Reducing anxiety about life in the later years is an important issue for Japan's ageing population, as anxiety could affect the wellbeing and quality of life of Japan's seniors (Hofmann et al. 2010). It is difficult to pinpoint the precise causes of anxiety in later years, although household assets, home ownership, cultural dimensions, age, education, gender, and marital status are all found to affect subjective wellbeing and anxiety about life (Kadoya 2016, Heinrichs et al. 2006, Okazaki 1997, Kallmen 2000, Pinquart and Sörensen 2000).

Despite this, a significant portion of late-life anxiety remains unexplained after controlling for social, economic, and cultural factors (Kadoya 2016). We argue that a lack of financial literacy can help explain late-life anxiety, because financial literacy enables people to become more financially and psychologically prepared for old age. Previous studies support this hypothesis. Financial literacy is found to affect household behaviour related to investments, retirement planning, wealth accumulation, stock market participation, and several other related issues (Van Rooij et al. 2011, 2012, Lusardi and Mitchell 2011b, Sekita 2013).

Measuring financial literacy and anxiety

In a recent study, we used data from Osaka University’s 2012 Preference Parameters Study, which was collected through a nationwide survey in Japan between December 2011 and May 2012 (Kadoya and Khan 2016). Although subjects in the study were aged 20 to 69, previous studies found that people became anxious about their later years around the age of 40 (Carta et al. 1991, Fichter et al. 1996, Weissman and Myers 1980, Jorm 2000). Therefore we considered respondents aged between 40 and 65.

Measuring anxiety and socioeconomic factors such as gender, age, education, house ownership, asset, social security, spouse, whether they were living with children, and exercise followed the methodology of Kadoya (2016). We used four questions to measure respondents’ financial literacy following the methodology of Lusardi and Mitchell (2007, 2008).

The questions asked to respondents to measure financial literacy included:

- Suppose you had 10,000 yen in a savings account, and the interest rate is 2% per year and you never withdraw money or interest payments. After five years, how much would you have in this account?

- Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After one year, how much would you be able to buy with the money in this account?

- Please indicate whether the following statement is True or False: “Buying a company stock usually provides a safer return than a stock mutual fund.”

- If the interest rate falls, what should happen to bond prices?

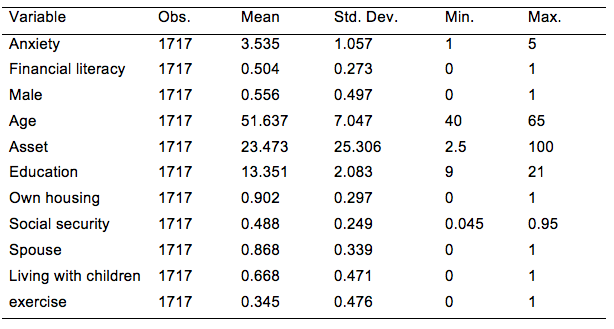

Table 1 provides descriptive statistics for the study. The mean value for anxiety is 3.54, moderately high on a five-point scale. The mean value of financial literacy is 0.50, reflecting the respondents’ inability to answer questions about financial securities pricing and risk. Our study included slightly more male than female respondents, with an average age of 51.64 years. Also, 66.8% respondents expected to live with children during their later years.

Table 1 Descriptive statistics

On average, respondents had 13 years of education, equivalent to slightly more than high school level. Respondents had high household assets, though with some inequality. The descriptive statistics reveal some interesting facts as well: 13.2% of the respondents were unmarried, and only 34.5% take exercise once per week.

Table 2 shows the current state of financial literacy in Japan as classified by gender and education level. Male respondents were more financially literate than female respondents – the number of female respondents who could not answer any question correctly was significantly higher than the number of males. Although women answered basic financial calculation questions almost as well as men, they did less well as the questions grew more complex.

Table 2 Financial literacy in Japan by gender and education level

Note: Figures within parentheses show the share of each category.

Our findings support previous studies that worldwide financial literacy is not high, and is particularly low among female and young respondents (Lusardi and Mitchell 2008, 2011a, Al-Tamimi and Kalli 2009, Alessie et al. 2011, Lusardi et al. 2010, Sekita 2011, 2013).

Financial literacy reduces late-life anxiety

We used ordered probit regression models to measure the linkage between financial literacy and late-life anxiety, controlling socioeconomic variables such as gender, age, education, household assets, ownership of house, social security, marital status, living with children, and doing regular exercise. Among these control variables, age, assets, home ownership, spouse, and social security reduce anxiety, while living with children is found to enhance anxiety.

We found that financial literacy reduces late-life anxiety, even taking into account the socioeconomic background of the respondents. This is consistent with previous studies examining the importance of financial literacy. Kadoya (2016) showed that age, household assets, home ownership, and living with children influence anxiety about life. Van Rooij et al. (2011), Sekita (2011, 2013), Al-Tamimi and Kalli (2009), and Bernheim and Garrett (2003) found that financial literacy positively affects savings and the investment behaviour of households. As a consequence, financial literacy enhances people’s capacity to accumulate wealth (Sekita 2013, Van Rooij et al. 2012, Behrman et al. 2010).

These studies highlight the role of financial literacy in reducing anxiety through financial preparedness, but we provide evidence that it reduces late-life anxiety even after controlling for asset holdings. We argue that financial literacy causes people to become both financially and psychologically prepared, and leads to less anxiety in their later years.

We checked the robustness of the findings using a weighted measure of financial literacy. This put more weight on difficult questions to accommodate the respondents’ ability to understand the complex pricing behaviour of financial securities. Regression models using alternative measure of financial literacy also show that financial literacy has a significant negative impact on anxiety, even taking into account the socioeconomic background of respondents. The effect of control variables is also found to be quite similar to those of the unweighted measures of financial literacy. Thus, the measure of financial literacy does not seem to affect the results of our study.

We also checked whether endogeneity creates biased results. We used the generalised structural equation model (GSEM) in probit to control the probable endogeneity problem. GSEM tests for endogeneity by including common unobserved components into equations for many variables. The effect of financial literacy and other control variables remained the same.

Even after controlling for a number of socioeconomic factors, this evidence suggests that financial literacy reduces late-life anxiety by making people both financially and psychologically prepared. This has an important implication for education and ageing policy in Japan. Providing financial literacy at the early stage of life, or acquiring financial knowledge through socialisation, can improve financial literacy. In turn, this would reduce anxiety about life in later years.

Editors' note: The main research on which this column is based appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Al-Tamimi, A. H. and A. B. Kalli. (2009). “Financial literacy and investment decisions of UAE investors.” The Journal of Risk Finance, 10 (5): 500-516.

Alessie, R., M. van Rooij and A. Lusardi. (2011). “Financial literacy and retirement preparation in the Netherlands.” Journal of Pension Economics and Finance, 10 (4): 527–46.

Behrman, J. R., O. S. Mitchell, C. Soo and D. Bravo. (2010). “Financial literacy, schooling and wealth accumulation.” NBER working paper No. 16452.

Bernheim, B. D. and D. M. Garrett. (2003). “The effects of financial education in the workplace: evidence from a survey of households.” Journal of Public Economics, 87 (7): 1487–1519.

Carta, M. G., B. Carpiniello, P. L. Morosini and N. Rudas. (1991). “Prevalence of mental disorders in Sardinia: A community study in an inland mining district.” Psychological Medicine, 21 (04): 1061–1071.

Fichter, M. M., W. E. Narrow, M. T. Roper, J. Rehm, M. Elton, D. S. Rae, B. Z. Locke and D. A. Heinrichs, N., R. M. Rapee, L. A. Alden, S. Bogels, S. G. Hofmann, K. J. Oh and Y. Sakano. (2006). “Cultural differences in perceived social norms and social anxiety.” Behavioral Research and Therapy, 44 (8): 1187–1197.

Hofmann, S. G., A. Asnaani and D. E. Hinton. (2010). “Cultural aspects in social anxiety and social anxiety disorder.” Depression and Anxiety, 27 (12): 1117–1127.

Jorm, A. F. (2000). “Does old age reduce the risk of anxiety and depression? A review of epidemiological studies across the adult life span.” Psychological Medicine, 30 (01): 11–22.

Kadoya, Y. (2016). “What makes people anxious about life after the age of 65? Evidence from international survey research in Japan, the United States, China, and India.” Review of Economics of the Household, 14 (2): 443-461.

Kadoya, Y. and M. S. R. Khan. (2016). “Can Financial Literacy Reduce Anxiety about Life in Old Age?” RIETI Discussion Paper No. 16-E-076.

Kallmen, H. (2000). “Manifest anxiety, general self-efficacy, and locus of control as determinants of personal and general risk perception.” Journal of Risk Research, 3 (2): 111-120.

Lusardi, A. and O. S. Mitchell. (2007). “Financial literacy and retirement preparedness: evidence and implications for financial education.” Business Economics, 42 (1): 35–44.

Lusardi, A. and O. S. Mitchell. (2008). “Planning and financial literacy: How do women fare?” American Economic Review, 98 (2): 413–417.

Lusardi, A. and O. S. Mitchell. (2011a). “Financial literacy around the world: An overview.” Journal of Pension Economics and Finance, 10 (04): 497-508.

Lusardi, A. and O. S. Mitchell. (2011b). “Financial literacy and retirement planning in the United States.” Journal of Pension Economics and Finance, 10 (04): 509–525.

Lusardi, A., O. S. Mitchell and V. Curto. (2010). “Financial literacy among the young: Evidence and implications for consumer policy.” The Journal of Consumer Affairs, 44 (2): 358–380.

Okazaki, S. (1997). “Sources of ethnic differences between Asian-American and white American college students on measures of depression and social anxiety.” Journal of Abnormal Psychology, 106 (1): 52–60.

Pinquart, M. and S. Sörensen. (2000). “Influences of socioeconomic status, social network, and competence on subjective well-being in later life: A meta-analysis.” Psychology and Aging, 15 (2): 187-224.

van Rooij, M., A. Lusardi. and R. J. Alesse. (2011). “Financial literacy and stock market participation.” Journal of Financial Economics, 101 (2): 449-472.

van Rooij, M., A. Lusardi and R. J. Alesse. (2012). “Financial literacy, retirement planning and household wealth.” The Economic Journal, 122 (560), 449-478.

Sekita, S. (2011). “Financial literacy and retirement planning in Japan.” Journal of Pension Economics and Finance, 10 (4): 637-656.

Sekita, S. (2013). “Financial literacy and wealth accumulation: Evidence from Japan.” Discussion paper, No. 2013-01, Graduate School of Economics, Kyoto Sangyo University, Kyoto, Japan.

Weissman, M. M. and J. K. Myers. (1980). “Psychiatric disorders in a U.S. community: The application of research diagnostic criteria to a resurveyed community sample.” Acta Psychiatrica Scandinavia, 62 (2): 99–111.