Nearly a decade since it took place, the US federal government’s rescue of the financial system in 2008-2009 remains highly controversial. At the time, the Troubled Asset Relief Program (TARP), which injected equity into commercial banks and provided for the bailout of the General Motors Acceptance Corporation (GMAC) — the lending arm of General Motors— and the US automobile sector, was initially rejected by Congress as a ‘bailout to bankers’. And even today, populists on both the right and the left echo a similar refrain, as economic growth remains tepid while asset prices boom. Moreover, nuance and careful research by highly respected economists observe that more aggressive intervention to relieve the household debt burden might have made for a stronger economic recovery (Mian and Sufi 2014). It remains an open question, then, whether the government’s rescue of the financial sector helped the US economy beyond Wall Street. Or was the government’s focus on the financial sector fundamentally misplaced?

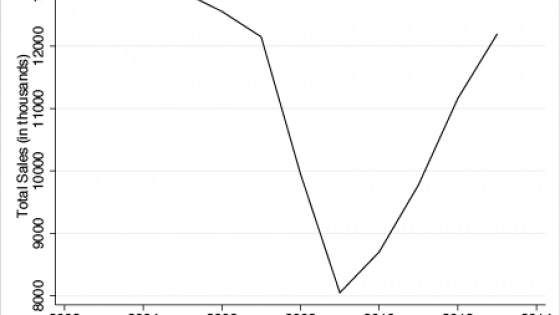

We may never have definitive answers to these questions. But in new research, we suggest that without federal intervention to stabilise financial markets and recapitalise some non-bank lenders such as GMAC, the magnitude of the economic collapse in 2008-2009 might have been much worse (Benmelech et al. 2016). Before the financial crisis, a large network of non-bank financial institutions, such as mortgage brokers and consumer finance companies —the shadow banking system — became increasingly important sources of credit in the US. For example, finance companies like GMAC financed about half of new car sales in 2005. The form of shadow banking financing differed markedly from traditional banks. While the latter use government insured deposits to make loans, non-bank lenders make loans using short-term uninsured wholesale funding, mostly from entities such as money market funds (MMFs) and pension funds.1 In 2008 and 2009, MMFs and pension funds became unwilling or unable to fund many of these non-bank lenders (Kacperczyk and Schnabl 2013). Car sales collapsed in the US, and GM and Chrysler entered bankruptcy (Figure 1).

Figure 1 Total retail car sales, 2002–2013

Note: Retail car sales are the sum of retail leases and retail purchases in Polk

Using data on every new car sold in the US, we show that this loss of MMF and pension fund financing played a significant role in explaining the collapse in US car sales, and it might have contributed to the bankruptcy of GM and Chrysler. In particular, the decline in car sales was much steeper in those counties that traditionally depended on non-bank credit for their automotive financing. This result persists even after controlling for variables that measure the contraction in demand for durables due to the rise in household debt and the collapse in house prices. In our sample, 8.1 million cars were sold in 2008 and 6.5 million cars in 2009. Our empirical estimates imply that the loss of non-bank financing capacity might explain between 30-40% of this collapse. That is, while the household debt channel was incredibly important in reducing demand and driving the collapse in consumer spending, the financial sector dislocations and the lack of credit also played a critical role.

The variation in car sales over time also point to the loss of non-bank financing capacity as a critical factor in the collapse. MMFs, especially those that catered to institutional investors, were the principal source of funding for many securitisation conduits. And when net flows into MMFs were plentiful, these funds tended to increase their demand for non-bank automotive structured debt products. Likewise, when investors pulled their money from some of these funds, they could no longer purchase these debt products. Consistent with this channel, we show that car sales were more sensitive to net flows into MMFs in those counties that were more dependent on non-bank credit.

Non-bank lenders tended to serve lower credit-quality borrowers—the very borrowers that experienced the biggest declines in their net worth due to the house price collapse. These borrowers would also have been more likely to face a reduction in their credit card limits. Therefore, rather than reflecting the effects of diminished captive financing caused by illiquidity in short-term funding markets, the results in Benmelech et al. (2016) could reflect a more general contraction in credit to riskier borrowers. We address this concern by using individual-level data that can control for credit card and other limits, credit risk scores, and other key measures of credit usage and risk. We continue to find that when net flows into MMFs declined, the likelihood of buying a car tended to decline more for individuals in counties more dependent on non-bank credit.

To be sure, traditional banks were also exposed to the dislocation in financial markets, as many of these institutions became connected to the shadow banking system during the boom. Many credit unions — a trillion-dollar industry devoted to consumer finance — bought structured debt products similar to those held by MMFs and pension funds. When the prices of these products declined during the financial crisis, credit unions incurred significant balance sheet losses. And the evidence in Ramcharan et al. (2016) suggests that the industry as a whole might have reduced consumer credit supply —automotive and mortgage credit — by about $60 billion in 2009 alone, in response to these balance sheet losses. Chowdow-Reich (2014) also observes that bank balance sheet losses might have also engendered a sizeable reduction in employment during this period as well.2

It may difficult to definitively judge whether the federal resources and attention devoted to rescuing the financial system, relative to relieving household debt overhang, was appropriate. And the evidence in Mian and Sufi (2014) makes a compelling case that too little might have been done for households. But Wall Street and Main Street are intimately connected. And despite the enormous scale of the federal rescue of the US financial sector, our work and others show that the dislocations in financial markets resonated well beyond Wall Street. One can surmise then that without the rescue, the Great Recession of 2008-2009 might have been much more severe. Indeed, research by Rajan and Ramcharan (2016) drawn from the Great Depression suggests that financial distress, left unchecked, might eventually lead to a full blown collapse.

Authors' note: The opinions expressed here are those of the authors and do not necessarily reflect the view of the Board of Governors or members of the Federal Reserve System.

References

Benmelech, E, R Meisenzahl and R Ramcharan (2016), “The Real Effects of Liquidity During the Financial Crisis: Evidence from Automobiles”, Quarterly Journal of Economics, forthcoming

Campbell, S, D Covitz, W Nelson, and K Pence (2011), "Securitization Markets and Central Banking: An Evaluation of the Term Asset-Backed Securities Loan Facility", Journal of Monetary Economics 58(5), 518-531

Chodorow-Reich, G (2014), “The Employment Effects of Credit Market Disruptions: Firm-Level Evidence from the 2008–9 Financial Crisis”, Quarterly Journal of Economics, 129 (2014), 1–59.

Mian, A, and Sufi (2014), A, House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again, Chicago: University of Chicago Press,.

Kacperczyk , M and P Schnabl (2013), "How Safe are Money Market Funds?", Quarterly Journal of Economics 128 (3), 1073-1122

Rajan, R, and R Ramcharan (2016), “Local Financial Capacity and Asset Values: Evidence from Bank Failures,” forthcoming, Journal of Financial Economics.

Ramcharan, R, S J. van den Heuvel, and S Verani (2016), “From Wall Street to Main Street: The Impact of the Financial Crisis on Consumer Credit,” forthcoming, Journal of Finance.

Endnotes

[1] Asset backed commercial paper (ABCP) conduits became one common method to access these short-term uninsured wholesale funding markets. Firms such as GMAC would bundle car loans into an ABCP conduit and sell these products to MMFs and pension funds, using the proceeds to make new car loans.

[2] Research by Campbell et al. (2011) also find that Federal Reserve interventions directly helped to stabilise short term funding markets.