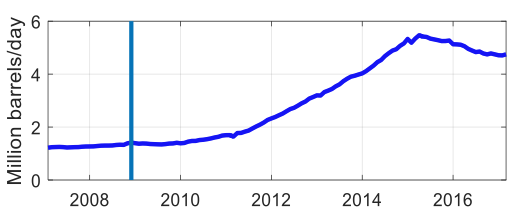

Starting in late 2008, the US production of tight oil (also known as shale oil) surged, causing a renaissance in the US oil sector that few industry analysts had anticipated (see Figure 1). This tight oil boom was made possible by technological advances in extracting crude oil from impermeable (or ‘tight’) rock formations. By 2014, tight oil production accounted for about half of the oil produced in the US. Even after the dramatic decline in the real price of oil in late 2014, production has remained resilient, as tight oil producers have managed to cut costs.

Figure 1 US tight oil production, 2007.1-2017.2

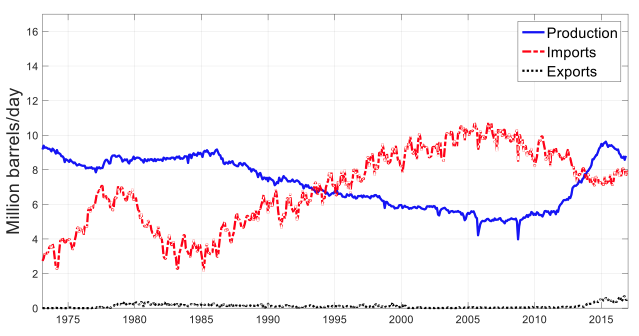

The tight oil boom was preceded by a similar boom in (natural) gas production based on the same technological advances, which caused a substantial decline in the price of natural gas in the US (Kellogg and Hausman 2015). Whereas the market for natural gas is regional, reflecting the high cost of shipping natural gas across oceans, the market for crude oil is globally integrated. Figure 2 illustrates that the increase in US domestic crude oil production between 2008 and 2014 coincided with falling US imports of crude oil.

Figure 2 US oil production and oil trade, 1973.1-2016.12

Thus, a natural question is how the surge in US tight oil production has affected the prices of crude oil and gasoline not only in the US, but in global markets. The analysis of this question is complicated by the fact that from 1975 to the end of 2015, US oil producers were subject to an oil export ban, which prohibited – with rare exceptions – exports of domestically produced crude oil. This fact explains why US oil exports remained negligible throughout this period (see Figure 2). Even in the absence of large-scale US oil exports, however, the global prices of oil and fuel were affected, as the US reduced its dependence on petroleum imports (defined as imports of crude oil as well as imports of refined products such as diesel fuel and gasoline). The tight oil boom also allowed the US to become, in turn, a major exporter of gasoline and diesel fuel, which were not covered by the US oil export ban.

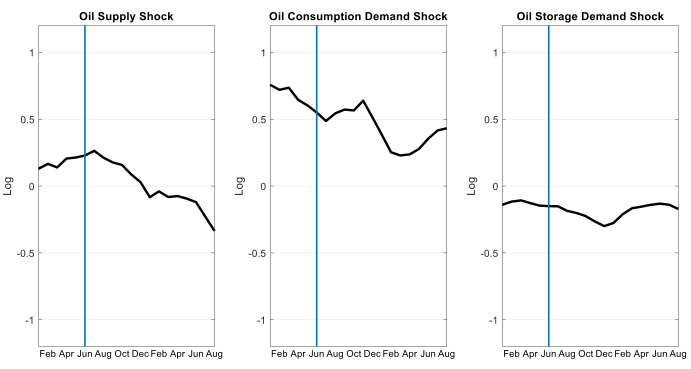

In a recent paper (Kilian 2017a), I address the impact of the tight oil boom on the price of Brent crude oil, as a proxy for the global price of crude oil, and, more generally, on the US economy, drawing on insights from a number of recent studies (e.g. Baumeister and Kilian 2017, Baumeister et al. 2017, Kilian 2016, 2017b). The paper draws on econometric analysis in Kilian (2017b) to quantify by how many dollars the tight oil boom has lowered the Brent price of crude oil. This cumulative effect is shown to be at most about $10, reaching its peak in early 2014. The econometric analysis also highlights the fact that the dramatic decline in the Brent price of crude oil after June 2014 would have occurred even in the absence of the tight oil boom. Among the many determinants of the decline in the real price of oil after June 2014, positive supply shocks were but one determinant (see Figure 3) – and many of the global supply shocks in turn were associated with unexpected oil production increases in other parts of the world, rather than merely US oil supply shocks (Kilian 2017b).

Figure 3 Cumulative effect of oil demand and supply shocks on the real price of oil, 2014.1-2015.8

It is also interesting to note that the US gasoline price in recent years has been determined by the Brent price of crude oil rather than the price of West Texas Intermediate (WTI) crude oil. Thus, when the tight oil boom caused an additional decline in the US price of oil (as measured by the WTI price) relative to the global price of oil (as measured by the Brent price) during 2011-2015, this additional decline was not passed on to the US retail price of gasoline. Instead, the US price of gasoline was effectively determined by the price of gasoline in global markets. The ability of US refiners to buy inexpensive domestic crude oil, while selling refined products at world fuel prices, made them the main beneficiaries of the tight oil boom between 2008 and 2015.

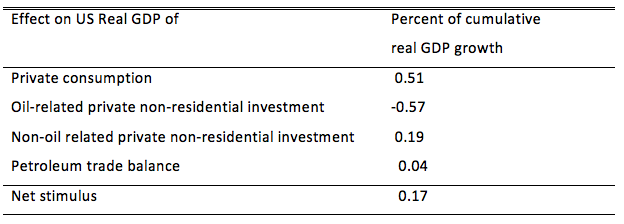

Clearly, one would anticipate unexpectedly low oil prices, whether caused by the tight oil boom or other determinants, to have some stimulating effect for the US economy. This has been the received wisdom for many years. The lacklustre performance of the US economy after mid-2014 has given rise to concerns that the tight oil boom may have fundamentally changed the transmission of oil price shocks to the US economy, requiring new theoretical models. It is instructive to disaggregate the cumulative changes in US real GDP in response to the decline in the global price of oil after June 2014 (see Table 1). The net stimulus on US economic growth from lower oil prices is near zero, but this overall result obscures some important contrasts.

Table 1 The net stimulus from unexpectedly lower real oil prices, 2014Q2-2016Q1

For example, Table 1 shows that lower oil prices stimulated private consumption and non-oil business investment and thereby raised US real GDP, as emphasised in traditional accounts of the transmission of oil price shocks, but this stimulating effect was largely offset by a decline in investment by US oil producers. Apart from the reduced investment by oil producers, the pattern and magnitude of the cumulative responses in Table 1 is, in fact, consistent with conventional models of the transmission of oil price shocks, designed for economies without domestic oil production. Such models would indeed be perfectly adequate in modelling the transmission of oil price shocks to many European economies without significant domestic oil production. What Table 1 tells us, however, is that we cannot ignore the role of changes in investment by domestic oil producers in the transmission of oil price shocks to the US economy. Traditional accounts ignoring this role are not so much wrong as they are incomplete, a point first made by Edelstein and Kilian (2007). Interestingly, the quantitative importance of the domestic oil sector in this context is not measured in terms of the share of the oil production in domestic output, but in terms of its share in domestic investment, a point that has been missed by the existing literature.

Given the important role played by oil investment, an important task going forward will be to model oil investment explicitly within US business cycle models. A common perception is that the investment decisions of tight oil producers are more sensitive to oil price fluctuations than investment decisions by conventional oil producers. This view is not true in general. Much depends on the horizon required for the completion of investment projects and on expectations about future oil prices.

It is also useful to extend the analysis of the implications of the decline in the Brent price of crude oil to European oil importers. There are several structural differences between these countries and the US that have to be kept in mind. To the extent that European oil importers, with the exception of Norway and the UK, do not have an important domestic oil industry, one would expect the decline in the Brent price of crude oil, all else equal, to have a larger stimulating effect on these economies than on the US economy. There are several reasons why the European stimulus may be smaller than the US stimulus to consumption and business investment, however. First, one of the determinants of lower oil prices has been a slowdown in the global economy that is likely to slow growth in export-oriented European economies more than in the US. Second, the euro has been depreciating against the US dollar since June 2014, in part offsetting the decline in the dollar price of Brent crude oil. Third, given the much larger share of gasoline taxes in European retail gasoline prices, the pass-through from lower oil import prices to retail gasoline prices is much smaller, and hence the response of consumers is more muted.

Going forward, a question of obvious policy interest is whether higher investment in the US oil sector would help offset the contractionary effect on private consumption of a future recovery of the real price of oil. As discussed in Baumeister and Kilian (2017), there is no simple answer to this question. The answer depends on the oil industry’s expectations about the future evolution of the real price of oil and on the degree of uncertainty surrounding these expectations. How a recovery of the real price of oil would affect US real GDP growth more generally also depends on the determinants of that recovery. No two oil price shocks are alike, and there is no reason to expect the composition, magnitude or evolution of the oil demand and oil supply shocks to mirror those in the past. For example, if a recovery of the real price of oil primarily reflected a more robust global economy, the overall effects on the US economy would be less negative than if the oil price recovery were driven mainly by actual or anticipated oil supply shocks.

References

Baumeister, C, and L Kilian (2017), “Lower Oil Prices and the U.S. Economy: Is This Time Different?” Brookings Papers on Economic Activity, Fall, 287-336.

Baumeister, C, Kilian, L and X Zhou (2017), “Is the Discretionary Income Effect of Oil Price Shocks a Hoax?” manuscript, University of Michigan.

Edelstein, P, and L Kilian (2007), “The Response of Business Fixed Investment to Energy Price Changes: A Test of some Hypotheses about the Transmission of Energy Price Shocks,” B.E. Journal of Macroeconomics, 7(1).

Kellogg, R, and C Hausman (2015), “Welfare and Distributional Implications of Shale Gas", Brookings Papers on Economic Activity, Spring, 71-125.

Kilian, L (2016), “The Impact of the Shale Oil Revolution on U.S. Oil and Gas Prices,” Review of Environmental Economics and Policy, 10, Summer, 185-205.

Kilian, L (2017a), “How the Tight Oil Boom Has Changed Oil and Gasoline Markets,” CEPR Discussion Paper 11876, forthcoming: Papeles de Energía,

Kilian, L (2017b), “The Impact of the Fracking Boom on Arab Oil Producers,” forthcoming: Energy Journal, 38, 137-160.