitments have almost doubled in value up until the beginning of the financial crisis, yet dropped strongly between Q2/2008 and Q1/2009 (22%) and have kept falling at a slower pace thereafter (2%). In contrast, medium to long-term commitments have remained almost constant in volume during the period of greatest financial stress in Q4/2008 and have recovered strongly since then (9% increase since Q1/2009).

How to explain the facts?

The upswing in medium to long-term insurance commitments relative to short-term commitments since Q2/2008 may well be due to the fact that demand for insurance for large scale transactions typically increases in an environment of high systemic risk. Given the need to recapitalise in a timely manner, supply side factors may also have affected the composition of different maturities in insurance commitments. Indeed, with insurers and banks needing to recapitalise and to off-load assets from their balance sheets whose risks are difficult to assess, it is the short-term rather than medium- or long-term commitments that are more easily terminated or reduced on short notice.

But given that insurance premia for longer-term insurance are particularly expensive in an environment of high systemic risk, and given that capital expenditure has been dropping rapidly during the crisis, the magnitude of the divergence between short and medium to long-term volumes is difficult to explain solely on the basis of the perspective of private market participants.

Indeed, a likely factor that could help explain these findings is the active intervention of the public sector. Whereas ECAs backed by state guarantees underwrite only about 10% of overall policies, this share is much higher for medium to long-term insurance and historically accounts for a majority of collected premiums and disbursed claims in export credit insurance.

This suggests that ECAs stepped in to ease financing terms and increase insurance supply in order to alleviate market tensions when spreads widened and markets began drying up. This support came in complement to the actions taken in parallel by international financial institutions and regional development banks to support trade finance markets in cooperation with private sector partners. For instance, the World Bank Group stepped up its assistance through the strengthening of the IFC’s Global Trade Finance Program in Q4/2008 and the launch of the IFC’s Global Trade Liquidity Program in April 2009.

Mission accomplished?

It has been known for some time that trade finance volumes have plummeted during the crisis although international trade volumes were hit harder (Chauffour and Farole 2009). The recent Berne Union data suggest that ECAs may have played a significant role in stabilising the trade finance market, and thus helped reduce credit risks and allowed exporters to offer open account terms in competitive markets in an environment characterised by heightened systemic and counter-party risks.

But not all countries are benefiting from the services of ECAs in insuring or guaranteeing their exporters’ medium and long-term claims. In particular, low-income countries are generally not equipped with such institutions.

ECAs in industrial countries can support trade flows to low-income economies, however the question arises as to whether low-income countries should establish their own agencies to support exporting firms and avoid trade finance shortages in times of crisis.

The tentative answer is that, while ECAs are institutions that can – under appropriate circumstances, rules, and discipline – help alleviate market failures in trade finance, conditions for their effectiveness are demanding in terms of economic environment, institutional design, and governance (Chauffour at al 2009).

ECAs are therefore more palatable for advanced economies than for low-income countries that are in many cases still confronting basic development challenges. Instead, low-income countries are likely to be better off tapping the trade finance instruments offered by the international financial institutions and regional development banks.

References

Auboin, M. (2009a), “Restoring Trade Finance During a Period of Financial Crisis: Stock-Taking of Recent Initiatives”, Staff Working paper ERSD-2009-16, WTO

Auboin, M. (2009b), "Trade finance: G20 and follow-up", VoxEU.org, 5 June.

Berman, N. and P. Martin (2009). “The Vulnerability of Sub-Saharan Africa to the Financial Crisis: The Case of Trade.” Sciences Po. mimeo.

Chauffour, J.-P. and T. Farole (2009), “Trade Finance in Crisis Market Adjustment or Market Failure?” World Bank Policy Research Working Paper 5003.

Chauffour, J.-P., C. Saborowski and A. Soylemezoglu (2010), “Trade Finance in Crisis: Should Developing Countries Establish Export Credit Agencies”, World Bank Policy Research Working Paper 5166.

Iacovone, L. and V. Zavacka (2009a), “Banking Crises and Exports: Lessons from the Past”, World Bank Policy Research Working Paper 5016.

Iacovone, L. and V. Zavacka (2009b), "Banking crises and exports: Lessons from the past for the recent trade collapse", VoxEU.org, 27 November.

ICC (2009), “Rethinking Trade Finance 2009: An ICC Global Survey”, ICC Banking Commission Market Intelligence Report, 470-1120 TS/WJ 31 March

IMF-BAFT (2009), “IMF-BAFT Trade Finance Survey: A Survey Among Banks Assessing the Current Trade Finance Environment”

Malouche, M. (2009), “Trade and trade finance developments in 14 developing countries post September 2008 - a World Bank survey”, World Bank Policy Research Working Paper 5138.