Having grown in real terms by 60% between 2000 and 2008, extra-EU exports have since stagnated. In terms of export volumes, the bounce back since 2009 was weaker for European exporters than for major trading partners. Average export prices essentially stopped rising after 2012. This matters, as the latest estimates suggest that extra-EU exports support over 50 million jobs worldwide (Rueda-Cantuche et al. 2013), both directly and indirectly through outsourcing and supply chains.

Download the new GTA report here:

The latest report from Global Trade Alert examines what is holding back EU exports (Evenett and Fritz 2017). Stripping out other determinants of EU export growth, such as productivity growth, the focus here is on the impact of trade distortions imposed by foreign governments since the global economic crisis began. Recognising that an EU member state’s exports to a foreign destination can be affected by market access restrictions and behind-the-border trade distortions imposed by the importing nation, as well as by policies (such as state-provided export incentives) implemented by third parties whose firms compete in the same importing nation, we reject a narrow approach that focuses exclusively on import restrictions in favour of an approach that encompasses a wider range of trade distortions. Doing so differentiates our analysis from earlier studies of the impact of crisis-era protectionism on trade flows and the global trade slowdown (e.g. Kee et at 2013 and Constantinescu et al. 2015.)

EU export exposure to trade distortions built up over time

Since the first crisis-era G20 Leaders’ Summit in November 2008, foreign governments have imposed 3,287 policy instruments that harmed the commercial interests of the EU, according to the Global Trade Alert database. Import tariff increases, bailouts and subsidies to foreign manufacturers and farmers, and steps to boost exports account for nearly 60% of that total. Government procurement-related measures, such as new Buy American rules, account for another 12% of the total. Our forefathers who experienced the 1930s would not have recognised this protectionist mix.

There is considerable variation across EU member states in the number of times their commercial interests have been hit by foreign trade distortions: from 268 for Malta to 2,600 for German’s sizeable export machine. These totals were not inflated by including health and safety-related trade restrictions, foreign policy-motivated trade sanctions, or discrimination associated with regional trading agreements. Nor do antidumping and anti-subsidy actions add much to these totals.

All too often, crisis-era protectionism is characterised as many pin pricks that each affect tiny amounts of trade – on this view, numerous but economically insignificant. We revisit this matter using fine-grained trade data,1 information on which products were affected by implemented trade distortions, and taking account of when those distortions came into force and lapsed. We calculated for every year 2009 to 2015 the percentage of each EU member state’s extra-EU exports that faced trade distortions which had been imposed since November 2008 and were still in effect.

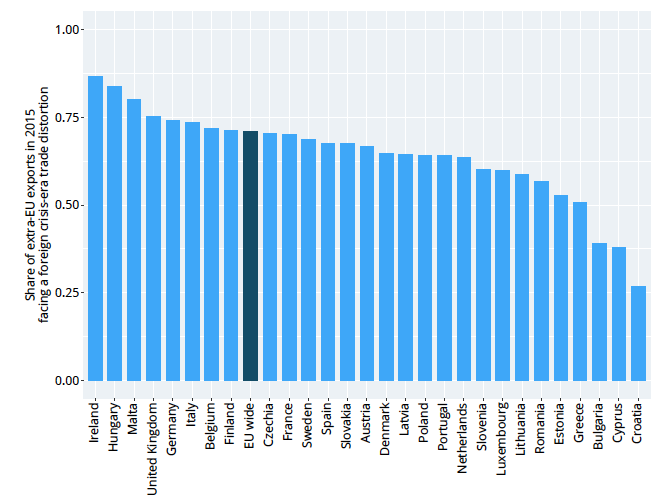

The spread of foreign protectionism since the crisis began was so extensive by 2015 that over 70% of extra-EU exports faced at least one crisis-era trade distortion when competing in foreign markets. Only three member states saw less than half of their extra-EU exports exposed to foreign protectionism (see Figure 1). In contrast, Ireland, Hungary, and Malta saw over three-quarters of their exports face trade distortions.

Figure 1 EU exposure to foreign trade distortions is sizeable

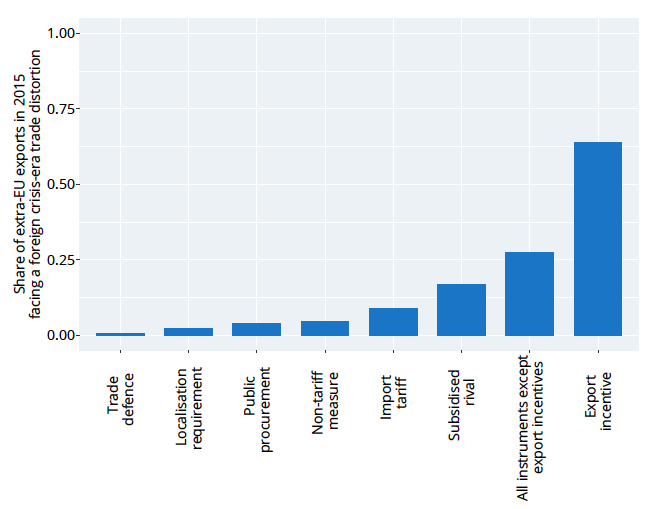

We then broke the total export exposure down according to type of policy intervention. Over 60% of extra-EU exports compete in destination markets where foreign rivals are eligible for some form of state-provided export support (see Figure 2). This is the cumulative effect of 294 foreign state initiatives to promote exports in markets where EU firms compete. China, for one, has introduced 28 export subsidies and tax-based export incentives. India has introduced a Merchandise Exports from India Scheme with incentives worth up to $3 billion.2 Even so, over a quarter of extra-EU exports amounting to €489 billion in 2015 faced other types of crisis-era trade distortion, including subsidised or bailed-out firms that only compete in their home markets. This suggests that the state-provided export incentives are not the only game in town.

Figure 2 Of all the trade distortions, EU export exposure to subsidies, export-related and otherwise, is greatest

By and large, the EU’s trading partners have eschewed 1930s-style across-the-board import restrictions; instead, since the onset of the Global Crisis some have resorted to export-led mercantilism, complemented by other behind-the-border trade distortions. That over 70% of extra-EU exports faced crisis-era trade distortions casts in a poor light claims that recent protectionism is second order necessarily on account of its limited scale (see, for example, the discussion in O’Rourke 2017).

Crisis-era protectionism reshuffled world trade

To take account of the impact of government policies of a third party on the bilateral exports between an EU member state and a destination market, the classic workhorse of empirical international trade research was adapted in a theory-consistent manner. By adapting Eaton and Kortum’s (2002) formulation of the gravity equation, the determinants were estimated of the growth from 2008 to 2014 of each EU member state’s exports to destination markets outside of the EU, relative to US, Chinese, and Japanese rivals.

Differential export exposure to trade distortions and trade reforms in foreign markets were used to identify the impact of policy changes on relative export growth. There is considerable intertemporal and cross-sectional variation in our measures of bilateral export exposure. Given the potential impact of contemporary trade distortions on observed export flows, our measures of bilateral export exposure were calculated using weights that reflect pre-crisis bilateral trade flows. Our adaption of the Eaton-Kortum gravity equation performed well in the extra-EU panel dataset we assembled.

We conducted a series of counterfactual policy experiments, each with the goal of gauging the impact of crisis-era protectionism and potential responses to that protectionism. In one counterfactual, we computed how much better EU export performance would have been (relative to Chinese, Japanese, and US rivals) had foreign governments been so fearful of EU trade enforcement that they avoided harming EU exports in the first place, but harmed others instead. We also estimated the impact on relative EU export performance if no crisis-era trade distortions had been imposed by any government. Finally, we considered what would have happened to EU export growth if China had not scaled up its export incentives.

Our econometric analysis implies that crisis-era trade distortions held back EU member state export growth to destinations outside of the EU by between 10 and 20 percentage points between 2008 and 2014. Our econometric estimates also imply that only implausible accelerations in EU member state productivity growth would have been able to offset the loss of EU exports due to foreign trade distortions imposed during the crisis, implying that shifting the blame on any supply side deficiencies of the EU is unconvincing.

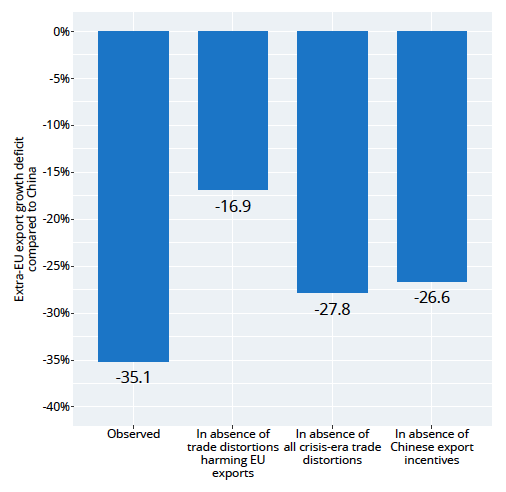

Figure 3 Eliminating trade distortions would narrow the EU export performance deficit with China

We estimate that the EU export growth deficit compared to China (which in fact amounted, on average, to 35 percentage points from 2008 to 2014) would have been halved if foreign governments had not imposed trade distortions that harmed EU firms (see Figure 3). Chinese export incentives alone were also found to account for a fifth of the export performance deficit between EU exporters and Chinese rivals.

Separately, the growth of EU member states’ exports to destinations within the EU was found to be statistically significantly reduced by state aid awarded in the destination country and by export incentives given by non-EU governments.

Our results demonstrate the zero-sum nature of contemporary protectionism where a variety of policies shift sales towards local firms in export as well as home markets. The competition for foreign market share means that many crisis-era trade distortions have reshuffled world trade rather than reducing it, although our results imply to a lesser degree for intra-EU trade than for extra-EU trade. Here our findings contrast with those studies that focus solely on the impact of crisis-era protectionism on the level of world trade.

Policy implications for the EU and beyond

The key policy implications for EU commercial and state aid policies are:

- Priortise trade enforcement action, including possible resort to the WTO Dispute Settlement, against foreign incentives to boost exports.

- Resist the temptation to copy trading partners’ export incentives; instead, build a coalition among WTO members in favour of tougher rules on export incentives, especially those delivered through national tax systems. Export incentives on this scale must cost significant amounts of money, so cultivate national finance ministries and the IMF as allies in this campaign.

- Redesign and ramp up the European Commission’s trade policy monitoring efforts as well as take a more aggressive line tackling other foreign trade distortions.

- Review the application of EU state aid rules so as to minimise the disruption to intra-EU trade. By 2015, 8.7% of intra-EU exports competed against local farmers and manufacturers that had been bailed out by an EU government since November 2008.

The systemic implications of this study on the export exposure to crisis-era protectionism as well as the impact on US, Chinese, and Japanese export performance ought to be of interest to policymakers and analysts outside of the EU as well. The rule book for world trade was revamped after the 1930s and the sharp recession of the 1980s, why should this time be any different?

References

Eaton, J and S Kortum (2002), “Technology, Geography, and Trade”, Econometrica 70(5): 1741–1779.

Evenett, S and J Fritz (2017), Europe Fettered: The impact of crisis-era trade distortions on exports from the European Union, A Global Trade Alert report, CEPR Press.

Constantinescu, C, A Mattoo, and M Ruta (2015), “The Global Trade Slowdown: Cyclical or Structural?”, IMF Working Paper 15/6.

Kee, H L, C Neagu and A Nicita (2013), “Is Protectionism on the Rise? Assessing National Trade Policies during the Crisis of 2008”, Review of Economics and Statistics 95(1): 342-346.

O’Rourke, K (2017), “The Two Great Trade Collapses: The Interwar Period & Great Recession Compared”, NBER Working Paper 23825.

Rueda-Cantuche, J M, N Sousa, V Anderoni, and I Arto (2013), “The Single Market as an Engine for Employment through External Trade”, Journal of Common Market Studies 51(5): 931-947.

Endnotes

[1] Technically, data at the six-digit level of disaggregation in the UN Harmonized System for trade flows.

[2] For details, see http://pib.nic.in/newsite/PrintRelease.aspx?relid=148539