Why do banking crises happen in ‘waves’ across countries? Do global developments matter for domestic financial stability? Is there such a thing as a global cycle in domestic credit? In this column, we link these ideas and show that foreign financial developments in general, and global credit growth in particular, are powerful predictors of domestic banking crises. Channels seem to be financial rather than related to trade, and these include transmission of market sentiment, cross-border portfolio flows and direct crisis contagion.

Foreign booms, domestic busts

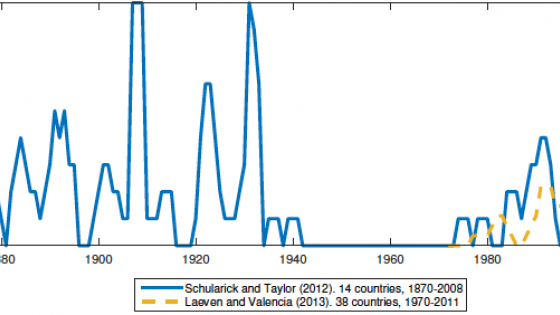

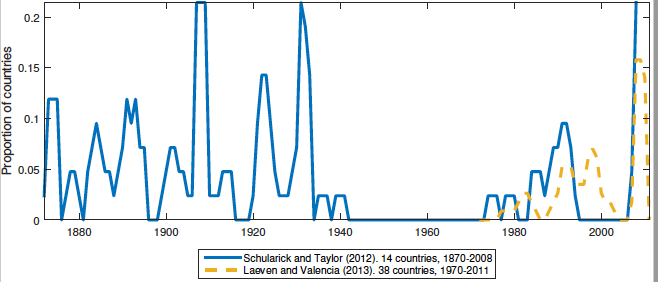

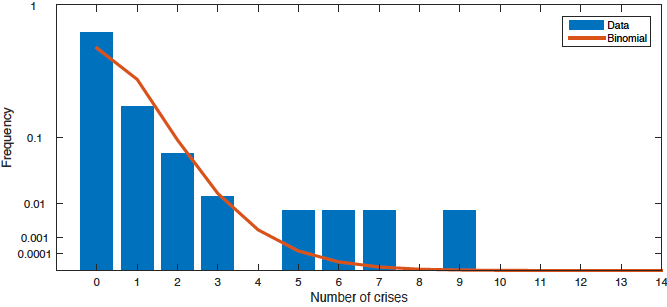

Maybe the most obvious of the stylised facts mentioned above is that banking crises tend to happen in ‘waves’ (Reinhart and Rogoff 2009). That is, they tend to happen simultaneously in a number of countries. The Asian crisis of the late 1990s and the last Global Crisis are only two examples of an old phenomenon. Figure 1 shows the proportion of countries in each sample suffering banking crises over time for two different datasets since the 19th century. These datasets base their definition of banking crises on a range of indicators, including bank runs, banking system losses, bank liquidations, and banking policy interventions. The lines in Figure 1 clearly show many spikes; that is, when crises hit, they tend to hit several countries at once. Another way of looking at the same phenomenon is by plotting a histogram of the number of crises per year in one of these samples, together with the density of a binomial distribution with the same underlying crisis probability (this is the distribution crises would follow if they were independent across countries) (Figure 2). It is clear that the empirical distribution has much ‘fatter’ tails – i.e. crises seem to be correlated. In a recent paper, we test this hypothesis more formally and find that the occurrence of banking crises is statistically correlated across countries (Cesa-Bianchi et al. 2017).

Figure 1 Proportion of countries with systemic banking crises

Figure 2 Frequency of synchronised banking crises in Schularick and Taylor (2012)

What do we know about the occurrence of such banking crises? The seminal paper in the field is Schularick and Taylor (2012), who find that booming domestic credit seems to be the best single predictor for the occurrence of a banking crisis at home. This is surely intuitive, but leaves us wondering whether the fact that banking crises are correlated across countries does not mean that we should also be looking at developments abroad.

With this in mind, and starting from Schularick and Taylor’s finding, a second stylised fact that could help us understand why banking crises are correlated across countries is the existence of a global cycle in domestic credit (Claessens et al. 2011). This means that domestic credit growth is also correlated across countries. The average correlation between countries’ domestic credit growth and the global average is high, and it has increased markedly over the last 20 years.

Is there a link between the stylised facts outlined above? Do global financial conditions affect domestic financial stability? Can that help us understand the ‘waves’ of banking crises?

In particular, we want to find out whether booming credit growth abroad contains useful information for predicting domestic banking crises, on top of that information already contained in domestic credit growth. We test this hypothesis in our paper and find that it holds up: elevated credit growth abroad is linked to the occurrence of banking crises at home, even when controlling for domestic credit growth. This is true both for a short, wide panel of 38 advanced and emerging economies over 1970-2011, and for a longer but narrower panel of 14 advanced economies over 1870-2008.

The effect of credit growth abroad on domestic financial stability is important: a one standard deviation increase in the five-year average of credit growth abroad increases the likelihood of experiencing a banking crisis at home by 2.2 percentage points. This effect is similar to that of domestic credit and is quite large: the overall frequency of crises in our baseline sample is only 3%.

Potential channels

So we now know that credit growth abroad has a major effect on domestic financial stability. But we don’t yet know why. A first clue comes from looking at which countries seem most exposed to credit growth abroad. Countries open to international finance seem to be more exposed, but those more open to international trade do not. This suggests that the channels transmitting these effects are likely to be financial rather than related to external trade.

Financial channels of transmission come in at least three varieties:

- cross-border capital flows,

- transmission of risk sentiment, and

- crisis contagion.

Although testing rigorously for each of these mechanisms is beyond the scope of our paper, we find suggestive evidence that all three seem to play a role.

First, we factor in different types of cross-border capital flows, namely, banking inflows and gross portfolio inflows (foreign purchases of domestic bonds and shares). We find no evidence that banking flows influence the risk of crisis, but we do find evidence for the impact of elevated portfolio inflows (even when controlling for domestic credit growth). The coefficient corresponding to credit growth abroad changes in magnitude and significance (which can be interpreted as evidence of some shared information with portfolio inflows) but remains significant, suggesting that capital inflows are not the whole story.

In a second exercise, we factor in a number of variables that the literature has found to affect and reflect conditions in global financial markets. We find that four of them (real short-term US interest rates, US corporate credit spreads, changes in the leverage of US broker dealer banks, and the VIX index) have a significant effect on the probability of experiencing a domestic banking crisis. More specifically, depressed values of real short-term US interest rates and of global risk aversion proxies tend to be associated with an increased probability of a banking crisis at home further down the line. Credit growth abroad remains significant when controlling for corporate credit spreads, but it does not in the rest of the cases, suggesting common channels. We interpret this as suggesting an important role for risk sentiment in explaining the influence of global conditions in general, and credit growth abroad in particular, on domestic financial stability.

Finally, we control for the occurrence of crises abroad. We find that this new variable, which is a weighted average of the number of foreign countries suffering banking crises, is significant for predicting banking crises at home, but credit growth abroad remains significant too. This suggests there is a role for contagion but also that it is not the whole story, strengthening the case for the channels described above.

In sum, credit growth abroad contains useful information for predicting the occurrence of banking crises at home, over and above that information contained in domestic credit growth. The channels behind this effect seem to be financial rather than related to foreign trade, and they seem more strongly linked to the international transmission of investor sentiment, including via portfolio capital flows (although there also seems to be a partial role for direct crisis contagion). Global risk sentiment can be captured with variety of price- and quantity-based measures, of which foreign credit growth is a prominent example. These findings highlight the importance of foreign developments for domestic financial stability.

References

Cesa-Bianchi, A, F Eguren Martin and G Thwaites (2017), “Foreign booms, domestic busts: the global dimension of banking crises”, Staff Working Paper No. 644, Bank of England.

Claessens, S, M A Kose and M E Terrones (2011), “Financial Cycles: What? How? When?”, in R Clarida and F Giavazzi (eds), NBER International Seminar on Macroeconomics 2010, University of Chicago Press.

Schularick, M and A M Taylor (2012), “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008”, American Economic Review 102(2): 1029-1061.

Reinhart, C M and K S Rogoff (2009), This Time Is Different: Eight Centuries of Financial Folly, Princeton University Press.