Mutualisation of sovereign debt is – in some form – at the top of most observers’ list of what must be done to end the Eurozone crisis. It will surely be discussed at the 28-29 June 2012 EU Summit. Eventually a decision will have to be taken.

Several proposals are on the table:

- Stability bonds (European Commission 2011),

- Blue bonds (Delpla and von Weizsäcker 2010),

- Safe bonds (German Council of Economic Experts 2011),

- Eurobills (Hellwig and Philippon 2011),

- European safe bonds (Brunnermeier et al. 2011), and

- Synthetic eurobonds (Beck and Uhlig 2011).

Though they differ in scope, liabilities, and implementation, they all share the fundamental feature of interpreting the Eurozone public debt security as the result of pooling –or mutualising – sovereign bonds.

For instance, the European safe bonds and the synthetic Eurobonds propose the creation of the European debt agency, with assets consisting of the pool of sovereign bonds and liabilities the Eurobonds. Likewise, the blue and safe bonds propose a Eurobond that is a pool of the tranche below and above the 60% of GDP respectively.

Linear risks down…

Mutualising sovereign bonds is equivalent to forming a linear combination of the underlying bonds, i.e. a portfolio of them. Hence the risk associated to the portfolio is a function of the risks of the constituents and their correlations.

- In tranquil periods these risks have a linear nature,

- In periods of turmoil non-linearities appear, namely due to extreme events, that induce non-linear -or tail- risks.

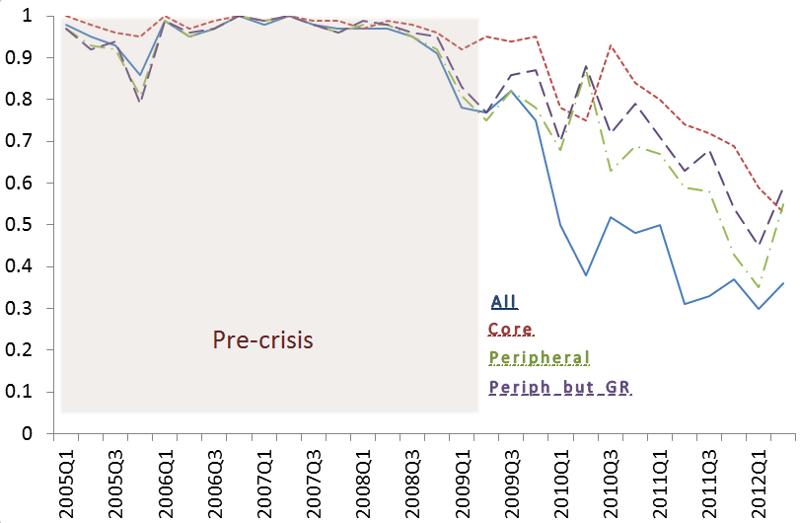

Figure 1 shows the quarterly cross-sectional average correlations (from 2005Q1 to 2012Q2) for the Sovereign bond yields of all the Eurozone countries (solid blue), the core countries (dotted red), the peripheral countries (doted and dashed green), and the peripheral countries but Greece (dashed purple).

Prior to the crisis correlations were very close to unity, reflecting the almost perfect co-movements among the yields. Since the beginning of the crisis the correlations have sharply decreased for all countries and groups of countries. From a risk perspective, the creation of the Eurobonds may be seen as appropriate since the benefits (creditworthiness, resilience, stability, and liquidity) offset the slight increase of risk associated to the small correlations.

Figure 1. Average linear correlations

Note: Quarterly cross-sectional average linear correlations of all Eurozone Sovereign bonds (solid blue line), core bonds (dotted red), peripheral bonds (dotted and dashed green), and peripheral but Greece bonds (dashed purple).

But this is a naïve view of risk given the current situation marked by unusual high uncertainty. The correlations shown in Figure 1 are the Pearson, also called linear, correlations, that only explain linear associations among bond yields.

…and tail risks up

In periods of turmoil, it is not enough to watch the linear relationships – non-linearities appear; tail risks increase. Indeed, when tail events occur, their effect is spread over the system. In recent work, Luca Ricci and I have recently introduced TailCoR, a new measure of tail correlation (Ricci and Veredas 2012).

- TailCoR is a function of linear and non–linear contributions, the latter characterised by the tail behaviour.

- It is based on quantiles and has a number of useful properties, such as simplicity, distribution freeness, and no need of optimisations.

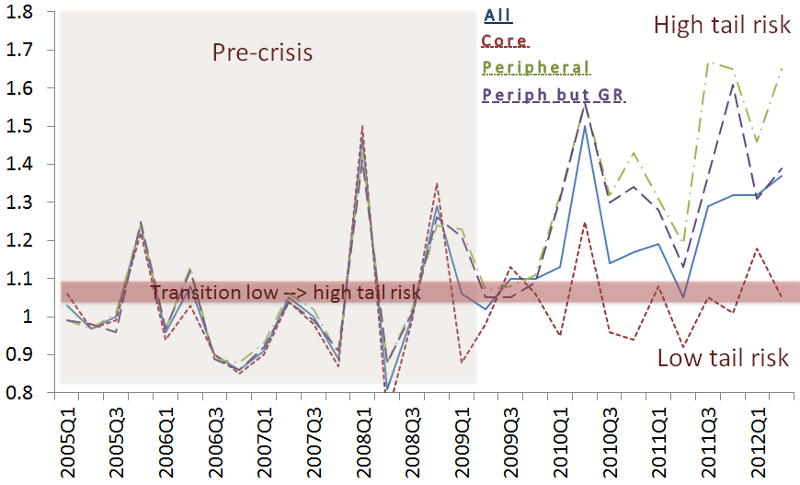

Figure 2 shows the quarterly cross-sectional average tail contribution to TailCoR for the same groups of countries as in Figure 1. Values below unity refer to thin tails, and hence low portfolio tail risk. Values above unity correspond to high portfolio tail risk. Prior to the crisis all the dependence among Sovereign yields was linear since the tail contributions were smaller or in the vicinity of one; the only exception being 2008, at the height of the financial upheaval. More importantly, since the beginning of the crisis the tail risk associated to all the Eurozone countries has increased substantially (blue and solid line), and the trend is positive. As a consequence, pooling Eurozone sovereign bonds today may be seen as too risky since a negative tail event in the yields of one country may cause a cascade of tail events in the yields of the other countries, increasing the probability of a large negative and generalised extreme event in the Eurozone as a whole.

Figure 2. Average tail contribution to TailCoR – part I

Note: Quarterly cross-sectional average tail contribution to TailCoR of all Eurozone sovereign bonds (solid blue line), core bonds (dotted red), peripheral bonds (dotted and dashed green), and peripheral but Greece bonds (dashed purple).

Further analysis is needed to understand the origin of the Eurozone tail risk. What is the tail risk of the peripheral and core countries? What is the contribution of the peripheral countries (mainly those that have been bailed out) to the overall tail risk? The answer to the first question is in Figure 2 (lines other than solid), while the answer to the second is in Figure 3.

- The origin of the Eurozone tail risk is the peripheral countries – the major player being Greece (dotted and dashed green line in Figure 2).

- The core countries however have not experienced a significant increase in their tail risk (dotted red).

This suggests that, as of today, forming Eurocore bonds is as risky as prior to the crisis. From a policy point of view, however, mutualising sovereign bonds only for the core countries without guaranteeing schemes for the peripheral countries has to be judiciously analysed. It may put further pressure on those countries that in the medium- and long-run affects the core countries.

Figure 3 investigates the role of the bailed out countries. Eurozone tail risk decreases significantly by just leaving out Greece (dashed and dotted green line). However, the most interesting finding is that Spain and Italy do not entail an increase in tail risk with respect to that of the core countries (dashed purple). In other words, bailed out countries have tail risks that are significantly larger than the other countries. Or, put it differently, bailing out a country does not help to tame the tail risk. Rather, investors perceive it as a source of tail uncertainty.

Figure 3. Average tail contribution to TailCoR – part II

Note: Quarterly cross-sectional average tail contribution to TailCoR of all Eurozone sovereign bonds (solid blue line), core bonds (dotted red), all bonds but Greek (dotted and dashed green), and all but bailed out countries (dashed purple).

Short-run and long-run policies for taming the tails

The conclusion that pooling Eurozone sovereign bonds today may be seen as too risky should not be overstated. For instance, it does not imply that the above-mentioned proposals are not appropriate. In all cases, the authors rightly and explicitly mention that their suggestions are to be implemented along with fiscal and monetary measures so as to ensure pan-European discipline and reduce domestic moral hazards.

Indeed, a dissection of the causes of the increase in the tail risks sheds light. The increase of tail risk in Figure 2 is due to a combination of fiscal and macro fundamentals, contagion, and market microstructure. Disentangling these factors leads to different policy advices and actions to tame the tails. If most of the increase relates with fiscal and macro fundamentals, then a clear policy prescription would be that the Eurozone should accelerate the implementation of fiscal consolidation policies. If some form of contagion were found to be the dominant source of tail risks, then coordinated policy responses could play a role to avoid a self-fulfilling diabolic loop of bailouts. Finally, if market microstructure considerations were found to generate a malfunctioning of Sovereign bond markets – such as liquidity, bid-ask bounces, or volatility surges due to stringent market rules – specific actions in the primary and, in particular, the secondary market might be needed.

If these measures are to be taken by EU policy leaders, it is likely that the tail risks will decrease, and the implementation of a mutualised Eurozone public debt security is worthy. These are however measures and actions that have a medium- and long-term effect. They frame within the recently agreed Euro Plus Pact of March 2011, which means that will still take time to be implemented since, for the time being, the Pact has to be ratified by all member states. For instance, ratification by the German Bundestag is still pending.

In the short-run, alternatives to boost growth and employment are needed. European project bonds, enhance the role of the European Investment Bank, and make a better use of the EU’s structural funds are some of the actions proposed. Another is to reinforce the duties of the European Financial Stability Facility (and its successor the European Stability Mechanism, ESM), always within the legal frameworks established by the EU Treaties. Indeed, the ESM can be seen as a quasi-European debt agency since its assets are contributions from the non-intervened Eurozone countries (in fact, if the contributions would come from Sovereign debt, the ESM would be de facto the European debt agency), and the liabilities are bonds, which enjoy the benefits of Eurobonds highlighted at the beginning of this article.

Concluding remarks

As of today, tail risks of the Eurozone sovereign debt are worryingly high. Furthermore, bailed out countries have increased their tail risks, even after the rescue packages. EU leaders should be cautious when pooling debt to create a Eurobond. It is only advisable once tail risks are tamed. In the meantime, the ESM can play the role of the European debt agency.

References

Beck, T, H Uhlig, and W Wagner (2011), “Insulating the financial sector from the European debt crisis: Eurobonds without public guarantees”, VoxEU.org, 17 September.

Brunnermeier, M, L Garicano, PR Lane, M Pagano, R Reis, T Santos, S Van Nieuwerburgh, and D Vayanos (2011), “European Safe Bonds (ESBies)”, Euro-nomics Group, 26 September.

Delpla, J and J von Weizsäcker (2010), “The blue bond proposal”, Bruegel policy brief 2010/03.

European Commission (2011), “Green paper on the feasibility of introducing stability bonds”, MEMO/11/820.

German Council of Economic Experts (2011), Annual Report 2011/12.

Hellwig, C and T Philippon (2011), “Eurobills, not Eurobonds”, VoxEU.org, 2 December.

Ricci, L, and D Veredas (2012), “TailCoR”, ECARES WP 2012/16. Available at SSRN http://ssrn.com/abstract=2071126.