Global imbalances are back on centre stage in international policy discussions. Having narrowed after the global crisis, the current-account positions of the world’s major economies are widening again. Such imbalances reflect the reallocation of savings across countries and are, to some extent, a welcome feature of international finance. Still, however, many countries remain concerned that these large savings-investment gaps will pose a constraint to growth in output and employment.

Yet external imbalances can, at least to some extent, be consistent with sustained growth of the global economy so long as a supporting policy framework is put in place. What should the features of such a policy framework be? The G20 has begun to address this issue, but a consensus has yet to be reached on the nature of external imbalances and their policy implications.

The ratio of the current-account balance to GDP, like other economic processes, is mean-reverting. The wider a country’s current-account position, the more likely it is to narrow. So, in principle, we should not worry too much about such imbalances. However, current-account reversals are often prompted by disruptive movements in capital flows and exchange rates, followed by banking crises and long periods of slow GDP growth. Ideally, we would like to see an environment in which imbalances eventually adjust without major disruptions. And it is important to understand better the policy requirements for such an outcome.

In this column we shed light on these issues by going beyond event analysis and focusing on the determinants of current-account reversals and the policy settings associated with the sustainability of external positions.

How can current-account reversals be identified?

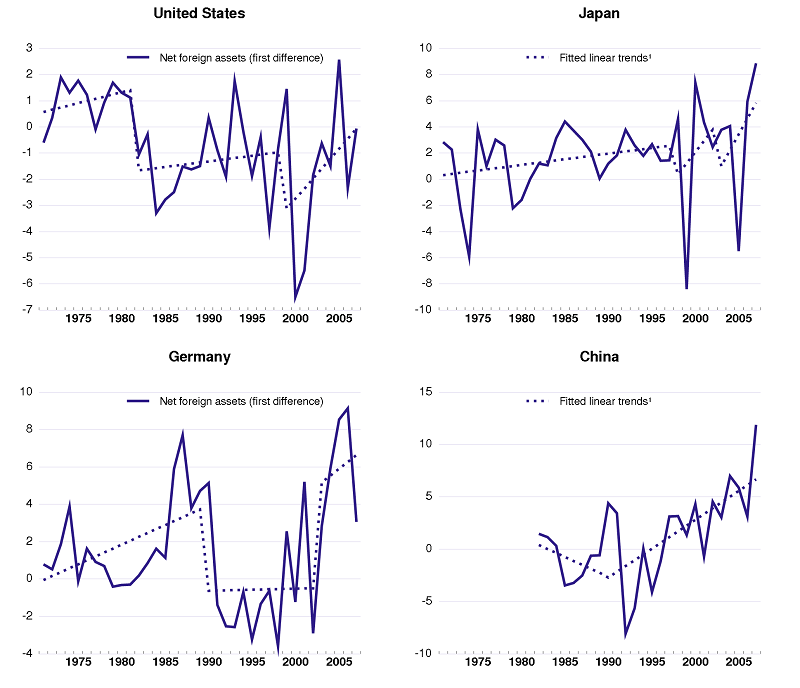

Scholars have proposed different chronologies of current-account reversals (see for example Milesi Ferretti and Razin 1998 and 2000, Eichengreen and Adalet 2005, Edwards 2005, Liesenfeld et al. 2007, and de Mello and Padoan 2010a). Much of this literature uses ad hoc definitions of reversals based on the actual size of adjustments, which overlooks shifts in trends and smaller adjustments in less volatile countries. In recent papers (de Mello and Padoan 2010b, de Mello et al. 2010), we use an alternative method based on unit root testing that allows for structural breaks in the levels and slopes (trends) of external positions (see Figure 1). We then estimate jointly the probability and magnitude of reversals using a selection model. This builds on previous studies that instead identify the determinants of the probability of reversals separately from those affecting the magnitude of reversals. In doing so, they do not take into account that the magnitude of reversals depends on the probability of a reversal taking place.

Figure 1. Structural breaks in external positions (Net foreign assets/GDP), 1971-2007

Notes: Linear trends are estimated using ordinary least squares to take account of the structural breaks. Source: Updated and extended version of the External Wealth of Nations Mark II database developed by Lane and Milesi Ferretti (2007) and authors’ estimations.

What are the characteristics of current-account reversals?

Applying our methodology to a set of 101 industrial, emerging-economy and developing countries in the period 1971-2007 yields a chronology of 159 reversals. We find that:

Current-account reversals are not a phenomenon of low- and middle-income countries. They occur across all countries, regardless of their income level (see Table 1). Most reversals involve a shift in levels followed by a shift (of the opposite sign) in slopes. By contrast, simultaneous positive and negative shifts in both levels and slopes are less frequent.

The number of improvements and deteriorations of external positions is fairly balanced. We identify 91 reversals associated with improvements in external positions (i.e, a positive shift in the slope of the current-account balance following a reversal) and 68 reversals associated with deteriorations (i.e., a negative shift in the slope of the current-account balance following a reversal). Most previous studies focus on improvements and ignore deteriorations in external positions.

Table 1. Distribution of current-account reversals {tc\f t\I 2 "Table 0. Geographical distribution of current account reversals"}

1. Only reversals associated with a stationary current-account balance are considered. Source: Authors’ computations.

What have we learned?

Our analysis confirms some well-known empirical findings and offers new ones. In particular:

- The probability of a current-account reversal depends not only on the level of external positions before adjustment, which is known in the literature, but also on their pre-adjustment trends. In other words, the higher the level or the faster the improvement in external positions prior to a reversal, the higher the probability of subsequent deterioration.

- Growth also matters. The faster the expansion of GDP prior to a reversal, the higher the probability of improvements in a country’s external position.

- There are simultaneous reconfigurations in external positions in different countries. The probability that a given country will face a reversal in its external position increases with the number of countries facing reversals in the same geographical area. This finding, which is new in the literature, is consistent with the presence of regional or contagion effects in current-account determination.

- Most of the determinants of the probability of reversals also influence the magnitude of post-reversal adjustments. But there are exceptions. The size of external imbalances prior to a reversal is a more powerful predictor of the probability of reversals than of the magnitude of adjustment. This is also the case of GDP growth, which is a good determinant of the probability of reversals but not of the magnitude of adjustment.

- Trends in capital flows are important predictors of both the probability and the magnitude of reversals. Rising portfolio investment raises the probability of improvements in external positions and is associated with larger reversals when they do occur. Since rising portfolio inflows reflect a deterioration of external positions prior to a reversal, it is plausible that rising inflows also raise the probability of a post-reversal improvement in external positions. In the case of FDI, however, rising inflows prior to a reversal reduce the probability of adjustment and the magnitude of improvements. This finding could be associated with the increase in factor payments abroad once FDI operations start.

What’s the role of macroeconomic policy?

By reducing absorption in the run-up to a current-account reversal, a tightening of monetary policy increases the likelihood of an improvement in external positions. When an improvement occurs, a monetary tightening is associated with smaller subsequent swings in external positions, most probably by addressing the underlying causes of the impending current account reversal.

A tightening of the fiscal stance prior to a current-account reversal increases the probability and magnitude of a post-reversal improvement in external positions. To some extent, this is because the corresponding increase in government saving is not fully offset by a decrease in private saving.

Lessons from the empirical analysis

We draw a few lessons which can be useful in, first, designing a policy framework aimed at monitoring global imbalances and the occurrence of reversals and, second, identifying appropriate policy responses.

- A relatively small number of variables provide important information about the drivers of current-account reversals, including GDP growth and trends in capital flows. The nature of capital flows, whether FDI or portfolio, also matters. A mechanism for monitoring global imbalances and current-account reversals should take such variables into consideration.

- Geographical proximity is associated with the probability of reversals. Geography therefore matters in current-account determination.

- Both monetary and fiscal policies have a bearing on the probability of occurrence and the magnitude of post-reversal adjustment.

These empirical findings suggest that a mechanism for monitoring global imbalances should take into consideration the impact that country policy actions, either macroeconomic policy or measures aimed at influencing capital flows, would have on external adjustment. In addition, coordinated policy action may be necessary if geographical proximity is relevant. However, our analysis does not cover all factors affecting global imbalances, including the effects of structural reforms on external positions. But, given that structural reforms impinge on the saving and investment behaviour of households and enterprises, and as a result countries’ current-account positions, a well-functioning policy framework would need to include structural policies as well.

References

de Mello, L, and PC Padoan (2010a), “Global imbalances: Lessons from historical reversals”, VoxEU.org, 1 August.

de Mello, L, and PC Padoan (2010b), “Are global imbalances sustainable? Post-crisis scenarios”, OECD Economics Department Working Paper 795.

de Mello, L, and PC Padoan (2010c), “Promoting Potential Growth: The Role of Structural Reform”, OECD Economics Department Working Paper 793.

de Mello, L, PC Padoan, and L Rousová (2010), “Are global imbalances sustainable? Shedding further light on the causes of current account reversals”, OECD Economics Department Working Paper 813.

Edwards, S (2005), “Capital Controls, Sudden Stops and Current Account Reversals”, NBER Working Paper 11170.

Eichengreen, B and M Adalet (2005), “Current Account Reversals: Always a Problem?”, NBER Working Paper 11634.

Lane, PR and GM Milesi Ferretti (2007), “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970-2004”, Journal of International Economics, 73:223 250.

Liesenfeld, R, GV Moura and J F Richard (2007), “Dynamic Panel Probit Models for Current Account Reversals and their Efficient Estimation”, Economics Working Paper, No. 2007 11, Department of Economics, Christian-Albrechts University, Kiel.

Milesi Ferretti, GM and A Razin (1998), “Sharp Reductions in Current Account Deficits: An Empirical Investigation”, European Economic Review, 42:897 908.

Milesi Ferretti, GM and A Razin (2000), “Current Account Reversals and Currency Crises, Empirical Regularities”, in P Krugman (ed.), Currency Crises, University of Chicago Press.