The deceleration of international trade since 2011 has been widely discussed. The general consensus is that the relationship between trade and GDP growth is undergoing a fundamental shift.1 The reasons for this are still debated, however. Some point out that spending on durable goods declined relative to services; their difference in trade-intensity was shown to be a major explanation of the Great Trade Collapse in 2008 (Bems et al. 2011, 2013, Bussière et al. 2013). If true, a future upturn in aggregate demand would fuel global trade once again. Others argue that international production fragmentation, and associated trade in intermediate inputs, has run out of steam lately. This might be due to increased protection, increases in local production capabilities, or realignment after initial overshooting. This would suggest a ‘new normal’ of stagnating trade intensity of world GDP.

An integrated approach: The global import intensity of production

Until now, supporting evidence for either of these hypotheses has been scattered and sometimes hard to reconcile. Demand-side explanations are buttressed by analyses of expenditure statistics at the national level, basically ignoring changes in international production structures. On the other hand, production-side explanations are supported by trends found in international trade data, ignoring shifts in demand structures.2 This separation precludes quantification of the relative strengths of both drivers in explaining the slowdown. In a recent paper, we introduce a novel modelling framework that allows for an integrated approach (Timmer et al., 2016).

We rely on a demand-driven model in the Leontief tradition, which provides a straightforward mapping of exogenous final demand to imports flows, extending the approach of Bems et al. (2011). We measure all imports needed in any stage of production. These include imports by the country in which the last stage of production takes place, as well as imports by other countries that are involved in earlier stages of production. The ratio of all imports needed over the value of the final product is referred to as the ‘global import intensity’ (GII) of production. This is a novel measure of international production fragmentation as it is positively related to the number of stages in production as well as the probability that any link between two stages involves cross-border trade.

Trends in international production fragmentation

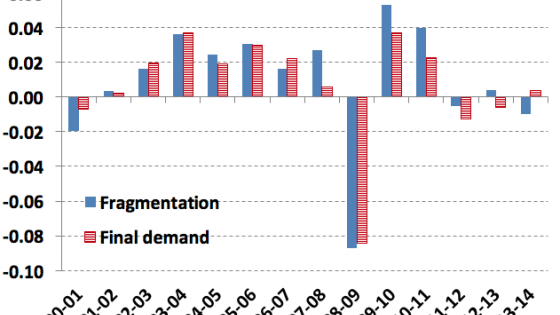

We updated the World Input-Output Database to provide an account of the changes in world trade during the period 2000-2014. We find that the process of international production fragmentation has stalled since 2011. This is shown in Figure 1. We have panel data on the GIIs of production of 836 final goods and regress this on a set of dummies. The figure shows the estimated coefficients for the year dummies and the associated 95% confidence intervals. The dummy for 2000 has been omitted, so all point estimates have to be viewed as relative to 2000. The figure clearly reflects the across-the-board increase in the GIIs. The year dummies were found to be significantly different from zero from 2004 onwards. The steady increase continued until the onset of the crisis in 2008. The crisis induced a major dip, but this appeared to be a short-run effect as the GIIs rebounded. Since 2011 there is a steady decline with recent levels not significantly different from the level in 2008.

Figure 1. Trend in international fragmentation of goods production

Notes: Based on regression of global import intensities of production of 836 final goods on dummies for country-industry of last stage and years. The figure provides estimated coefficients and 95% confidence intervals for the year dummies relative to 2000.

Accounting for changes in global import intensity

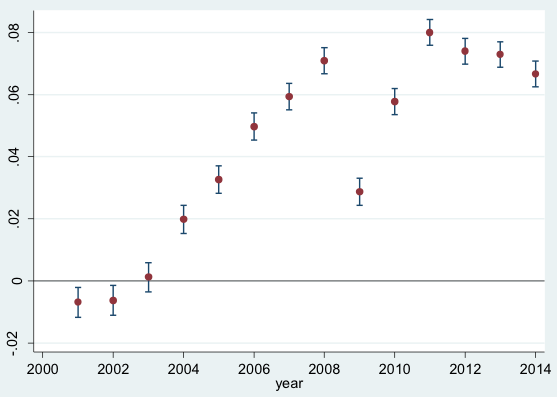

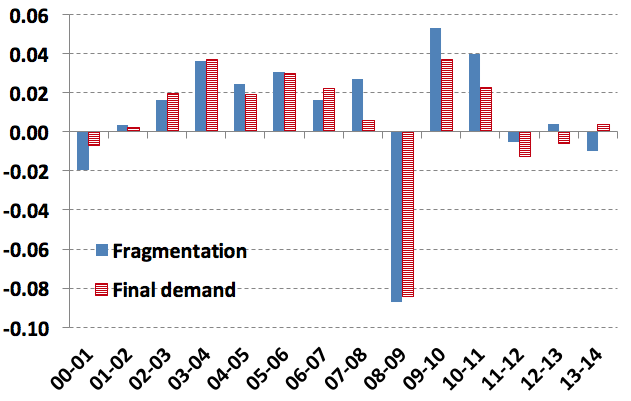

Next, we employ a novel decomposition technique to account for the change in the import intensity of world GDP. Put simply, this intensity can increase when production processes become more fragmented (that is, when the GIIs increase), or when final demand shifts to products with higher GIIs. The former can be thought of as an intra-effect (within production chains), and the latter as a shift-effect (across output of production chains). By keeping global final demand for each product fixed, we find the contribution of changes in the GIIs of production. Conversely, we derive the contribution of changes in the product structure of global final demand by keeping GIIs constant. The decomposition of (annual) changes in import to world GDP is given in Figure 2. Roughly half of the increase during 2000-08 (0.033 log points per year) was due to international production fragmentation. Demand shifts accounted for the other half. After the Great Trade Collapse in 2008, trade rebounded in the following two years. But fragmentation increased only marginally over the whole period from 2008 to 2011. And the demand shift effect even turned negative. Since 2011, the GIIs of many products actually fell (as shown above) such that the fragmentation effect turned negative as well. During the period 2011-14, both effects drove down the import intensity of world GDP, on average each by 0.005 log points per year.

Figure 2. Accounting for changes in global import intensity

Notes: Annual change (log points) in global import intensity on vertical axis. Decomposed into contribution from change in international production fragmentation and change in structure of demand for final products.

The China effect

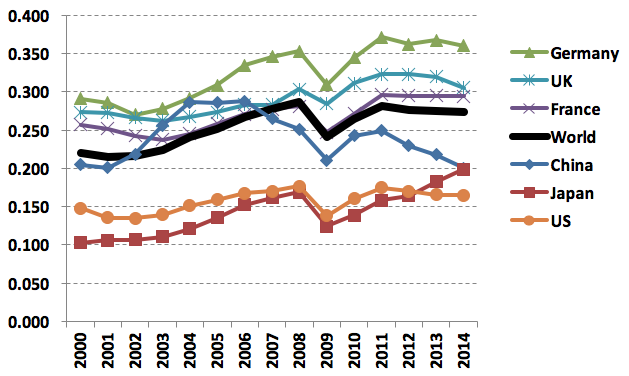

In a final step we analyse the impact of final demand changes of individual countries. Perhaps surprisingly, we find that growing Chinese demand did not have a major impact on the global trade intensity. This is because the GII of Chinese demand was barely above the world average in the 2000s (see Figure 3). Furthermore, it has been on the decline ever since, as demand shifted towards services. In addition, demand shifted to products finalised at home which contain an increasing share of domestic value added.3 With a move to greater self-reliance, the import intensity of Chinese final demand dropped below the world average. By 2014 the level was comparable to levels in Japan and the US. When Chinese growth remains above world average, it will continue to dampen the import intensity of world GDP.

Figure 3. Global import intensity of final demand by country

Note: all imports needed for final demand of a country (as a ratio of final demand). This includes imports by any country in any stage of production.

Concluding remarks

We do not claim that this exercise delivers a causal analysis of the drivers of global trade. Rather we consider it to be a useful organisation of the empirical facts to be explained in further work. The findings may be informative for parametrisation of the trade part in macroeconomic models. In particular, they highlight the importance of including endogenous development of global supply chain structures in such models. As for the future of global trade, we see two counteracting forces on the basis of this study. The process of international production fragmentation might be reignited. Baldwin (2016) and Los et al. (2015) argue that much potential is still unused. The recent outcomes of the Brexit referendum and the presidential elections in the US suggest that tighter production links cross borders are not likely in the near future, however. Moreover, global import to GDP ratios are expected to remain low as Chinese final demand continues to mature. From this perspective, the current slowdown in global trade is only natural and should not be a major concern.

References

Al-Haschimi, A, M Gächter, D Lodge and W Steingress (2016), “The great normalisation of global trade”, VoxEU.org, 14 October.

Baldwin, R (2016), The Great Convergence: Information Technology and the New Globalization, Harvard University Press.

Bems, R, R C Johnson and K-M Yi (2011), “Vertical Linkages and the Collapse of Global Trade,” American Economic Review Papers and Proceedings, 101(3): 308-312.

Bems, R, R C Johnson, and K-M Yi (2013). “The Great Trade Collapse,” Annual Review of Economics, 5(1): 375-400.

Bussière, M, G Callegari, F Ghironi, G Sestieri and N Yamano (2013), “Estimating Trade Elasticities: Demand Composition and the Trade Collapse of 2008-09”, American Economic Journal: Macroeconomics 5(3): 118-51.

Hoekman, B (ed.), The Global Trade Slowdown: A New Normal?, CEPR Press and EUI.

IMF (2016). “Global trade: What’s behind the slowdown?”, World Economic Outlook, Chapter 2, October.

Kee, H L and H Tang (2016), “Domestic Value Added in Exports: Theory and Firm Evidence from China,” American Economic Review, 106(6): 1402-36.

Los, B, M P Timmer and G J de Vries (2015), “How global are Global Value Chains? A New Approach to Measure International Fragmentation”, Journal of Regional Science, 55: 66–92.

Timmer, M P, B Los, R Stehrer and G J de Vries (2016), “An Anatomy of the Global Trade Slowdown based on the WIOD 2016 Release”, GGDC research memorandum number 162, University of Groningen.

Endnotes

[1] A list is provided in a recent Vox column by Al-Haschimi et al. (2016).

[2] The contributions in the Vox book edited by Hoekman (2015) and a recent IMF (2016) study provide a sample of methods and data sources used.

[3] See Kee and Tang (2016) for firm-level evidence.