Who should have access to central bank refinancing and which assets should be eligible for central bank operations? As the Bank for International Settlements recently noted in 2013 and 2015, the answers to these questions vary widely among central banks (BIS 2013, BIS-CGFS 2015). Some central banks, like the Eurosystem, give almost every financial institution direct access and against a widely defined set of collateral including, for example, corporate bonds or credit claims. Other central banks, like the Federal Reserve, restrict their normal operations to a small set of counterparties, allowing them to use only the most liquid investment-grade assets such as treasury bills or government bonds.

One simple explanation for why rules differ among countries might be that these differences simply do not matter for economic outcomes (Borio 2001). Yet in the wake of the Lehman failure, both the Eurosystem and the Fed made significant adjustments to their frameworks by admitting new counterparties (e.g. the Term Auction Facility, or TAF) and new instruments (e.g. the Commercial Paper Funding Facility or the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)), arguing that these adjustments were necessary to safeguard financial and economic stability. Today, as central banks gradually move out of crisis mode, the future long-run design of operational frameworks is on the table. It is no coincidence that this subject – purely technical at first glance – featured in last year’s Jackson Hole conference (Bindseil 2016).

What can economic research tell us about the optimal design of central bank eligibility frameworks? While there is a reasonable amount of policy work on operational frameworks as well as on the changes that central banks undertook in reaction to the 2008 crisis, these studies are mostly descriptive and do not make any claim on the possible causal link between the design of the framework and economic outcomes (e.g. Borio 2001, BIS-CGFS 2015). Some empirical work in finance has established a positive impact of TAF or AMLF (Berger et al. 2017, Duygan-Bump et al. 2013). But the main challenge is empirical. Eligibility regimes only change rarely. When they do, it is typically in reaction to acute stress and in order to support some specific segment of the financial sector that is deemed worthy. Per design institutions that do receive help are not the same as institutions that do not and so outcomes cannot be compared. As a result, the necessary counterfactual is difficult to come by. Moreover, programmes like the TAF or AMLF are often introduced at the same time as other key parameters of monetary or fiscal policy are changed, which further complicates the identification of the program’s impact through general equilibrium effects.

In a new paper, we believe we have identified a setting which does allow a counterfactual analysis (Bignon and Jobst 2017). Our results show that eligibility does matter for real economic outcomes. Regions that benefit from easier access to central bank refinancing exhibit lower default rates as firms can more easily smooth liquidity shocks. Importantly, the lower default rates are not the result of the central bank taking over bad loans.

The empirical set-up uses a number of features of a series of non-agricultural economic crises in 19th century France caused by a disease, which allows disentangling all the confounding factors that normally impede the empirical investigation of lending of last resort policies. The main actor is an insect barely larger than one millimeter, but a very unpleasant one (Figure 1). Starting in 1863, phylloxera devastated French vineyards by sucking out the sap of vines and ultimately causing their death. As a result, revenues from wine, which had represented 6.4% of GDP in 1862, declined to 2.8% by 1890. Given the importance of wine for the French economy, the crisis spilled over to non-agricultural firms, causing widespread defaults.

Figure 1 “The phylloxera, a true gourmet, finds out the best vineyards and attaches itself to the best wines”, cartoon from Punch, 6 September 1890

Source: wikipedia

The following features allow the identification of the impact of eligibility for central bank operations:

- First, while financial crises are often argued to be linked to previous central bank policies and therefore to be endogenous, this is definitely not the case for phylloxera, which was an exogenous shock to the French economy.

- Second, the design of the Banque de France refinancing operations during the 19th century created two groups of eligible and non-eligible banks which otherwise were identical, thus creating the necessary counterfactual. The reason is a particular feature of the assets the central bank bought to implement its monetary policy – the bill of exchange. Collecting payment on these bills at maturity required the physical presence of the Banque de France at the place of payment. To this end the bank operated a network of branches. For reasons unrelated to farming or phylloxera, the density of the branches varied across the French territory. In districts with more branches, more firms enjoyed easier access to the bank’s discount window, allowing firms outside agriculture to more easily smooth the shock brought about the arrival of phylloxera in the region. We exploit these geographical differences in the accessibility of central bank refinancing to determine whether firms in districts with more branches experienced lower increases in the default rate than districts with fewer branches.

- Last but not least, the particular historical setting allows to exclude further confounding factors like countercyclical fiscal policy (inexistent in our 19th century policy setting) and moral hazard on the side of the farmers (the Banque de France was forbidden by law to refinance the agricultural sector directly).

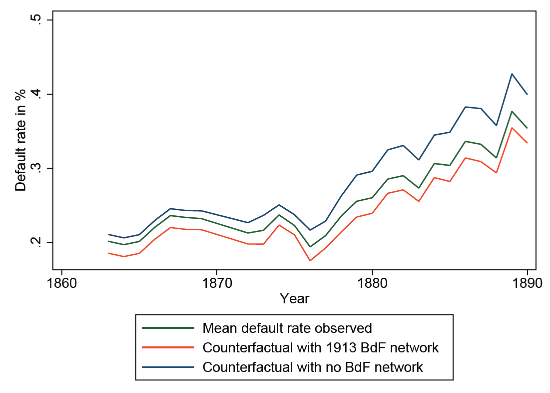

The estimation results, based on a hand-collected set of a uniquely rich administrative data, give a clear answer: better access to central bank lending provided by local branch offices of the Banque de France significantly lowered the number of defaults among non-agricultural firms. A counterfactual exercise shows that defaults would have been 10% to 15% higher in the absence of Banque de France branch network. This is an economically significant magnitude (Figure 2).

Figure 2 Observed and counterfactual default rates of non-agricultural firms in France during the wine crisis of 1863-1890

Note: The figure compares the impact of having very restricted eligibility (blue line) or wide eligibility (orange line) with the actual data (red line)

Source: Bignon and Jobst (2017)

Did saving the non-agricultural sector come at a price? We argue that the answer is no. Losses from discount loans did not increase; the reduction in defaults was thus not due to the Banque de France bailing out the private sector by buying up worthless assets. Much of this seems to be due to a tight risk control framework within the central bank. The mechanism through which the discount window impacted real outcomes may be related to theories of asset liquidity that emphasise the gain associated with the conversion of (illiquid) debt into (liquid) cash (Kiyotaki and Moore 2005, Venkateswaran and Wright 2011)

To conclude, the results clearly show that the design of the eligibility framework matters, in particular during periods of financial stress, and that the devil is in the details. It is therefore worthwhile for central banks to ponder the exact set-up of their operations. As a result, practices, which currently vary widely, might converge. At the same type the exact details of the set-ups might continue to differ, as different financial systems render different designs of the operational framework optimal.

Authors’ note: The views expressed here are our own and should not be interpreted to reflect those of the Banque de France, the Oesterreichische Nationalbank or the Eurosystem.

References

Berger, A, L Black, C Bouwman and J Dlugosz (2017), “Bank Loan Supply Responses to Federal Reserve Emergency Liquidity Facilities”, Journal of Financial Intermediation, forthcoming.

Bignon, V and C Jobst (2017), “Economic Crises and the Eligibility for the Lender of Last Resort: Evidence from Nineteenth Century France”, CEPR Discussion Paper No. 11737.

Bindseil, U (2016), “Evaluating monetary policy operational frameworks”, paper presented at the 2016 Jackson Hole Economic Policy Symposium.

BIS (2013), “Central bank collateral frameworks and practices. A report by a study group established by the markets committee”, Markets Committee Publications No 6, Bank for International Settlements.

BIS-CGFS (2015), “Central bank operating frameworks and collateral markets”, CGFS Papers No. 53, Bank for International Settlements.

Borio, C (2001), “A hundred ways to skin a cat: comparing monetary policy operating procedures in the United States, Japan and the euro area”, BIS Papers No 9.

Duygan-Bump, B, P Parkinson, E Rosengreen, G A Suarez and P Willen (2013), “How effective were the Federal Reserve emergency liquidity facilities? Evidence from the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility”, The Journal of Finance, 68: 715–737.

Kiyotaki, N and J Moore (2005), “Liquidity and asset prices”, International Economic Review 46 (2), 317–349.

Venkateswaran, V and R Wright (2014), “Pledgability and liquidity: A new monetarist model of financial and macroeconomic activity”, NBER Macroeconomics Annual 28(1): 227–270.