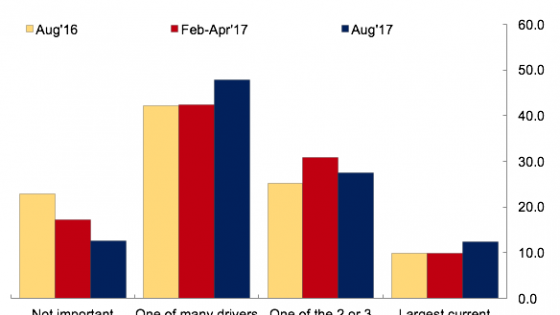

First, we should do something economists need to do more often – apologise for making bad predictions. In advance of the June 2016 referendum on Brexit, one of us in particular – Nicholas Bloom – predicted a collapse in investment and growth. Thankfully, so far this has yet to happen. Yes, Brexit had lowered growth - UK growth rates are now falling and about 0.5% lower versus trend compared to Europe and the US (see Figure 1). But there has not been the catastrophic growth collapse we feared (e.g. Dhingra et al. 2016) – at least not yet.

Figure 1 UK growth versus the rest of the G7 economies

Notes: Plots the two quarter moving average of UK growth less the average of the growth rates in the other six G7 economies (Canada, France, Germany, Italy, Japan and the US).

Four reasons have saved the UK from a more serious post-Brexit growth collapse. First, the pound fell about 20% after Brexit, while access to the EU markets has been maintained, providing a temporary honeymoon for exporters. Second, growth in the Eurozone has been rising, boosting demand. Third, monetary policy has loosened with lower interest rates. Finally, growth expectations of the approximately half of the voters supporting Brexit have remained strong.

But what now – is the Brexit collapse about to happen, or will economic growth remain lower but not disastrous, or maybe growth will now accelerate as some Brexit supporters claim? A year on we are in better shape to assess the evidence. In collaboration with the Bank of England, we have worked to set up a new Decision Maker Panel survey1 of about 2,500 UK firms (Bloom et al. 2017). Each month we ask panel members made of CFOs and CEOs from a broad range of UK companies about their current business conditions. We ask for their data on past growth, current levels, and possible future changes (with the probabilities they ascribe to each) in three areas: investment and borrowing; employment and costs; and sales and prices. We also have a few one-off questions on the possible impact of Brexit on business conditions.

This has revealed four results about the impact of Brexit

1. Brexit is a major source of uncertainty for firms.

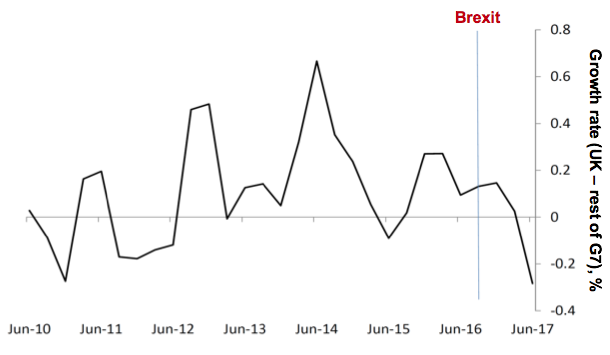

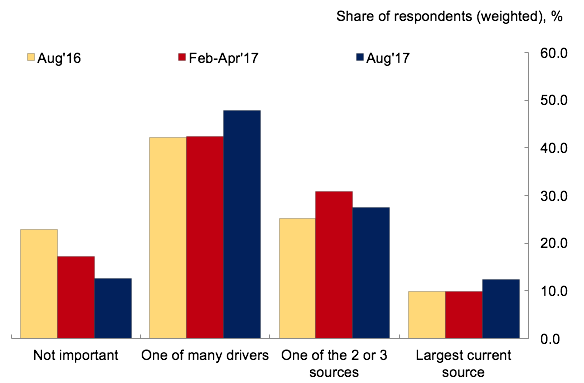

In August 2016 in response to the question: ‘How much has the result of the EU-referendum impacted the level of uncertainty affecting your business?’ more than one third of CEOs and CFOs cited Brexit as at least one of the top sources of uncertainty. Indeed, back then 10% said that Brexit had been the most important factor and 25% said it had been one of the top two or three sources of uncertainty (Figure 2). Successive waves of this question have shown that firms continue to place Brexit high on the list of sources of uncertainty. In fact, the share of firms placing Brexit in the top drivers of uncertainty has risen from 35% in August 2016 to almost 40% in August 2017, while the share of companies considering Brexit not important almost halved in the same period, from 23% to 12%.

Figure 2 Brexit as a source of uncertainty

Notes: Results are from the Decision Maker Panel survey and are based on 315 responses in Aug-16, 768 responses in Feb to Apr-17 and 414 responses in Aug-17. Results are weighted by employment size.

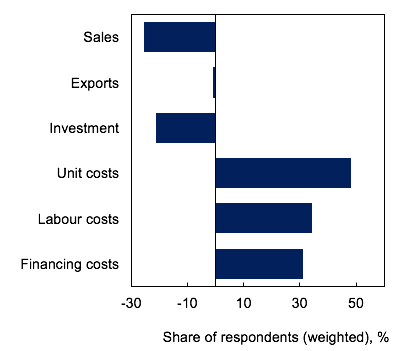

2. Most firms expect a negative impact of Brexit on sales, investment and costs.

Companies believe it is more likely than not that Brexit will reduce their sales and investment, and increase their exports, unit costs, labour costs and financing costs. Figure 3 shows the net probability that companies attach to Brexit having a positive rather than a negative effect on each variable. According to our survey the average probability attached to Brexit increasing sales by 2020 was 20%, while the average probability of a negative impact was 42%. The net effects shown in the chart below is a net balance of -22% for the effect of Brexit on sales by 2020. It means that companies place more weight on Brexit reducing sales than on increasing them. There was a net negative expected effect on investment, and a positive effect pushing up unit costs, labour costs and financing costs.

Figure 3 The expected impact of Brexit

Notes: Results are from the Decision Maker Panel survey and are based on 1036 responses to the question on sales, 218 responses to the question on exports, 1286 responses to the question on investment, 525 responses to the question on unit costs, 738 responses to the question on labour costs, 548 responses to the question on financing costs. Questions were asked between Oct-16 and Aug-17. Results are weighted by employment size.

When we break these responses down by firm size, we find larger firms are more pessimistic about the impact of Brexit than smaller firms. These firms are often more exposed to international markets than smaller firms, although many small firms form part of a supply chain for larger firms.

3. The majority of firms are not considering moving any operations abroad, but a few larger firms are.

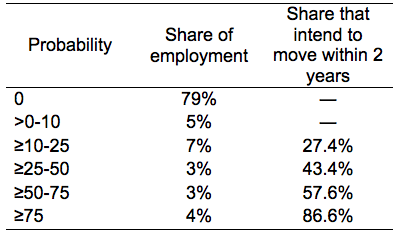

Most firms see no possibility of shifting the location of their operations abroad – many have no presence abroad and export little or nothing. Firms accounting for 80% of employment attached zero probability to moving any operations. Among larger firms and exporters, however, the story is different. Larger firms and those that are more exposed to international markets were more likely to think that they might move part of their business abroad compared to firms that are smaller or domestically focused. By sector, firms in manufacturing were most likely to say there was a chance of moving. Across all respondents, the average (employment-weighted) probability of moving some operations abroad was 7%, with companies who accounted for 7% of employment thinking that it was more likely than not that they would move some operations abroad (Table 1). These probabilities are still quite small at this stage, but not negligible.

Companies that reported higher probabilities of moving abroad were more likely to expect to move within the next two years, before the UK has actually left the EU, whereas those reporting lower probabilities were less likely to plan on moving within two years.

Table 1 Probability of moving some operations abroad

4. Exit risks lowering aggregate productivity growth.

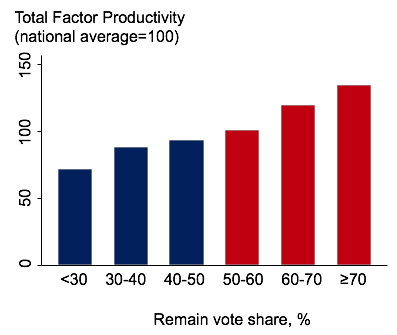

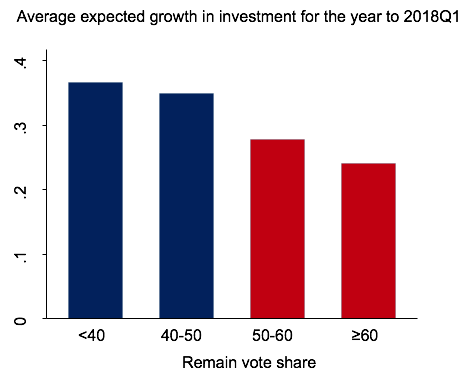

The higher productivity parts of the country voted to remain in the EU (Figure 4). After the vote in the referendum they became less optimistic about future prospects for the economy (Figure 5), and have likely lowered investment and employment growth.

Figure 4 Productivity by Regional Brexit vote share

Notes: Results are from the Electoral Commission and the Bureau van Dijk Fame dataset covering 14,896 UK companies. Total factor productivity is measured as a natural logarithm of profits less 0.7* the log number of employees and 0.3* log of tangible assets demeaned at the industry level. The productivity measure, which is based on 2015 data (2014 if 2015 not available), has been winsorized at the 1% and 99% to reduce the impact of any possible outliers. Results for average wages – another proxy for productivity – look similar across regions.

Figure 5 Economic optimism by regional Brexit vote share

Notes: Results are from the Electoral Commission and the Decision Maker Panel survey based on 606 responses between May-17 and Jul-17. Growth rates refer to the difference between the expected and current level of capital expenditure in terms of a percentage of their average value. The investment growth rates have been winsorized. Results are weighted by employee size.

In contrast, the parts of the country that were in favour of Brexit had lower productivity (Figure 4), and have become more positive about future prospects since the vote (Figure 5), potentially raising investment and employment growth. If this leads to a reallocation of investment and employment from higher to lower productivity parts of the country it could reduce UK productivity growth.

Authors' note: Principal Investigators Bloom and Mizen have received £683,636 in the form of an ESRC standard grant for “Measuring the Impact of Brexit on UK Investment, Productivity, Sales and Employment”. The funding will support an online survey and research into the impact of Brexit on the UK for three years, 1 Sept 2017 – 31 August 2020. The project is carried out with the collaboration of HM Treasury, Bank of England, the Universities of Nottingham (UK) and Stanford (US).

References

Bloom, N, P Bunn, P Mizen, P Smietanka, G Thwaites and G Young (2017) “Tracking the views of British businesses: evidence from the Decision Maker Panel” Bank of England Quarterly Bulletin, 2017Q2.

Dhingra, S, H Huang, G Ottaviano, T Sampson, J Van Reenen (2016), “The consequences of Brexit for UK trade and living standards”, VoxEU.org, 4 April.

Endnotes

[1] Decision Maker Panel data: On 20 September 2017 the Bank of England published aggregate level results from the Decision Maker Panel survey of 2500+ businesses alongside its regular summary report of business conditions based on intelligence gathered by the Bank’s Agency network. See "Agents’ summary of business conditions 2017 Q3 and results from the Decision Maker Panel", available at http://www.bankofengland.co.uk/publications/Pages/agentssummary/default.aspx. Decision Maker Panel data will be published on a quarterly basis.